RUSSELL WRIGHT, Contributing Editor, and PRAMOD KULKARNI, Editor

|

| One bright spot in the international arena is Argentina’s Neuquén basin, where Apache completed the first horizontal multi-stage hydraulically fractured shale gas well drilled and completed in South America. |

|

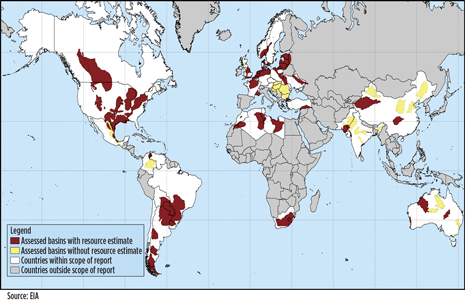

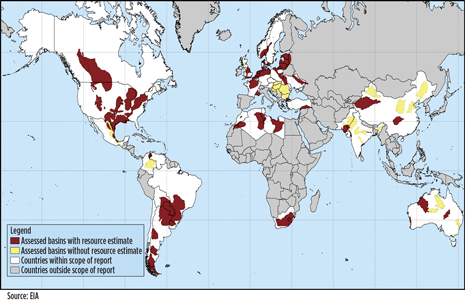

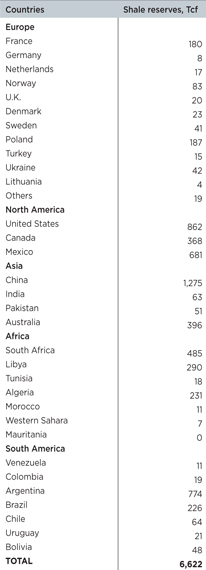

Around the world, shale assessments are underway in an attempt to emulate the success of shale gas and liquids production in North America. The U.S. Energy Information Administration (EIA) issued a report in April 2011 that discusses 48 shale gas basins in 32 countries (not including the U.S.), which contain about 70 shale gas formations, Fig. 1. Initial estimates of technically recoverable shale gas resources in these countries examined is 5,760 Tcf. Adding 862 Tcf of technically recoverable resources in the U.S. results in a total shale resource base estimate of 6,622 Tcf for the world. The study excludes countries such as Russia, Qatar and Indonesia that have vast conventional gas resources.

Despite the extensive international potential, discoveries are few and far between. Drilling and production activity is underway in Australia and Argentina’s Neuquén basin, but there have been no discoveries of tantalizing Bakkens and Eagle Fords of the world. In fact, ExxonMobil has pulled out of shale activity in Poland due to disappointing drilling results.

|

| Fig. 1. Shale resources around the world |

|

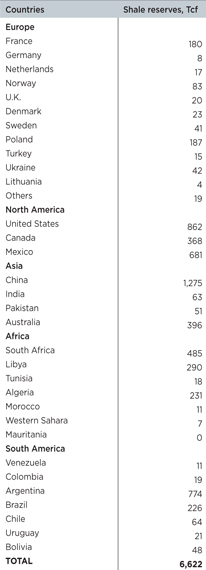

| TABLE 1. TECHNICALLY RECOVERABLE SHALE RESERVES |

|

|

EASTERN EUROPE

Poland. This coal-rich country was expected to be the first of the major international shale prospects. While leasing and exploration activities are still underway in Poland, no major discoveries have been reported. The target is the Lower Silurian-Ordovician organically rich shales, present in the Lower Paleozoic sedimentary basin that exists as a northeast to southwest band through the center of the country. The shales are deposited in three basins—Baltic in the north, Lublin in the south, and Podlasie in the east.

Baltic basin shales are being leased by numerous large international and smaller independent exploration companies, as well as the country’s national gas entity, PGNiG. The most active company in the basin is 3Legs Resources, a subsidiary of Lane Energy Poland. ConocoPhillips has partnered with 3Legs to jointly evaluate the shale potential of the Baltic basin. In late 2010, the joint venture drilled the basin’s first shale exploration wells, which were drilled vertically through the Silurian and Ordovician formations.

