JIM REDDEN, Contributing Editor

|

| A PetroChina drilling operation, left, reflects the severe topographical challenges confronting onshore operators. Photo courtesy of PetroChina. One of the Wenchang platforms, center, in the western Pearl River Mouth basin. Photo courtesy of Husky Energy Inc. A PetroChina production site. Photo courtesy of PetroChina. |

|

With China’s oil and gas giants continuing their global buying bender and showing no signs of closing their wallets anytime soon, it’s easy to overlook the spirited onshore and offshore drilling campaign taking place within the country’s ample borders as it struggles to quench an unequaled thirst for energy.

Even as its once otherworldly economy falls back to earth, China’s world-leading appetite for oil and gas is projected to only intensify over the next two decades, so much so that it promises to be the wild card in future global oil price scenarios. In its World Energy Outlook 2012, released on Nov. 12, Paris-based International Energy Agency (IEA) went so far as to forecast that by 2035, China, alone, would account for 50% of the net increase in global oil demand. Despite its ranking as the world’s fourth-largest oil producer, China is also the second largest net importer, and one of the premier markets for liquefied natural gas (LNG).

While accelerating efforts to increase home-grown production, Chinese national oil companies (NOCs), in the meantime, continue to scour the world, snapping up reserves to help narrow the ever-widening gap between production and consumption. Last year, alone, Chinese companies added oil and gas assets valued at well over $22 billion to their international shopping cart, according to a Wall Street Journal tabulation. Of that, some $6 billion was spent in North America—a tally that more than doubled on Dec. 7 when Canada gave its blessing to China National Offshore Oil Co. (CNOOC) Ltd’s highly contentious $15.1-billion bid to acquire Nexen Inc. The blockbuster bid also includes substantial holdings in the UK North Sea and U.S. Gulf of Mexico. The deal is certain to meet stiff resistance in the U.S., where legislators have expressed strong reservations over CNOOC having an operator’s stake in strategic offshore blocks.

Also in Canada, China Petrochemical & Chemical Corp., or Sinopec, which attempts to sidestep political backlashes by taking partnership interests over outright acquisitions, inked a $1.5-billion investment with Canada’s Talisman Energy Inc. in July that includes a 49% stake in Talisman’s UK North Sea holdings. In January, Sinopec crept back into the U.S., spending $2.5 billion to acquire a one-third interest in the 1.3 million acres that Devon Energy holds in Ohio, Michigan and elsewhere.

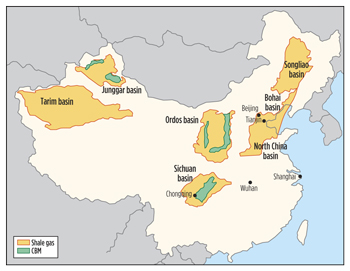

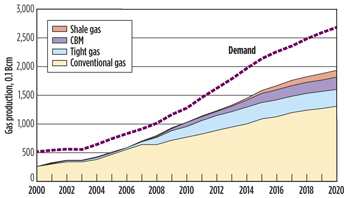

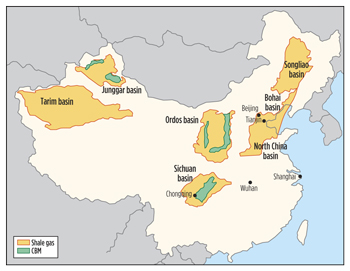

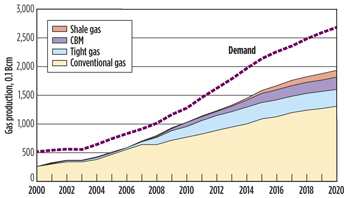

Back home, with output peaking at Daqing, Shengli and most of the other large, older fields, mainly in the northeast, China is aggressively pursuing largely unexploited reservoirs in the deepwater and western provinces. Much of this focus is on what has been identified as the world’s largest reserves of shale gas and coalbed methane (CBM), primarily locked within seven basins, Fig. 1. While many see it as an unattainable goal as things now stand, the Ministry of Land and Resources (MLR) and other government agencies continue to steadfastly tout the national line that has China going from basically zero shale gas production in 2011 to nearly 230 Bcf/year by 2015. Whatever the eventual production numbers may be, the NOCs insist that shale and CBM will take a considerable share of the overall energy mix in the not-too-distant future, Fig. 2.

