An expanding spectrum of technologies—from “basic” subsea wellheads to seafloor separators, pumps and compressors—are providing new solutions to age-old reservoir problems in a variety of ocean environments.

John L. Kennedy, 21st Century Energy Advisors Inc.

For roughly half a century, the offshore oil and gas industry has been learning how best to perform production operations on the seafloor. Early in this process, after equipment prototypes were designed and tested, the idea of sending humans to work on the ocean floor—the manned, or atmospheric, concept—was abandoned.

Now, unmanned subsea wellheads connected to an above-water platform or to shore for wellstream processing and export are common from Norway’s Arctic waters to Brazil’s southeastern coast, from the US Gulf of Mexico to offshore West Africa. And the tools for the next level of offshore reservoir optimization comprise an expanding array of seafloor production technologies, including wellstream separation and boosting, water injection and gas compression.

ACTIVITY HIGHLIGHTS

Subsea processing can accelerate and/or increase recovery; enable development of challenging subsea fields; improve flow management and flow assurance; make commercially viable low-quality assets with a low gas-oil ratio (GOR), high-viscosity oil and low permeability; reduce capital expenditure for topside processing equipment and pipelines; and provide infrastructure flexibility for all phases of field life. Subsea pumping to boost a wellstream to a platform or to shore has the longest track record of the “advanced” subsea production technologies—and probably the broadest future application. Although there are a number of subsea separation and compression systems planned, operating installations are still few.

But new solutions will come. GE Oil & Gas alone will spend over $500 million on R&D in the next three years on subsea compression, separation and power, subsea multiphase boosting, AC and DC power transmission systems, and CO2 reinjection, said Manuel Terranova, the company’s senior vice president of drilling and production. GE also is participating in R&D co-funded by the US Department of Energy to develop downhole electronics solutions that raise operating temperature ratings from the current 175°C to 300°C. And four major technology providers will build facilities in Rio de Janeiro to develop subsea solutions for Brazil’s pre-salt development, expected to be a major long-term play requiring advanced subsea technology.

Three key regions—the North Sea, Brazil and West Africa—continue to contribute much to subsea technology development. And in the US Gulf of Mexico, operators increasingly are applying subsea boosting to cope with very deep water and long tiebacks.

Norway. There are more than 700 seabed wells on the Norwegian Continental Shelf alone, and the number is rising, according to the Norwegian Petroleum Directorate (NPD). Statoil, a leader in subsea technology, operates subsea developments in its Ormen Lange, Snohvit, Åsgard, Troll and Tordis Fields.

Though Troll has more than 100 dry wells connected to surface facilities, Troll Pilot, in about 1,100 ft of water, includes a subsea facility to separate and reinject produced water.

In Tordis Field, subsea water disposal has been at least temporarily suspended. Statoil’s chief engineer for subsea, Roald Byhre Sirevaag, told World Oil that, following the failure of the Tordis water disposal well, the system has been slightly reconfigured. While a new disposal well is being considered, the combined capacity of the multiphase boosting pumps and water injection pumps will be used to boost production back to the Gullfaks C platform.

“This configuration will reduce backpressure on the wells and increase recovery,” Sirevaag said.

In Tyrihans Field, 16 mi southeast of Åsgard Field in about 890 ft of water, subsea pumps will be used for seawater injection to increase recovery, Fig. 1.

|

|

Fig. 1. A subsea template being installed at Tyrihans Field. Courtesy of ABB.

|

|

Framo Engineering is working under a Statoil contract to develop and qualify a subsea boosting system for Statoil’s Gullfaks asset based on Framo’s subsea wet gas compressor. Subject to successful qualification, a Framo subsea multiphase compressor will be installed in 2013 to maintain the plateau production at Gullfaks C and increase overall recovery.

Because of disappointing well results in the northern part of the Ormen Lange subsea development, gas compression solutions are being evaluated for that field, according to the NPD.

