NELL LUKOSAVICH, Senior Editor; and DAVID MICHAEL COHEN, Managing Editor

|

|

Hydraulic fracturing equipment covers a multi-well pad in Lycoming County, Pennsylvania, where a total of 32 frac stages were pumped in three wells to stimulate production from the Marcellus shale. Image courtesy of Baker Hughes.

|

|

Despite gas prices circling around $4/Mcf and intense environmental scrutiny, Marcellus shale activity continued to grow rapidly last year, with a near doubling in the number of wells drilled and high permitting rates indicating a further activity surge to come. As in other US shale plays, there has been a move toward more liquids-rich windows; liquids production in the Marcellus actually quadrupled in 2009, and producers snapped up acreage with high prospectivity for NGLs with voracity last year.

Nevertheless, even dry gas drilling in the Marcellus has been increasing, due to the formation’s shallower placement and, thus, lower well costs compared to other US gas plays, combined with the close proximity to large gas markets on the eastern seaboard. Recent analysis by the investment group Jefferies & Co. suggests that a gas price of $3.55/Mcf is required for operators to see a 20% pre-tax return on Marcellus production, compared with $5.58 in the Haynesville, $5.80 in the Fayetteville and $7.08 in the Barnett. Of these plays, the Marcellus was the only one with a higher rig count at the end of 2010 than at the beginning.

Even those companies for whom Marcellus gas isn’t currently economic want to hold onto their acreage, to develop at a profit when gas prices eventually rebound. Furthermore, the emerging prospect of producing the deeper Utica shale using Marcellus infrastructure already in place is making the long-term economics of this region even more attractive.

DRILLING AND PERMITTING

In Pennsylvania, the most active state by far for Marcellus drilling, 3,314 well permits were issued in the shale play last year, according to the state Department of Environmental Protection (DEP). This represents a 67% jump from the 1,984 permits issued in 2009. Permitting is on pace to increase again in 2011, with an impressive 590 permits issued in January and February alone.

The state drilled 1,454 Marcellus wells in 2010, almost double the 768 wells drilled in 2009 (Fig. 1), which itself was a fourfold increase from 195 in 2008. In the first two months of 2011, 300 wells were drilled—on par to surpass the 2010 drilling total.

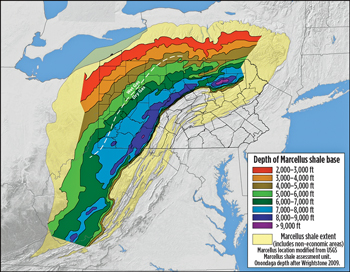

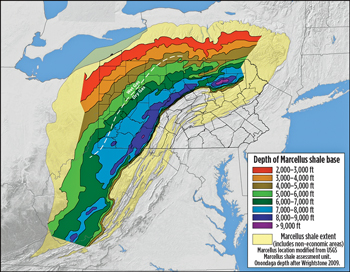

Pennsylvania’s two most active counties in 2010 for both permitting and drilling were Bradford (830 permitted, 386 drilled) and Tioga (564 permitted, 266 drilled), both along the state’s northern border, where the Marcellus is located at depths of 4,000–7,000 ft, Fig. 2. Adjacent Lycoming County had the third greatest number of permits (254), while Washington County, in the southwest, drilled the third greatest number of wells (139).

In West Virginia, operators drilled 58 horizontal Marcellus Shale wells last year. However, state regulators issued permits for 433, which suggests that drilling is likely to increase significantly in 2011 as companies act on the existing permits.

Despite the fact that its Southern Tier counties along the Pennsylvania border sit on considerable Marcellus gas resources, New York has almost no drilling activity in the play, as the state is still drafting rules to govern development after two years of delays. A moratorium on high-volume hydraulic fracturing remains in effect until June. Single-stage, low-volume fracing is allowed under current rules, and a few producers reportedly use this method to stimulate vertical and horizontal wells drilled in the southern part of the state.

OPERATOR ACTIVITY

Activity continues to be led by US independents, though new international joint ventures have brought a significant level of foreign investment into the play. The majors active in the play are Shell, through its purchase of East Resources in 2010, Chevron, which acquired Atlas Energy this February, and ExxonMobil through its acquisition of XTO Energy.

