JERRY GREENBERG, Contributing Editor

|

| Aker Solutions has designed the world’s largest spar platform for Statoil’s development of the Aasta Hansteen field in the Norwegian Sea. The “belly spar” concept is so named, because of the increased diameter on the part of the circular hull, where condensate storage tanks are located. |

|

Back in the late 1970s and early 1980s, when only several hundred feet of water was deep water, it was considered the “glamorous” part of the offshore industry. After all, if you saw one jackup drilling rig, you essentially saw all jackup drilling rigs. But semisubmersibles were different. They floated, and even though they may have been limited to 500 ft of water at the time, they were “new” and intriguing.

The industry got way ahead of itself in the early 1980s, when operators would bid on Gulf of Mexico acreage in water depths where no rig existed that could drill a well on the block. Those visionary operators and their engineers saw further than a lot of people in the industry. It doesn’t seem that long ago when the industry couldn’t drill in Gulf blocks held by some oil and gas companies. When they developed the capability to drill in those water depths, equipment wasn’t available to develop and produce fields.

Visionaries are still running the deepwater segment of the industry, as it has become almost commonplace to drill in water depths approaching 10,000 ft, with the comforting knowledge that fields in those water depths can be developed. There have been some minor, and major, lessons learned along the way, but overall the deepwater drilling and production industry is doing fine, thank you.

While increasing depths and extreme downhole conditions are challenging enough, operators in the Gulf of Mexico must now contend with regulatory compliance, specifically with drilling and workplace safety rules and stringent requirements for spill containment. An elaboration of these requirements is provided below, followed by the activity report.

REGULATORY COMPLIANCE

Since the Macondo blowout and the Gulf oil spill, offshore operators in the Gulf of Mexico must contend with an increasing set of safety and spill containment regulations. These include the Workplace Safety Rule and the Drilling Safety Rule. Such regulatory regimes are also being extended to international arenas. For well capping and containment, industry organizations and operators are combining their resources to develop viable strategies and equipment.

Workplace Safety Rule. In October 2010, the Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) issued its Workplace Safety Rule, requiring offshore oil and gas operators to develop and maintain a Safety and Environmental Management System (SEMS), a comprehensive management program for identifying, addressing and managing operational safety hazards and impacts, with the goal of promoting human safety and environmental protection. The Workplace Safety Rule covers all offshore oil and gas operations in federal waters and makes mandatory the previously voluntary practices in the American Petroleum Institute’s Recommended Practice 75 (RP 75).

Following the division of BOEMRE into the Bureau of Safety and Environmental Enforcement (BSEE) and Bureau of Ocean Energy Management (BOEM), the Workplace Safety Rule is being enforced by BSEE.

The Workplace Safety Rule is a unique regulation in that it’s performance-based. Regulations in the U.S. have tended to be prescriptive, where the industry is told exactly what it needs to do and is checked exactly against that requirement. This regulation, since it references API RP 75, must have the 13 elements. There are certain basic components to these elements, but then companies are free to implement these elements outside of those basic requirements in a way that is most effective for them.

The 13 elements of RP 75 that the Workplace Safety Rule makes mandatory are:

-

General provisions: for implementation, planning, and management review and approval of the SEMS program;

-

Safety and environmental information: safety and environmental information needed for any facility, e.g. design data; facility processes such as flow diagrams; mechanical components, such as piping and instrument diagrams; etc;

-

Hazards analysis: a facility-level risk assessment;

-

Management of change: a program for addressing any facility or operational changes, including management changes, shift changes, contractor changes, etc.;

-

Operating procedures: evaluation of operations and written procedures;

-

Safe work practices: manuals, standards, rules of conduct, etc.;

-

Training: safe work practices, technical training for operators and contractors;

-

Mechanical integrity: preventive maintenance programs, quality control;

-

Pre-startup review: review of all systems;

-

Emergency response and control: emergency evacuation plans, oil spill contingency plans, etc.; in place and validated by drills;

-

Investigation of incidents: procedures for investigating incidents, corrective action and follow-up;

-

Audits: rule strengthens RP 75 provisions by requiring an audit every four years, to an initial two–year reevaluation; and then subsequent three-year audit intervals;

-

Records and documentation: documentation required that describes all elements of the SEMS program.