Brazil. In the deep water off Brazil’s southeastern coast, Petrobras has traditionally used subsea completions connected to FPSOs equipped for wellstream processing. But in its largest field, Marlim, Petrobras will install a subsea separation system to relieve the load on surface facilities and boost recovery in the face of increasing watercuts and sand production. Marlim, in the Campos Basin 70 mi offshore, has more than 100 subsea wells and eight FPSOs.

In Shell’s multi-field Parque das Conchas project located 68 mi off Brazil’s southeastern coast, three heavy oil fields were developed with subsea wells and manifolds. Each field is tied back to a centrally located FPSO moored in about 5,840 ft of water. According to Shell, Parque das Conchas is the first development to be based fully on subsea oil and gas separation and subsea pumping.

Brazil’s emerging pre-salt play offers much future opportunity for applying subsea production technology. But the pre-salt brings an additional level of complexity because of its much deeper water, long distance from shore, and significant amounts of CO2 in the wellstreams.

West Africa. In Pazflor Field, operator Total faced a challenging low-pressure reservoir in deep water that contains highly viscous oil. Since standard production methods would only allow very low recovery rates, the solution was to install subsea pumps along with a subsea gas/liquid separator during initial field development.

The separator removes the gas from the oil and water, and the gas flows freely to the FPSO. With the gas removed, the oil and water can be pumped to the surface using more efficient pumps. Only one production flowline is needed instead of two, reducing capex.

Installation will begin this year, with production startup set for next year. The subsea production systems will include three 1,050-ton subsea separation units supplied by FMC Technologies, each connected to two subsea pumps. The field contains 25 producing wells, 22 water injectors and two gas injectors.

“This represents the next generation of subsea processing,” said Brad Beitler, vice president of technology for FMC Technologies. “It will allow this field to sustain initial production and boost revenue.”

United States. In the US Gulf of Mexico, the luxury of dry-tree wells has allowed operators to continue placing pumping and processing equipment on surface platforms, even as subsea deployment of this equipment has become an accepted practice in other parts of the world, said Peter Batho, business development manager for pumps and subsea systems at Framo Engineering North America.

“With the shift in GOM production to satellite production areas and deeper water, subsea production systems are becoming a necessary reality. Subsea boosting is now perceived as a viable technology,” Batho told World Oil. “Of course, the closer you can get to the sand face with the lift technology, the more incremental benefit you will achieve.”

Challenges for multiphase meters and pumps in the GOM include higher operating pressures. Last year, Framo launched a 15,000-psi subsea multiphase meter specifically for the GOM market, and the company currently has eight units for three separate projects on schedule for delivery in the fourth quarter of 2010.

Shell’s Perdido project, which came onstream in March 200 mi from the Texas coast in Alaminos Canyon Block 857, is the first commercial production from the Lower Tertiary in the Gulf of Mexico. In about 8,000 ft of water, it is also the US GOM’s first fully subsea separation and boosting system. The system will reduce backpressure on the wells by about

2,000 psi, according to Shell information.

The Perdido platform is the hub for the development of three fields—Great White, Tobago and Silvertip. Tobago, in 9,596 ft of water, will be the world’s deepest subsea completion.

OCEAN FLOOR SOLUTIONS

Though the line is often blurred, Batho says the benefits of artificial lift fall into two categories, enabling and enhancing: “In the deeper waters of the Gulf of Mexico, boosting is perceived as production enabling from the early years of reservoir life forward. In shallower waters there are many brownfield production enhancement opportunities that justify retrofitting of boosting systems.”

Separation and boosting. Framo deployed its first seabed booster pump in 1995 and now has over 1 million operating hours of experience in more than 20 projects, each with multiple pumps. In Statoil’s Lufeng Field in the South China Sea, five Framo subsea booster pumps ran for 11 years and were pulled only because the field was decommissioned, Batho said.

The few operating and planned subsea separation systems are bespoke solutions for their respective applications and are deployed in relatively shallow water. According to Batho, Framo has supplied pumps to every subsea (mud line) separation system to date, including Troll and Tordis, and two additional projects are currently under construction, Pazflor and Marlim.