|

| Fig. 1. Location of China’s primary shale and CBM basins. Source: U.S. Energy Information Administration (EIA) |

|

|

| Fig. 2. Role of unconventional resources in overall gas mix going forward. Source: U.S. Energy Information Administration (EIA) |

|

The lofty expectations have raised a few eyebrows within the international petroleum community. While recognizing the tremendous potential down the road, many view the expectations over such a relatively short timeframe as far too ambitious for a sector still in the embryonic stage with no production. That sector also confronts a severe dearth of technological and geological expertise, not to mention take-away bottlenecks and topographical challenges that range from semi-desert to mountain ranges with precipitous canyons. In addition, would-be producers of China’s enormous unconventional resource base also must contend with stiff environmental and regulatory restrictions.

During last November’s 18th Communist Party Congress that installed a new leader, cabinet members said that any new onshore or offshore industrial project must now pass a “social risk” test in addition to an environmental impact statement. The move was to head off a surge in once-unheard-of public protests that recently forced the suspension of a petrochemical project in Ningbo.

Regardless of the drawbacks, government officials continue to defend their prognosis for the shale and CBM plays. “This goal can be attained,” said Zhang Yuqing, deputy administrator of the National Energy Administration (NEA), in early September during the bilateral U.S.-China Oil and Gas Industry Forum (OGIF) in San Antonio, Texas. “We would like to utilize U.S. technology to increase our development. We would like to learn from you and establish a good framework for shale gas development.”

PRODUCTION LAGS DEMAND

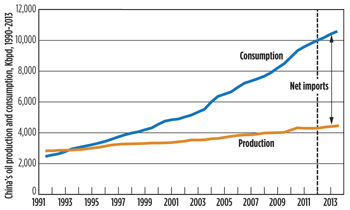

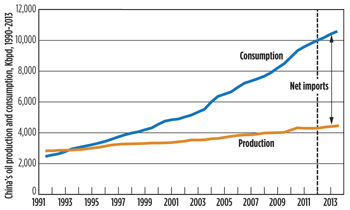

According to the IEA, China’s 2012 oil production in August had increased modestly to 4.13 MMbpd, compared to 4.10 MMbpd during the same period last year. The U.S. Energy Information Administration (EIA) expects production to reach 4.5 MMbopd by the end of next year, thanks in no small part to new offshore discoveries coming online and increased emphasis on water and polymer flooding and other enhanced oil recovery (EOR) techniques in the oldest brown fields. The higher forecasted production levels, nevertheless, will fall far below consumption levels, Fig. 3. For the first six months of 2012, the IEA reported that China’s cumulative oil production stood at just over 857.6 million bbl, which was down 1.3% year-on-year.

|

| Fig. 3. Oil production compared to consumption through 2013. Source: U.S. Energy Information Administration (EIA) |

|

While China conservatively holds 20.4 billion bbl of proven oil resources as of Jan. 1, 2012, the EIA predicts that oil production over the long haul will average only around 4.7 MMbpd over the next 22 years.

Production from Sinopec’s and PetroChina’s interests in the Tarim basin, combined, has grown 4% annually, reaching 261,000 bopd, according to IHS Global Insight. PetroChina also says it intends to boost production in the mature Junggar basin from 218,000 bopd in 2011 to 400,000 bopd in 2015, by using more cost-effective and advanced heavy oil extraction techniques.

In a related development, worries over supply disruptions have led China to develop eight emergency oil storage sites, with a reported, combined capacity of some 207 MMbbl. All the facilities are expected to be operational next year.