The Workplace Safety Rule became an auditable regulation in November 2011. The API established the Center for Offshore Safety (COS) to continuously enhance and improve safety in the offshore by focusing on safety and environmental measurement systems. In its first year of operations, the COS developed audit tools to assure that an operator has all of the elements of SEMS in place, as well as develop audit guidance documents and other documents. Companies can use these audits and deliver them to BSEE as their official SEMS audit.

|

| BP’s Global Deepwater Well Cap and Tooling Package can be sent by heavy-lift aircraft to any location in the world where the company operates, along with a subsea tool package that includes oil dispersant equipment and remotely operated vehicle (ROV) debris removal tools. |

|

“We are going to provide training for third-party auditors," said Charlie Williams, executive director of COS. “We are also going to audit the auditors periodically.” The documents outline a series of requirements for the auditors, including the size and experience of the auditing team.

The auditor requirement documents will be disseminated by August. Williams said the COS has received tremendous interest from people and organizations, such as ABS and DNV, who want to be audit service providers. This is an extra degree of training and qualification, because there had not been an audit requirement for SEMS or even a requirement from BSEE for companies to have SEMS previously. “That doesn’t mean companies didn’t have a safety and environmental management system,” Williams explained. “It means there wasn’t a regulatory requirement to have a SEMS or a regulatory requirement to do the auditing.”

“The industry has three years from November 2011 to complete the initial audits,” Williams said. “BSEE can conduct audits of their own where they think they need to be done.”

The audits will take place at the operator level. The current regulation says that operators are to be audited for SEMS, and they have to certify that their contractors are capable and have good safety management systems, Williams explained. If an offshore rig wasn’t up to an operator’s standards, it probably wouldn’t be hired in the first place; but if there are issues with a drilling rig or drilling contractor hired by an operator, it is the operator who would fail the audit. “If an operator hired a drilling contractor that didn’t have a SEMS system and didn’t have the demonstrated capabilities to do the job, the operator would fail the SEMS audit,” Williams said.

Not all of an operator’s facilities would be inspected during a specific audit period. During the next audit period, the team would visit different facilities. So, over a period of time, all the operator’s facilities would be audited. Subsequent audits are conducted during a five-year period after the initial three-year period. “We expect operators will do more auditing than that,” Williams said. “That’s what’s required to meet the regulation.”

If the audits show there are gaps in the way SEMS has been implemented, then the COS can work to close the gaps. “We will create task groups like those that developed the audit documents,” Williams said. “An example of one that we’ve done proactively in advance of audit results is what we call Leadership or Management Site Visits.”

Drilling Safety Rule. In addition to the Workplace Safety Rule, the Department of Interior established the Drilling Safety Rule, which became effective immediately upon publication in 2010. It made mandatory several requirements for the drilling process that were laid out in Interior Secretary Ken Salazar’s May 27, 2010, Safety Report to President Obama. The regulation prescribes proper cementing and casing practices, and the appropriate use of drilling fluids to maintain wellbore integrity. The regulation also strengthens oversight of mechanisms designed to shut off the flow of oil and gas, primarily the blowout preventer (BOP) and its components, including remotely operated vehicles (ROVs), shear rams and pipe rams. Operators must also secure independent and expert reviews of their well design, construction and flow intervention mechanisms.

International safety rules and guidelines. Outside of the U.S., many of the regulatory regimes tend to be performance-based. The regulator may tell the contractor that it has to have a way of managing its BOP to ensure safety. The contractor would describe what it is going to do and describe what standards it will follow to do that. In some ways, with these international regulatory regimes, they wouldn’t be directly implementing a regulation because they don’t tend to have prescriptive type regulations.

“Every regulatory regime outside the U.S. has mostly followed the work and reports that were done post-Macondo,” Williams said. “They all have developed plans to address the recommendations in these reports and to implement anything they feel they need to implement for their business that would close any gaps they see after reviewing the reports. There has been an intense effort outside the U.S. to understand all of these recommendations and to implement what they need.”

