WILLIAM J. PIKE, Contributing Editor, Leonardo Technologies, Inc.

|

| NAFTA Pita driling activities at the Kebien LE-1 well in the Baltic basin located in the northwestern region of Poland. Photo courtesy of NAFTA Pika. |

|

IOCs, NOCs and independents are active around the world, attempting to replicate the success of North American shale plays. There are promising assessments in Russia and China. Exploratory drilling is underway in Poland, but with generally disappointing results. The two bright spots for international shale activity are Argentina and Australia.

GLOBAL OVERVIEW

A 2011 U.S. Energy Information Administration study (World Shale Gas Resources: An Initial Assessment of 14 Regions Outside the United States, U.S. Department of Energy, April 2011) estimates technically recoverable shale gas resources at 6,622 Tcf in 32 major shale countries containing almost 70 shale gas formations in 48 basins. Russia and Central Asia, the Middle East, Southeast Asia and central Africa are not included in the study, primarily because there are either significant quantities of conventional natural gas in place in the areas (Russia and the Middle East), or because of a general lack of information with which to carry out even an initial assessment. However, especially given the probable, large-scale resources of Russia and the Middle East, it is reasonably safe to assume that their inclusion would raise total technically recoverable reserves, worldwide, by 20%-25%, to 8,000–8,250 Tcf.

WESTERN EUROPE

Geological assessments are underway in the Carboniferous, Permian, Jurassic and Ordovician shales in France, Germany, the Netherlands, Sweden, Denmark and Austria. Estimated technically recoverable gas reserves in these countries stand at 372 Tcf, with France leading the pack. The largest shale gas resource in the area is the Alum shale in Scandinavia.

France. The Paris basin in France contains two organically rich shale formations, the Toarcin “Schistes Carton” formation and the Permian-Carboniferous shale formations. The “Schistes Carton” is immature and, therefore, a target for oil development but not for gas. The Permian-Carboniferous is deeper and more mature, with estimated technically recoverable reserves of 76 Tcf. While firms have acquired acreage totaling about 4,000 sq mi in the eastern part of the basin where the Permian-Carboniferous formation is thickest, development activity is at a standstill, due to the French ban on hydraulic fracturing in the basin. While Total CEO Christophe de Margerie has said France should have the “courage” to explore for shale gas, Environment and Energy Minister Delphine Batho insists that the ban on hydraulic fracturing will remain until a “clean” technology is available.

North Sea-German basin. The North Sea-German basin has been defined as the large, 78,000-sq-mi area of Paleozoic through Tertiary fill extending from Belgium to Germany’s eastern border. Exxon Mobil remains the leading leaseholder in the area. In a report released by the German Environment Ministry in September, the agency urged the enactment of a government ban on fracing near drinking water reservoirs and mineral springs. The report also suggested further environmental studies. Fracing has been used in Germany since the 1960s, with at least 275 frac operations linked to conventional gas and oil wells in Lower Saxony, according to the study.

Scandinavia. The region’s shale gas resource exists, primarily, in the Cambrian-Ordovician Alum shale with prospective areas occurring in western Norway, eastern Sweden and northern Denmark. Shell Oil drilled three wells on an acreage position in the Skane region of southern Sweden, which amounted to approximately 400 sq mi. Due to low gas saturation in the shale, no further work has been undertaken. In October 2011, Aura Energy began a series of five planned wells in the Alum shale. Results of the wells are unknown.

UK Northern and Southern petroleum systems. The UK’s Department of Energy and Climate Change (DECC) has noted that recoverable shale reserves from both the UK North and Southern Petroleum Systems could exceed 5.3 Tcf. While, to date, nearly 400 onshore exploration licenses have been issued, development of shale gas in the region remains slow. Following two small earthquakes near a Cuadrilla Resources drilling site in Lancashire, the UK government suspended fracing. In October, the government announced that it is considering a ‘generous new tax regime’ for companies wishing to invest in shale gas development. The fracing ban may be lifted as early as spring 2013. Cuadrilla has thus far completed the drilling of three wells and is drilling one additional well in the Lancashire license area, as part of its exploration program. While all four have been vertical wells, the company has applied to drill its first horizontal at the Anna’s Road prospect.

