JIM REDDEN, Contributing Editor

|

| Harsh winter conditions dominate Neighbors drilling operations for Nexen Inc. in the Dilly Creek area of the Horn River basin. Photo courtesy of Nexen. |

|

When commodity prices crater and supply exceeds hometown demand, you can either shut in production and await better times, or if you happen to be a producer in the gas-rich Horn River and Montney shale plays of British Columbia, seek out markets elsewhere, in this case some 8,000 mi away.

By 2016, an Apache-led, three-operator consortium plans to begin processing no less than 5 million metric tons of liquefied natural gas (LNG) a year at its Kitimat export terminal, much of which is already destined contractually to Asia-Pacific buyers. Now under construction just south of Prince Rupert, Kitimat will be the only LNG terminal on the west coast of North America. Apache has controlling interest with 40%, while EnCana Corp. and EOG Resources make up the rest of the consortium, each holding a 30% interest.

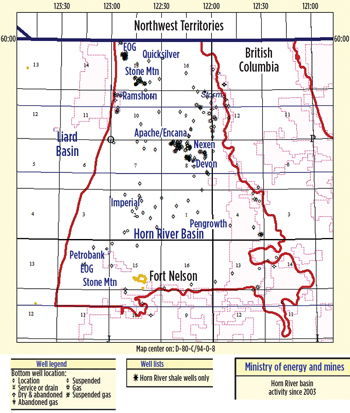

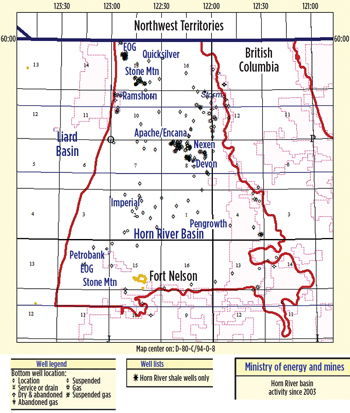

Today, the Kitimat LNG project dominates the spotlight in the geologically complex, 4,200-sq-mi Horn River basin of far northeastern British Columbia (Fig. 1) and the companion Montney shale play due south. Like their counterparts in the U.S., the more than 20 operators in the twin “pure gas” plays are dealing with stockpiles that are increasing appreciably, thanks in no small part to escalating microseismic surveys that are helping increase recovery rates significantly. While year-end 2011, province-wide production numbers are not yet available, most say they are likely to exceed the 392 MMcfgd that the British Columbia Ministry of Energy and Mines documented at the end of 2010 from some 98 producing shale gas wells.

|

| Fig. 1. Core areas of activity in the Horn River basin. Source: British Columbia Ministry of Energy and Mines. |

|

Comparative neophytes in the North American unconventional shale stampede, the Horn River and Montney plays also are situated in one of the continent’s most sensitive ecosystems, one that is highly regulated. Regulations, such as a mandated short winter drilling season, and other access availability issues, also serve to increase production costs for a commodity that already is selling at rock-bottom prices. To offset some of the pricing constraints and encourage development, British Columbia “has done some very creative things in order to stimulate and facilitate greater development,” Travis Davies of the Canadian Association of Petroleum Producers (CAPP) told the Vancouver Sun earlier this year. Predominant among the creative things he alluded to is one of the industry’s most liberal royalty relief packages. In late February, the province repeated its $120-million royalty credit program, pointing out that the 2012 allocation is expected to generate new, net incremental royalties of approximately $300 million. The latest installment was directed primarily to stimulate infrastructure expansion and ensure that the Kitimat LNG terminal remains well-fed.

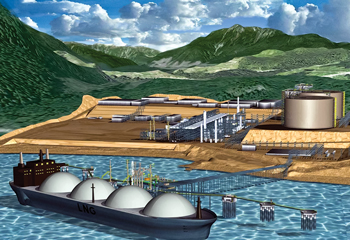

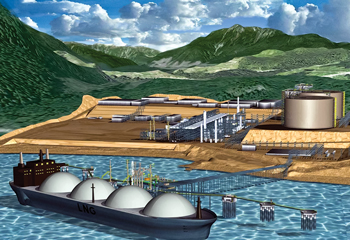

The Kitimat terminal (Fig. 2), which includes jetty and port facilities for tankers, was designed originally with a capacity of 700 MMcfgd , but if the results of current engineering studies prove encouraging, the facility’s appetite will grow exponentially. An ongoing Front End Engineering and Design (FEED) study is being carried out to determine the feasibility of a two-train design that would double the per-annum capacity from 5 to 10 metric tons. “The FEED will provide certainty around project design, construction timelines, costs and labor force requirements. The FEED study is expected to be completed in 2012, followed by a final investment decision by the partners,” said Apache Corp. spokesman John Roper.

