PRAMOD KULKARNI, Editor

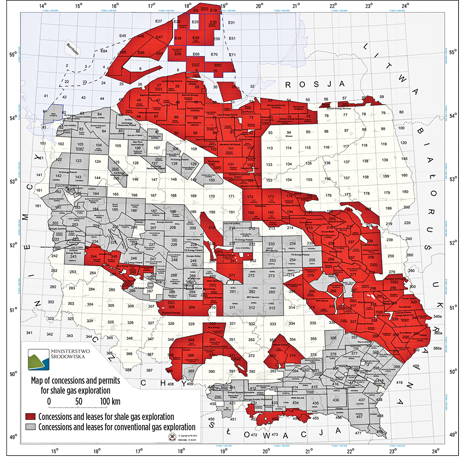

The natural gas shale gale that was supposed to sweep across Europe has stalled in England and France due to an impasse over fracing operations. In Poland, however, exploratory shale drilling is progressing steadily. Across the globe in Australia, the first horizontal shale wells are being drilled and fraced. Meanwhile, in late October, YPF made a tantalizing announcement about a potential 927-million-bbl shale oil discovery in Argentina’s Neuquen basin. Here is an update of recent activity in several countries outside North America. ENGLAND Among the most promising shale projects to get a head start in Europe was Cuadrilla Resources’ Bowland basin exploration program near Lancashire, England. The UK-based operator received an exploration license in 2008 for a 500-sq-mi area that includes the towns of Blackpool, Preston and Southport. The company drilled two vertical test wells in 2010 at Preese Hall and Grange Hill Farm. Based on petrophysical analysis of the region and well data, Cuadrilla in September estimated the in-place gas resource in its license area at 200 Tcf—dwarfing the British Geological Survey’s 2010 high-end estimate of 5.3 Tcf for total UK shale gas reserve potential. When Cuadrilla began hydraulic fracturing operations at the Preese Hall-1 well in April, two seismic tremors were recorded, one of magnitude 2.3 on the Richter scale on April 1 and another of magnitude 1.4 on May 27. The company then commissioned a geomechanical study, which concluded that “it is highly probable that the fracking at Preese Hall-1 well triggered the recorded seismic events. This was due to an unusual combination of factors including the specific geology of the well site, coupled with the pressure exerted by water injection. This combination of geological factors was rare and would be unlikely to occur together again at future well sites. If these factors were to combine again in the future, local geology limits seismic events to around magnitude 3 as a worst-case scenario.” In June, Cuadrilla voluntarily postponed its hydraulic fracturing operations at Preese Hall-1. The Grange Hill wellsite remains active, and the company has invested in monitoring equipment to record future seismic events. In an interview with Platts following the report, junior energy minister Charles Hendry said the UK has no plans for new legislation governing shale gas, saying the existing regulatory regime is “robust, and that the key regulatory bodies have appropriate powers to regulate these activities.” He added, “In future onshore licensing rounds, applicants wishing to explore for shale gas will have to demonstrate that they have the appropriate competences and management systems, including systems to ensure protection of the environment.” Meanwhile, Cuadrilla announced that it will drill another five to seven exploratory wells with a goal of determining a recoverable gas estimate by next summer, and will determine by the end of first-quarter 2013 whether to proceed with commercial development of the Bowland basin. Cuadrilla holds a 75% interest in the prospect with Australian firm AJ Lucas owning the remainder. In nearby Wales, the Vale of Gamorgan Council rejected Coast Oil and Gas’ application to drill an exploratory well for shale gas near Llantwit Major, citing concerns about groundwater contamination related to fracing. The company plans to appeal the Oct. 20 ruling. FRANCE In France, the central portion of the Paris basin is being targeted for both conventional and unconventional exploration. Several wells have been focusing on the Liassic interval, where the prospective Banc de Roc limestone is sandwiched between the upper Schiste Carton and Lower Domerian shales. Among the operators in the Paris basin is Toreador Resources, which recently merged with Texas-based ZaZa Energy. ZaZa has acquired over 340,000 net acres in the Paris basin. Hess is partnering with ZaZa in the basin and plans to drill six conventional wells in 2012. Another US operator that has entered the Paris basin is ConocoPhillips, which has established a conditional farmout agreement with Canada-based Realm Energy. Realm has applications pending with the French government for exploration licenses across 1.65 million acres. Shale activity in the region has been dampened, however, by French government’s revocation of three licenses for hydraulic fracturing granted to Total, Toreador and Schuepach Energy. No such action has been issued against the remaining 61 licenses in the Paris basin. Total CEO Christophe de Margerie has warned French government authorities that their actions were endangering the energy security of the country. POLAND While there is no news yet of fraced horizontal wells with high-volume initial production rates, several operators are making steady progress in petrophysical analysis, seismic surveys and exploratory drilling. Poland’s Ministry of the Environment has leased much of the country’s prospective acreage through more than 100 exploration permits, Fig. 1. The country, which relies on supplies from Russia for two-thirds of its natural gas consumption, hopes to ramp up shale gas production to a rate of 7 Bcfd (200 MMcmd) by 2014. In support of that goal, state-controlled companies PGNiG and PKN Orlen are each scheduled to drill 65 shale wells by the end of 2013.