Future separation applications in deeper water will dictate higher-pressure service, which will add significant complexity, making compact separation solutions more attractive, he said.

To separate water from the wellstream underwater and inject it into a disposal formation in the Tordis project, Statoil chose FMC’s separation technology.

In Brazil’s Marlim Field, where water production is increasing, Petrobras will use FMC subsea separation and pumping technology to separate gas from the wellstream, then separate water and oil. Oil will then be commingled with the gas and will flow to the FPSO. Water will be reinjected into the producing reservoir, providing additional pressure support. Equipment fabrication has begun in Brazil, and the system will be installed next year in about 2,950 ft of water. Marlim is the fifth project awarded to FMC Technologies that will use subsea separation technologies.

ESPs for marginal reserves. Subsea production systems typically used in water depths to 1,000 ft are not well-suited for deeper waters where longer stepouts are necessary. As a result, marginal reserves not large enough to justify a platform or FPSO have been put on hold awaiting technology that can efficiently boost production from those fields to a surface facility.

While in-well systems have operated effectively, intervention costs are a constant concern. Though it is usually better to install an artificial lift pumping system as close to the reservoir as possible, in very deep waters, these systems are expensive to install and replace.

Baker Hughes’ Centrilift division has been working to develop seabed booster systems that provide more options, says Ignacio Martinez, Centrilift’s technical support manager for artificial lift and flow assurance.

“The seabed booster concept is a compromise that provides some boost without the large capital costs of in-well installation and intervention,” Martinez said.

When reservoir pressure will not lift production to a surface platform, a well still may be able to flow to the seafloor, where seabed boosters systems can recover a significant amount of additional oil. And even if an in-well system is eventually required, seabed boosting equipment makes it possible to install lower-horsepower electrical submersible pumping (ESP) systems, which Martinez said “offer simplicity and a capacity to develop high differential pressure.”

Each of these three main subsea configurations using ESP systems for boosting can serve one well or multiple wells:

-

Non-separator caisson ESP system—also called a dummy or false well—in which the ESP system is placed inside a caisson that acts as a tank that feeds the pump

-

Separator caisson ESP system for use if gas must be separated from fluids; the gas is separated by gravity and flows up to the surface facilities as liquids fall to the bottom of the caisson and are pumped to the surface facility

-

ESP system installed in a purpose-built capsule supported by a skid on the seabed.

The challenge of ESP systems in subsea applications is to pre-plan the system as an integral component of the entire hardware configuration, Martinez says.

Baker Hughes will provide subsea boosting for Shell’s Parque das Conchas development offshore Brazil, where three separate fields each pose different challenges. Two of the fields, Ostra and Argonauta B-West, are equipped with ESP systems located inside a caisson on the seabed that serves several wells.

One goal of current development is to reduce the length of the ESP system by about 60%. That will facilitate assembly, storage and transportation of the system, and will enable rigless intervention using light vessels. Reducing the system’s size also increases differential pressure and flowrate capabilities, making longer stepouts possible.

ESP development is also increasing system horsepower capabilities above 2,500 hp, an increase of more than 800 hp over current standard technology.

Compression. Statoil has two subsea compressor qualification projects in progress for fields it operates, Sirevaag said. The submerged testing of the 4-MW wellstream compressor for Gullfaks began at the end of July; testing of the equipment for the two 10-MW units for a wet gas system for Midgard was close to completion in mid-August.

In both applications, the subsea alternative is competing with a dry solution. The final concept selection for both fields is scheduled for the end of the year. Further into the future, Luva Field, in about 4,300 ft of water, will require a gas infrastructure solution. “In both brown and green fields, we are considering the application of boosting and separation technologies on a number of candidate fields,” Sirevaag said.