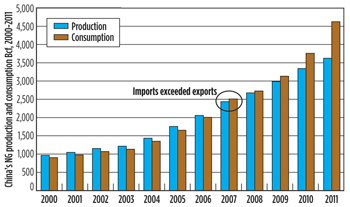

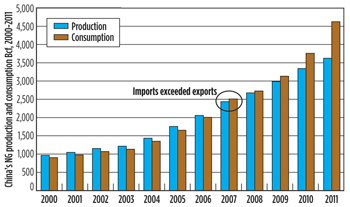

As for gas, the EIA in its latest analysis has China producing 3.6 Tcf in 2011, which represents a 9% increase over the previous year, but still some 1.3 Tcf short of demand, Fig. 4. With a growing environmental wave sweeping the country, most analysts expect gas consumption to increase even more appreciably, as China slowly moves to wean itself from dependence on coal. BP, in its Energy Outlook 2012-2030, released in January, sees China’s gas production increasing at an annual rate of 6.1% over the next 18 years, while consumption will grow at a 7.6% yearly clip during the same period. BP also foresees shale and CBM contributing up to 46% of new gas production during the period examined.

|

| Fig. 4. Gas production vs. consumption. Source: U.S. Energy Information Administration (EIA) |

|

Until its domestic gas production and demand begin to approach equilibrium, China will continue to be one of the world’s primary destinations for LNG, having secured long-term contracts with a number of global suppliers. At the end of October, CNOOC ensured even more supplies, when it acquired interests in the BG Group’s Queensland Curtis LNG plant in Australia, in a deal worth a reported $1.93 billion.

The growing chasm between oil and gas production and consumption is certainly not the result of sluggish drilling activity. According to World Oil estimates, China’s NOCs and their international partners set another record last year, drilling an estimated 24,350 new wells, which would amount to a 746-well increase over those drilled in the previous year. The bulk of new drilling activity is centered in Bohai Bay and the South China Sea, as well as in Xinjiang, Sichuan, Gansu, Inner Mongolia and other western interior provinces.

DOORS OPENING WIDER?

Many Chinese observers are cautiously optimistic that the installation of Xi Jinping as the country’s first new leader in a decade will promote more flexibility in international participation within its oil and gas sector. They point to the new president’s former leadership of the flush coastal province of Zhejiang, the nation’s richest, most ardent free enterprise enclave, where Xi was credited with luring a host of international conglomerates.

Xi’s coronation last month as the all-powerful general secretary of the Communist Party of China followed on the heels of media reports earlier in the year that said a “super-ministry” will be created in 2013 to replace the NEA as the chief regulatory agency. According to Reuters and others, the ministry would consolidate duties now spread across a host of government bodies, which Beijing feels would cut down on the bureaucratic infighting that has long plagued the industry.

Whether such a ministry would cut the regulatory gridlock, and streamline the issuance of production sharing contracts (PSC) and similar agreements with international companies, remains to be seen. However, with oil and gas imports continuing to climb, the recent signs are definitely encouraging for international operators and service companies as China desperately seeks technical know-how, particularly in developing its nascent unconventional resources.

In late October 2012, the MLR said it is evaluating the 152 bids that it received from non-state operators for 19 of the 20 shale gas blocks that were put up for lease in September. The second government-sponsored auction of shale gas blocks spanned 7,723 sq mi across Guizhou, Chongqing, Hunan, Hubei, Jiangxi, Anhui, Zhejiang and Henan provinces.

In a related development, PetroChina reportedly has offered oil and gas blocks in the northwestern Xinjiang Uighur Autonomous Region for joint development with international operators. If confirmed, this would be an astonishing reversal, as no independent operator has been granted a joint permit in nearly seven years in the resource-rich area controlled entirely by PetroChina and Sinopec. China has said that by 2015, it intends to make the Xinjiang Uygur Autonomous Region one of its largest oil and gas production and storage centers.

More evidence that China may open its doors more widely to outside companies came with the State Council’s October release of its 2012 energy policy white paper, “Strengthening International Cooperation in Energy.” The report, which has been described as a major policy switch, addressed all forms of energy. However, relating specifically to oil and gas issues, it stated, in part, “The Chinese government encourages foreign investment to engage in the exploration and development of oil, natural gas and unconventional oil and gas resources, such as shale gas and coal-bed gas, by way of cooperation.”

RIGS TARGET DEEP WATER

Historically, offshore activity has accounted for only about 15% of China’s total production, and most of that has flowed out of Bohai Bay, a resource-rich, seaward extension of the Liaohe, Dagang and Shengli onshore oil fields. More recently, CNOOC and its who’s who of international partners that includes Anadarko, BG Group, BP, ENI, Chevron, Husky and others, are focusing on deepwater blocks in the hotly-contested South China Sea. In an earlier estimate, the U.S. Geological Survey (USGS) predicted that the South China Sea could hold some 28 billion boe.

