JIM REDDEN, Contributing Editor

|

| From left, in 80 m of water, Woodside’s Angel platform is the North West Shelf Project’s newest offshore gas production facility. BHP Billiton’s Pyrenees field off the North West Coast of Western Australia gathers crude from Ravensworth, Crosby and Stickle fields and has been producing for two years through a 13-well subsea development tied back to the FPSO Pyrenees Venture. Onshore, a drilling rig operates on behalf of Beach Petroleum in the onshore Cooper basin. |

|

As Australia accelerates its drive to become the world’s premier liquefied natural gas (LNG) exporter—sooner rather than later—oil (what there is of it) continues to reside on the nation’s energy backburner.

Despite astronomical development costs and an ambiguous regulatory regime, Australian Petroleum Production and Exploration Association (APPEA) CEO David Byers says the nation’s producers are on pace to leap-frog Qatar and emerge as the kingpin of global LNG production by the end of the decade. The 20 million tonnes of LNG that the government says the industry exported in 2010-2011 is reportedly half the production capacity of its Middle East competitor. However, Byers and others contend that the developments underway or near sanction should propel Australia to the top spot.

“In just the past 12 months, four LNG projects have been given the go-ahead, representing an investment of more than $90 billion,” Byers said at last month’s APPEA convention in Adelaide. “There are also tens of billions of dollars worth of other Australian LNG projects currently awaiting sanction. Australia’s annual LNG export capacity is set to quadruple to 80 million tonnes by the second half of this decade.”

By all accounts, there is no shortage of feedstock to satiate that appetite, thanks in no small part to mushrooming onshore shale and coal seam gas (CSG) reserves. An APPEA-commissioned Deloitte study, released at the May conference, identified 392 Tcf of combined gas resources, but that assessment did not consider unconventional shale and CSG reserves. Not counting CSG, the U.S. Energy Information Administration (EIA) estimates up to 400 Tcf of recoverable shale gas, primarily in the Cooper and Maryborough basins in the south.

Australian Bureau of Resources and Energy Economics (BREE) statistics have annual gas production standing at nearly 16 million tonnes of oil equivalent (MMtoe), with yearly growth of 5% projected out to 2035. Offshore Western Australia remains the most prolific, conventional gas-producing sector, with aggregate output of nearly 35 MMtoe.

OIL DECLINE CONTINUES

Oil is another matter, altogether, with an economically demonstrated resource base that is paltry by international standards. Crude oil production has declined steadily since topping out at 722,000 bpd in 2000, according to the EIA. Last year, EIA statistics show Australian crude production dropped to an historical low of 359,000 bpd.

Until a clearer picture emerges of the liquids potential within the onshore shale plays, new prospects appear few and farther between, raising doubts that the downward trend will reverse itself anytime soon. “Liquids are tough in Australia. They truly are,” BHP Billiton Petroleum Chief Executive J. Michael Yeager told reporters at the APPEA conference. Industry observers cite rapid declines in the mature Bass Strait off Victoria. While operators there and elsewhere are pushing to increase production, a lack of appreciable identified reserves lingers.

Last year, veteran Bass Strait joint partnership, ExxonMobil and BHP Billiton, installed its 23rd platform in the Bass Strait off the southern Gippsland coast as part of its Kipper-Tuna-Turrum field development. The Marlin-B platform will gather oil from Turrum, as well as subsea wells in the Kipper fields. Turrum is slated for full production of 11,000 bcpd and 200 MMcfgd, while Kipper is expected to produce 10,000 bcpd and 80 MMcfgd. Tuna has been producing oil for many years, and as part of the project will be developed further to produce gas and associated liquids. Although oil production of about 50,000 bpd is a tenth of what it was in its halcyon days, ExxonMobil says plenty of gas remains in the Bass Strait.

