ROBERT CURRAN, Contributing Editor, Canada

|

| Although Canadian gas drilling, overall, has declined, some projects continue to thrive. For example, Nexen is actively drilling for shale gas in northeastern British Columbia. Pictured below is Nexen's b-77-H, 18-well pad site at Dilly Creek in the Horn River basin. Nexen began drilling at the site in early July 2011. |

|

As unsettled and uncertain as things were for Canadian producers in 2011, the last 12 months have done little to provide any of the stability that the industry craves. Oil prices have weakened; gas prices remain flat; oil sands, hydraulic fracturing and pipelines have become political issues across North America; the Canadian dollar is virtually at par with the greenback (reducing export revenues); and drilling activity is down.

Perhaps the most influential of these factors in 2012 is the political uncertainty. Calls continue from across Canada for some sort of energy strategy, albeit without any clear idea of what such a strategy would attempt to achieve. Despite encouragement from Canada’s appointed Senate—which recently issued a report stating that the provinces should work together, ensure other parties are at the table, and that the federal government should act as a catalyst for consensus—regional interests continue to outweigh national considerations.

Pipelining/political matters. Just as the proposed Keystone pipeline dominated the political landscape a year ago in the U.S., Enbridge Inc.’s C$5.5-billion Northern Gateway pipeline project (which would ship crude oil from Alberta to the West Coast, and ship imported diluent back to Alberta) is dominating the Canadian political scene during 2012. Most recently, British Columbia Premier Christy Clark issued five demands that must be met, to secure her province’s support of the project, which would carry oil from Alberta’s oil sands to the West Coast. The demands pertain to requisite approvals from the National Energy Board; oil spill response and prevention; requirements and opportunities associated with First Nations; and, controversially, a “fair share” of the economic benefits of the project, widely believed to be a share of the royalties that Alberta collects on the oil sands produced in the northeastern corner of the province. Not surprisingly, Alberta Premier Alison Redford has rejected the notion of sharing royalty revenues with British Columbia, to gain its support for the pipeline.

Concern in British Columbia is understandable, following scathing statements made by U.S. National Transportation Safety Board Chairman Deborah Hersman in early July. Hersman’s remarks were in response to actions by Enbridge that led to an enormous spill into Michigan’s Kalamazoo River back in 2010. Hersman likened Enbridge to the Keystone Cops, a comment, and image, that has resonated deeply with Canadians that have reservations about the Northern Gateway project, further escalating political trepidation on the West Coast.

The disagreement between Canada’s two most western provinces potentially undermines ongoing efforts to achieve a national energy strategy. It also illustrates some of the fundamental barriers to actually creating that type of plan. First and foremost, Canadian provinces own the resources within their borders, and they regulate oil and gas activity, including pipelines, within their borders. Shifting oil and gas revenues from province to province could potentially require constitutional change, as well.

But pipelines that cross borders, provincial or international, are regulated by the federal National Energy Board (NEB), not the provinces. Ultimately, the NEB must determine whether Northern Gateway should be recommended for approval, not British Columbia or Alberta. To have one of the two provinces oppose its construction would pose some difficult challenges for the federal regulator, and it is unclear whether, or how, that might affect the approval process.

Meanwhile, in an effort to win some support for its controversial proposal, Enbridge has pledged to spend up to an additional C$500 million to enhance the design and operations of the Gateway pipeline. This would include increased pipeline wall thickness, more emergency shutdown valves, and increased inspections. Regardless, Enbridge also says that 60% of the aboriginal communities along the route have accepted an equity stake in Gateway.

Federally, the administration of Premier Stephen Harper continues to support the responsible development of Canada’s resources, as well as the expansion of Canadian markets beyond a North American scope. Shipping oil and gas to the West Coast is the most expeditious way to access Asian markets, where demand for oil and natural gas continues to grow. A project like Northern Gateway fits nicely with the government’s plan.

Meanwhile, others are calling for pipeline capacity to be expanded from the West into Eastern Canada, providing feedstock to refineries there. Currently, Eastern Canadian refineries import crude from the Middle East and South America. Overall, Canada imports more than 50% of the crude it consumes from foreign countries. Of course, there is no guarantee that building a pipeline to the east will be any easier than building it to the west—the same concerns and demands raised in British Columbia could easily arise in other provinces.