According to Baker Hughes, an average 16 rigs were drilling offshore China for the first nine months of 2012, unchanged from the same period last year. Attesting to increased emphasis on the deeper waters of the South China Sea, China Oilfield Services, the drilling arm of CNOOC, in October added another semisubmersible rig to its fleet. The newly acquired semi is capable of drilling in water as deep as 4,600 ft, and it was scheduled to begin drilling before the end of 2012.

In its mandatory yearly filing with the U.S. Securities and Exchange Commission (SEC), CNOOC, which essentially controls all of China’s offshore activities, reported net proved reserves of 2.9 billion boe, including 2.3 billion boe from its domestic holdings. Of that figure, 632 MMboe were listed in Bohai Bay, with the remainder spread out between the South China Sea and the East China Sea. Its international assets accounted for the remaining 22.1% of the total net proved reserves.

By the end of 2011, CNOOC and its international partners drilled 93 exploration wells offshore China, notching up 13 new discoveries. “In 2011, we spent approximately $1.3 billion developing proved undeveloped reserves into proved developed reserves; $1.1 billion, or 84.5%, were spent on 15 major development projects in Bohai East China Sea and Eastern South China Sea in offshore China, and the Akpo oil field in Nigeria. The remaining 15.5% were spent on our domestic infill drilling programs in Bohai and Eastern South China Sea,” CNOOC reported in its SEC filing.

More recently, activity has shifted to the deeper waters of the northern South China Sea, mainly in the Pearl River Mouth (PRM) and Qiongdonghan (QDN) basins, with water depths ranging from just under 985 to more than 10,500 ft. The QDN basin off Hainan Island Province is, by far, the more technically demanding of the two, with bottomhole temperatures (BHT) up to 475°F and pressures requiring equivalent mud weights up to 19.5 lb/gal.

Geologically, the northern section of the South China Sea is a particularly attractive target, CNOOC chief geologist Zhu Weilin said during the 12th OGIF technology exchange. “In the northern part of the deepwater South China Sea, there are three sets of proven source rocks, multiple reservoir rocks and play concepts, including shelf margin deltaic sands, deepwater fans and reef. A series of large-scale structures and drillable prospects has been mapped and is ready for exploration,” he said. “Huge hydrocarbon resources potential is remaining for further exploration in the deepwater of the South China Sea.”

As of year-end 2011, Zhu said 78 oil and gas fields had been discovered in the shallow waters of the South China Sea, with 33 oil and five gas wells now onstream. He estimated that deep water comprises more than 70% of the South China Sea, much of which has long been embroiled in territorial disputes between a number of Southeast Asian nations.

Meanwhile, in late October, CNOOC initiated production from its wholly owned and operated Weizhou 11-2 and Weizhou 6-9/6-10 fields in the shallow waters of the Beibu Gulf in the South China Sea. The Weizhou 11-2 field is expected to reach peak output of 3,960 bopd by the end of this year, while the Weizhou 6-9/6-10 field is expected to reach peak output of 5,870 bopd in 2013, CNOOC said.

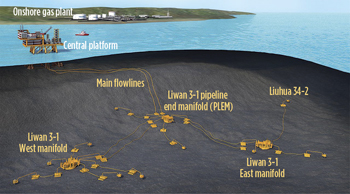

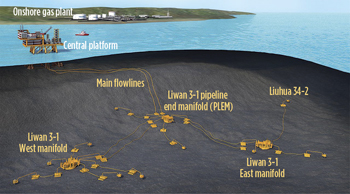

Also nearing first production are three adjacent gas fields on CNOOC and Husky’s Block 29/26 in undisputed waters of the South China Sea. Canada’s Husky, which also holds 40% interest in Wenchang oil field in the PRM basin, made its first major gas discovery on the block with its Liwan 3-1 field. The two sister fields, Liuhau 34-2 and Liuhau 29-1, will share subsea infrastructure (Fig. 5), with first production slated for late 2013 and ramping up throughout 2014, Husky said.