The International Regulators Forum is a group of 10 regulators of health and safety in the upstream offshore oil and gas industry that exists to drive forward improvements in the sector through collaboration in joint programs and through information sharing. The member countries are:

-

Australia: National Offshore Petroleum Safety and Environmental Management Authority

-

Brazil: National Agency of Oil, Gas and Biofuels (ANP)

-

Canada: Canada-Newfoundland and Labrador Offshore Petroleum Board; Canada-Nova Scotia Offshore Petroleum Board; and the National Energy Board

-

Denmark: Danish Energy Agency (DEA)

-

Mexico: National Hydrocarbons Commission (CNH)

-

Netherlands: State Supervision of Mines

-

New Zealand: Department of Labor

-

Norway: The Petroleum Safety Authority

-

UK: Health and Safety Executive

-

U.S.: Bureau of Safety and Environmental Enforcement (BSEE).

The first IRF offshore safety summit was hosted by the Petroleum Safety Authority (PSA) in Stavanger, Oct. 4-5, 2011. This conference offered an opportunity for regulators and other industry participants to join for a dialogue about offshore safety issues in the wake of the Montara blowout in the Timor Sea in 2009 and the Macondo blowout in 2010.

“These two disasters have seriously impacted all kinds of petroleum activities, as well as all players in the international offshore sector,” Magne Ognedal, director general of the PSA and chair of the event, told delegates. “They must lead to improvements in the petroleum industry as a whole.” He emphasized the fact that a number of international players look to the IRF as an important organization in the work of sharing experience and strengthening the global focus on petroleum safety.

More than 200 delegates representing the industry, academia, the workforce and regulators attended the meeting and took part in its roundtable discussions. Key speakers at the summit included Michael Bromwich, head of the BSEE (prior to James Watson’s appointment), who addressed the response of U.S. safety regulators to the Macondo incident.

Steve Walker, head of the offshore safety division (OSD) at the UK Health & Safety Authority, provided an overview of responses by safety regulators around the North Sea. Kevin O’Carrol of Ospar, Dr. Valery Sorokin of the G20’s GMEP expert group, and Jan Panek from the European Commission, spoke about the ways in which their international bodies are currently approaching petroleum‐related safety challenges.

IRF regulators and professional international experts in the areas of BOPs, well control and integrity, standards development, safety culture, and the fitness of companies to operate, outlined the challenges that face regulators as well as industry players.

Lars Herbst, director of BSEE’s Gulf of Mexico region office and a member of the IRF, concluded the summit by summing up its results. Herbst said stakeholders must obtain and maintain an understanding of the lessons emerging from the Montara and Macondo disasters, and the “avalanche” of responses from industry, trade associations, regulators and other government bodies. Herbst also encouraged the industry to grasp the links between safety integrity and environmental protection, and to identify the gaps which should be followed up.

Capping stack development. The deepwater drilling moratorium in the Gulf of Mexico was officially lifted in October 2010, but the first new drilling permits weren’t granted until the following March, due to a requirement that operators have access to a deepwater capping device in the event of a blowout or oil spill. Two companies developed such a system—Helix and the Marine Well Containment Co. Once these systems were developed and made available to the industry, the number of drilling permits began to increase.

In late July, BSEE initiated its first exercise designed to deploy critical pieces of well control equipment to the ultra-deep Gulf of Mexico. The multi-week drill is testing the MWCC and is part of a series of planned and unannounced exercises and inspections conducted by BSEE to ensure the industry’s ability to meet the conditions of its oil spill response plans and effectively respond to a potential spill. The exercise would demonstrate the ability of MWCC to mobilize a capping stack in a timely fashion from its onshore base to the deepwater seabed of the Gulf.

The exercise will involve the mobilization and field deployment of the capping stack to the sea floor in approximately 7,000 ft of water, latching it to a test wellhead, and pressurizing the system. The exercise is also designed to test an operator’s ability to obtain and schedule the deployment of the supporting systems necessary for successful containment, including debris removal equipment and other oil collection devices. The MWCC capping stack is similar to the one that was used to stop the flow of oil from the Deepwater Horizon well.

BSEE inspectors, engineers, and spill response experts will be embedded in various locations throughout the exercise, including in the command center and on the vessel deploying the capping stack, to oversee the mobilization, deployment, and associated tests of the system. BSEE experts will oversee the capping stack being lowered to the seafloor by wire, a technique that offers the potential to be significantly faster than the deployment via pipe that occurred during the Deepwater Horizon response.

