|

|

Lewis Energy Rig 4 is drilling in the Eagle Ford shale in Webb County, Texas. Working in a joint venture with BP, Lewis has drilled 61 Eagle Ford wells to date, of which 18 are waiting on frac stimulation and 43 are producing a total of 95 MMcfd and 720 bopd.

|

|

DAVID MICHAEL COHEN, Managing Editor

It was big news in March when the Haynesville shale of Texas and Louisiana surpassed the nearby Barnett, in Texas’ Dallas-Fort Worth area, as the most productive shale play. Less widely reported, until very recently, has been the feverish rate of drilling in their new neighbor to the south, the liquids-rich Eagle Ford. As operators begin to bring those wells online and move in even more rigs while low gas prices take their toll on Barnett and Haynesville activity, the Eagle Ford is emerging as a dark horse with potential to overtake those two plays in production volume.

GEOLOGY

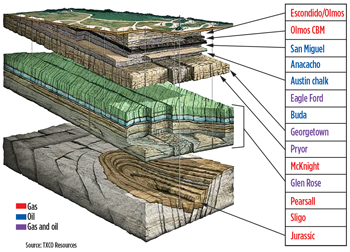

Extending about 400 miles from the Texas-Mexico border, at Webb and Maverick Counties, toward East Texas, with an average width of 50 miles, the explored area of the Eagle Ford shale lies at depths ranging from 4,000 ft to 12,000 ft between the overlying Austin chalk and underlying Buda limestone. The Cretaceous formation has an average thickness of 250 ft, and reaches thicknesses up to 330 ft in some areas, Fig. 1. It is generally deepest in the southeastern gas window, shallowing as it trends to the northwest into the wet gas and, finally, oil window. Outcrops of the Eagle Ford are seen as far north as Dallas-Fort Worth.

Not a typical shale formation, the Eagle Ford has been described as a “borderline carbonate reservoir,” with horizontal well data indicating significant early matrix flow and 30 years of vertical well history confirming long-term matrix support. According to the Texas Railroad Commission (RRC), which regulates oil and gas activity within the state, in South Texas the carbonate content is up to 70%, with shale content increasing as the formation shallows to the northwest. Despite the relative lack of natural fracturing in the Eagle Ford, the high carbonate content has attracted many operators because it makes the rock brittle and easier to fracture, thereby lowering completion costs and improving productivity.

Top net Eagle Ford leaseholder EOG Resources reports that a typical well in the crude oil window produces 77% oil, 12% gas and 11% NGLs. Based on the large spread between the initial reservoir pressure and the bubble-point pressure, EOG reported to investors in May that it expects wells in the oil window to produce 40% percent of their reserves on average during the first five years.

Resource estimates for the Eagle Ford are still sketchy. Transform Software has placed the total gas in place around 84 Tcf, and estimates of recoverable oil have ranged from 3 billion bbl to 4.8 billion bbl.

Within the Maverick basin, concentrated on the border counties Maverick, Zavala, Dimmit and Webb, the Eagle Ford lies above the Pearsall dry gas shale, Fig. 2. Although few wells have been drilled into this formation, those that were (by Encana and Anadarko in 2009 and 2010) have been quite productive, with monthly maximum rates in the 4-MMcfd range. With gas prices remaining low, it is not currently economic for most operators to develop (and build transport capacity for) this deep gas, but companies with Eagle Ford acreage in this area will likely find the Pearsall shale to be a worthwhile secondary target when gas prices eventually rebound.

|

|

Fig. 1. Map showing depth and thickness of the Eagle Ford shale across South Texas, along with oil and gas producing wells as of Oct. 6, 2010.

|

|

OPERATOR ACTIVITY

According to RRC data, the state issued 1,010 drilling permits in the Eagle Ford last year, more than 10 times the 94 permits issued in 2009. The state is on track to double that number this year, with 743 Eagle Ford drilling permits issued in the first four months alone.