EASTERN EUROPE

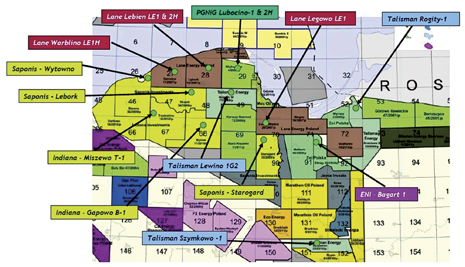

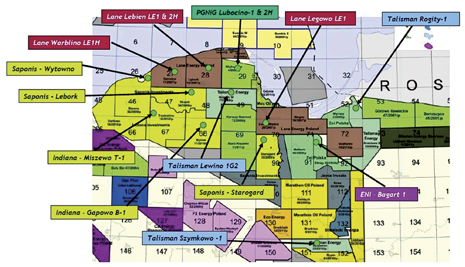

Poland. While the coal-rich nation was estimated by EIA in 2011 to have 187 Tcf of shale gas, a feverish rush by several companies to produce gas has been slowed down by mixed results in exploratory drilling in three basins—Baltic in the north, Lublin in the south, and Podlasie in the east, Fig. 1. Polish Deputy Environment Minister Piotr Wozniak recently said that while shale development has seen “humble” results, with only 33 wells completed as of November, the government expects activity to sharply increase in coming years, with another 270 wells drilled by 2020. Almost 120 shale drilling permits have been issued so far, with several will waiting for approval.

|

| Fig. 1. Drilling activity in Poland’s Baltic basin. Operators are still awaiting a major discovery. Map courtesy of 3Legs Resources. |

|

In June, Exxon Mobil announced plans to abandon its Polish shale gas operations after weak results from two exploratory wells. Exxon and Canadian operator Talisman are reportedly in negotiations to sell their licenses to Poland’s largest oil firm, PKN Orlen. France’s Total, however, is planning to begin unconventional oil and gas recovery in the country as soon as 2013. Additionally, a consortium of five state-controlled Polish companies has agreed to spend $500 million on joint shale gas exploration and extraction.

Rest of Eastern Europe. The Ukraine, Lithuania, Hungary, Romania and Bulgaria boast promising shale gas resources. For the three basins for which sufficient information exists—Baltic (Lithuania), Dnieper-Donets (Ukraine) and Lublin (Ukraine)—technically recoverable reserves are estimated to be 65 Tcf. The EIA estimates Ukrainian shale gas reserves at 42 Tcf, and the country is moving forward swiftly with plans to develop these formations. In May, the Ukraine chose Shell and Chevron Corp to develop the giant Yuzivska and Olesska fields, which are estimated to cost $300 million and $200 million, respectively, to explore. Eni is serving as operator of nine blocks in the Lviv basin. In August, Exxon Mobil, Shell, OMV Petrom and Ukrainian state-owned Nadra, were awarded approval to explore the Black Sea deepwater Scythian field. The marine formation is estimated to hold between 3 and 4 Bcm. Chevron recently acquired a 50% stake in LL Investicijos, a private Lithuanian exploration company, adding to its four million acres in Poland and Romania. The company is also looking to enter the Ukraine and Bulgaria, which is under a fracing moratorium.

RUSSIA

While Russia is thought to have huge shale gas potential, development of that potential poses a significant threat to Russian interests in conventional gas production, and its development has, at times, been hotly contested. While little shale gas exploration is known to have taken place, Rosneft has entered into an agreement with ExxonMobil that refers to the transfer of shale gas-related technological know-how and experience. No reliable estimates of shale gas reserves are available for Russia.

CENTRAL NORTH AFRICA

The central North Africa region contains two major shale gas basins—the Ghadames basin in eastern Algeria, southern Tunisia and northwestern Libya; and the Sirte basin in north-central Libya. Despite recent protests regarding the safety of fracing, foreign companies are expressing interest in exploring the area. The EIA has estimated Algerian reserves to be around 231 Tcf.

Shell has been in talks with the Algerian and Tunisian governments regarding shale exploration, and in June, the operator drilled its first shale gas well in Algeria’s Ahnet basin. In Tunisia, Shell is still awaiting approval for an exploration permit, which it filed in June of this year. Calgary-based Winstar Resources completed a study this year of shale potential in Tunisia’s Ghadames basin. The company announced that its data indicate high-quality formation attributes and has compared the Silurian Tannezuft hot shale to several shale plays in the U.S.

Despite recent political turmoil, Libya is looking to study its own shale gas reserves. While the war-torn country works to increase its output, which was suspended last year, IOCs, such as Shell, ExxonMobil and Total, are reportedly in talks with government officials and initial formation studies. The EIA has estimated Libya’s shale gas output at 290 Tcf.

CHINA

China boasts seven shale gas-rich basins, Sichuan and Tarim, and the less prospective Ordos, Junggar, North China [Huabei]), Turpan-Hami and Songliao. With recoverable shale gas reserves of 1,275 Tcf, development is slowly picking up speed. In November, China unveiled plans to subsidize energy companies working to develop shale gas resources. Central government funds will back a subsidy of 6.3 cents for each cubic meter produced by shale gas developers through 2015, in a move to spur thus-far lackluster interest in China’s shale resources.