3Legs Resources is now conducting further tests of its Lebien LE-2H and Warblino LE-1H wells. The tests will involve placing artificial lift equipment in each wellbore to remove hydraulic frac fluid, with a view to gathering additional data on the properties of the target formations and developing strategies to increase gas flow. The company will commence drilling of its fifth well, Strzeszewo LE-1, in October 2012. The well will be drilled initially as a near-vertical well and is expected to be extensively cored and logged for detailed formation evaluation. 3Legs and ConocoPhillips, will consult on a drilling campaign during 2013. Acquisition of new 2D data in the area of the company’s Baltic Basin concessions is expected to be completed by the end of 2012. In southern Poland, 3Legs has completed processing of the 2D and 3D seismic data acquired earlier this year and these data are now being interpreted.

|

| Fig. 2. 3Legs Resources is extracting downhole frac fluid for lab analysis of the formation properties. |

|

San Leon Energy, in partnership with Talisman, drilled its third shale gas exploration well in the Baltic basin. The well was drilled to a depth of 14,930 ft. During drilling, continuous gas shows were encountered over more than 1,970 ft of the lower Silurian and Ordovician shales. The gas shows consisted of C1-C3 and are consistent with a potentially wet gas system. The strongest gas shows were encountered in the Lower Silurian and Ordovician interval, which is estimated to be almost 330 ft thick. Talisman is planning to drill and test its first horizontal well during the first half of 2013.

Marathon Oil has one concession in the Baltic basin, in which it plans to drill one well and perform 2D seismic. Both Chevron and ExxonMobil have accumulated acreage in the Baltic basin and have reported plans to drill exploratory wells within the next year. In addition to the major exploration companies, a number of smaller firms are acquiring and testing acreage in the Baltic basin, including Realm Energy International and Aurelian Oil and Gas.

The Lublin basin is the site of modest oil and gas production from a small group of conventional oil and gas fields. As in the Baltic basin, a number of international firms and Poland’s state owned gas company (PGNiG) are actively evaluating the Lublin’s shale gas potential. Halliburton completed Lublin basin’s first shale gas well fracturing operation on the Markowola-1 exploratory well for PGNiG. At least six other exploration companies have acquired unconventional gas exploration concessions in the basin, including ExxonMobil, Chevron, Marathon Oil and others. Although no exploratory wells have yet been drilled into the Silurian shale in the Podlasie basin, it is being actively leased, with ExxonMobil holding the largest position in the basin. In June, ExxonMobil dropped further shale exploration in Poland after two wells didn’t produce commercial quantities of natural gas. “We have completed exploration operations in Poland,” said company spokesman Patrick McGinn. “There have been no demonstrated sustained commercial hydrocarbon flow rates in our two wells in the Lublin and Podlasie basins.”

In early July, Poland announced the formation of a consortium of five state-controlled companies that will join forces to co-finance and co-develop shale exploration of the Wejherowo concession along the Baltic coast. The total investment expenditure could reach $515 million. In Poland, the average cost per well is estimated at between $8-to-$13 million, about 2-3 times more expensive than wells in North America.

Rest of Eastern Europe. Other than Poland, Eastern Europe’s shale gas potential has been lightly explored. However, several basins contain promising shale gas targets, such as the northern Baltic basin in Lithuania, the southeastern extent of the Lublin basin into Ukraine and the Dnieper-Donets basin in Ukraine, other potentially prospective basins include the Pannonian-Transylvanian in Hungary and Romania, and the Carpathian-Balknian in southern Romania and Bulgaria.

The Dnieper-Donets basin is also being investigated for unconventional gas potential. At present, shallower CBM deposits in the eastern area of the basin are the primary exploration targets, but firms are also studying the deeper shale gas potential. EuroGas recently partnered with Total to explore the shale gas potential of its recently acquired lease concessions. Major E&P companies such as Shell and ExxonMobil have also expressed interest in Ukrainian shale gas potential, but have not specified which areas they intend to explore. Marathon Oil exited Ukraine in 2008.

Shale gas exploration in the Pannonian-Translyvanian basin is still in a very speculative phase. East West Resources of Alberta is targeting shale formations in the Cretaceous-Jurassic pre-rift basement of the basin. It applied for lease concessions to explore the conventional and shale horizons in the northern Romanian portion of the basin.