Chesapeake Energy is the largest leaseholder in the Marcellus, with about 2.7 million gross acres and 1.73 million net acres. At the end of 2010, the company was operating 32 rigs in the area. The company estimates its average 2010 production in the Marcellus at 215 MMcfe and its total proved reserves in the play to be 863 Bcfe.

|

a).jpg)

b).jpg)

|

|

Fig. 1. Marcellus (red) and non-Marcellus (blue) wells drilled a) in 2009 and b) in 2010. Images courtesy of the Pennsylvania Department of Environmental Protection.

|

|

Chesapeake had 183 producing Marcellus wells at the end of 2010 and expects to drill 305 new wells and have a total of 395 online by the end of 2011, of which 167 will be in prolific Bradford County, Pa. Also by the end of this year, the company expects to be producing 250 MMcfd from its wells in Bradford County.

However, Chesapeake’s Marcellus activity will be restrained by the company’s announced strategy to reduce gas drilling except as required to hold acreage or to use drilling carries. This gas slowdown will be accompanied by accelerated drilling in liquids-rich assets with a goal to have 75% of drilling capex targeting liquids by 2012.

Statoil, which holds 600,000 acres in the Marcellus through a joint venture formed with Chesapeake in November 2008, signed a $253 million deal to add 59,000 acres to its Marcellus portfolio. The initial deal gave the Norwegian firm a 32.5% share in Chesapeake’s acreage in the play at the time, covering leases in West Virginia, Pennsylvania, New York and Ohio. It also gave Statoil the right to periodically acquire the equivalent share of new leases obtained by Chesapeake. Statoil expects its equity gas production from the Marcellus to increase to at least 100 Bcfd in 2012 and at least 350 Bcfd after 2020. The company also recently stated on its website that it could drill as many as 17,000 Marcellus wells over the next 20 years.

Fort Worth, Texas-based Range Resources is shifting its E&P efforts dramatically toward the Marcellus this year, with 86% of its $1.38 billion capital budget for 2011 focused on Marcellus shale development. Toward that end, the company is selling almost all of its Barnett shale properties—52,000 net acres containing 390 producing wells—to an undisclosed company for $900 million. The deal is expected to close by the end of April. The company is also selling its tight gas properties in Ohio for $330 million.

Despite the 113 MMcfed that it will lose in the Barnett sale, Range forecasts a 10% increase in production this year compared to 2010, to about 540 MMcfed, and 25%–30% growth in 2012—mostly due to Marcellus development. In the Marcellus alone, Range is producing 260 MMcfed now, with plans to reach 400 MMcfed by the end of the year and 600 MMcfed in 2012. The company hopes to fund its 2013 capex solely from its cash flow.

The company’s shift to the Marcellus is motivated by lower development costs as well as higher liquids content to offset stagnant gas prices; NGLs accounted for 18% of Range’s Marcellus production in the fourth quarter of 2010, up from 10% a year earlier.

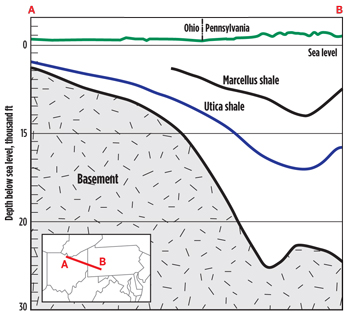

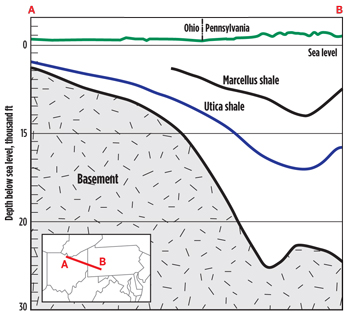

There are also deeper considerations behind Range’s Marcellus drive—a few thousand feet deeper. In a recent conference call with investment analysts, Range chairman and CEO John Pinkerton said he views the Marcellus as “really three plays in one,” referring to the Upper Devonian shale above the Marcellus and the Utica shale below. According to Pinkerton, about 60% of the 700,000 net Marcellus acres Range plans to develop will also be in the Upper Devonian and Utica shales, which will significantly lower the incremental costs to develop these formations on the same acreage, since the company will have already incurred the cost for acreage, roads, surface location, water management, gas pipelines and compression. The Utica, in particular, is attracting interest as a candidate for the next big shale play. It is thicker than the Marcellus, more geographically extensive (Fig. 3) and, although it has not been thoroughly evaluated, early testing indicates it to be a very significant resource. Range reported that its first Utica well drilled in Pennsylvania averaged 4.4 MMcfd in a seven-day production test.