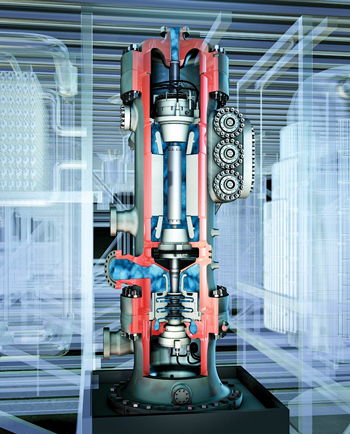

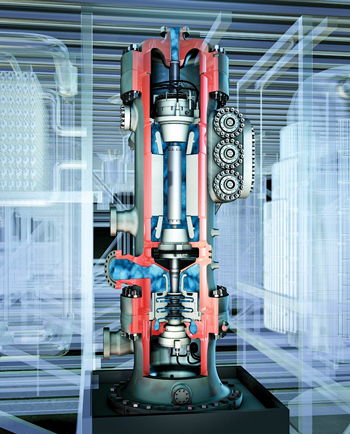

GE Oil & Gas has successfully completed a test of its Blue-C subsea compressor, which it calls the first “marinized” compressor designed exclusively for subsea service. The compressor was co-developed with Aker Solutions for deployment in Norway’s Ormen Lange Field, Terranova told World Oil. Designed for unattended operation in about 2,950 ft

of water, it has a power rating of 15 MW. Installation is expected in 2014.

The unit is driven by a gas-filled, high-speed electric motor stacked in a vertical orientation, and packaged in a single sealed housing designed to withstand high hydrostatic pressure, Fig. 2. The entire unit is NACE compliant.

|

|

Fig. 2. GE’s Blue-C subsea compressor, co-developed with Aker Solutions for deployment in Ormen Lange Field offshore Norway, will be installed in 2014. Courtesy of GE Oil & Gas.

|

|

A key design challenge was the elimination of dry gas seals, which are susceptible to damage from sand-gas mixtures and transient conditions, Terranova said.

Power and control. “Subsea power grids are a key solution to enable subsea production,” Bjoern Einar Brath told World Oil. Brath is responsible for subsea applications at Siemens Oil & Gas. “The subsea environment leads to a recovery gap compared to surface wells that can be as high as 30%. The Siemens subsea power grid can help close that gap by opening the way for full-fledged subsea processing.”

Siemens’ system can deliver about 36 kV over fields covering an area up to about 100 sq mi

in a water depth of nearly 10,000 ft to allow cost-efficient operation of a large subsea production facility with multiple consumers such as variable speed drives and compressors.

Brath said the system will be available for deployment by late 2012 or early 2013.

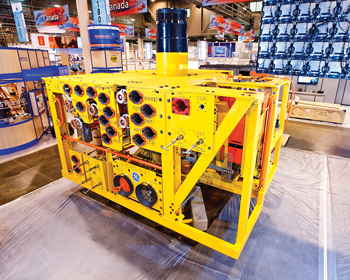

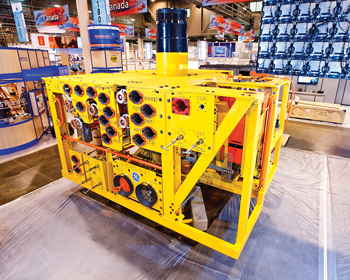

In July, ABB Group announced it had successfully tested the largest subsea transformer in the world (20 MVA, 132 kV/22.5kV) at Finland’s port of Vaasa. The 60-ton device was put through a heat-run test under conditions that correspond to expected operating conditions, Fig. 3.

|

|

Fig. 3. ABB’s 60-ton subsea transformer successfully completed a heat run test under real world conditions in July. Photo by Jyrki Tervo courtesy of ABB.

|

|

As a means to power compressors, the transformer will be used to assess a fully subsea gas compression alternative to a floating platform to boost gas production from Norway’s Ormen Lange Field. The full subsea installation would consist of a 70-MVA transformer, four compressors with variable speed drives (including VSD transformers) and four condensate pumps. An ABB subsea transformer was scheduled for delivery this fall for acceptance testing of the entire compressor system. First use of the system is expected in 2014 at the earliest.

ABB’s liquid-filled, pressure-compensated transformer keeps the internal pressure close to the outside water pressure by immersing all insulation in liquids and eliminating all air- and gas-filled vaults. Cooling is provided by natural convection. The unit can be delivered with a single or double shell. It has been qualified for depths to 8,200 ft, but development continues to extend capability to 10,000-ft water depths.