|

| Fig. 2. Artist’s conception of the Kitimat LNG export terminal, set to begin shipping up to 5 million metric tons a year by 2016. Courtesy of Apache Canada Ltd. |

|

The National Energy Board (NEB) has granted an LNG export license, while purchase agreements have either been signed or in final negotiations with customers in China, Malaysia, South Korea and elsewhere in Asia Pacific.

CHALLENGING GEOLOGY, HIGH POTENTIAL

In May 2011, the NEB updated the reserve assessment of the Horn River basin, putting the ultimate unconventional potential at 78 Tcf. According to the NEB, the new evaluation now has northeastern British Columbia holding some 55% of the reported, ultimate, remaining conventional and unconventional natural gas resources in the Western Canada sedimentary basin. With its core area extending north of Fort Nelson, where it touches the Northwest Territories, the Horn River basin is subdivided into, from bottom up, the Evie, Otter Park and Muskwa shales, ranging in depths from 8,500 to nearly 10,000 ft. The Evie formation ranges in thickness from 131 to 246 ft and overlies limestones and dolostones of the Lower Keg River formation. The Otter Park Shale reaches a maximum thickness of over 886 ft and on well logs exhibits lower radioactivity and resistivity than either the Evie or Muskwa formations. The Muskwa, meanwhile, ranges from 98 to 197 ft thick, and on well logs it is characterized by high gamma ray readings and high resistivity.

The Montney play consists of a blend of low-permeability sandstone, siltstone and shale intervals, lying to the south where it sprawls across Peace River farmlands to the foothills, well to the west of Fort St. John. Montney pioneering operator Progress Energy Resources of Calgary said the play, which is evolving from the southeast to the northwest, becomes thicker and more over-pressured as it nears the foothills, with abundant faulting and truncation in the western reaches of the play.

2011 DRILLING DOWN FOUR WELLS

Most of the drilling operations in the Horn River and Montney shale plays are conducted from multi-well pads to reduce the overall environmental footprint. During the 2011 season, a total of 84 gas-directed wells were drilled in the Horn River, a decrease of four from the basin record 88 drilled the previous year. By British Columbia standards, those numbers could be considered mercurial, considering that only four wells were drilled in the entire basin in 2005, and in 2009, a high of only 34 wells had been constructed.

As in most years, Apache and EnCana are one and two among the registered operators in the Horn River play, with a cumulative 72 and 68 wells, respectively, drilled in the basin as of year-end 2011 (Fig. 3). Others, like homegrown Progress Energy Resources and ARC Resources Ltd, operate primarily in the Montney shale play.

|

| Fig. 3. Most active shale gas operators in the Horn River from 2003 to 2011. Source: British Columbia Ministry of Energy and Mines. |

|

While 2012 drilling plans are mixed, with some operators focusing primarily on acreage retention, data provided by both the Ministry and the most active companies in both the Horn River and Montney plays suggest Kitimat will be not be lacking for raw material when the time comes.

Apache Canada Ltd, which in 2007 formed a 50/50 joint venture with EnCana Corp. to explore the then-emerging Horn River, remains the basin’s most active operator with an interest in more than 400,000 acres. Most of the operator’s production growth has been from the Muskwa play; primarily in the Etsho and Ootla areas, where it reportedly holds unrisked resource potential of 9 to 16 Tcf. In 2011, Apache concluded hydraulic frac operations on a 16-well pad, with operations now centering on the completion of two additional pads with 42 new wells coming onstream.

EnCana’s 2012 partnership with Japan’s Mitsubishi Corp. gives the two companies control over 409,000 net acres of undeveloped Montney-formation properties in the Cutbank Ridge resource play. EnCana remains the play leader in producing from deep multi-zone horizontals with as many as 28 fracs per well. The operator, which holds a controlling 60% share of the partnership, intends to increase average daily production to more than 600 MMcfgd by 2014. In February, EnCana finalized the divestiture of two natural gas processing plants in the Cutbank Ridge area.