|

|

Fig. 2. Depth of the Marcellus shale base. Image courtesy of the Penn State Marcellus Center for Outreach and Research.

|

|

Another company that is shifting resources into the Marcellus from other plays is EQT Corporation, known until February 2009 as Equitable Resources. The Pittsburgh, Pa.-based integrated energy company holds 500,000 net acres that are prospective for the Marcellus in Pennsylvania and West Virginia and drilled 90 Marcellus wells last year. The company plans to drill 86 Marcellus wells in 2011 with an average 4,200 ft of pay at $5.3 million each, and will reduce development of its other Appalachian properties in the Huron play and Nora field, a coalbed methane project, to fund further Marcellus development in the coming years.

Seneca Resources, a subsidiary of National Fuel Gas Company, produces natural gas from about 2,900 wells in Pennsylvania and New York, including Marcellus shale wells. NFG, which is headquartered in Amherst, N.Y., controls drilling rights on about 750,000 acres in the Marcellus. It operates 32 Marcellus wells through Seneca, and holds an additional 27 operated by its joint venture partner EOG Resources. The company’s production in the region has been growing dramatically, recently reaching 120 MMcfd. It expects the Marcellus to account for about half of its total gas output in 2011, averaging 90–100 MMcfd.

To fund continued Marcellus growth, NFG in March agreed to sell its oil and gas wells in the Gulf of Mexico for $70 million to an undisclosed buyer. The deal is expected to close by the end of April. The company plans to drill 80 Marcellus shale wells over the next three to four years in various parts of Pennsylvania. In January, NFG announced the purchase of additional Marcellus acreage in Tioga County, Pa., from EOG for $23 million, adding about 42 Bcfe to its proved reserves base.

Anadarko Petroleum holds about 760,000 gross acres and 200,000 net acres in the Marcellus shale, which is the only US dry gas play where the company will drill in 2011, due to its proximity to major gas markets. Anadarko expects to operate 10 rigs there this year and to participate in drilling more than 250 wells.

Midstream expansion in the play during the fourth quarter of 2010 enabled Anadarko to nearly double its gross daily sales volumes from the end of the third quarter to about 330 MMcfd at the end of the year. Meanwhile, 100% of its 2010 capital costs in the Marcellus were carried through the $1.4 billion joint venture announced in February of that year with Mitsui, which made the Japanese conglomerate a 32.5% partner in Anadarko’s Marcellus assets, holding about 100,000 acres. The deal calls for Mitsui to carry 90% of Anadarko’s development costs in 2011 and beyond. At the end of 2010, Anadarko had a net risked resource potential of 1.5 billion boe in its combined Marcellus and Eagle Ford shale assets.

Last month, the company announced that it plans to increase capital expenditures this year, with 10% ($560–$600 million) targeting Marcellus and Eagle Ford shale activity. It also expects shale gas to account for 10% of its total daily sales volume by the end of the year. The company also said that its well performance in the Marcellus has been improving, with estimated ultimate recoveries (EURs) trending toward the high end of its previous estimates of 4–6 Bcf per well.

Atlas Energy, which was acquired by Chevron for $4.3 billion in February, controls mineral rights to 519,000 gross acres (486,000 net acres) in the Marcellus shale. In addition to this acreage, holding an estimated 9 Tcf of gas resource including 850 Bcf of proved reserves, the deal gives Chevron a 49% interest in a joint venture with Laurel Mountain Midstream, which owns over 1,000 mi of intrastate and gas-gathering lines servicing the Marcellus.

The merger received opposition from India’s Reliance Industries, with which Atlas entered into a $1.7 billion joint venture last April. That deal gave the Indian conglomerate a 40% stake in 300,000 acres in the Marcellus and the right to buy 40% of future Atlas acquisitions in the play. Under the merger agreement, Chevron will now take Atlas’ stake in that deal. The US major plans to drill 70 Marcellus wells this year.

