BRUCE CRAGER, Endeavor Management; and JOHN BAILLIE, Addax Petroleum

|

| The Knock Adoon FPSO has been on station at Antan and Adanga fields offshore Nigeria since 2006. |

|

The success of developing an offshore field requires selecting the best development option dictated by the realities of the potential resource base. The development option is directly affected by the location, which includes existing infrastructure, water depth, resource size (volumes and density) and expected production rates, along with local requirements for project development. Other key criteria include expected life of the field, timeframe of licensing, export options, and partner experience and preferences. All of these criteria are critical to the selected development option.

Addax Petroleum has been involved with many marginal fields in West Africa that have reserves of less than 100 million bbl of oil dispersed over large areas in the range of 19 sq mi (50 sq km). These locations are generally remote, requiring stand-alone development in water depths ranging from 40 to 500 ft, and are in benign met-ocean environments. Addax has developed the majority of these fields with subsea or platform wells that produce to a Floating, Production, Storage and Offloading (FPSO) vessel.

FPSOs are best utilized for fields that primarily produce oil. The FPSO has an on-deck processing system that can handle produced oil, water and gas. The oil is stored in the FPSO’s hull; the gas can be used for fuel, reservoir support and/or re-injection of excess gas; and the water can be processed and then disposed.

The type of well installation (platform or subsea) is often determined by water depth, as well as reservoir size and density. Fixed platforms are often used in shallower water depths that contain concentrated accumulations, which can be reached from a single location. Subsea wells can be used in any water depth, but they are normally utilized in deeper water depths, where fixed platforms become more expensive, or there is insufficient resource density.

DETERMINING THE BEST DEVELOPMENT SOLUTION

When developing an offshore field, it is important to perform a comprehensive concept identification and selection process before moving into more detailed design. This allows consideration of all viable concepts, to explore potential sources of value and mitigate risk. The concept identification phase should be as broad as practical. After initial concepts are identified, multiple parameters (economic, operational and technical) can be used to initially reduce the number of concepts to those considered worthy of further consideration.

Before embarking on a concept identification effort, it is important to identify the stakeholders and understand the important drivers for each of them. Stakeholders, beyond the operator’s internal ownership structure, include partners, government entities and key subcontractors, such as leased production contractors. The field development scenario must also accommodate unknowns in production rates, changes in produced fluid properties, and the ability to allow more drilling in the area. Contracting strategies need to be considered. For example, a short-life field will normally be produced with a leased production unit, such as an FPSO (Fig. 1), jackup production unit or semisubmersible Floating Production System (FPS). A fixed platform, spar or Tension Leg Platform (TLP) is sometimes better in a long-life field, particularly if there are other adjacent fields that could utilize the initial facility as a hub.

|

| Fig. 1. The traditional approach to producing a short-life field is to use an FPSO, with a topsides arrangement similar to this scheme used on the Petroleo Nautipa at Etame field, offshore Gabon. |

|

Initial efforts should determine all viable concepts, not just use what has “worked in the past.” For example, an alternative to using an FPSO is an FPS with a Floating, Storage and Offloading (FSO) vessel for crude storage after processing on the FPS. While this alternative may be more expensive, due to having two vessels, it can include capability on the FPS for initial drilling, or to perform workovers. This can significantly reduce drilling and workover costs over the life of the field.

Another consideration is the use of surface trees on fixed platforms, spars or TLPs versus various subsea options. Fixed platforms, spars and TLP’s can support platform rigs, as opposed to mobile drilling rigs, such as jackups, semis and drillships. Platform rigs operate at lower costs than mobile rigs, and allow drilling and workovers to be performed from the facility’s deck. FPSOs and semi FPS units have too much motion for surface wells, so they require subsea completions. Subsea options can include single-well tie-backs, subsea manifolding from central drilling centers and daisy-chaining multiple wells to minimize flowlines.

The benefit of identifying all reasonable options is to make sure that nothing is overlooked in the early phase of concept development. These options can then be compared qualitatively, as well as quantifiably, in terms of cost, schedule and flexibility, along with operational robustness and proven technical design. Key areas to be considered are constructability and installability, risk mitigation and any upside benefits of each case. With this broad approach, it is important to stay at a high level in the evaluation, until a relatively small number of concepts remain. After determining the best alternative concepts, usually on the order of five to 15 options, it is appropriate to perform more detailed cost and schedule estimates on each of the remaining alternatives, to make comparisons of the best concepts for a specific field development. At this stage, a formal risk evaluation of the concepts should be completed. As the number of concepts is reduced, hybrid solutions are often discovered, which combine several of the best features of the alternatives being considered.

IDENTIFYING OPTIONS

Key criteria for identifying and then selecting options is the number of wells, and the production rates per well. This is often done in ranges, as opposed to a specific value. It is, therefore, essential to consider these ranges for each option. One option might be preferred for smaller production, and another might be better for larger production rates. It may be necessary to carry both of these preferred options for further consideration in the concept evaluation phase, to make sure both are considered in more detail.