The shale gas potential of the Carpathian Balkanian basin was first realized in 2008, when Direct Petroleum Exploration drilled through a gas-bearing shale formation while targeting the Alexandrovo sandstone interval. Several firms have since begun exploring the shale gas potential in Bulgaria, including Park Place Energy Group, Integrity Towers and Chevron. Chevron secured three shale gas exploration blocks in the Romanian portion of the Carpathian-Balkanian basin, totaling 675,000 acres. The company has not provided a timeline for exploration. In an official statement after meeting with the Bulgarian government to petition for shale gas exploration rights, Chevron estimated that it could extract up to 8 Tcf of shale gas in the country. Bulgaria’s Energy and Economy ministry estimates that industrial production of shale gas could commence within 5 to 10 years.

RUSSIA

Russia is expected to have significant shale resources in Western Siberia. ExxonMobil and Rosneft are expected to approve geological studies and drilling for selected Rosneft license blocks in Western Siberia, including the Bazhenov and Achimov plays. ExxonMobil will finance the studies and exploratory drilling, which is expected to begin in 2013. ExxonMobil CEO Rex Tillerson has said, “there is huge shale potential in shale rocks in West Siberia ...we just don’t know what the quality is.” The challenges of drilling in Siberia include the shortage of heavy duty drilling rigs and the extreme cold weather.

WESTERN EUROPE

The gas-bearing shales of Western Europe are being actively explored and evaluated by many companies. Numerous shale gas basins exist in Western Europe, containing Carboniferous, Permian, Jurassic and Ordovician-age shales. Shale gas leasing is ongoing in France, Germany, the Netherlands, Sweden, Denmark and Austria.

France. The Paris basin covers 61,454 sq mi and contains two organically rich shale source rocks—the Toarcian “Schistes Carton” black shale formation and the Permian-Carboniferous shales. A number of firms, such as Toreador Resources, are investigating the shale oil potential of the Liassic interval in the Paris basin. Significant shale drilling will have to await lifting of the ban on fracturing. France has no intention of lifting its ban because of continued concerns over its environmental impact, Environment and Energy Minister Delphine Batho said in late July. “The government clearly and distinctly maintains the ban on exploiting shale gas, because nowhere in the world has it been proven that this exploitation can be done without significant environmental damage and important health risks,” Batho told BFMTV.

Germany. ExxonMobil has been the lead company leasing prospective shale gas acreage in Germany. The company has drilled five test wells on its exploration leases, at least three of which are reported to be testing shale gas potential. ExxonMobil announced an additional 10-well exploration program that will be targeting shale gas potential in northwest Germany. Realm Energy received a small, 25-sq-mi shale gas exploration permit in western Germany. The company plans to explore the potential in the Posidonia and Weald shales under its acreage. The concession is valid for three years and does not require drilling, but it does provide the company with data from the 21 wells drilled on its acreage in past years. BNK Petroleum has leased some 3,745 sq mi of land for shale, CBM and tight gas sand exploration in western and central Germany. The company has yet to drill on any of its properties, but reports targeting “three different shale formations,” most likely the Posidonia, Wealden and Permian shales. Most of its concessions are not near areas with recognized shale gas potential.

Sweden. Shell Oil is the most active firm currently investigating the Alum shale and has been accumulating an acreage position in the Skane region of southern Sweden, which now amounts to approximately 400 sq mi. Shell’s leases provide three years for the firm to drill three exploration wells and evaluate the area’s shale gas potential. Local opposition to well drilling delayed the first spudding until earlier this year, though the firm has now drilled two of the three wells. Shell will analyze well tests results for one year before determining whether to proceed with the project.

UK NORTHERN PETROLEUM SYSTEM

The UK contains two major petroleum systems—a Carboniferous Northern Petroleum System that ranges from the Varascan Front in central England north through Scotland; and a Mesozoic Southern Petroleum System that exists between the Varascan Front and the English Channel in England and Wales. While each of these systems contains several basins, they share similar depositional and tectonic history and contain the same shale gas prospective formations. The main source rock in the Northern Petroleum System is the marine Namurian Bowland shale (also known as the Holywell shale in the Cheshire and West Lancashire basins). Current development has only targeted the shale’s eastern areas. Additional exploration and data will be needed before the western extent of the shale can be established.