For many operators, drilling programs in the Eagle Ford are part of a larger effort to shift their revenue mixes from gas to liquids. For example, EOG Resources expects 71% of its total 2011 revenue mix to be sourced from liquids and 21% from gas, exactly reversing its 2008 revenue mix. Production volumes in the play have followed this trend: While gas output has ramped up considerably—from 47 MMcfd in 2009 to 216 MMcfd in 2010 (a 360% increase) to 288 MMcfd in January and February 2011 (33% up)—its pace of growth has been dwarfed by that of liquids, which shot up 650% from 2,270 bpd in 2009 to 17,100 bpd in 2010, and then another 76% to 30,100 bpd in the first two months of this year.

A major constraint on Eagle Ford production is a lack of adequate takeaway capacity to keep up with the rapid rate of development. To overcome this obstacle, midstream operators are scrambling to build additional pipelines, committing more than $1 billion during the last two months to add 940,000 bpd of capacity by the end of 2012, according to Reuters. In the meantime, several leaseholders are using trucks when necessary to bring their oil production to market. Given the rapid pace of development drilling and infrastructure construction, some analysts are predicting that Eagle Ford production will overtake that of the Barnett and Haynesville shales within just a few years, despite the fact that current Eagle Ford volumes are less than 10% of the output from either of those two plays.

EOG Resources is the largest net leaseholder in the Eagle Ford shale, with 595,000 net acres concentrated heavily in the liquids-rich areas of the play. The company has 520,000 acres (87% of its total) in the play’s crude oil window, 26,000 acres in the wet gas window and 49,000 acres in the dry gas window. Within this total acreage, the company estimates its potential reserves at 690 million bbl of oil, 100 million bbl of NGLs and 661 Bcf of gas. Unlike many independent shale operators, EOG has avoided joint ventures, preferring to maintain sole ownership of its acreage in resource plays.

EOG is also one of the top Eagle Ford producers, with 23,000 boepd net as of March 31. The company drilled 96 net Eagle Ford wells in 2010 and plans to ramp up the pace this year, with 18 rigs currently operating in the play.

Chesapeake holds the second largest net territory with 450,000 net acres, all in liquids-rich portions of the play. That’s after closing a deal in November to sell 33% of its Eagle Ford assets to China National Offshore Oil Corp. for $2.2 billion, half in cash and half in drilling carries. The deal marks CNOOC’s first investment in the onshore US, and is part of a larger strategy by Chesapeake of aggressively acquiring prime leasehold in resource plays and then selling off minority interests to derisk the acreage. The Oklahoma City-based company’s Eagle Ford position holds an estimated 203 Bcfe of proved reserves and 3 billion boe of unrisked, unproved resources.

Chesapeake’s drilling program in the Eagle Ford began in earnest during the second half of last year; it now operates 17 rigs in the play, up from just two in mid-2010. The company plans to increase its drilling program to 40 rigs by the end of 2013. To support this increase in activity, the company leased 19,652 sq ft of office space in San Antonio last year, and it plans to increase its workforce there from 50 to more than 200 by the end of 2011.

Because of its small drilling program until late last year, Chesapeake’s Eagle Ford production has lagged despite its large leasehold. The company is currently producing 4.5 MMcfd of gas and 1,519 bpd of liquids in the play. However, it expects to ramp up production, especially liquids, within the next few years. In May, the company announced an agreement to supply 100,000 bpd of firm crude oil transport capacity to an 80-mile, 200,000-bpd extension of Enterprise Products Partners’ Eagle Ford pipeline. The pipeline extension is planned to commence operations in the first quarter of 2013.

Petrohawk was one of the first companies to establish a foothold in the Eagle Ford, and the company spent $420 million last year to acquire additional leases, mostly targeting the condensate-rich Black Hawk field. With 392,500 net acres at the end of 2010, containing 457 Bcf of gas, 19 million bbl of crude and 27 million bbl of NGLs in proved reserves, the Houston-based independent is now the third largest leaseholder in the play, and it has made delineating and drilling that acreage a major focus of its 2011 budget. The company is operating 14 rigs in the play. It drilled 28 wells in the first quarter of 2011, in substantially less time than the company had expected (an average of 30 days spud to spud, vs. 38 days budgeted). This aggressive drilling program and a push to reduce the number of wells waiting on fracture stimulation have resulted in a 43% jump in the company’s Eagle Ford production during the first quarter, to 156 MMcfed (about 26,000 boepd) from 109 MMcfed in fourth-quarter 2010. The company plans to accelerate its drilling program in the second half of 2011, perhaps adding a 15th rig with a goal to drill a total of 164 wells (147 operated) for the year.