|

| Fig. 5. Artist’s conception of shared subsea infrastructure for the Liuhau 34-2 and Liuhau 29-1 gas discoveries. Source: Husky Energy Inc. |

|

Elsewhere, Chevron operates three deepwater blocks in the South China Sea that cover approximately 4.8 million acres, including a 100% interest in Blocks 53/30 and 64/18, and a 59.2% interest in Block 42/05. Chevron holds separate PSCs for each block and also has interests in the PRM basin of the South China Sea as part of the CNOOC/Agip/Chevron/Texaco (CACT) operators consortium.

The operator collected 3D seismic data over the two blocks last year prior to launching a three-well drilling program. The first well was deemed non-commercial, while the remaining two wells in the program were scheduled to be drilled by mid-2012.

Earlier, Eni and CNOOC signed a PSC to explore deepwater Block 30/27, nearly 250 mi off Hong Kong. That agreement was followed in late September with CNOOC and Taiwan’s CPC signing a joint gas exploration deal for the deepwater Taiwan Strait.

The BG Group recorded a discovery in its first Chinese exploration well (Lingshui 22-1-1) in late 2010, on Block 64/11. Last year, additional 3D seismic was acquired on the block, which is still under examination. Further 3D seismic was expected to be acquired on Block 64/11 by the end of this year. In February, BG relinquished it interests in Block 53/16 after assessing the results of the Yongle 2-1-1 exploration well drilled last year.

Owing in part to the intensified environmental scrutiny nationwide, CNPC initiated what it terms a “green oil field” approach at its Dagang oil field on its Chenghai Block in Bohai Bay. To minimize the environmental impact of drilling and production, CNPC describes the strategy as the onshore production of offshore oil, Fig. 6. The project includes three artificial islands, where operations include wellhead slot batch and cluster well drilling, using a modular rig, extended-reach horizontal drilling and water flooding.

|

| Fig. 6. CNPC is using a “green oil field” approach at its Dagang oil field on the Chenghai Block in Bohai Bay. CNPC describes the project as “the onshore production of offshore oil.” At three artificial islands, operations include wellhead slot batch and cluster well drilling, extended-reach horizontal drilling and water flooding. |

|

ALL IN ON SHALE, CBM

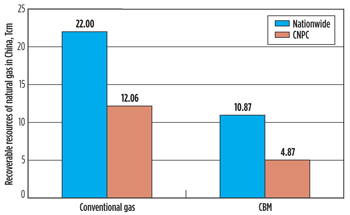

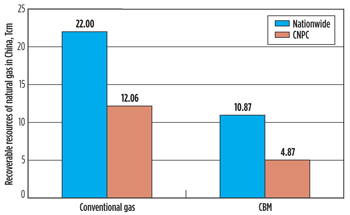

Fueling China’s grand projections for the near-term exploitation of shale and CBM is the world’s largest estimated reserve base. While estimates vary depending on who’s doing the measuring, the EIA estimates proven recoverable shale gas resources of 1,275 Tcf, with the highest volumes situated in the Sichuan and Tarim basins. In addition, the EIA estimates current CBM proved reserves of 10.2 Tcf, but acknowledges recoverable reserves could exceed 350 Tcf, mainly in the Sichuan, Junggar and Tarim basins, Fig. 7.

|

| Fig. 7. CNPC’s share of China’s total conventional and CBM reserves. Source: China National Petroleum Corp. (CNPC) |

|

In a presentation at the September OGIF, Du Weidong, deputy chief engineer of the China National Petroleum Corp. (CNPC) HSE Research Institute, said that three regions of marine shale gas hold a cumulative 21 Tcm. He cited the Paleozoic shale of southern China, the Lower Paleozoic of northern China and the Cambrian-Ordovician in Tarim basin, as holding 12.0, 4.0 and 5.0 Tcm, respectively. Elsewhere, if the South Sichuan basin had a similarly flat topography, it would bear a strong resemblance to the Haynesville shale of Louisiana and Texas, said Liu Honglin, deputy director of the CNPC Research Institute of Petroleum E&D.