Cuadrilla Resources has finished drilling its first exploratory well into the Cheshire basin’s Bowland shale. Initial results indicate that the shale has high prospectivity. Cuadrilla was to have drilled two additional wells last year, but its drilling campaign has been hampered by environmental activists concerned about contamination of drinking water and the possibility of earthquakes due to fracturing. Last June, fracturing operations were halted when minor tremors were detected in the area. In July, Cuadrilla announced plans to install a traffic light system based on a seismometer network, which measures earthquake activity. The government is due to soon announce whether it will lift the temporary ban on shale gas fracing.

UK-based Island Gas has acreage positions in the Northern Petroleum System that it considers promising for shale gas potential, and is in the process of evaluating its acreage. Celtique Energy also has acreage positions in the Northern Petroleum System, namely in the East Midlands and Cheshire basins, on which it plans to target Carboniferous and Triassic sands sourced by Namurian shales. The company has not stated that it intends to target shale formations on its acreage, but it is targeting the Weald shale in southern England.

UK SOUTHERN PETROLEUM SYSTEM

The UK Southern Petroleum System contains the Mesozoic Weald and Wessex basins. The formations are regionally equivalent with the shale formations in the Paris basin. The most prospective source rock for shale development is a group of Liassic interbedded shallow marine shales and clays, known as the Liassic clays. Across much of the Weald and Wessex basins, the formations are within the oil window. Previously believed to be immature for gas development, a 160-sq mi area has been identified in which the Liassic shales are within the gas window.

Celtique Energy has a 386-sq mi acreage position it believes to be prospective for shale gas, although it is currently untested. The company also has a 700-sq mi exploration license in the Weald basin. This area could contain up to 2 Tcf of recoverable resources. No timeline for drilling has been provided, but the license is valid until 2014.

Eurenergy has a small concession in the Weald basin, totaling 192 sq mi on which it reports 40 Tcf of shale gas potential. The company was actively looking for a joint venture partner, but has not provided additional information. Cuadrilla also has small acreage positions in the Southern Petroleum System, though it has not made its plans for the region public.

VIENNA BASIN

The Vienna basin in northwest Austria extends northward into the Czech Republic. Faults traversing the basin provide pathways for hydrocarbons produced in Jurassic strata to migrate into a series of overlying stacked reservoirs, which have provided over one billion bbl of oil to date, making the Vienna basin one of Europe’s most important hydrocarbon sources. OMV is exploring the Mikulov Marl’s potential as part of a three year study of its concession within the Vienna basin. OMV has estimated that the Vienna basin contains 200 to 300 Tcf of resource, but cautions that formation depth and pressure may make exploration technically or economically infeasible. OMV’s chief executive noted that well costs at depths greater than 16,400 ft could be $20 million or more.

CENTRAL NORTH AFRICA

The Central North Africa region (Algeria, Tunisia and Libya) contains two major shale gas basins—the Ghadames basin in eastern Algeria, southern Tunisia and northwestern Libya; and the Sirt basin in north-central Libya. The Ghadames underlies eastern Algeria, southern Tunisia and western Libya. The Ghadames contains two major organic-rich shale formations—Lower Silurian massive shales of the Tannezuft formation and The Middle Devonian Frasnian shale.

Considerable exploration activity is underway in the Ghadames basin. Cygam Energy has acquired four permits in the Tunisia portion. Chinook Energy Inc. also has acquired seven lease blocks in the Tunisia portion of the Ghadames. The Sud Remada block totals 1.2 million acres with structures identified, including the Tannezuft shale. Cygam’s exploration program involves 2D/3D seismic, three exploration wells and two appraisal wells. Cygam Energy conducted a frac job on Well No. 1 in the Tannezuft shale at a depth of 13,000 ft in the Sud Tozeur permit area.

To date, no shale gas production has been reported from the Ghadames basin. This year, Cygam plans to drill two appraisal wells in the Sud Remada lease block. Previous drilling into the deeper, oil bearing “TT” Ordovician reservoir, showed hydrocarbon potential in the Silurian Tannezuft formation. Meanwhile, Sonatrach has started talks with Royal Dutch Shell and ExxonMobil on shale gas exploration after having signed a similar agreement with Eni.