In the third quarter of last year, Atlas’ average production from its Appalachian unit was about 63.3 MMcfed, an increase of 53% from the same quarter in 2009. The company attributed the increase primarily to the development of its Marcellus shale position in southwestern Pennsylvania. In November, the company announced a record Marcellus well completion in that area, with an initial output of 21 MMcfd.

|

|

Fig. 3. Cross-section of the subsurface positions of the Marcellus shale, Utica shale and continental basement rock across southwestern Pennsylvania and northeastern Ohio. Image compiled by geology.com using data provided by the US Energy Information Administration, US Geological Survey, Pennsylvania Geological Survey and US Department of Energy.

|

|

XTO Energy, which was acquired last year by ExxonMobil for $34.8 billion in stock and debt, reportedly slowed its Marcellus activity in 2010, drilling less than 15 wells. Nonetheless, XTO President Jack Williams said in December that the company remains committed to natural gas development, even as other producers in the current low-gas-price environment are shifting their focus to liquids. Williams, a veteran Exxon executive who took the reins of XTO in June, told his audience at the Petroleum Club in Fort Worth, Texas, that the company plans to maintain a US focus for the near future, but is also investigating gas development opportunities in Canada, Germany, Poland and Indonesia.

The acquisition made Exxon the largest gas producer in the US at 3.7 Bcfd. XTO holds more than 280,000 net acres of Marcellus leasehold in West Virginia, Pennsylvania and New York. Exxon has interest in an additional 300,000 net acres through a joint venture with independent Pennsylvania General Energy.

Talisman Energy holds 230,000 acres in the Marcellus, concentrated in Bradford, Tioga and Susquehanna Counties. The Calgary-based producer drilled 152 gross (145.4 net) Marcellus shale wells during 2010, of which it operated 139. It has announced plans to reduce overall dry gas drilling this year by 35%; in the Marcellus, it plans to drill 100 net wells using an average of nine rigs, a reduction from the 12 rigs it was operating in the play at the end of 2010. Including infrastructure capital, the company has budgeted about $800 million in the play.

Talisman’s Marcellus production skyrocketed in 2010, increasing more than sixfold to an average of 181 MMcfd from 29 MMcfd in 2009, and ended the year at 315 MMcfd. The company expects its Marcellus gas output to average 350–400 MMcfd this year.

Exco Resources holds 152,000 net acres in the Marcellus, after having purchased 50,000 acres in December from Chief Oil & Gas for $459.4 million and sold 50% of those assets in February to joint venture partner BG Group. The assets from Chief include 15 wells with 60 MMcfd of gross production (16 MMcfd net). The partnership with BG, entered in June, gave the British company a 50% interest in Exco’s Marcellus acreage and gave each company the right to purchase up to 50% of the other’s future acquisitions in the play. In 2011, Exco plans to spend $37.8 million in the Marcellus shale to drill and complete 52 gross (16.7 net) horizontal wells, in addition to 12 gross (6 net) appraisal wells to test the formation in other locations.

EOG Resources recently scrapped plans to sell 50,000 acres of its Marcellus shale holdings—part of its strategy over the last year to shift its portfolio more toward oil—with CEO Mark Papa telling investors that it will hold the land instead to develop when gas prices improve. The company holds 210,000 net acres in the Marcellus with an estimated 3 Tcf of potential net reserves, almost entirely in Pennsylvania.

EOG drilled 33 net Marcellus wells in 2010, including 18 net wells in northeast Pennsylvania’s Bradford County that will be completed in 2011. The remaining 15 net wells were drilled in north-central Pennsylvania as part of EOG’s joint venture with Seneca Resources, which EOG operates with a 50% working interest. Most of these JV wells are producing. In 2011, the company plans to drill 30 net wells in the Marcellus, split between the JV area and Bradford County.

EOG’s Marcellus net production last year averaged 12 MMcfd, with several wells having initial rates in excess of 8 MMcfd, a substantial improvement from previous years that the company attributes to new completion procedures it implemented in 2010.