As part of the exercise, BSEE will also analyze the results from tests conducted on the sea floor. “This exercise will help further enhance industry’s preparedness by deploying one important component of their well control capabilities to the sea floor,” said BSEE Director Jim Watson. “Testing this equipment in real-time conditions and ultra-deep water depths will help ensure that the MWCC is ready and able to respond in a moment’s notice should the need arise.”

In addition to these systems, BP had been developing a “portable” system, based upon what it learned during the capping of the Macondo well. Other organizations and companies began developing and building their own systems, based upon BP’s design for use in other regions outside the Gulf. Two other organizations developing a capping stack system are the Oil Spill Prevention and Response Advisory Group (OSPRAG) and the Subsea Well Response Group (SWRG).

The UK oil and gas industry established OSPRAG in May 2010 following the Deepwater Horizon accident. It brought together senior representatives from across the industry, regulators and trade unions, to proactively review the UK’s regulations and arrangements for prevention and response, including assessing the financial provisions required, to monitor and review information following the Deepwater Horizon incident and to implement relevant recommendations.

Two options were considered for controlling a blown-out well: capping or containment. Capping involves permanently sealing off the well before killing it completely. Containment involves controlling the flow of oil and piping it to a waiting production vessel on the surface, before transferring it to a tanker while a means to permanently kill the well is sought.

|

| The Pacific Santa Ana is currently drilling for Chevron in the Jack/St. Malo prospect in the deepwater Gulf of Mexico. |

|

Due to challenging metocean conditions in the North Sea, in particular in the areas west of Shetland, it was decided to focus on the expedited development of a capping solution. Conditions such as high winds, heavy seas and fog, have the potential to constrain the amount of time that containment equipment and vessels could be connected and maintained in position, while strong currents could also hamper the success of containment operations, and therefore, the volumes of oil recovered.

The experience of Macondo proved that it was possible to cap a leaking well, and the UK industry moved to develop its own cap, designed specifically for the conditions and types of oil wells typical of the UKCS, including west of Shetland. The cap was designed to be deployed quickly, in short operational weather windows and in harsh conditions.

|

| BW Offshore was responsible for managing the design, construction and installation of the BW Pioneer FPSO, the first such unit in the Gulf of Mexico. |

|

OSPRAG’s Technical Review Group, under the leadership of Oil & Gas UK, was responsible for developing the concept. The group worked with BP, acting as project manager of the detailed design, procurement and construction phases, with support from engineering services company Wood Group Kenny. Oil Spill Response Limited commissioned (OSRL) the device’s construction, which was carried out by Cameron Ltd.

The capping device is held by OSRL at an operational base in northeastern Scotland and can be deployed from a multi-service vessel or drilling rig. Its portable size and weight means it can be transported by a wide range of vessels, so there would always be a suitable vessel immediately available to transport it to the site. The device can be attached to various points of the subsea BOP stack, to seal off the flow of oil.

SWRG planned a new integrated intervention system and is collaborating with Oil Spill Response Limited (OSRL) to develop a capping system. OSRL contracted Trendsetter Engineering to construct four capping stack toolboxes capable of handling a variety of scenarios. Oceaneering was contracted to develop two hardware kits for the subsea application of dispersant at the wellhead, based (apparently) on the perceived success of dispersing Macondo oil.

The first equipment is due to be completed by the end of 2012 and will be ready for transportation from vendor sites by sea and/or air in the event of a subsea well incident. During 2013, the equipment will be moved to four strategic storage locations in northern Europe, South America, Africa and Asia-Pacific to further enhance international deployment and response readiness.

BP began engineering its capping stack, the Global Deepwater Well Cap and Tooling Package, in 2010. It is based on lessons learned from the Macondo blowout and efforts to contain the spill. The capping stack will be stored at a warehouse in Houston until needed, and then is capable of being air transported to virtually any location by Antonov AN-124 and Boeing 747 aircraft. Deployment to nearly any location would be about 10 days from Houston. BP will continue to utilize the MWCC capping stack in the Gulf of Mexico. About 250 pieces of equipment comprise the well cap and tooling package, which also includes equipment for dispersing oil flow and removing debris. The package can be deployed in 10,000 ft of water.