Imperial Oil Ltd/ExxonMobil recently added another 7,300 hectares, bringing its joint holdings to 346,000 acres. ExxonMobil holds a 70% interest in Canada’s largest operator. The joint venture’s 2011 winter drilling program was to include an undisclosed number of exploration wells and a multi-well pad pilot development. The JV is averaging 10 to 12 fracs per well, with recoveries ranging from 500,000 to 1.5 MMcfgd per frac stage.

Quicksilver Resources Inc. holds 130,000 net acres in the basin, from which it has booked a cumulative 16 Bcfe of gas production. The Fort Worth, Texas, operator is continuing the horizontal well testing program in its Muskwa and Klua shale properties that hold an estimated resource potential of 10 Tcf. The operator planned to complete drilling on five new wells during 2011 to join the four it put on production the previous year.

Devon Canada Corp. holds more than 70,000 net hectares with the potential to produce up to 700 MMcfgd. While Devon drilled all seven of the horizontal wells it planned for 2010, the operator last year reduced its capital investments to a minimum as it seeks a JV for its Horn River assets.

EOG Resources focused its attention in 2011 on acreage retention, which will continue into this year, a spokesman said. EOG has approximately 157,000 net acres with potential estimated net reserves of 9 Tcf in the Horn River basin. This year, EOG says it will drill seven net wells in the play.

Nexen Inc. remains a significant Horn River player with 100% working interest in more than 36,400 hectares in the Dilly Creek area. Nexen has been producing from an eight-well pad, and its nine-well pad started up ahead of schedule in fourth-quarter 2011. Last year, the company also began drilling on another 18-well pad. Production is expected to increase from 50 MMcfgd to a capacity of 175 MMcfgd over the next two years. The company found two JV partners to accelerate value realization for various portions of its shale gas acreage.

Progress Energy Resources Corp. is a pioneer in the Montney play, where it holds the largest land position at more than 820,000 acres. In February, Progress said its reserve base had grown 29% over 2011, primarily owing to its operations in the North Montney resource play that now holds more than 1.1 Tcfe of proved and probable reserves. The operator said it has additional inventory of 5,000 to 10,000 drilling locations. This year, Progress plans to drill 25 North Montney horizontals and another 30 horizontals as part of its North Montney JV with Petronas.

ARC Resources Ltd, driller of the first horizontal well in the Montney play, has increased year-over-year production from its North Montney Dawson development from 110 MMcfgd in 2010 to 165 MMcfgd last year. The Canadian operator controls 369 gross sections in the play and intends to produce from 80 horizontal wells by the end of this year.

TAKEAWAY CAPACITY EXPANDING

Most of the impetus behind pipeline projects now underway is to ensure a steady supply of natural gas to the Kitimat LNG facility from not only the Horn River and Montney wells, but others throughout the Western Canada Sedimentary basin.

Chief among the infrastructure advancements on the boards is the $1-billion, 288-mi, Pacific Trail Pipelines that will provide Kitimat a direct connection from the Spectra Energy Transmission network at Summit Lake to the east. Operating the pipeline is a limited partnership also consisting of Apache, EnCana and EOG, which plans to begin funneling up to 1 MMcfd of gas to the LNG terminal. The network is on tap for completion in 2015.

Meanwhile, Nova Gas Transmission Ltd (NGTL), a subsidiary of TransCanada Corp., hopes to begin site clearing the 2012-2013 winter for its aggregate, 81-mi, Northwest Mainline Komie North Extension. The $307-million project will extend NGTL’s Alberta System in northeastern British Columbia and northwestern Alberta to capture new Horn River basin production. Nova Gas plans to have the extensions in operation by 2014. In a related development, EnCana has received all the necessary permits for its Cabin gas plant, designed for a capacity of 800 MMcfgd in two phases. EnCana, however, has announced that the plant, which is expected to begin producing up to 400 MMcfgd by the third quarter, has been put up for sale.