One way to handle the issue of multiple inputs is to run the analysis and compare the various options probabilistically, as opposed to deterministically. This way, the production rate, number of wells and other variables can be input as ranges instead of single numbers. Probabilistic methods can also allow for ranges in cost estimates, delivery dates and similar data. Risks can be identified and then included in the analysis, such as the impact of late delivery or schedule overruns.

Concept identification/selection can be done by a relatively small, multidisciplinary team with an associated low cost, but this still can have a large, positive impact on the overall project. The benefits of carrying out a thorough concept identification/selection process can be significant cost and schedule savings. It often provides results that would not be anticipated in the initial stages of concept identification. Also, this effort will ensure that no major operational and technical issues are overlooked.

Performing concept selection also allows all stakeholders to be sure their preferred, and sometimes internally biased, solution(s) are considered. This can be very important as the project progresses, especially if questions arise about the selected concept and why other options were not utilized. If proper concept identification work is performed, there should be clear documentation of why other options are not preferred. This can be particularly important if a new stakeholder joins the project, such as a new partner, or if there are changes in partner/government personnel that approve the project.

|

| Fig. 2. At Okwori field offshore Nigeria, the original development plan (left) had 16 subsea wells in 140 m of water tied back to the Sendje Berge FPSO (right). Additional subsea wells have been added over time, and more subsea completions are planned soon. |

|

CONCEPT SELECTION EXAMPLE

One example case study is a recent concept selection evaluation for a new development in West Africa. The reserve base is less than 100 million bbl, and the resource is spread over 60 sq km in water depths of 200 to 600 ft. The reservoir basis of design has five subsea centers with about 14 wells. During the first development phase, it will require a processing capacity of 50,000 bopd and 80,000 bfpd, with gas compression of 40 MMcfd, for lift gas and injection. There is potential to expand to 100 MMcfd of gas handling in a second phase.

Over a six-month period, a Generation-to-Screening-to-Evaluation-to-Validation concept process was undertaken. Of 335 concepts generated, 23 were taken into screening, and nine made it to the evaluation stage. Of those nine, only two are in the validation process for final concept selection. In the process of concept evaluation, drilling centers/FPSO location and manifold concepts were modified to come up with a robust, fit-for-purpose basis-of-design that can be put into a project basis-of-design for contractor consideration.

A statement of requirements package that outlines the concept, project basis of design and capacities/sizing will be used to solicit interest by contractors and consortia for an EPIC contract to take the project to first oil. Having done the work on concept generation, screening, evaluation and validation allow the project to move forward quickly, as there is a good understanding of the concept chosen by all stakeholders

ADDAX EXPERIENCE IN WEST AFRICA

The following items highlight several examples of Addax experience with marginal fields in West Africa.

Antan/Adanga (OML 123 in Nigeria). This field was originally developed by Ashland in the early 1980s. It is in shallow water (10 to 140 ft) with multiple, fixed platforms producing through a network and processing facility to an FPSO. The original FPSO was FPSO VI, which had the unusual design of being moored to a small, fixed platform, with a bow turret attached to the platform, known as a “jacket soft yoke” mooring. Addax bought the field in 1998, and FPSO VI was replaced by a spread-moored FPSO, the Knock Taggart, with a processing capacity for 30,000 bpd. This vessel was replaced in 2006 with the spread-moored FPSO, Knock Adoon, to accommodate significantly more processing, up to 140,000 blpd. This change-out was preformed with a shut-in period of only five days, and the field was back to full production in another three days.

Okwori (OML 126 in Nigeria). This field is in 140 m of water and has 16 subsea production and injection wells (Fig. 2) tied back to the FPSO, Sendje Berge. The field was brought on production in 2005. Subsea wells have been added over time, and more subsea completions are planned for the near future. All wells are tied back to the port side of the vessel, and space for more tie-backs is limited. In addition, routing on the seabed for new flowlines and umbilicals becomes more challenging, as more wells are added. This has resulted in the new subsea wells producing to a subsea manifold system, minimizing the number of risers and umbilicals to the FPSO.