Cabot Oil & Gas saw its Marcellus shale gas production triple last year to an average of 236 MMcfd from 47 horizontal and 36 vertical wells, compared with 71 MMcfd in 2009 from 17 horizontal and 28 vertical wells. The Houston-based producer drilled 56 horizontal wells in the play last year, with many having 30-day flowrates ranging 8–19 MMcfd. The company plans to use five rigs to drill an additional 54 Marcellus shale wells in 2011, which will have 10–20 frac stages per well with lateral lengths of 2,500–6,000 ft depending on the geographic layout of the units.

Mergers and acquisitions. Transactions in the Marcellus shale were a significant contributor to record global M&A activity last year, according to a report released in January by PLS Inc., Derrick Petroleum Services and Rystad Energy. The report names the Marcellus as the most active regional market in the US with $16.9 billion in transactions, followed by the Permian basin with $10.6 billion.

Besides the acquisition of Atlas by Chevron, ExxonMobil’s XTO purchase and various joint ventures mentioned above, Shell entered the Marcellus in July with its $4.7 billion purchase of Warrendale, Pa.-based producer East Resources and its subsidiaries. In addition to East Resources’ properties in the Rockies and South Texas, the deal gives Shell about 650,000 acres of Marcellus shale rights in Pennsylvania, West Virginia and New York.

In August, Reliance Industries increased its Marcellus position by buying out Avista Capital’s share of a 50/50 partnership with Carrizo Oil & Gas, plus 20% of Carrizo’s position. Thus, Reliance will hold 60% and Carrizo 40% of the joint venture, consisting of 104,400 net acres of undeveloped leases in the core Marcellus area in central and northeastern Pennsylvania. Reliance, which paid a total of $392 million in the deal, said the acreage will support the drilling of about 1,000 wells during the next 10 years. It estimates resource potential net to the joint venture at 3.4 Tcfe. Carrizo operates the joint venture.

In December, Antero Resources acquired privately held West Virginia gas producer Bluestone Energy Partners for $93 million. The deal gave Bluestone 40,000 net acres in the West Virginia and Pennsylvania Marcellus, with gross operated production of 19 MMcfd (13 MMcfd net including non-operated) from 93 operated vertical and three operated horizontal wells, as well as gathering and compression assets.

Infrastructure. While producers in the Marcellus region have a long-term interest in expanding its pipeline infrastructure, mountainous terrain and protected natural areas provide a challenging landscape for planning and construction. The cost of building and maintaining pipeline is estimated to be $1 million per mile in the region. Nonetheless, several project proposals and partnerships over the last year indicate that midstream activity is bustling.

In Pennsylvania, Superior Appalachian Pipeline is planning a 14.5-mi pipeline in Centre County and Anadarko Petroleum is looking to construct a 30-mi line through Centre and Clinton Counties. Williams Partners plans to spend $2 billion between 2010 and 2012 on various midstream growth projects, with many targeting the Marcellus region. The company also agreed to purchase Cabot Oil & Gas’ midstream Marcellus assets, which include 74 mi of pipeline, for $150 million. A new Williams Marcellus gathering system will create 1.2 Bcfd of takeaway capacity for Cabot during the next two to three years.

Buckeye Partners last year proposed building the 400-mi Marcellus Union Pipeline Project to transport NGLs from Marcellus wells in Pennsylvania to Michigan. Sunoco Logistics Partners recently announced plans to partner with MarkWest Liberty Midstream & Resources to convert an existing pipeline from the Marcellus to Ontario, Canada. The system of new and existing pipelines will transport 65,000 bpd of ethane. In March, Denver-based MarkWest said it has nearly completed an expansion of its cryogenic processing capacity at Majorsville, W.Va., and that it is evaluating the potential of other processing expansions in the region.

El Paso subsidiary Tennessee Gas Pipeline Company, already expanding its existing 300 Line natural gas pipeline in Pennsylvania, in September proposed an additional expansion to serve growing markets in the Northeast. The Northeast Upgrade Project (NUP) would involve construction of five looping segments totaling 20.5 mi adjacent to or near the existing 300 Line, as well as modification of existing compressor stations.

EQT Corporation plans to spend $69 million to add 1,300 MMcfd of Marcellus shale gas gathering capacity this year in Pennsylvania. The company also plans to spend $94 million in 2011 and $126 million in 2012 on expanding Equitrans transmission. The project is expected to increase transmission capacity by 230 MMcfd in 2011 and 330 MMcfd in 2012 and will, among other things, connect the outlet of the MarkWest processing plant in West Virginia to five interstate pipelines.