In May, Petrohawk announced a deal to sell $920 million worth of midstream assets to Kinder Morgan, including 25% of its gas gathering and processing business in the Eagle Ford. Kinder Morgan also agreed to invest $200 million to build a crude and condensate pipeline to the Houston Ship Channel, originating at Petrohawk’s Black Hawk field. Petrohawk will supply 50,000 bpd of condensate to the 300,000-bpd pipeline, which is expected to enter service in the second quarter of 2012.

SM Energy (formerly St. Mary Land & Exploration) operates three rigs on its 250,000 net acres in the Eagle Ford, the play’s fourth largest leasehold, and plans to increase its operated rig count to six and drill a total of 70 net wells by the end of 2011. The company operates 165,000 net acres and is a non-operating partner with Anadarko on an additional 310,000 acres (85,000 net).

Its drilling is focused on areas with higher-Btu gas content and higher condensate yields. The company’s Eagle Ford production shot up about 50% in first-quarter 2011, to 91.6 MMcfed (about 15,000 boepd) from 60.3 MMcfed the previous quarter. Almost the entire increase is from NGL production, SM Energy’s first in the Eagle Ford. To transport this increased production, the company has secured multiple firm agreements that will increase its takeaway capacity from the current 100 MMcfd to 230 MMcfd by the end of second-quarter 2011, and to a total long-term commitment of 470 MMcfd by second-quarter 2014.

In June, SM Energy announced that it was in negotiations to sell some of its Eagle Ford properties. The Denver, Colorado-based company intends to sell 20%–30% of its Eagle Ford position, or about 72,000 net acres.

Shell acquired about 250,000 net acres in the Eagle Ford last year and has been conducting seismic work, but has yet to invest significantly in development of the acreage. In May, the company made a long-term commitment to Velocity Midstream Partners for transport and terminal services for the light oil and condensate it will eventually produce from its Harrison Ranch asset, a contiguous leasehold of over 100,000 acres in the liquid-rich portion of the Eagle Ford in Webb and Dimmit Counties. Velocity has begun construction on the 12-in. Gardendale pipeline, which will transport production through Webb, Dimmit and La Salle Counties, terminating at a 100,000-bpd (initially) hub near Gardendale, Texas. The pipeline and hub are scheduled to be operational this fall.

ConocoPhillips was one of the first majors to invest in the Eagle Ford, picking up 220,000 net acres, largely in the oil window, at low cost and immediately beginning delineation work. In 2010, the company drilled 45 wells without a dry hole, ending the year with 11 rigs running and 10,000 boepd of net production. By the end of first-quarter 2011, production had doubled to 20,000 boepd from about 50 wells, of which 71% was liquids. The company reports that about 5,000 boepd of production has been curtailed due to limited takeaway capacity, but said it expects enough pipeline infrastructure to be laid in the play by 2013 to handle all of its production, which it expects will be 65,000–70,000 boepd by that time. In the meantime, existing pipelines and trucks are being used to move as much production as possible to market.

The company plans to spend $1.4 billion on E&P in the Eagle Ford this year, more than 10% of its total upstream budget. That spending will keep an average of 14 rigs running in the play in 2011, with a goal to drill a total of 144 wells by the end of the year.

Anadarko holds 200,000 net acres in the Eagle Ford following the sale of 96,000 acres in the Maverick basin of southwest Texas to Korea National Oil Corp. (KNOC) in March. In exchange for the 80,000 acres in the Eagle Ford and 16,000 prospective acres for the deeper, dry gas-bearing Pearsall shale, KNOC will spend $1.55 billion to fund Anadarko’s drilling program in the basin. The South Korean company’s new Eagle Ford acreage produces 28,000 boepd, of which 75% is oil. KNOC also acquired a 25% interest in midstream assets associated with the acreage for an additional $38 million.