Woodside Energy Ltd., and partners BHP Billiton, BP, Chevron and Japan Australia LNG, in September began production from their North West Shelf Oil Redevelopment Project. Ultimately, upwards of 30,000 bopd is expected to flow into the recently installed Okha FPSO. The development was initiated to boost production from Cossack, Wanaea, Lambert and Hermes oil fields southwest of the Goodwyn A platform, Fig. 1. Aggregate proved plus probable oil reserves for the fields have been estimated at 88.2 million bbl.

|

| Fig. 1. The Goodwyn A gas platform on the North West Shelf. Courtesy of Woodside Energy Ltd. |

|

Another relatively bright spot in an otherwise shadowy oil picture is the BHP Billiton-operated Pyrenees field off the North West Cape of Western Australia, which gathers crude from Ravensworth, Crosby and Stickle fields. BHP and partner, Apache Corp., began production in March 2010 through a 13-well subsea development tied back to the FPSO Pyrenees Venture. Yeager said at the APPEA press conference that five to six new wells will be drilled over the next three years and tied into Pyrenees, which was designed with a capacity of 96,000 bopd. “We’re going to do our best to keep it loaded,” he said. “Believe me, the industry’s scouring every little bit of the geologic world out there, trying to see if we can’t find a little more liquids.”

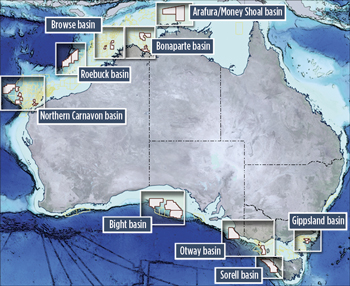

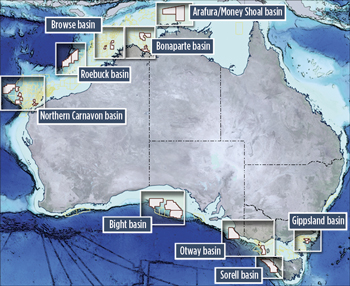

There will be more opportunities to do just that with the latest governmental release of new exploration acreage, covering 27 areas in nine basins, Fig. 2. Under the jurisdiction of the Department of Resources, Energy and Tourism, the first round of the 2012 Offshore Petroleum Exploration Acreage Release comprises 15 areas. The initial round closes on Nov. 8, with the second round closing May 9, 2013.

|

| Fig. 2. The 2012 Offshore Petroleum Exploration Acreage Release covers 27 areas in nine basins. Source: Australia Department of Resources, Energy and Tourism |

|

The offshore acreage includes the Northern Territory, Western Australia, South Australia, Victoria and Tasmania. Areas included in the release range from the highly prolific, widely explored Browse and Carnarvon basins, to the comparatively virgin Arafura and Money Shoal basins, which are largely unexplored and have yet to yield a commercial discovery.

COSTS, SLOW APPROVALS POSE RISKS

Despite buoyant forecasts for LNG, myriad roadblocks could temper the outlook significantly. The rising Australian dollar and the famously daunting logistical, personnel and environmental restrictions combine to further escalate development costs that are among the highest in the world.

Increased interest in unconventional onshore gas prospects notwithstanding, APPEA said in its newly released State of the Industry report that drilling levels remain unacceptably low. A total of 42 offshore exploration wells was drilled between 2010-2011, a four-well decline from the previous reporting period, while appraisal and development drilling declined more precipitously from 57 in 2009-2010 to 40 by the end of last year.

Current offshore drilling activity, however, is up slightly, according to World Oil’s offshore rig database, Table 1. With this month’s arrival of the Atwood Falcon semisubmersible, on contract with Apache, there are now 12 offshore rigs drilling off Australia, compared to the 10 rigs on location during the same period last year.

| TABLE 1. DRILLING ACTIVITY OFFSHORE AUSTRALIA. (Click to enlarge) |

|

|

In what is strikingly familiar to U.S. producers, industry leaders Down Under complain of the sluggish pace of regulatory approvals by the newly installed minority Labor government. They also point to an excessive level of taxation and a regulatory regime that is fraught with uncertainties.

Santos Chief Executive and APPEA Chairman David Knox said that government regulatory uncertainty could lead to a loss of $329 billion in future industry investments. The latest APPEA industry status report referenced a 2012 survey by the Canadian-based Fraser Institute that concluded, “dozens of regions around the world have fewer barriers to investment in petroleum exploration and development than Australia.” The otherwise bullish Byers warned that the newly released report “points to some concerning trends that could hamper the capacity of this industry to continue to underpin Australia’s economic well-being.”

“Australia has traditionally had a relative advantage as a destination for long-term investment through its reputation as a country of low political risk. Yet, in this era of carbon pricing, renewable energy subsidies, increasingly onerous approvals processes, and the disproportionate influence of special interests that characterizes the minority government, we cannot take that reputation for granted,” he added.