TECHNOLOGY ADVANCES

In 2010, the US Patent and Trademark Office reported issuing a record-breaking 257 patents referring to hydraulic fracturing, compared with about 150 patents a year prior to that. Already in 2011, the patent office has issued 47 fracing-related patents, indicating a continuation of the fast pace of technology development to tap shale resources.

Water treatment and storage. Challenges regarding water treatment in the Marcellus include supply, storage, treatment and removal. With frac jobs requiring millions of gallons of water, there has been a significant focus over the last year on water-related technologies.

Hawbaker Engineering recently installed its first Portadam above-ground water retention system at a Marcellus shale wellsite in a Pennsylvania state forest. The impoundment system replaces traditional in-ground impoundments and frac tanks that can expose the environment to acid mining conditions, where large amounts of sulfur are exposed during excavation and end up in acidic groundwater runoff. The system also eliminates disturbance of the groundwater table and greatly reduces the disturbed land area and number of transportation vehicles needed to haul the water.

Companies are also looking for new ways to reduce the amount of water used and recycle highly impaired waste water during a frac operation. GE recently introduced its first mobile evaporator for treating and recycling shale gas frac water onsite. The fully transportable evaporation system treats high volumes of wastewater, such as frac flowback and produced water, so it can be reused in the industrial process.

Integrated Water Technologies opened its first DEP-approved FracPure treatment and recycling facility in southwest Pennsylvania. The facility chemically treats and recycles 250,000 gal of water per day with 100% reuse of flowback water. The company is currently working to receive permits for multiple treatment facilities and onsite treatment units.

Fluids and proppants. Several new water-based drilling fluids were introduced in response to operators’ desire to replace traditional diesel- and oil-based fluids with clean and efficient alternatives.

Newpark Drilling Fluids released its Evolution water-based mud system, developed specifically for shale gas applications. The system features a clay-free combination of polymeric viscosifier and a proprietary high-pressure/high-temperature lubricant that delivers coefficient-of-friction values similar to those of oil-based mud.

M-I Swaco introduced a range of water-based muds that mimic the characteristics of hydrocarbon-based ones. The fluids were developed for applications in highly reactive shales like the Marcellus, including lost-circulation zones, unconsolidated formations, casing-milling operations, coiled tubing and high-angle and horizontal wells.

Several new water-based frac fluids were introduced over the last year as well. Trican released its EcoClean product line, which includes non-toxic fluids designed to protect water wells and aquifers during reservoir stimulation. The fluids also can be foamed to reduce water usage.

Researchers at the Pennsylvania State University have developed a proppant called Penn Prop, which they say could increase gas production by 50%. Penn State scientists recently launched the startup company Nittany Extraction Technologies for the collection and processing of materials diverted from landfills, including recycled bottle glass, for the Penn Prop product line. Field testing is currently underway in the Marcellus shale, and the company expects mass production to begin in 2012.

Others. Smith Bits released its Spear shale-optimized steel body PDC bit, designed to drill a curve and a long lateral at high penetration rates in low-hydraulic-energy environments like the Marcellus.

Weatherford introduced its Fracology stimulation services, which include laboratory, wellsite formation evaluation, fracturing and microseismic monitoring services. The data is captured in real time during frac operations and is used to monitor the reservoir’s behavior, adjust the fracturing parameters and optimize results.

REGULATORY ISSUES

Environmental scrutiny of hydraulic fracturing and other activity related to shale gas drilling has been particularly acute in the Marcellus. This is in part due to the fact that the few, highly publicized accusations of water well contamination linked to fracing have been concentrated in the play, and partly a result of the proximity of the New York section of the play to the New York City aquifer. That proximity has made for an uncomfortable introduction between drillers and the city’s residents, most of whom are unfamiliar with oil and gas production practices. The local industry got another black eye in February when The New York Times published a series of articles claiming that naturally occurring radioactivity brought to the surface in frac flowback water at Marcellus wellsites was being inadequately treated at municipal sewage treatment facilities.