WATER USAGE TOPS CONCERNS

Throughout British Columbia, drilling activity comes to a halt during the so-called “Spring Break-Up,” when melting snow and ice make the province’s swamps virtually impassable. Consequently, operators must cram their yearly drilling programs into the winter campaigns (Fig. 4), when temperatures can plummet to -40°F, forcing them to engineer safeguards to prevent equipment from freezing over and becoming inoperable.

|

| Fig. 4. An EnCana drilling location near Fort Nelson. Photo courtesy of EnCana. |

|

Wintertime drilling challenges aside, perhaps the biggest issue confronting Horn River and Montney operators is the exorbitant demand for water. As typical wells are highly deviated, with some having close to 30 frac stages, each requiring more than 30,000 bbl of water, it’s not surprising that water usage is a primary concern of regulators, the local communities and operators alike.

In September, 2011, CAPP unveiled what it termed new guiding principles for hydraulic fracing, aimed at enhancing water management and improving water and fluids reporting practices for shale gas development. “Protecting Canada’s water resources is fundamental to our social license to operate and to grow,” said CAPP President Dave Collyer. “Canada’s upstream industry has a strong track record as a safe and reliable producer of natural gas. With the increase in natural gas production from unconventional sources such as shale, Canadians have told us they want more information as to how industry uses and protects water. We respect that request, and these CAPP principles articulate our water management objectives and water protection practices, as well as our focus on improving our water performance over time.”

Calgary operator Arc Resources Ltd. has taken the principals to heart, claiming it recovers and recycles more than 90% of the flowback water it uses in its Montney Dawson development. Arc said its mobile water treatment technology restores flowback water to frac quality.

TECHNOLOGY APPLICATIONS

Microseismic helps boost recoveries. Operators in both the Horn River and Montney shale plays credit an increase in microseismic surveys, often correlated with surface-seismic data, with helping fuel the higher recovery rates across British Columbia. Owing to the comparative newness of these plays, microseismic is seen as a cost-effective methodology for determining the behavior of the shale to help optimize fracture design and, hence, increase production.

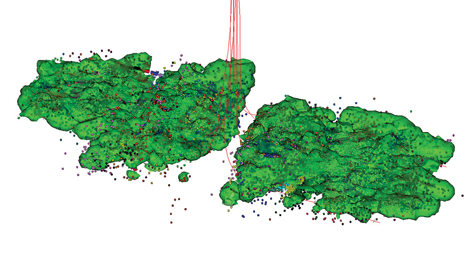

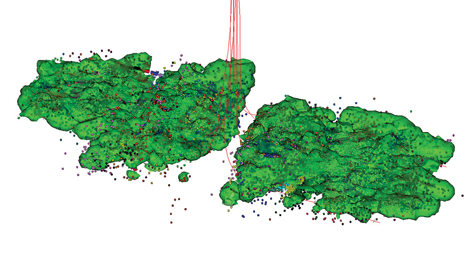

Last summer, Ontario-based ESG Solutions followed up the major Horn River microseismic program it initiated for Nexen Inc. the previous year. An ESG spokesperson said that in 2011, the company continued to build on its microseismic expertise in the Horn River basin, with a second Nexen program that included an analysis of microseismic data from 76 fracture stages in six horizontal wells, Fig. 5. During its 2010 Nexen campaign, ESG said it processed the largest microseismic monitoring program in Canada to date, with a 143-stage program that evaluated fracture stimulation operations in eight horizontal wells. The objective of the ultra-multi-stage fracture project was to observe how the reservoir accepted the frac fluid, paying particular attention to any fracture asymmetry, fracture azimuth and instances of vertical fracture growth.

|

| Fig. 5. Estimated stimulated reservoir volume (SRV) based on deformation for a multi-well, multi-stage hydraulic fracture operation in the Horn River basin. Image courtesy of ESG Solutions and Nexen Inc. |

|

Extensive advanced seismic moment tensor inversion (SMTI) analysis of high-quality microseismic events collected during the 43-day project, focused on identifying the discrete fracture network, fracture intensity, fracture complexity and stimulated reservoir volume (SRV). Results of this microseismic analysis were used to evaluate the effectiveness of the stimulation program, and assess stage spacing and sequencing. According to ESG, during two years of ongoing microseismic work across Nexen’s Horn River holdings, approximately 153,000 events have been located, of which 75,000 will have been used for advanced SMTI analysis.