Operators weighing final investment decisions on capital-intensive LNG projects also are looking warily at the enormous gas glut in North America and the prospects that much of that surplus could end up as competition in their targeted Asia/Pacific and Far East markets. Australian LNG producers are especially targeting Japan, which is desperate to acquire new energy sources to replace its earthquake-decimated nuclear industry.

MAJOR GAS PROJECTS ADVANCE

Nonetheless, feeding mega-LNG projects continues to push offshore gas exploration. While overall exploration of Western Australia, as defined by wells drilled, continued to decline, operators Chevron and Woodside increased activity to provide feedstock to their giant floating and conventional LNG plants under development, according to a Deloitte study.

In January, Chevron said it notched up its 13th offshore natural gas discovery since 2009, when it encountered 243 ft of net gas pay at its Satyr-3 well, more than 100 mi off Western Australia in about 3,600 ft of water.

That discovery will help satisfy an increasing hunger for gas, primarily for conversion to LNG. A host of large-scale offshore gas projects, nearly all connected to the LNG market, is in production or in various stages of development. APPEA said that Australia has three LNG projects operating, and another seven are under construction with a combined value of $170 billion.

Pluto. The initial shipment of LNG was to leave the Woodside-led Pluto Project near Karratha in Western Australia, in May, aboard the tanker, Woodside Donaldson, Fig. 3. Approved for development in July 2007, Pluto gas and condensate field is in the Carnarvon basin, about 118 mi northwest of Karratha. The initial phase of the project included the installation of a platform in 279 ft of water, connected to five subsea wells, from which gas is piped through a 119-mi trunkline to onshore facilities. The LNG processing train is designed with a production capacity of 4.3 MMt per annum.

|

| Fig. 3. The tanker Woodside Donaldson on station at the Pluto LNG project near Karratha in Western Australia. Courtesy of Woodside Energy Ltd. |

|

Woodside said Pluto should contribute 17 to 21 MMboe to the firm’s 2012 production. Over the long-term, Pluto will average about 37 MMboe added to Woodside’s annual volumes, said Coleman. Tokyo Gas Pluto Pty Ltd and Kansai Electric Power Australia Pty Ltd each hold 5% of Pluto.

Wheatstone. Late last September, Chevron and its minority partners gave the final go-ahead for development of the Wheatstone LNG project off Western Australia. Apache Corp., which holds 13% of the project, will supply gas from its Julimar and Brunello gas fields in the Carnarvon basin. Kuwait Foreign Petroleum Exploration Company (KUFPEC) and Shell hold 7% and 6.4% interests, respectively.

The first phase of the project will comprise two LNG trains, with a combined capacity of approximately 8.9 MMt per annum, a domestic gas plant, and associated onshore and offshore infrastructure. First production is planned for 2016.

Apache operates the Julimar Development Project with partner, KUFPEC, encompassing Julimar and Brunello fields. The two fields have aggregate estimated recoverable gas reserves of 2.1 Tcf. “Wheatstone represents Apache’s first project in the growing worldwide market for LNG, providing an additional pathway for premium pricing of our gas resources offshore Australia,” said Chairman and CEO G. Steven Farris. “It’s also scalable, allowing for development of any future discoveries in the Carnarvon basin, where we hold interests in several prospective blocks.”

GE Oil & Gas signed a $150-million contract last year to provide subsea equipment for the Julimar Development Project near Dampier. Said to be the largest contract that Apache has ever awarded in Australia, GE will begin shipments in June 2013, with installation underway later in the year. The contract covers subsea manifolds, well systems and fully integrated subsea and topside control systems.

Gorgon. Construction of the gigantic, Chevron-operated Gorgon LNG complex, destined to be the largest in the world, is 40% complete (Fig. 4) and on track for first deliveries in late 2014, Chevron Chairman and CEO John Watson told analysts in March. Chevron and partners, ExxonMobil and Shell, will decide next year whether to add a fourth train to the complex.

|

| Fig. 4. Aerial view of the Gorgon LNG plant under construction on Barrow Island. Courtesy of Chevron |

|

As currently designed, Gorgon would house three LNG processing units with export capacity of 15 MMt per annum. Chevron says the consortium has discovered enough gas in its offshore fields off Barrow Island on the northwestern coast to possibly justify the addition of a fourth train. The consortium plans to begin front-end engineering design (FEED) this year before making a final decision.