“The Sunan long-maxi shale is similar to Haynesville shale, in that it is overpressured and has high free gas proportion,” he told the OGIF. “There is similarity in the sedimentary environment, but there are more carbonate deposits in the Haynesville shale, with intra-grain pores that are more developed, which leads to a higher porosity.”

Despite the enormous reserve base, China’s NOCs are the first to admit that they are behind the technical eight ball, when it comes to full-scale development. In his presentation to the OGIF, Zheng Herong, deputy director of the Sinopec Petroleum Exploration and Development Institute, laid out the myriad technical challenges they face. He cited everything from suitable logging technology for the identification and evaluation of shale oil and gas reservoirs, enhanced steering technologies and vastly improved multi-stage fracing techniques. It certainly comes as no secret that Chinese companies continue to desperately seek Western technologies to help exploit their unconventional resources. A major effort in that regard is the continuing effort to form a partnership with fracing specialist FTS International of Fort Worth, Texas.

Recognizing that the only way to meet its future production targets is to solicit outside help, the government earlier removed the NOCs’ exclusive jurisdiction over shale and CBM reserves, effectively putting out the welcome mat for non-state operators. While those same operators doubt that China will replicate the shale success of the U.S. anytime soon, they nonetheless are gobbling up interests, citing, among other attractions, the tremendous reserve base, relatively low drilling costs and much higher, comparative commodity prices.

On the flip side, CNPC’s Du said that operators have to comply with eight national laws and 30 environmental regulations dealing specifically with shale gas. Many of those regulations are in response to severe water shortages in the western provinces.

Sinopec and its fellow NOCs have signed shale gas agreements with a host of international companies, including Shell, ConocoPhillips, ExxonMobil, Australia’s Leyshon Resources and others. Liu Jia, senior engineer for the CNPC Economics and Technology and Research Institute, said in San Antonio that a host of CBM agreements has been signed with a diverse group of international oil companies (IOC), including Chevron, BHP Billiton, Asia-Pacific Petroleum Ltd., Orion Energy, Far East Energy Co., the Shell (China) Ltd/Verona Development Corp. alliance and others.

Last month, the nation went further in encouraging development, when the Ministry of Finance unveiled plans to subsidize operators to the tune of 6.3 cents for each cubic meter of gas produced. The ministry said the subsidy would extend to 2015, at least. This and other efforts to attract Western companies appear to be working.

ConocoPhillips, which holds a number of offshore PSCs, suggested in September that it will expand its operations in China to include shale gas, but provided no additional details. Chevron also signed a joint study agreement with CNPC and began drilling shale gas wells in the southwestern Quinnan basin earlier this year. Chevron operates and holds a 49% interest in the Chuandongbei gas area in the Sichuan basin.

ENI, meanwhile, said it is evaluating the shale prospects of a block in the Shunan area of central Sichuan province. The investigation included field visits to survey the terrain, external environment and water supply conditions surrounding the block, partner CNPC said.

In November, Shell and PetroChina agreed to jointly explore and develop a CBM tract in the Daning Block of the Erdos basin of northern China. No further details were made available. Shell, which invests around $1 billion a year on Chinese E&P projects, plans to drill at least seven wells next year on its Zitong Block, as well as make a final investment decision on developing the Fushun-Yongchuan Block with CNPC, the operator told Bloomberg News.

Also next year, Shell is expected to begin the first field operation in China of a fully-automated Well Manufacturing System (WMS) that it is developing in conjunction with CNPC for use in multi-well programs, Fig. 8. The WSM is designed to construct and complete multiple wells in a standardized, repeated method. Shell said one of the key components of the WSM is the proprietary SCADAdrill software that sets and controls the trajectory, basically eliminating the need for an onsite directional driller.

|

| Fig. 8. Artist’s conception of the Shell/CNPC automated Well Management System (WSM). Source: Royal Dutch Shell |

|

THE WILD CARD

As China goes, so goes the global price of oil for the foreseeable future. At least, that’s the opinion of analysts and oilfield economists, who say that the IEA’s staggering expectations for China’s demand over the next 22 years could come unglued, if the country’s economy takes a severe downturn. A Chinese economic decline would take global oil prices with it, they warn.