Workover and stimulation. “For a long time, we produced from big pools of nice clean crude offshore,” Beitler said. But offshore reservoirs decline and become water or gas constrained, bringing a need for stimulation, workover and treatment. “Everything we’ve done on land to stimulate wells, we are going to end up doing under water.”

In June, FMC received the NPD’s 2009 improved oil recovery award for a well control system applied on Åsgard Field. Together with operator Statoil, FMC developed and tested its through-tubing rotary drilling (TTRD) technology in the field’s P-4H well last year, drilling the world’s longest sidetrack from a floating rig.

Subsea trees. Among other design goals, subsea tree manufacturers are focused on reducing weight, footprint and cost. Toward that goal, GE Oil & Gas this year launched its D-Series DHXT deepwater horizontal tree and integral control system, designed for 10,000-ft water depths and pressures to 15,000 psi, Fig. 4. The streamlined design reduces the horizontal tree footprint by 12% (to 4.5 m x 4.4 m) and weight by 10% (to 43.7 tons), compared with industry standards. The integral control system provides open-architecture subsea control and instrumentation.

|

|

Fig. 4. GE’s streamlined subsea tree for water depths to 10,000 ft and pressures to 15,000 psi reduces footprint and weight. Courtesy of GE Oil & Gas.

|

|

For harsh shallow waters like the North Sea, VetcoGray’s S-Series SVXT subsea tree, launched in September 2009, combines horizontal and vertical tree technology to reduce weight by 20% and decrease height. The modular package can be deployed by a standard jackup rig without major modifications.

In an effort to bring some standardization and repeatability to tree design, FMC looked at the portfolio of opportunities held by some of its larger clients. “We found that a certain tree design could typically work on 80–90% of a given client’s wells,” Beitler said.

That led FMC to develop a “standard” tree that is applicable for most subsea wells in the North Sea, Brazil and West Africa. And because casing programs are somewhat standardized in each region, smaller companies and independents that need only a few trees can adapt the casing programs to be able to use these standard trees, lowering their development cost.

The company’s OnDemand program is designed to deliver pre-engineered, field-proven equipment within six months of the purchase order.

FUTURE DIRECTION

Emerging subsea technology challenges include CO2 separation, high-voltage power, and improved instrumentation and monitoring capabilities. FMC is developing sensors and fast-acting controls that will enable real-time data gathering, and condition- and performance-monitoring systems for subsea rotating equipment.

Corrosion-resistant alloys are needed throughout a system that handles wellstreams containing CO2, making it very expensive to bring CO2 to the surface in, say, 8,000 ft of water. Ideally, CO2 would be separated from the wellstream on the ocean floor and injected into the reservoir to enhance recovery. But that poses additional technical hurdles.

Accessing subsea equipment for workover, particularly in special situations such as icebound regions, is also a challenge. FMC has invested in a firm that makes robotic arms, anticipating that remotely operated vehicles (ROVs) will play a major role in future subsea field operations.

“We see a convergence of robotics technologies, ROV technologies and subsea technologies, especially for places like the Arctic,” Beitler said.

In addition to the current subsea hot spots, “Australia represents a huge growth market, particularly for large-bore subsea gas developments,” GE’s Terranova told World Oil, adding that the company is heavily involved in a number of key projects in the region.

“Our goal is to standardize the equipment for our small-field portfolio,” said Statoil’s Sirevaag. “For open-water workover systems, our ambition is to start using systems with interface capabilities such that the same system can be used regardless of who supplied the subsea tree.

“We have 480 subsea wells, and the need to work over these wells for mechanical or improved-recovery reasons gives us a strong incentive to phase out old field- and vendor-specific intervention systems.”

|

THE AUTHORS

|

|

John Kennedy, president of 21st Century Energy Advisors Inc., analyzes oil and gas technology, markets and issues for a variety of clients. He has an engineering degree and has covered global petroleum activity for several decades.

|

|