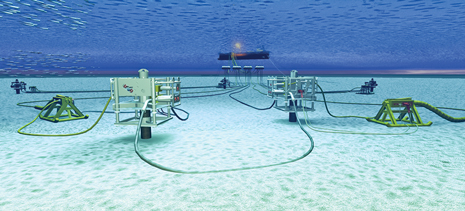

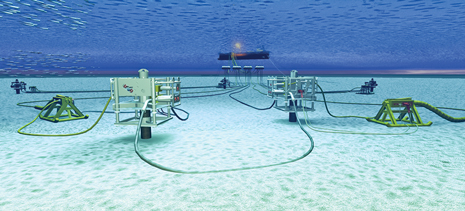

Etame (Gabon). Addax holds the largest percentage interest in this field and is an active non-operating partner. The FPSO, Petroleo Nautipa, was installed in this field in 2002, in 240 ft of water. It continues to produce from two wellhead platforms and a number of subsea wells, Fig. 3. Field expansion plans are ongoing, and development drilling continues.

|

| Fig. 3. Subsea wells at Etame field, offshore Gabon, are tied back to the Petroleo Nautipa FPSO. Thanks to a carefully considered development scheme, the field’s partner companies will be able to expand the field through existing facilities and drill additional development wells. |

|

This experience with marginal fields has allowed Addax to economically develop a unique capability to produce marginal West African fields. It also gives Addax a unique perspective on lessons learned.

For instance, FPSOs are the preferred floating production option for small fields that have large areal extent. There is a robust market for leased units that can be fitted out to meet the operator’s needs for a specific field. An FPSO has a large deck that allows space for multiple processing packages and which can have equipment added in-situ, if needed. Spread-moored vessels are acceptable for most West African locations, which can accommodate a large number of wells, because they do not have a turret with a limited number of swivel paths.

Second, the FPSO should be designed to allow for field expansion. This could include having excess process capability, additional riser/umbilical porches, and gas handling, such as reinjection. Where possible, consider adding extra support structure in the shipyard before the FPSO arrives in the field, so that additional modules can be added above-deck without having to weld directly to the FPSO’s main deck.

Third, outfit the FPSO for a longer field life than expected, if possible. This can include coating tanks before going on location, adding cathodic protection for the hull and ensuring new mooring legs are used. Many projects start out with short-term contracts, under five years, but if the field exceeds expectations, the FPSO might have to disconnect and go to drydock late in the field’s life, when production is decreasing. This can result in shutting in the field with no revenue to the operator, and it may be difficult to bring some of the wells back on-line after extended shut-in.

Fourth, a larger FPSO storage capacity is preferred, if this can be accommodated by standard hull shapes. An example would be using an FPSO based on VLCC storage sizes (over 1 million bbl), as opposed to a Suezmax vessel (about 800,000 bbl of storage capacity) or even smaller vessels. Larger storage reduces the number of liftings (offloading from the FPSO to a shuttle tanker) per year, with the resultant safety benefit, as well as the associated savings in logistical costs for remote locations. In addition, offloading to larger shuttle tankers (over 1 million bbl) normally results in a reduced transport cost of about $2/bbl compared to shipping smaller parcels.

Fifth, subsea wells allow production from multiple drilling centers, and single wells are easily accommodated, if necessary. Tie-back distances of over 10 km are very feasible from a flow assurance standpoint.

Last, simple subsea architecture is preferred, as opposed to sophisticated manifolding of multiple wells. It is also preferred to avoid hardware needing subsea maintenance, such as subsea chokes on manifolds.

CONCLUSIONS

Addax has carried out a number of successful offshore projects and has significant experience with marginal West Africa fields. The company uses a stage gate process, which includes concept identification and selection for all new projects. Because most of the firm’s West African projects are comparable—having reserves of less than 100 million barrels, over a large area in shallow-to-medium water depths—Addax has been able to utilize a sound technical database from prior projects, and the selected development concepts have been similar. These fields have been brought on-line using FPSOs with subsea wells. The company understands the importance of allowing for field growth, to design for possible life extension and facility expansion, and to keep subsea systems simple. These lessons learned have allowed Addax to continue to produce fields economically, well beyond the initial development timeframe. The firm continues to evaluate new fields and expects to utilize their processes for concept identification/selection, as well as past experience to select the optimum field development options in the future.

|

AUTHORS

|

|

BRUCE CRAGER is managing director of Endeavor Management, a management consulting group, based in Houston. At Endeavor, he leads the firm’s Offshore, Subsea and Marine Group. He has 37 years of experience in offshore drilling and production activities, primarily in management positions. This has included a significant amount of experience in evaluating and providing field development solutions, based on floating production systems and subsea production equipment. Mr. Crager’s previous industry experience includes work with Oceaneering, ABB Offshore Systems and INTEC Engineering. Most recently, he was vice president-–Subsea at J. Ray McDermott. He earned a BS degree in ocean engineering from Texas A&M University in 1975, and an MBA from University of Houston in 1979. |

|

|

JOHN BAILLIE is corporate development director at Addax Petroleum, a Switzerland-based company that is a subsidiary of the Sinopec Group. He leads the organization’s development efforts in Nigeria, Gabon and Cameroon. Mr. Baillie earned a BSc degree in engineering from The University of Calgary in 1981 and then went to work for Chevron. Over the next 25 years, he served in various positions for Chevron, in Canada, California, Texas and Angola, rising to engineering manager. He has been with Addax since 2008. |

|