“If the growth in China comes unhinged for any reason, that’s when you’ll see oil prices collapse,” Ken Medlock, a fellow in energy and resource economics at Rice University’s James A. Baker Institute, told the Houston Chronicle, the day following release of IEA’s global forecast.

Shale takes higher profile in U.S.—China outreach initiative

While CO2 sequestration and other measures aimed at suppressing greenhouse gases remain its focal point, the government-sanctioned U.S.-China fossil fuel technology outreach initiative has shifted much of its attention to unconventional resource exploration and development.

From an oil and gas perspective, a high-water mark in the nations’ long-standing bilateral technical collaboration came in late 2008, with the signing of an unprecedented Memorandum of Understanding (MOU) between the U.S. Department of Energy’s (DOE) National Energy Technology Laboratory (NETL) and China National Petroleum Corp. (CNPC). The non-binding MOU was the first between NETL and a Chinese operator. It also represents CNPC’s only collaborative agreement with a U.S. governmental agency.

The CNPC MOU was one of three that NETL and Chinese scientific and technical organizations signed that year. According to NETL, the agreements were fashioned to “foster collaboration among Chinese and American scientists and engineers, in studies relating to the efficient use of fossil fuels, and the capture and storage of carbon dioxide.”

Including meetings between NETL scientists and engineers, and their counterparts from the CNPC Research Institute of Petroleum Exploration and Development (RIPED), activities under the MOU have progressed steadily, says Margaret Lou, NETL director of International Technology Cooperation. The Sugarland, Texas-based director said the unprecedented MOU focuses entirely on oil and gas, with specific emphasis on methane hydrates, HPHT drilling and production, reservoir modeling, CO2 EOR, and environmental issues.

Since 1998, the annual U.S.-China Oil and Gas Industry Forum (OGIF), which alternates between the two nations, has been a key feature of the inter-country technology exchange. Some 150 attendees were on hand for the 12th version of the forum, held Sept. 10-12 in San Antonio. Reflective of the alliance’s increased focus on unconventional gas, most of the presentations dealt with China’s efforts to exploit its world-leading shale gas and coalbed methane reserves.

“Basically, the OGIF is a public-private partnership involving government and industry representatives from the United States and China, working together towards the goal of developing secure, reliable, and economic sources of oil and natural gas while facilitating investment in the energy industry,” Lou says. “The U.S. government is represented by the DOE and Department of Commerce (DOC) while the National Energy Administration (NEA) represents the China side. Industry representatives include Exxon/Mobil, Chevron, ConocoPhillips, GE, Hallibuton, Far East, Anadarko, Baker Hughes, Dow Chemical, Hess, McDermott, Devon, and others from the U.S. China brings industry personnel from CNPC, Sinopec, CNOOC, China Coalbed Methane Co. and others.”

“The industry always steps up and feels the forum is very beneficial to them, in terms of networking and helping their respective businesses,” she added.

In related developments, a 25-member Sinopec delegation arrived in Houston in mid-November for meetings with NETL and industry representatives, focusing primarily on shale gas, and CO2 EOR. Meanwhile, the public-private Research Partnership to Secure Energy for America (RPSEA), which NETL largely funds, for the third consecutive year lent support to the annual Gas Technology Institute’s Global Unconventional Gas Summit, which this year was held Nov. 6-8 in Beijing.

The U.S.-China outreach program reached a milestone in May 2009 with NETL, Pacific Northwest National Laboratory (PNNL), and the Chinese Academy of Sciences (CAS) signing an MOU that provided a foundation for collaborative efforts related to energy research. A year later, the MOU transitioned to the more-binding Annex VI of the Protocol for Cooperation in the Field of Fossil Energy Technology Development and Utilization between the Department of Energy/Fossil Energy of the U.S. and the Ministry of Science and Technology (MOST) of the People’s Republic of China. Lou said the protocol places the collaborative efforts “under a much larger umbrella,” with officials of the DOE Office of Fossil Energy now working directly with their equals in China’s Science and Technology Ministry.

According to NETL, the protocol provides a framework for promoting Chinese-U.S. scientific and technological cooperation in joint research, development, and technology transfer for fossil energy technologies, while safeguarding intellectual properties.

|

|