Anadarko has stressed short drilling times in the Eagle Ford; in first-quarter 2011 it drilled one well in a record 8.4 days, bringing to 10 the number of Eagle Ford wells it has drilled in less than 10 days. The company drilled a total of 45 wells during the quarter, about on pace to meet its 2011 goal of 200 new Eagle Ford wells, which will be double the number drilled last year. It currently has 10 rigs running in the play.

The Woodlands, Texas-based company has a strong portfolio of producing wells in the Eagle Ford, with an average estimated ultimate recovery (EUR) of 450,000 boe. Its Eagle Ford production has increased substantially, from 14,400 boepd at year-end 2010 to about 20,000 boepd at the end of first-quarter 2011. Its average sales volumes for the quarter were 31 MMcfd of gas, 8,000 bpd of oil and 4,000 bpd of NGLs, up from 6 MMcfd, 1,000 bopd and no NGLs in first-quarter 2010. Anadarko is currently shipping the liquids by truck, according to Barclays Capital, but in April it signed a long-term deal to pipe the liquids to Corpus Christi through a 12-in., 90,000-bpd pipeline to be built by Harvest Pipeline, operator of the existing Arrowhead pipeline system in the Eagle Ford.

El Paso announced a decision in April to go it alone in the Eagle Ford shale, after an extensive evaluation of proposals from potential partners on its 170,000 net acres in the play. In a statement, Brent Smolik, president of the company’s E&P division, attributed the decision to the rising value of El Paso’s acreage position in the play and its importance as “a key resource for oil reserves and production growth.” He added that well results in the company’s central operational area, within the oil window in La Salle County, have exceeded expectations. El Paso has completed the delineation phase in its central area and is in what it calls a “manufacturing mode,” with four rigs running. The company drilled 10 successful Eagle Ford wells in first-quarter 2011 using an 80–100-acre well spacing, bringing its total in the play to 31. The company plans to end 2011 with six to seven rigs running.

El Paso is currently building a gas gathering system in the Eagle Ford incorporating existing South Texas pipeline infrastructure to handle both its own production and third-party volumes. The system will have an initial capacity of over 150 MMcfd. The Camino Real pipeline and processing system will target liquids-rich Eagle Ford gas, moving dry gas to end-use markets and NGLs to the Mont Belvieu hub for fractionation and marketing.

Marathon became the latest Eagle Ford entrant on June 1 with a definitive agreement to purchase 141,000 net acres (217,000 gross) from Hilcorp Resources Holdings for $3.5 billion in cash. (That’s a record $24,800 per acre for the Eagle Ford, far surpassing the $19,400 per acre paid by KNOC for a stake in Anadarko’s leasehold.) The move establishes Marathon’s confidence in shale and the Eagle Ford in particular as a key part of its E&P strategy as it prepares for the spinoff of its refining business at the end of June.

The acreage is located primarily in Atascosa, Karnes, Gonzales and DeWitt Counties, with potential opportunity to acquire an additional 14,000 net acres. Current production is 7,000 boepd, of which 80% is liquids, and the assets are expected to produce 12,000 boepd by year-end. Marathon believes the acreage could produce about 80,000 boepd by the end of 2016. Total net risked resource potential is 473 million boe; Marathon believes it could potentially book up to 100 million boe of proved reserves by the end of 2011. The transaction is expected to close Nov. 1, with an effective date of May 1, 2011.

Pioneer is in the process of substantially ramping up production in the Eagle Ford as the operator (holding 42% interest) of a joint venture with India’s Reliance Industries (41%) and others. The JV holds about 300,000 acres in the play (126,000 net to Pioneer) of which 80% is in the condensate window. It has drilled a total of 50 horizontal wells through the end of first-quarter 2011, 24 of which are producing. Pioneer reports that completion of some of the wells has been slower than anticipated due to limited third-party frac fleet availability. The company has nine rigs running in the play and plans to increase that to 12 rigs by mid-year, 14 rigs in early 2012 and 16 rigs in early 2013.