Gorgon also will include a domestic processing plant designed to deliver some 280 MMcfgd to Western Australia. The estimated $43-billion complex also includes an estimated $2-billion CO2 sequestration project, which Chevron claims is one of the world’s largest. Feedstock for Gorgon is delivered through a subsea gathering system to exploit producing wells about 81 mi off Barrow Island in a maximum 4,265-ft water depth. Gorgon fields are said to hold some 40 Tcf of recoverable reserves.

Browse. Woodside is awaiting approval from its four partners to proceed with the sale of a 14.7% stake in its $30-billion Browse LNG project to Japan’s Mitsui and Mitsubishi Corp. If approved by partners BHP Billiton, BP, Chevron and Shell, Woodside’s interest in the Western Australia development would drop to 31.3%, said CEO Peter J. Coleman.

The development produces from three gas and condensate fields in the Browse basin, with a combined resource base of about 13.3 Tcf of dry gas and 360 million bbl of condensate. In late November, the Browse project reached a key milestone with approval of a Draft Environmental Impact Statement for the upstream component. With that potential hurdle removed, Woodside remains on schedule for first production in 2017.

Prelude. Shell says construction of what promises to be one of the world’s largest Floating LNG (FLNG) production vessels is set to begin later this year in Geoje, South Korea. The FLNG vessel is scheduled to begin delivering its first shipment in 2016 from gas field offshore Western Australia, 295 mi north-northeast of Broome. The Prelude Floating LNG Project is expected to produce at least 3.6 MMt per annum of LNG, 1.3 MMt per annum of condensate and 0.4 MMt per annum of LPG for about 25 years.

Construction of the subsea infrastructure is underway to develop the fields, which hold an estimated 3 Tcf of gas. FMC Technologies Inc. signed a contract last year to provide the subsea production and associated topside systems.

Greater Sunrise. Woodside and its partners in the Greater Sunrise LNG project remain in negotiations with the Timor-Leste government for final approval for its plans to use an FLNG vessel to produce its Sunrise and Troubadour fields, some 93 mi southeast of the island. Timor-Leste has opposed the FLNG concept and instead wants the gas piped to an LNG facility built on the island. The fields, about 280 mi northwest of Darwin in the Northern Territory, hold a cumulative, estimated 5.13 Tcf of gas and 226 million bbl of condensate.

Woodside is operator, with partners ConocoPhillips, Shell and Japan’s Osaka Gas. “In 2012 Woodside and the Sunrise Joint Venture will build on the positive engagement with the Australian and Timor-Leste governments established during 2011,” said the operator in a status update. “Engagement will focus on obtaining a common understanding of the respective expectations and needs of the Timor-Leste and Australian Governments, and the Sunrise Joint Venture, resulting from the development of the Greater Sunrise fields.”

Icthys. Operator INPEX and partner Total made a final investment decision in January, clearing the way for construction of the Icthys LNG processing plant on Darwin. The partners plan to begin exporting up to 8.4 MMt per annum of LNG and 1.6 MMt per annum of LPG by 2014.

Icthys will process gas from its field in the Browse basin that the partners estimate could hold 12.8 Tcf of gas and 527 million bbl of condensate. The 552-mi Ichthys gas export pipeline will transport production from the offshore central processing facility through a subsea pipeline to the onshore LNG facility on Blaydin Point in Darwin.

Scarborough. BHP Billiton and ExxonMobil remain undecided on how best to develop their jointly held Scarborough field, 174 mi off Western Australia. BHP’s Yeager said at last month’s APPEA convention, that the partners are weighing development options that include an FLNG vessel and an onshore processing facility, or connecting production to Woodside’s Pluto platform. “Right now, we’re doing more exploration than we’ve ever done in Western Australia. We want to round out our holdings around Scarborough and make them as large and robust as we can,” Yeager said. He added that a well drilled recently on the firm’s wholly-owned Scarborough North Block, several miles north of the main appraisal wells, successfully delineated the complex’s upper boundary.

Macedon. BHP Billiton Petroleum has now entered the pipeline connection phase of its Western Australian Macedon gas project, Yeager said last month. “Macedon is going well. The wells have been drilled offshore, and we’re actively in the pipeline (connection) part, and the plant is coming up as we speak,” he said. “All things are go right now; the off-take and the demand for the product are high.” The onshore gas processing plant is under construction at Ashburton North, with a design capacity of 200 MMcfd. The plant is designed to process wet gas from four offshore production wells.