According to a recent study by the US Energy Information Administration, Poland’s technically recoverable reserves of shale gas are the biggest in Europe at an estimated 190 Tcf. Poland’s lower Paleozoic shales exhibit total organic content (TOC) ranging up to 7%. Shale thickness varies between 100 ft and 500 ft, with well depths ranging 8,000–13,000 ft. Recent exploration activities are highlighted below. PGNiG. The Polish gas monopoly has about 20% of the shale gas licenses in the country. In 2010, PGNiG completed drilling of the Markowola-1 well in the Lublin province. As the well logs confirmed the probability of a tight gas formation, a hydraulic fracturing operation was carried out in the well; however, no commercial gas flowrates were recorded. In March 2011, PGNiG drilled the Lubocino-1 well near Wejherowo, in northern Poland. According to the company, the initial results indicate a satisfactory rate of gas flow. Lane Energy/ConocoPhillips. UK independent Lane Energy has six license areas in Poland comprising 506,000 acres targeting rich Silurian and Ordovician shales. Lane’s exploration program began in 2009 with a 3D seismic program totaling 225 sq km. In 2010, the company drilled two vertical wells in Łebień and Legowo fields to acquire well data and core samples. A single-stage hydraulic fracture stimulation was conducted in the Ordovician interval to obtain a gas sample. In 2011, Lane drilled a horizontal well, Łebień LE-2H, consisting of a vertical section of 3,000 m and a 1000-m lateral section. The well “encountered high gas saturations throughout the horizontal section,” according to a company press release. A fracture stimulation program and further tests are pending. ConocoPhilips has agreed to provide funding for seismic and three wells, in return for a right to acquire a 70% interest in the Baltic concessions. Based on the seismic and well data, Lane’s independent technical consultants Netherland, Sewell and Associates have ascribed a gross best-case estimate of about 169.6 Tcf of original gas in place for the Baltic concessions. Marathon. The US independent currently holds 11 concessions in Poland that total about 1.2 million net acres. In April, Nexen acquired a 40% interest in 10 of these concessions. Marathon has farmed out an additional 9% interest to Mitsui. The present holdings include an onshore exploration license of 249,000 acres in the Orzechow block in southern Poland, where Marathon is operator with 100% working interest. In the Kwidzyn block of north-central Poland, the company also holds a 100% working interest in 296,000 acres. Marathon began drilling operations in the Łeczna and Siedlce districts in the fourth quarter of 2011, with plans to drill seven to eight wells by the end of 2012. Chevron. The US major began drilling its first shale gas exploration well in early November on one of its four licenses in southeastern Poland consisting of 1.1 million acres with 100% interest. The drilling operation on the first well began after the completion of a seismic program conducted earlier in 2011. Aurelian Oil & Gas. A UK-based company focused on European gas, Aurelian holds 28 licenses across Poland, Slovakia, Romania and Bulgaria covering 4.8 million acres in two core areas, the Permian basin and the Carpathian thrust fold belt. In 2011, the company drilled and fraced two horizontal wells at the Siekierki tight gas project in the Permian basin. Early mechanical difficulties with the Trzek-2 well completion were overcome successfully on Trzek-3, which produced at a stabilized rate of 3.2 MMcfd after 28 days of testing. This rate indicates that, like Trzek-2, Trzek-3 is expected to have an ultimate recovery in the range of 4–8 Bcf. Detailed work is now underway to identify ways to improve future well performance. Aurelian’s Niebieszczany-1 well, the first of a three-well program on the prospective oil block in Bieszczady, southern Poland, was drilled to 13,840 ft and encountered extensive oil and gas shows, including two intervals totaling over 190 ft of formation that have already produced oil, gas and condensate in earlier drill-stem tests, Fig. 2.