Because of its favorable oil and gas investment incentives, Tunisia has attracted many international E&P countries, and it is the only country in North Central Africa where unconventional natural gas potential is being explored. Tunisia had the first shale gas well and frac job in North Africa and is actively supporting the pursuit of this resource.

SOUTH AFRICA

The Permian-age Ecca Group, is South Africa’s targeted shale gas resource. However, major and independent companies have signed Technical Cooperation Permits (TCPs) to pursue shale gas in the Karoo basin, including Royal Dutch Shell, Falcon Oil and Gas, the Sasol/Chesapeake/Statoil joint venture, Sunset Energy Ltd. of Australia and Anglo Coal of South Africa.

Falcon Oil and Gas Ltd. was an early entrant into the shale gas play of South Africa, obtaining a Technical Cooperation Permit (TCP) along the southern edge of the Karoo basin. Shell obtained a larger TCP surrounding the Falcon area, while Sunset Energy holds a TCP to the west of Falcon. The Sasol/Chesapeake/Statoil JV TCP area and the Anglo Coal TCP application area are to the north and east of Shell’s TPC.

Five older wells have penetrated the Ecca shale interval. Each had gas shows, while one flowed 1.84 MMcfd from a test zone at 8,312 ft. The gas production, judged to be from fractures and secondary porosity in the shales, depleted relatively rapidly during the 24-hour test. The well had been drilled to the Table Mountain quartzite and had gas shows from six intervals. These shows indicate that the South African shales may be gas saturated.

|

| Fig. 4. Beach energy is drilling some of the early wells to test shale potential in the Cooper basin. |

|

CHINA

China has two large sedimentary basins that contain thick, organic-rich shales with excellent potential for shale gas development, namely the Sichuan and the Tarim basins. Additionally, China has five sizeable, but less prospective shale gas basins with non-marine shales. Since shale exploration is just now beginning, information is limited. It seems likely that five to ten years will be needed before production will be at meaningful levels.

China’s earliest natural gas producing region, the Sichuan basin hosts numerous large operators (PetroChina, Shell, Chevron, ConocoPhillips, EOG) that are evaluating and testing the shale- and tight-gas resources. ConocoPhillips is the only operator in the Sichuan to have selected its block based on shale gas exploration quality. The other PSC’s in Sichuan were previously signed based on tight gas sand and carbonate gas potential and are being re-evaluated for shale gas. These programs are at an early stage, with no commercial shale gas production reported.

China’s most active shale gas explorer, PetroChina, is partnered with several international companies in the Sichuan basin and also operates its own exploration program. PetroChina has noted that seven of the company’s conventional wells in the basin experienced gas kicks while penetrating shales, including one well that flowed 1 MMcfd from an unstimulated shale. The company reportedly spud its first dedicated shale gas test well in September 2010.

In 2010, Sinopec reported that its first shale well (Yuanba-1), a vertical test in the northeast part of the basin flowed 406 Mcfd after stimulation. Sinopec and PetroChina had plans to drill several more test wells and install several horizontal production pilots in various locations during 2011. PetroChina’s production target for Sichuan shale gas is 100 MMcfd by 2015.

Shell and CNPC had jointly submitted a 30-year PSC application for approval in the Sichuan basin, targeting tight gas and shale gas resources. Further west of Sichuan, Chevron reported that it is negotiating with Sinopec for a shale gas exploration block near Guiyang.

EOG Resources holds a tight gas PSC in the Sichuan basin that may also be prospective for shale gas. EOG expects to test the PSC with a shale gas exploration well. In the Jinqiu region, Shell announced that, assuming its two planned exploration wells reveal good potential, the company’s investment for this project could reach $1 billion annually for each of the next five to seven years. ConocoPhillips reportedly is evaluating a block in the Sichuan basin for shale gas development and may sign a PSC later in 2012.

INDIA/PAKISTAN

Indian oil company, ONGC recently drilled and completed India’s first shale gas well, RNSG-1, northwest of Calcutta in West Bengal. The well was drilled to 6,560 ft and had reported gas shows at the base of the Permian-age Barren Measure shale. Two vertical wells (Well D-A and D-B) were previously tested in the Cambay basin and had modest oil and shale gas production in the shallower, 4,300-ft thick intervals of the Cambay “Black Shale”.