Bonaparte. Australia’s third FLNG project is expected to begin shipments by 2018 from the GDF Suez-operated Petrel, Tern and Frigate fields in the Bonaparte basin. In 2009, GDF acquired a 60% share of the fields from Santos, 155 mi offshore Darwin. The FLNG vessel is being designed for a capacity of 2 MMt per annum. The Bonaparte LNG acquisition gave GDF Suez its first foothold on Australia’s North West Coast.

ONSHORE WELLS UP TWO-FOLD

The newly released Deloitte drilling and licensing report has 2011 onshore drilling activity double that of the previous year, primarily in South Australia’s growing unconventional shale and CSG prospects. Driven mainly by smaller home-grown and international independents, government figures show 38 onshore exploration wells drilled during 2010-2011, compared to 19 during the previous period.

To fully analyze the reserve potential, especially for liquids, Yeager said BHP, Australia’s largest operator, is exploiting the shale expertise of U.S. independent Petrohawk, which BHP Billiton acquired in August. Petrohawk discovered the liquids-rich Eagle Ford play of South Texas.

“We’ve got a couple of our very best Petrohawk guys, who have come across to us, and we are studying every square inch of Australia right now,” he said. “There are vertical wells that have been drilled through old shales here in Australia. We are getting that log data. We’re going to look at it and see where we are.”

Most of the onshore activity is centered in the Cooper basin, straddling the South Australia/Queensland border, and to a lesser extent in the Perth and Canning basins of the west. To the north, Falcon Oil & Gas of Denver, CO, also says it has identified “world class” unconventional gas and associated oil in four permits it holds in the Betaloo basin of the Australian Outback. Falcon and Amerada Hess agreed in 2011 to jointly explore three of the four permits covering 100,000 acres.

However, the center of onshore activity remains South Australia, where unconventional production is beginning to comprise a larger percentage of the total energy mix, Fig. 5. APPEA’s Byers said South Australia “is clearly set to play a major role in Australia’s emergence as a global energy superpower.”

|

| Fig. 5. South Australia exploration and appraisal wells dominate onshore activity. Source: South Australia Division of Mines & Energy. |

|

Recently, Australian independent Linc Energy released details of a “significant” Permian-age oil shale deposit within the Stuart Range formation in the more-than-16 million acres it controls in South Australia’s Arckaringa basin, Fig. 6. The deposit was intersected during completion of the Arck 1 stratigraphic well, drilled in PEL 122 as part of Linc Energy’s South Australian exploration program.

|

| Fig.6. SAPEX division of Linc Energy holds more than 16 million acres in South Australia’s Arckaringa basin. Courtesy of Linc Energy |

|

Linc has completed a 2D seismic program in the Arckaringa basin, and data processing is underway with preliminary results indicating a substantial number of new and previously unknown target locations. The company’s newly formed SAPEX division is exploring the untapped potential of the Arckaringa basin.

Drawing much of the onshore attention, however, is the rapidly increasing CSG sector in South Australia, where no less than three CSG-to-liquid projects are in development. Once online, these projects are expected to add more than 20 MMt per annum to the unconventional resource production stream.

BG plans to begin producing 8.5 MMt per annumn of liquefied CSG from its wholly owned Queensland Curtis LNG project in the Surat basin by 2014. The project includes a nearly 336-mi. pipeline that will connect production from the Surat basin of southern Queensland with the Gladstone gas fields. A two-train LNG plant, to be located on Curtis Island near Gladstone, will process gas for export.

Australia Pacific Energy, a ConocoPhillips/Orgin Energy Ltd. joint venture, plans to initiate production from its APLNG project by 2016, with initial production of 4.5 MMt per annum. The project stretches across the Surat and Bowen basins along a 280-mi pipeline to a processing unit at Laird Point on Curtis Island off Gladstone.

Partners Santos, Petronas, Total and Korea Gas plan to start CSG production from their Gladstone LNG project by 2015 with estimated production of 7.8 MMt per annum for export to Asia.

POSITIONED FOR TOP ROLE?

Whether the ever-increasing LNG sector will, as Byers contends, elevate Australia to global energy superpower status remains to be seen, as internal and external threats could ultimately tone down the optimism. Even though his own government is cited as the cause of many of those threats, Australian Resources Minister Martin Ferguson said the upbeat forecasts are justified.

“While global uncertainty remains a threat to ongoing investment, our trading partners continue to show confidence in Australia’s capacity to meet their energy demands. Australia is poised to be a leader in the energy revolution,” he said in a speech at the May APPEA conference.

|