In October, the nation opened a second shale gas bidding round for 20 blocks, with an area of 20,000 sq km. The leasing auction attracted a record 83 companies, although the bidding was open to only to domestic companies or Chinese-held joint ventures with capital of more than $48 million. The leasing rights will have a three-year term, and winners are required to use local content in developing their leases.

In August, Shell announced plans to spend at least $1 billion per year in recovering shale gas resources. Earlier this year, Shell China signed off on the country’s first production sharing contract, with CNPC. ExxonMobil, Chevron, BP and Statoil are also active in China’s shale gas development.

SOUTH ASIA

India and Pakistan contain a number of shale-rich basins. Those in India include Cambay, Krishna Godavari Cauvery and the Damodar Valley sub-basins, such as Raniganj, Jharia and Bokaro. In Pakistan, shale potential exists in the southern Indus and Baluchistan basins. The Upper Indus basin may also have unconventional resources, but it is yet to be tested. India has estimated technically recoverable reserves of 63 Tcf, compared to Pakistan’s 51 Tcf. In August, the Indian government announced plans for its first shale auction, to be held in December 2013. This licensing round will mark the first time that foreign energy companies have been allowed to bid. Incentives are also being discussed to encourage foreign participation, such as waving customs duties on the importation of shale exploration equipment. Eni plans to invest $10 billion in three shale pilot projects in Pakistan, with 1,100 new wells to be drilled in 2013.

AUSTRALIA

The Cooper basin, Australia’s main onshore gas producer, is in initial shale gas production, although it’s Permian-age shales have a non-marine depositional origin, and the gas has elevated CO2 levels. Estimated risked recoverable reserves in the basin total 85 Tcf. Shale exploration is occurring in other prospective shale basins in Australia, including the Georgina, Galilee, Bowen, Sydney, Canning, onshore Perth, Beetaloo and McArthur basins. These basins hold an estimated 396 Tcf of technically recoverable reserves.

Santos initiated Australia’s first shale gas production in October from its Moomba-191 well in the Cooper basin. Initial stabilized flowrate from the well was 2.7 MMcfd from the Rosneath, Epsilon and Murtee target shales. Further drilling is planned for the area, including an ongoing vertical well appraisal program and Santos’ first horizontal shale well planned for early 2013.

In June, Statoil farmed into Petrofrontier’s exploration permits in the South Georgina basin, in the Northern Territories. Statoil has committed to contribute $25 million for the first phase of the exploration program. Beach Energy was expected to complete drilling four vertical wells by the end of 2012 and has six more wells planned for the first half of 2013. The company is looking to drill its first horizontal well test. Meanwhile, Total announced in November that it has signed a farm-in agreement with Central Petroleum to receive shale exploration permits in the South Georgina. ConocoPhillips and New Standard Energy have partnered up for an exploration project in the northeastern region of the country, while BG Group and Drillsearch are focusing their efforts on the Cooper basin.

Shale plays abound in Latin America

MAURO NOGARIN, Contributing Editor, Latin America

In a region teeming with new shale discoveries, Argentina is seeking to increase its short-term investment in the exploration of shale plays to increase its national oil production. Mexico’s Pemex is increasing its shale gas exploration efforts, as of 2012. Although not a top priority, and despite its large offshore reserves, Brazil is also looking at unconventional resources.

ARGENTINA

Diplomatic relations between Argentina and the United Kingdom are at an all-time low. Nevertheless, the president of state oil company YPF is holding extensive meetings in London, with the aim of attracting British investors to develop shale oil and gas deposits in Neuquén and Santa Cruz Provinces. During her visit to New York City for the 63rd United Nations General Assembly, President Cristina Fernandez met with Exxon Mobil CEO Rex Tillerson and YPF President Miguel Galuccio, to analyze the possibility of jointly developing Argentina’a non-traditional natural resources. This confirms that shale is an integral part of YPF’s growth projections, and a means of increasing the hydrocarbon production, and decreasing oil and gas imports.

|

| Argentinean President Cristina Fernandez and Exxon Mobil CEO Rex Tillerson discussed unconventional hydrocarbon development. |

|

The five gas and oil shale discoveries mentioned in YPF’s Business Plan presentation for 2012-2017 are in the San Jorge Gulf (Los Perales, Loma del Cuy and Cañadón Yatel) of the D-129 formation; and two in the Vaca Muerta formation in Neuquén (El Orejano and Loma del Molle), which span 1,055 sq km and represent barely 5% of the known reserves of Vaca Muerta oil field. Of the four projects mentioned, development work has only begun on Loma Campana–LLL norte. This oil field will produce 8,000 bpd in 2013 and is projected to produce 55,000 bpd by 2015, when the other clusters go into production.

The potential appears to be very good; Vaca Muerta could produce 150,000 bpd of shale oil by 2020.