Although ONGC has identified the Cambay basin shales as a priority, no plans for exploring them have been announced. However, two shallower conventional exploration wells (targeting the oil-bearing intervals in the basin) penetrated and tested the Cambay “Black Shale.” Vertical well D-A had gas shows while drilling the Cambay “Black Shale” at about 4,300 ft. After hydraulic stimulation, Well D-A produced 13 bpd of oil and 11 Mcfd of gas. Well D-B, an older vertical well drilled in 1989, had also encountered the Cambay shale at about 4,300 ft. The well was subsequently fractured and produced 13 bpd of oil and 21 Mcfd of gas.

The Damodar Valley basin is a priority for shale gas exploration by the Indian government. ONGC spudded the country’s first shale gas well, RNSG-1, in the Raniganj sub-basin. The well was completed in 2011, having reportedly encountered gas flows from the Barren Measures shale. Detailed well test or production results are not available. This well was the first of a four-well R&D program in the basin. Plans call for an additional well in the Raniganj sub-basin and an additional two wells in the Karanpura sub-basin by March 2012.

AUSTRALIA

Australia has major gas shale potential in four primary basins. The Cooper basin, Australia’s main onshore gas producing basin, could be the first to develop, although its Permian-age shales have a non-marine depositional origin and the gas has elevated CO2 levels. Other prospective shale basins in Australia include the small, scarcely explored Maryborough in coastal Queensland and the Perth basin in the west. The large Canning basin in Western Australia has deep, Ordovician-age marine shale that is roughly correlative with the Bakken, Michigan and Baltic basins.

The Cooper basin has been Australia’s most active area for gas shale leasing and testing. Santos, Beach Energy and DrillSearch Energy have active shale evaluation programs, though only Beach is known to have drilled a test well. The vertical shale test well penetrated the REM shale formation with continuous gas shows. The company is analyzing five REM cores for gas content and mechanical properties. Beach was planning to conduct an 8-stage frac of the Encounter-1 test well.

The Perth basin is a petroleum producing region that extends on and offshore in southwestern Australia. Local operator AWE is evaluating the shale potential over some one million gross acres. AWE and partner Norwest Energy have cored these shale targets and may fracture stimulate a shale well in the future.

Buru Energy controls exploration permits with shale gas potential in the Canning basin. The company reported cores of gas-mature, organic-rich shale from the Laurel formation taken from the Yulleroo-1 conventional exploration well in permit EP-391. Other potential shale targets include the Early Permian Noonkanbah, Carboniferous Lower Anderson, Gogo, and Goldwyer formations. In 2010, Mitsubishi agreed to fund an exploration and development program, including 80% of Buru’s 2011 unconventional oil and gas exploration budget, to earn a 50% interest in most of Buru’s permits.

New Standard Enegy, operating in the Canning basin, holds an exploration license with Goldwyer shale potential and additional acreage in EP 413 with Laurel Shale potential. The firm estimates 40-480 Tcf of gas-in-place within shale formations on the company’s leases.

Beach Energy started drilling its first two shale gas exploration wells in March, with Encounter-1 now complete and Holdfast-1 currently being drilled. The core from the recently completed Encounter-1 exploration well was gas saturated and is currently being evaluated to test the core for brittleness as well as gas content. Beach is “derisking” its PEL218 tenement through the drilling of the exploration wells, with the aim to attract one of the majors to possibly free carry Beach through the development phase of shale gas production. Beach currently has a memorandum of understanding with Japanese company Itochu, with Itochu considering the construction of an LNG facility which could be supplied by Beach’s shale gas, should it be commercialized. Estimates at this stage have the LNG facility producing approximately one million tonnes of LNG per year.

In June, Statoil farmed into Petrofrontier’s exploration permits in South Georgina basin in Australia’s Northern Territories. Atle Rettedal, Statoil’s senior vice president for new ventures feels this is an early entry at scale into over 13 million acres of immature, but potentially highly prospective play at low cost, with high risk but also with significant upsides. The joint venture plans to drill 10-20 wells by 2017 in three phases to demonstrate prospectivity. Statoil has committed to contribute $25 million for the first phase of the exploration program. This figure could escalate to $200 million through a phase two and three, depending on exploration results. PetroFrontier launched a three-well horizontal drilling campaign in 2011. Petrofrontier drilled two wells into the Lower Arthur Creek formation in the second half of 2011. Multi-stage frac and completions of both wells was scheduled for the second quarter 2012. A third horizontal was planned later in 2012 to test the unconventional potential of the Toko syncline.