As the attention on pipelines intensifies, TransCanada Corporation announced that it has been selected to build and operate a C$4-billion natural gas pipeline from British Columbia’s Montney area to a proposed LNG terminal in Kitimat, British Columbia. The latter facility is a project announced this past May by partners Shell Canada Limited, Korea Gas Corporation, Mitsubishi Corporation, and PetroChina Company Limited.

Other factors. One of the very real issues that the Canadian oil patch has to deal with continuously is its ability to attract and retain skilled labor. Even now, with so much uncertainty on the horizon, demand for skilled labor continues to grow. And as always happens with this sort of supply/demand scenario, the buyers are concerned that the price of skilled labor will continue to increase as a result.

|

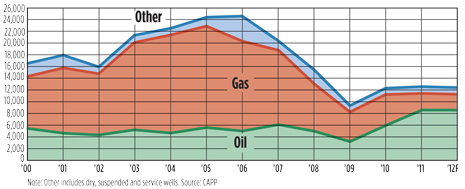

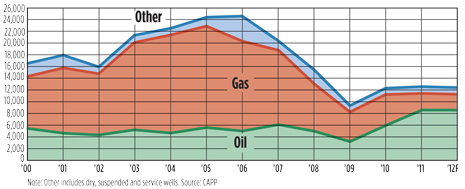

| Canadian wells drilled, 2000–2012 |

|

Despite all the uncertainty and increasing political rhetoric, there are some positive factors. Although oil prices are down, they are still hovering around a robust US$90/bbl, which has provided liquids-weighted producers with some financial stability. And some third parties have even stepped up to defend the beleaguered oil patch, on those rare occasions when the voice of reason rises above the din of anti-oil campaigns.

M&A activity. In times of turmoil, merger and acquisition activity often heats up, and 2012 is no different. In late July, China National Offshore Oil Corporation signed an agreement to acquire Calgary-based Nexen Inc. for US$15.1 billion in an all-cash deal, the largest foreign takeover in Chinese history. The purchase is subject to approval from shareholders and the Canadian federal government. Last year, CNOOC purchased OPYI Canada Inc., Nexen’s partner on the Long Lake Steam Assisted Gravity Drainage (SAGD) project, for $2.1 billion.

A month earlier, Malaysia’s Petronas picked up all of Progress Energy Resources Corp.’s outstanding shares, in a deal worth C$5.5 billion. The companies were already joint venture partners on a Montney prospect in British Columbia. The two companies were also looking at building an LNG plant on Canada’s West Coast.

On the same day that the Nexen deal was announced, the Chinese – via Sinopec International Petroleum Exploration and Production Corporation—also picked up a 49% stake in Talisman Energy Inc.’s North Sea operations for US$1.5 billion. Talisman will continue to operate the assets under terms of the deal, which is also pending government approvals.

And in mid-June, Penn West Petroleum Ltd. announced plans to divest over C$1 billion of assets over the next two years, rather than reduce its monthly dividend. Proceeds from the asset sale will be used to accelerate production growth.

|

| Canadian oil production, both conventional and oil sands, increased last year, and another gain is seen for 2012. Photo courtesy of Enerplus Corp. |

|

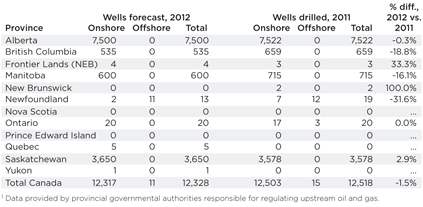

Drilling subsides. Drilling numbers were off during the first six months of 2012, when a total of 5,234 wells were drilled, down 24% from last year’s 6,884. Of the total drilled in 2012, 61% targeted oil. It should be noted that despite the decrease, industry has drilled a record amount of development footage, as more and more horizontal wells are drilled.

Given the decrease, Canada’s industry associations have downgraded their 2012 forecasts. In May, the Canadian Association of Oilwell Drilling Contractors revised its 2012 Western Canadian forecast downward to 11,834 wells drilled, compared to the forecast of 12,672 that CAODC issued in November 2011.

In April, the Petroleum Services Association of Canada also revised its forecast downward by 200 wells from January, predicting there will be 13,150 wells drilled this year, up slightly from 12,850 drilled in 2011. Last, but not least, the Canadian Association of Petroleum Producers (CAPP) is now calling for a 5.8% decline in drilling, from 11,368 wells in 2011 to 10,710 wells in 2012. CAPP said that 65% of all wells drilled in Canada during 2011 were oil completions, and that percentage may finish higher this year.