AUSTRALIA Despite access to tremendous offshore conventional gas and onshore coal-seam gas, Australian companies are forging ahead with shale gas exploration. The current focuses of shale interest are the Cooper basin in the northeast part of South Australia and the Georgina basin in the Northern Territory. Beach Energy. In August, Beach Energy booked a contingent resource of 2 Tcf based on the results of its Holdfast-1 and Encounter-1 shale wells in the Cooper basin. The previous month, Holdfast, Beach’s vertical data-gathering well, achieved up to 2 MMcfd of gas flow from the Cooper basin’s Roseneath-Epsilon-Murteree shale sequence after it was stimulated in seven stages. Beach is planning additional testing and data analysis before implementing a commercial drilling and production program, Fig. 3. The company expects its PEL 218 block to hold 300 Tcf of gas potential. A full drilling and production program is planned for 2013–2014.

PetroFrontier. Canadian independent PetroFrontier announced in October the drilling of Baldwin-2Hst1, Australia’s first horizontal well in the Lower Arthur Creek “hot shale” formation in the southern Georgina basin, in the company’s EP103 block. PetroFrontier has a 100% working interest in EP103, which covers 3.16 million gross acres. The “hot shale” formation is comprised of interbedded shale, silt, sand and carbonates. Because it is slightly radioactive, the formation is easily identified on gamma-ray logging tools. According to PetroFrontier, the 130-ft-thick formation is geologically and mechanically analogous to the Bakken and Eagle Ford. The Baldwin-2Hst1 well reached a total measured depth of 6,390 ft and remained within the main target zone for 2,870 ft while directionally drilling up a regional dip of 1.7°. Positive hydrocarbon indications were recorded with elevated gas readings and evidence of heavier hydrocarbons. ARGENTINA The most promising shale news is emerging from Argentina’s Neuquen basin, where the local company YPF-Repsol has been active since 2007. A vigorous licensing program has brought leading IOCs such as ExxonMobil and Total as well as large independents such as Apache. YPF. In late October, YPF announced the existence of 927 million bbl of unconventional oil in Neuquen province based on output from 15 producing wells in the Loma La Lata Norte area, including a previously announced discovery of more than 150 million bbl of oil in the Vaca Muerta formation. Last December, YPF said it found an estimated 4.5 Tcf of shale gas after drilling four exploratory wells on the south side of its Loma La Lata field. Americas Petrogas. ExxonMobil has reentered Argentina’s upstream sector after a 30-year gap by joining with Canada’s Americas Petrogas, which has a 1.3 million-net-acre shale portfolio in 16 blocks located in the western portion of the Neuquen basin. Apache has farmed into the western Huacalera block. The company suggests that the Vaca Muerta and Los Molles shales are up to 1,300 m in thickness and have excellent TOC and maturity characteristics that compare well with North American shale plays, Table 1.

Apache. The US independent is testing the potential of the Precuyo formation and Los Molles and Vaca Muerta shales. The company has drilled more than 70 unconventional wells in four Neuquen fields since 2008. In November, Apache revealed that its horizontal ACS-15h well in the Campamento field tested at 7 MMcfd after multistage fracing of a 2,800-ft lateral at 12,800-ft TVD. Service companies such as Weatherford are currently engaged in the laboratory analyses of cuttings to provide additional reservoir characterization and augment results from whole core and openhole log analysis. Detailed onsite lab analyses of cuttings and entrained gas gathered during the drilling of lateral wellbores are particularly effective in determining TOC, elemental detail, and proper wellbore position. ZONE OF UNCERTAINTY While shale plays in North America are in full production mode, international shale activity remains in a zone of uncertainty, with controversy over fracing casting a dark cloud on exploration in Western Europe. Poland and Australia are areas of steady progress in petrophysical analysis and initial exploratory drilling. Argentina appears to be the next frontier, with both E&P operators and the investment community thrilled at the prospect of a full-strength shale gale.

Click here for New Geological and Mining Law in Poland - an overview of key changes by Konrad Madej |

|||||||||||||||||||||||||||||

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Mixed outlook for activity on the UK Continental Shelf (December 2023)

- EOR/IOR technology: Advanced shale oil EOR methods for the DJ basin (May 2023)

- The last barrel (April 2023)

- What's new in production (April 2023)

- ShaleTech- Permian shales: Production hits new high amidst talk of looming plateau (April 2023)