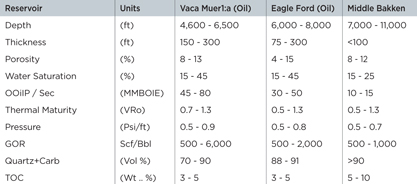

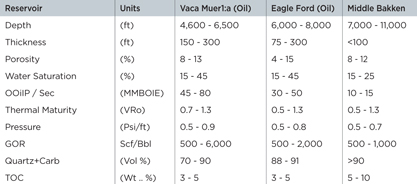

| TABLE 2. APACHE’S ANALYSIS OF THE VACA MUEERTA PLAY IN COMPARISON TO THE EAGLE FORD AND BAKKEN PLAYS |

|

|

SOUTH AMERICA

The Maracaibo and Catatumbo onshore basins in Venezuela contain the most prospective shale gas plays in northern South America, holding an estimated 120 Tcf of risked shale gasin-place, according to the EIA report. The EIA estimates technically recoverable shale gas resources at 30 Tcf, due to the fact that a high proportion of these two basins are immature for gas generation or are over 16,000 ft deep.

In the southern portion of South America, Argentina’s Neuquén basin appears the most prospective with good potential evident in the Cretaceous shales in the Golfo San Jorge and Austral-Magallanes basins. Additional shale gas potential exists in the frontier Parana-Chaco basin complex of Brazil and Paraguay in the Devonian Los shales. These shales contain an estimated 4,449 Tcf of risked shale gas in-place with 1,195 Tcf of technically recoverable resources.

Apache Corporation has 900,000 net acres in the Vaca Muerta play of which 450,000 net acres are in the liquids window. The operator feels this is a world class shale play, with greater thickness, porosity and mobility than the U.S. Bakken and Eagle Ford plays.

Earlier in 2012, Apache’s first horizontal well in Campamento field in the Neuquén basin began producing at a rate over 10 MMcfd. The well was a test of horizontal drilling and multi-stage hydraulic fracturing in the low-permeability pre-Cuyo formation. Wells later in the year will test the pre-Cuyo, Los Molles, and Vaca Muerta formations. Technical evaluation of liquids is now transitioning to drilling for oil. Other oil companies—ExxonMobil, Petrobras, EOG Resources, Pan American Energy and Total—are focusing on the basin as well. Together, the international operators will spend approximately $4.5 billion in the Neuquén basin during 2012. Future development will depend on how these operators view their investments in the region in the wake of Argentina government’s takeover of YPF Repsol.

SHALE GRAIL

On the international scene, 2012 has been a disappointing year for Poland while sustained formation evaluation and initial drilling are taking place in Australia and Argentina. How the international shale grail develops will become clearer by 2015. One expects positive developments based on the premise that shale basins with mature carbon content are not unique to North America.

India’s guar rush

India may be well advised to ignore shale exploration and, instead, cash in on the soaring demand for guar gum. Indian farmers produce 80% of the guar bean, whose gum is used as a thickening agent for fracturing fluid, as well as for food products, such as ice cream and salad dressing.

“Guar has changed my life,” Shivlal, a guar farmer, told Reuters. Shivlal earned $7,000 in 2011—five times more than his average seasonal income—from selling the beans he planted on five acres of sandy soil in Rajasthan state. “Now, I have a concrete house and a color TV. Next season, I will even try to grow guar on the roof.”

India exported more than 400,000 tonnes of guar products, including gum, in 2011. US energy firms will need nearly 300,000 tonnes of guar gum in 2012, according to Simmons & Company International. To take advantage of the guar rush, Vikas WSP, India’s largest producer of guar gum, is distributing seeds free of charge to 100,000 farmers and giving them a guaranteed return.

The U.S. produces guar, but only on 40,000 acres in comparison with about 10 million acres on which Indian farmers are expected to plant this year in the Rajasthan desert.

|

| The highly sought-after guar bean is grown in India’s western desert state of Rajasthan. |

|

|

|