To improve its completion program and reduce costs, Pioneer purchased two fracture stimulation fleets in the Eagle Ford. One was placed in service in April, and the other is expected to be operational during fourth-quarter 2011. The company also entered into a two-year contract for a dedicated third-party frac fleet, which commenced operating in April. The dedicated frac fleets will allow Pioneer to bring its Eagle Ford wells online at an accelerated pace. As a result, the JV’s production, which already shot up to 5,000 boepd in first-quarter 2011 from 2,000 boepd the previous quarter, is expected to grow to an average of 12,000–15,000 boepd for the year, with a further expected increase to 26,000–30,000 boepd in 2012 and 40,000–45,000 boepd in 2013.

|

|

Fig. 2. Within the Maverick basin, the Eagle Ford is one of more than 20 producing zones, along with the underlying, dry gas-producing Pearsall shale.

|

|

Five central gathering plants have been completed as part of the joint venture’s midstream business, and three additional plants are expected to go online by the end of the year. Pioneer reports that sufficient gas processing, fractionation and transportation capacity is in place to handle this increased output as well as growing production volumes from the company’s Spraberry trend development in the Permian basin.

ExxonMobil became one of the Eagle Ford’s top 10 leaseholders with the purchase of XTO last June, holding 120,000 net acres. The company drilled 15 wells there in 2010, but it is still in the delineation stage.

REGULATORY ISSUES

Lower population density, along with the development activity’s positive impact on the depressed local economy, has helped Eagle Ford operators so far avoid the type of tension with local residents that has recently plagued the Barnett shale to the north. However, the large amounts of water used in fracing operations are likely to put a major strain on aquifers in the comparatively arid Eagle Ford. Also, the aquifers are deeper than in North Texas, which will make protecting them from contamination a more contentious issue.

Permitting has already seen delays due to a staffing shortage at the RRC, which is down to 625 full-time-equivalent employees from 704 in 2009. The commission has requested funding for 120–130 new positions above current levels, but it is unlikely to get it given the state’s current belt tightening.

To address some of these issues and encourage a smoother development path for the Eagle Ford, the RRC is forming a task force to keep the lines of communication open between various stakeholders as operations ramp up. The task force will have about a dozen members, including elected officials, landowners, and representatives from operators, service companies and environmental groups.

RRC Chairman Elizabeth Ames Jones gave service companies in the Eagle Ford some peace of mind in early June when she told Bloomberg News that they won’t be required to reveal the complete chemical makeup of their frac fluids under new disclosure regulations. The state will begin establishing the new rules later this year, under legislation passed 137–8 by the Texas House of Representatives and unanimously by the Senate. The legislation is awaiting Gov. Rick Perry’s signature. In a recent statement, Railroad Commissioner David Porter said he expects to complete the rulemaking process by July 1, 2012. Texas officials have been very vocal critics of efforts to regulate fracing on the federal level.

DOWN THE ROAD

Beyond the economic boom that the Eagle Ford is driving and will continue to drive for several years in South Texas, the flurry of activity may soon spill over into neighboring Louisiana. In that state, three companies have recently announced plans to drill in a stratigraphically equivalent formation to the South Texas shale play, which is being called the Louisiana Eagle Ford. Also known as the Tuscaloosa marine shale and located in central Louisiana, the formation is 200–400 ft thick at depths of 11,000–14,000 ft.

Indigo II Louisiana Operating drilled a vertical test well into the shale in Vernon Parish earlier this year, and received a permit in May to drill a second, horizontal well in Rapides Parish. Devon, which recently acquired 250,000 acres in the shale, plans two horizontal wells to test the target interval this year, involving up to 15 frac stages in one well. Also, Denbury Resources recently announced it had secured a joint-venture partner for the play and plans to drill a horizontal well there soon. This new Louisiana play is sure to see great interest very soon from companies that have been watching the rapid success of those who entered its South Texas equivalent on the ground floor just two years ago.

The comparisons of relative permeability values obtained by DRP and conventional lab SCAL tests are presented in Fig. 6, for each of the four rock types considered. In all cases, relative permeabilities were scaled by relative permeability to oil (Kro) at irreducible water saturation, and all DRP-derived relative permeabilities were computed at imbibition steady-state conditions. The DRP data overlay reasonably well with the lab SCAL data.

|