Integration of surface seismic and microseismic. Meanwhile, during the 5th Annual Unconventional Technical Forum in Victoria, sponsored by the provincial energy ministry, representatives of Progress Energy, Schlumberger and the University of Calgary teamed up for a presentation on the integration of surface seismic and microseismic to improve both drilling and completion operations in the Montney shale. According to the presenters, the correlation of seismically derived properties with microseismic provides “a better understanding of the reservoir properties in the early stages of development that will benefit the long-term production and costs.”

Record single-bit run. EnCana said its latest Horn River drilling program was highlighted in January with a world record for the longest single-bit run. In collaboration with Schlumberger, EnCana employed BHA design modeling and system integration to drill 17,250 ft in one run, comprising more than 297 drilling and circulating hours at a downhole temperature of 293°F. Schlumberger said the horizontal well included use of a Smith PDC bit, as well as an NBR-HR PowerPak mud motor and a TeleScope MWD and Slider system.

Potassium silicate drilling fluids. Toronto-based National Silicates has developed what it calls a uniquely engineered potassium silicate drilling fluid that meets provincial restrictions aimed at reducing mud-induced drilling waste. Both Alberta and British Columbia enacted regulations to tighten the allowable increases in receiving soil electrical conductivity (EC) and sodium absorption ratio (SAR), which served to restrict the use of certain drilling fluids like sodium silicates. The earlier introduction of potassium silicate drilling fluids throughout Western Canada effectively addressed the environmental concerns related to the relatively high sodium loadings present in some drilling wastes. Potassium silicate-base drilling fluids have more recently been evaluated in the Horn River.

“The success in conventional drilling plays has made potassium silicate-based drilling fluids a top candidate for the transition away from oil-based drilling fluids to environmentally friendly, water-based systems,” said National Silicates spokesman Mike McDonald. “The shale stabilization characteristics of potassium silicate also are well established as is improved cement bonds. For the Horn River, it is anticipated that potassium silicate will be used in the top and build sections which require the most shale stabilization. Potassium silicate will be depleted from the drilling fluid approaching the lateral section.” He said the environmental benefits were reflected in National Silicates’ recent approval by the Canadian government to have its potassium silicate classified as a fertilizer.

High-volume ESP lift systems for fracture water supply. One of the challenging dynamics of the Horn River play has been the increasing number of fracture stimulations required per horizontal wellbore and the consequent massive volume of water required to supply the 24/7 fracturing operations. Since 2005, slickwater fractures have grown from 2,500 bbl of water with 10 tonnes of proppant in a vertical well to 29 staged fractures per horizontal well, with each fracture consisting of over 30,000 bbl of water with 200 tonnes of proppant. As the volume and number of fractures have grown, so has the demand for fracture water; at 30,000 bbl per stage, approximately 900,000 bbl of water is required for one horizontal well completion with 30 fractures.

It became clear to Encana that reliance on fresh surface water from the nearby Two Island Lake was not sustainable as a primary fracture water source. In an effort to eliminate the reliance on surface water, Encana engaged in a novel approach to produce high volumes of sour waters from a relatively unknown under-pressurized saline aquifer. The Debolt formation was identified as a potential water source that could supply the completions operation with frac water. The challenge was designing an appropriate high-volume lift system capable of producing and achieving volumes of up to 50,000 bwpd for each wellbore while addressing unknown fluid inflows, fluid transmissibility and re-charge, and reservoir fluid chemistry characteristics.

Encana designed, pilot-tested and successfully implemented full-scale high-volume sour water lift ESP systems. These systems have demonstrated significant potential to alleviate the high costs, production withdrawal limitations and environmental impact of delivering large volumes of fracture supply waters in the remote Horn River region.

EATING INTO THE GLUT

While acknowledging that rock-bottom gas prices are the wild card, an official with the Ministry’s Oil and Gas Division predicted that production in the Horn River basin will continue to climb, as operators wait for Kitimat to start eating into the glut. Christopher Adams, oil and gas specialist in the Geoscience and Natural Gas Development Branch, said at the 2011 Victoria forum that while advancing development technologies, like improved understanding of the operational complexities associated with pumping large fracture treatments, will increase output, operators also must contend with a pricing picture unlike most areas. “Exploitation is likely to be challenging given the access constraints, which will result in a higher (production) cost structure,” he said.

|