DEEPWATER ACTIVITY

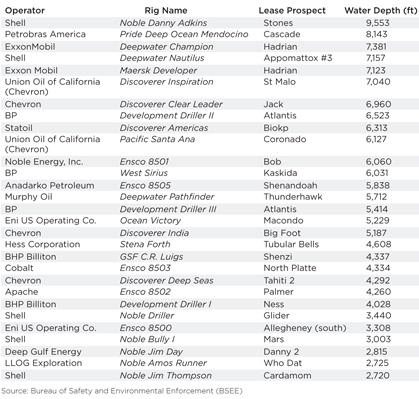

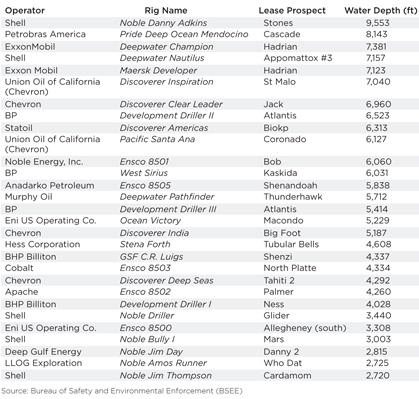

U.S. Gulf of Mexico. The drilling activity in this leading offshore arena is nearly at the pre-Macondo level, with 29 deepwater rigs active as of June 16, Table 1. The region is expected to at least reach pre-Macondo activity levels, if not surpass them, by the end of this year, as several newly built semisubmersibles and drillships will be delivered to the Gulf during 2012 against long-term drilling contracts. One well is approaching a 10,000-ft water depth.

| Table1. Gulf of Mexico deepwater drilling activity. |

|

|

The Pacific Santa Ana drillship, contracted to Chevron, is the the first vessel designed with the capacity to perform dual-gradient drilling (DGD). The rig is rated to drill in up to 12,000 ft of water. Conventional deepwater drilling uses a single drilling fluid weight in the borehole. Dual-gradient drilling employs two weights of drilling fluid, one above the seabed and another below. This allows drillers to more closely match the pressures presented by nature and effectively eliminate water depth as a consideration in well design. DGD also allows drillers to more quickly detect and appropriately react to downhole pressure changes, Chevron said, which can enhance the safety and efficiency of deepwater drilling operations. The drillship is equipped with a DGD riser, a mud lift pump handling system, six mud pumps—three for drilling fluid and three for seawater—extensive fluid management system enhancements and more than 72,000 ft of DGD-related cables.

A unique (for the U.S. Gulf of Mexico) production system is Petrobras America’s FPSO BW Offshore, located in about 8,200 ft of water. Following delays due to the Macondo blowout, and then an incident in which a riser was dropped while being installed, the FPSO finally went onstream in early 2012. The system will be used to develop Cascade and Chinook fields. Phase 1 includes two wells from Cascade field and one from Chinook. Natural gas will be exported via pipeline, and the oil will be shuttled by two tankers built in U.S. shipyards. The shuttle tankers were ready to deploy before the FPSO and were used in the effort to transport oil pumped into it from the blowing Macondo well.

Potential expansion of the development scenario during Phases 2 and 3 includes up to six additional wells in Cascade field and seven more wells in Chinook, along with additional subsea trees and manifolds. As the two fields are expanded, Petrobras will likely replace the FPSO with a floating production platform. The company already is investigating different designs for the replacement.

Development of the fields presented numerous challenges. For example, the development scheme includes the deepest free-standing hybrid riser in 8,200 ft of water. It contains the deepest pipe-in-pipe transportation system in 8,845 ft of water and the deepest subsea boosting system in 8,857 ft of water. The field also includes the deepest export pipeline in 8,200 ft of water. Installation of the FPSO also included the first umbilical riser pull-in, using a subsea winch.