The tumult raised by that report was hardly quieted by a Pennsylvania Department of Environmental Protection study released in early March that reported no radiation problems in water sampling of seven rivers in the state. The US Environmental Protection Agency reacted with a letter urging the DEP to require more frequent radiation testing at municipal drinking water systems near sewage treatment plants receiving Marcellus shale wastewater and hinting at a more active role for the federal agency in Marcellus water discharge permitting. The EPA recently established its 23-member advisory panel and a draft plan to study the possible environmental impacts of fracing, with preliminary results of that study expected in early 2012. Meanwhile, the Marcellus states are struggling to define their own oversight structures for the play.

Pennsylvania. Shortly after taking office this year, Gov. Tom Corbett signaled his commitment to growing the state’s natural gas industry by reversing restrictions imposed in October by his predecessor, Ed Rendell. Rendell’s policy required operators seeking to drill in state forests to obtain an assessment of environmental impacts from the state Department of Conservation and National Resources (DCNR). The assessments would have required consideration of “threatened and endangered species habitat; wildlife corridors; water resources; scenic viewsheds; public recreation areas; wetlands and floodplains; high-value trees and regeneration areas; avoiding steep slopes; pathways for invasive species; air quality; noise; and road placement and construction methods.” Because an earlier DCNR study had concluded that any leasing would unavoidably damage the ecology of state forests, the ruling was effectively a drilling moratorium on state land.

Corbett has not announced plans to renew leasing in state forests, which was also banned late last year by Rendell. In March, State Rep. Greg Vitali introduced a bill to place all oil and gas leasing in state forests under a three-year moratorium. A similar bill last year had passed the state House of Representatives 157–33 but died in the Senate. After midterm elections gave Republicans control of both houses, the bill will likely get even less traction in this session. Rendell’s executive order last year did not affect existing leases or leasing on private land.

In early March, Gov. Tom Corbett announced the formation of a Marcellus Shale Advisory Commission “to oversee how we can build around this new industry and how we can make certain we do this while protecting our lands, our drinking water, our air—all the time growing our workforce.” The 30-member panel will report to the governor in mid-July with its policy recommendations to balance job growth, environmental stewardship and state revenue. Environmental recommendations could include regulations on hydraulic fracturing and produced water treatment. One revenue measure being considered by the panel is a locally assessed impact fee on gas drillers. But a statewide severance tax, opposed by the Corbett administration, is “off the table,” according to statements by Lt. Gov. Jim Cawley, the commission’s chairman.

New York. June 1 is the expiration date for a statewide moratorium on high-volume fracing signed by former Gov. David Paterson. The executive order requires the state Department of Environmental Conservation (DEC) to complete a supplemental generic environmental impact statement (SGEIS) by then. If DEC makes its deadline, natural gas producers could potentially file new frac application using this SGEIS protocol and spud new Marcellus wells by the end of the year. The DEC’s new chairman, Joseph Martens, has expressed confidence in the state’s ability to adequately regulate the industry while protecting the New York City watershed. He has also said that New York should not wait until the EPA completes its own study of fracing impacts to begin issuing permits.

The new guidelines for New York are likely to be more stringent than existing rules in neighboring Pennsylvania. According to the news and research service PLS, producers will probably have to disclose frac fluid contents for each well; test and monitor water wells within 2,000 ft of a drill site; and follow Susquehanna River Basin Commission and Delaware River Basin Commission protocols for water removal, plus stringent stream-flow analysis, among other requirements.

West Virginia. State lawmakers failed to pass new rules to govern Marcellus shale operations during the legislative session that ended in March, creating uncertainty for producers that could last until the next regular session of the Legislature in early 2012. Some of the provisions considered in legislation last session were a requirement for operators to reach agreements with the state Division of Highways regarding road use; submission of water management plans; 1,000-ft buffer zones between wells and homes, and between fraced wells and public water supplies; and at least 30 days’ advance notice to surface owners before drillers enter leased property to survey or stake out planned operations.

The Senate version also would have increased horizontal well permit fees to $5,000 from the current $650 to raise money for more inspectors, with an additional $1,000 fee for each lateral or sidetrack. The current fee is $650 to drill either a horizontal or a vertical well. In March, Gov. Ray Tomblin asked lawmakers for funding to increase the state’s inspection staff of 17.

|

.jpg)

.jpg)