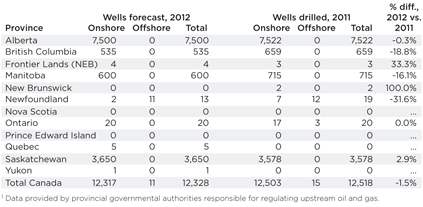

| Canadian drilling, 2012 provincial forecasts—midyear update1 |

|

|

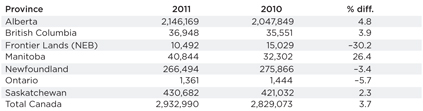

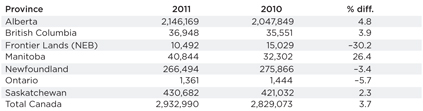

| Canadian liquids production, 2011 vs. 2010, bopd |

|

|

Reserves increased substantially. As interest in shale resources has increased across North America, the development of which in Canada has been largely confined to northeastern British Columbia, the continental reserves profile has been significantly altered, perhaps permanently. In fact, 2011 turned out to be a record year for gas reserve additions in Canada, according to data compiled by the Daily Oil Bulletin.

Gas reserves increased by almost 6%, led by producers tapping tight gas and liquids-rich gas fields. Producers replaced 137% of production. The liquids side remains anchored by Alberta’s massive oil sands deposits, which weigh in at 169 billion bbl. Oil reserves increased by about 4%, overall.

As the development of oil sands has become one of the key economic drivers of the Canadian economy, the extraordinary activity accrues its own suite of problems. For starters, nowhere in Canada is the demand for skilled labor greater than in northeastern Alberta. The other emerging threat is to the ability of producers to deliver their oil to market. Without expansion of pipeline or refining capacity, some experts are predicting that planned, but currently unfunded projects may be shelved if the situation doesn’t improve. Other producers are considering shipping their oil by rail to alleviate the crunch. The other result of the limited capacity has been to dampen Alberta prices, as compared to the West Texas Intermediate benchmark.

Production increases all around. According to CAPP, output of liquids averaged 2.933 million bpd last year, up 3.7% from 2.829 millon bpd in 2010. Production from oil sands deposits gained 3.4% to 1.510 million bpd. Compared to the recent long-term trend of small annual losses, conventional oil production actually increased last year, rising 2.0%. The number of oil-producing wells was up about 2%, at 76,869.

Natural gas production was down 2.1% last year, averaging 14.318 Bcfd. The number of gas-producing wells was up approximately 1% in 2011, at 140,825.

Oil sands activity. Despite the recent shift to smaller thermal oil sands projects, two more massive oil sands mining projects are on the horizon. Both of these have been proposed by Shell Canada. The company is looking to expand its Jackpine mine by 50% from 200,000 bopd to 300,000 bopd. It is also seeking approval for its proposed Pierre River Mine, which is designed to produce 200,000 bopd. A joint panel, assembled by the federal Canadian Environmental Assessment Agency and Alberta’s Energy Resources Conservation Board, will consider both applications at a hearing that has not yet been scheduled.

Land sales tumble. The tumultuous first half of 2012 may be represented best by land sales activity, the bellwether of future development. Leases and licenses acquired in these sales form the basis for future drilling plans and are viewed as an indicator of future activity. Revenue from land sales is down substantially, compared to the first six months of 2011, primarily due to a sizable decrease in Alberta.

Through six months, land sales brought in C$797.7 million down 63% from the C$2.1 billion garnered at the half-way point last year. The six-month record was set in 2006, when governments took in C$2.7 billion. Despite the big year-over-year decrease, Alberta once again led the way, taking in 81% of the total amount, C$647.6 million, as interest in shale deposits waned. That total was 65% lower than last year, when Alberta had already collected C$1.86 billion.

British Columbia recovered slightly through six months, with land sale revenues increasing 26% to C$83.7 million, compared to C$66.4 million in 2011. Both of these totals are dwarfed by the C$609 million collected in 2010. Low natural gas prices continue to hamper the province and its predominantly gas-prone reserves. Saskatchewan also saw its revenue levels fall yet again, to C$55.6 million, down 71% from C$193 million through six months last year.

|

The author

|

| ROBERT CURRAN is a Calgary-based contributing editor with extensive industry experience. |

|