Norway. Another unique development system is Statoil’s spar platform for development of Aasta Hansteen field in the Norwegian Sea. Aker Solutions conducted front-end engineering and design while Technip, in a consortium with Hyundai Heavy Industries, was awarded a letter of intent for construction. Statoil said the spar will be the world’s largest. It will be the first spar with condensate storage capacity, capable of storing about 25,000 cu.m of condensate, and export gas via the Norwegian Sea Gas Infrastructure (NSGI).

The spar’s catenary risers will be made of self-supporting steel pipes in a bow shape between the platform and the seafloor. The mooring system will consist of a set of polyester lines. The field is in about 1,000 ft of water. An investment decision is expected in late 2012/early 2013, with production start-up at the end of 2016. Production is expected to extend to 2040.

Brazil. Petrobras continuously announces new discoveries, many in the deepwater pre-salt reservoirs. Foreign operators aren’t slacking either when it comes to announced discoveries. Illustrating just how busy Petrobras is with anticipated and planned deepwater discoveries and their development, is a recent announcement by FMC Technologies that it has signed a four-year agreement with the operator to supply up to 130 subsea trees, multiplex controls and related tools and equipment. The tree systems are for use in up to 8,200 ft of water, with deliveries scheduled to begin in 2014.

Additionally, Petrobras has been negotiating for some time with Sete Brasil and Ocean Rig for construction of up to 28 deepwater semisubmersibles and drillships that would be constructed in Brazil, due to local content regulations. Negotiations seemed to be off again/on again. It wasn’t clear when Petrobras would begin ordering any of the rigs until earlier this year when it announced that it was approved to execute contracts with Sete Brasil for the construction of six drilling rigs to be built in Brazil at the Brasfels Shipyard in Angra dos Reis (RJ), with domestic content between 55% and 65%.

The semisubmersible rigs are part of the lot of 21 rigs negotiated with Sete Brasil and will be delivered during 2016. The rigs will be capable of operating in water depths of about 10,000 ft. The rigs will be contracted to Petrobras for a 15-year period. Three rigs will be operated by Petroserv SA, two by Queiroz Galvão Óleo e Gás SA and the other by Odebrecht Óleo e Gás SA.

Africa. It sometimes seems that operators drilling deepwater wells off Africa have almost as many deepwater discoveries as Petrobras. Announcements are made for discoveries off West Africa, which has been busy with deepwater exploration and development for many years, with seemingly no slowdown. Operators apparently see continued deepwater activity in the proven West African countries of Angola, Ivory Coast, Nigeria, Ghana and others. However, an area that has opened up with numerous deepwater discoveries is East Africa, with Mozambique and Tanzania leading the new wave of exploration.

Recent natural gas discoveries were announced by Anadarko and Eni offshore Mozambique. Anadarko’s discovery was in Area 1 of the Rovuma basin, where the company is the operator. The well is in about 3,370 ft of water. Eni’s gas discovery offshore Mozambique was in about 2,260 ft of water in Area 4. The operator plans to drill five (maybe more) wells in the area.

Offshore Tanzania, BG Group continues to hit the sweet spot, announcing its fifth consecutive gas discovery in Block 1. The Mzia-1 well is the operator’s first discovery within the deeper Cretaceous section and opens an extensive new play fairway within its offshore acreage in Blocks 1, 3 and 4, to complement the now proven Tertiary fairway. The well has de-risked a number of adjacent Cretaceous prospects, which could form part of a future Mzia hub. These prospects are expected to be tested in a future appraisal program to be defined following incorporation of data from this new well and 3D seismic.

Statoil announced its second gas discovery in Block 2 off Tanzania. The Lavani well is south of the company’s earlier Zafarani discovery and confirms the high potential in Block 2. A recently drilled Zafarani sidetrack added another 1 Tcf of gas in place, in addition to the up to 5 Tcf announced in February. The Lavani well was drilled in 7,870 ft of water by Ocean Rig's Poseidon drillship. “The results so far mark an important step towards a possible natural gas development in Tanzania,” said Tim Dodson, Statoil executive vice president for exploration.

FULL SPEED AHEAD

With high oil prices as the incentive, offshore and deepwater activity is proceeding at a rapid pace in all the mature, as well as the frontier, areas of the world. The long sought Arctic region is seeing initial efforts with Shell leading the way offshore Alaska and Statoil exploring the Bering Sea.

|