The shale gas projects are no less impressive—eight clusters identified with a total area of 1,888 sq km, which represent approximately 20% of the potential gas formations.

The El Orejano project is the first one being developed, and by 2017 it is projected that shale gas from Vaca Muerta will produce 13 MMcmd (21% of current national gas production in Neuquén province), and up to 30 MMcmd by 2020.

MEXICO

In northeastern Mexico and all along the Gulf of Mexico coastline, considerable shale oil formations exist that have great thickness and date back to the Jurassic and Cretation periods. Some of them, such as Burro-Picachos, run into the Eagle Ford formation in the U.S. It is estimated that many of the Gulf of Mexico shale deposits are located at a depth of 5,000 m.

In the Burro Picachos and Burgos deposits, where Pemex has drilled five exploratory wells, formations have proven the continuation of the Eagle Ford shale deposits. If the Tampico-Misantla deposits are proven, the shale oil potential would include a very large area of opportunity in the Pimienta and Agua Nueva plays. Pemex and EIA are not in agreement over the potential shale deposits of gas and oil. EIA published a study evaluating the world’s potential oil and gas resources, in April 2011, and placed the recoverable amount in the Mexico basin at around 681 Bcf of natural gas. However, based on its 70-year experience in exploring the Gulf of Mexico, Pemex Exploration and Production (PEP) identified the geological formations of Burro-Picachos-Sabinas, Burgos, Tampico-Misantla, Veracruz and Chihuahua as having shale oil precursors with the following recoverable resources, Table 1.

| |

|

|

Based on new geological and geochemical studies conducted by Pemex, the Tampico-Misantla basin has been identified as the one with the greatest potential for shale oil. The potential production of the Sabinas-Burro-Picancho-Burgos basins has been recalculated on the basis of technically recoverable resources.

To date, the main activities carried out by Pemex, as of 2010, have been to conduct the geological and geochemical studies of the plays in the aforementioned five basins through 3D seismic surveys.

Pemex has drilled four wells, of which three yielded dry gas (Emergente-1, Percutor-1 and Arbolero-1), and one produced wet gas (Habano-1). At the end of 2012, Pemex will begin an exploratory well in Tampico-Misantla and Burgos.

Emergente-1 and Habano-1 are in the Burro-Picachos basin, and the other three are in Sabinas field, Table 2.

In the Sabinas-Burgos-Picachos portion of the Eagle Ford play (Superior Cretation), the Emergente-1 and Habano-1 wells confirmed the continuation of the dry and wet gas zones. This play has estimated resources of 55 Bcf of natural gas.

The Percutor-1 has confirmed production of dry gas and also proved an eastward extensión of this play toward Sabinas. The last wells, Nomada-1 and Montañes-1, explored the oil and wet gas areas, respectively, yielding conclusive results. This play has potential resources of 109 Bcf of gas.

In the projected drilling plan for 2012-2045, Pemex has projected development of five strategic areas, including Chihuahua, by drilling 172 wells to evaluate prospectivity between now and 2018, and 590 additional exploratory wells by 2025. In the final phase, the company would develop 27,000 production wells by 2045.

Pemex is evaluating 90 companies, from which they will select five to help with this effort, with an important criterion being which five can best adapt to Pemex’s in-field laboratories.

BRAZIL

Brazil has good possibilities for developing its tight gas production, as well as shale gas in the future, in several land-based basins. These include the Parana basin (south-central Brazil), Parecis basin (Mato-Grosso), Parnaiba basin (Maranhão, Piuaí and Tocantins), Recôncavo basin (Bahia) and São Francisco basin (Minas Gerais and Bahia). There is also good potential in the Amazon basin and in some offshore reserves. However, due to their remote locations, which makes them more expensive to develop, the National Petroleum Agency (ANP) is abiding by a study that indicates it is more cost-efficient to concentrate exploration resources in three areas for tight gas and shale gas (Parecis, Parnaiba and Reconcavo). Together, they have an approximate potential for 200 Tcf of gas, Fig. 2. However, since these estimates are still preliminary, they are in a consolidation phase. The U.S. Energy Department made an evaluation, which is not yet backed by ANP, that the Parana basin could hold 226 Tcf of shale gas.

|

| Fig. 2. Brazil’s Parecis, Parnaiba and Reconcavo basins hold an estimated 200Tcf. |

|

The only companies authorized to explore the San Francisco basin in Minas Gerais are Petra, Petrobras and Orteng. However, as of September, Shell announced that in 2013, it will also begin a 3D seismic study and drill exploratory wells for shale gas in Minas Gerais, in the São Francisco River basin.

In ANP’s multi-year plan, including 2012, activities in several basins were mentioned, Table 3.

|

|