Leasing and drilling operations in the shale oil play are reaching record highs due to a significant oil price advantage over natural gas.

Pramod Kulkarni, Editor

Price, as expected, is a key economic determinant in the oil field. As natural gas prices have dropped from the winter high of $6/Mcf to about $4/Mcf in mid-April, drilling activity in the natural gas shale plays, such as the Barnett and the Marcellus, has suffered a corresponding drop. Chesapeake Energy CEO Aubrey McClendon was quoted by Platts Oilgram News to say that about half of the shale gas drilling lately is involuntary, primarily to satisfy lease requirements. The economic scenario is exactly the opposite in the Bakken. As the Bakken is a shale oil play, rising oil prices to a high of $86/bbl in mid-April have led to a leasing and drilling boom, Fig. 1.

.jpg) |

|

Fig. 1. A major Bakken operator, Marathon Oil expects to increase production from its properties from 11,000 boepd in 2010 to 22,000 boepd by 2013. Several other Bakken operations are expanding their leasing and drilling programs.

|

|

The Baker Hughes rig count in the US portion of the Williston Basin reached 102 in late March from a low of 34 in June 2009, Fig. 2. As a result, the Bakken is currently the leading onshore oil play in the continental US. North Dakota’s production may reach 300,000–400,000 barrels a day by mid-2011 and stay at that level for 10–15 years, said Lynn Helms, director of the North Dakota Mineral Resources Department. The state’s previous estimate was 220,000–280,000 bpd. The Bakken contributed to last year’s 7.5% gain in US crude output, the biggest since 1955 and the first in 18 years.

|

|

Fig. 2. After hibernating in the first half of 2009, drilling activity in the Williston Basin has been going up in response to steadily rising oil prices.

|

|

OIL PRICE ADVANTAGE

One barrel of crude oil has about six times the energy content of a thousand cubic feet of natural gas. With the natural gas price at about $4/Mcf and WTI at $86/bbl, crude oil was trading at an energy-equivalent price advantage of 3.58 in mid-April. While finding costs are higher in the Bakken (approximately $13 according to Brigham Exploration Company) versus $7–$10 in the natural gas shale plays, operators in the Bakken enjoy a $73/boe price advantage compared to about $14/boe for the shale gas operators. This price advantage has left the Bakken operators feeling smug and shale gas operators looking for oil shale opportunities, since the technologies of horizontal drilling and multistage fracturing can be applied to advantage for either gas or oil.

BAKKEN BASIN POTENTIAL

The Bakken Formation lies within the Williston Basin, which occupies 300,000 mi2 across the states of North Dakota, South Dakota and Montana in the US and the adjacent Canadian provinces of Saskatchewan and Manitoba, Fig. 3. The formation depth is about 11,000 ft at the depocenter in the southwest corner of North Dakota, but rises to 4,500 ft on the eastern edge of the basin, and 3,100 ft on the northern edge in Manitoba and Saskatchewan. The formation was deposited in the Paleozoic era during the Upper Devonian and Lower Mississippian periods.

|

|

Fig. 3. The Bakken Formation lies within the Williston Basin at depths ranging from 3,100 ft to 11,000 ft.

|

|

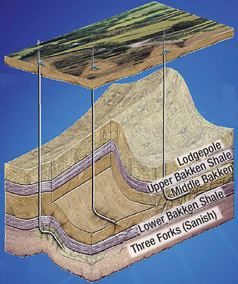

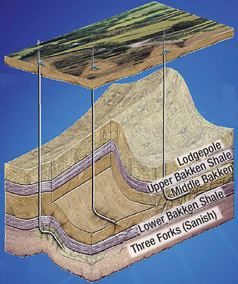

The Bakken Formation consists of three members: Upper Bakken, a 23-ft-thick black marine shale; Middle Bakken, an 85-ft-thick interbedded layer of limestone, siltstone, dolomite and sandstone; and Lower Bakken, another black marine shale that is 50 ft thick, Fig. 4. Over geologic time, the Williston Basin subsided, causing increased temperatures and pressures that converted the kerogen content in the shales into crude oil. As there is no high-permeability conduit for the crude, the rising internal fluid pressure caused the middle member to fracture from within. Operators are able to achieve economic production in the thermally mature areas of the middle member that correspond to a burial depth of 8,500 ft or deeper by hydraulic fracturing in the direction of these natural fractures. Some operators are also producing oil from the Sanish sand in the 250-ft-thick Three Forks Formation, which lies immediately underneath the Bakken. In 2008, the US Geological Survey (USGS) conducted a petroleum resource assessment of the Bakken Formation. Based on the analysis of geological models and production history, the USGS estimated the technically recoverable resources as being 3.65 billion bbl of oil, 1.85 Bcf of gas and 148 million bbl of natural gas liquids.

|

|

Fig. 4. The Williston Basin stratigraphic sequence showing the three Bakken Formation members and, directly beneath them, the Three Forks (Sanish) layer. Courtesy of Corporate Montage.

|

|

LEASING AND DRILLING ACTIVITY

The Bakken has experienced several episodes of drilling activity over the last 50 years, beginning with Antelope Field in 1953. The recent resurgence is the result of the new technology to maximize reservoir contact by drilling long horizontals with as many as 40 hydraulic fracturing stages. In 2000, Lyco Energy was the first company to apply horizontal drilling technology in the Bakken to discover Elm Coulee Field in Richland County, Montana. Production from the field reached 100,000 bpd in 2006, but declined to 70,000 bpd by mid-2009. Elm Coulee has already produced in excess of 41 million bbl of oil and 24 Bcf of gas from more than 400 horizontal wells. Another notable field is Parshall, discovered by EOG Resources in 2006. The initial production rate from the first well drilled was 836 bpd, but 11 subsequent wells had an average production rate of 1,386 bpd.

Continental Resources is the largest leaseholder in the Bakken Shale with 652,000 net acres in North Dakota and Montana. About 17% of the net acreage is producing and 83% is undeveloped, with the largest undeveloped acreage being in North Dakota. Until mid-2009, production in the North Dakota Bakken was 6,286 boepd, more than three times the 2008 production of 2,082 boepd. In 2010, Continental has budgeted $543 million in capital expenditures for the North Dakota Bakken by operating 11 rigs. This number is expected to increase to 15 by mid-2010. While most industry drilling in the North Dakota Bakken has targeted the Middle Bakken member, Continental was among the first to target the Three Forks/Sanish (TFS) zone. Over 50% of acreage is prospective for dual-zone development in both the Middle Bakken and the Three Forks. To exploit both formations, Continental has developed its ECO Pad technique (Fig. 5) to drill eight laterals from two drill pads.

|

|

Fig. 5. Continental Resources’ ECO Pad method allows drilling of eight lateral from two drilling pads, enabling simultaneous exploitation of the Middle Bakken (MB) and Three Forks/Sanish (TFS) zones.

|

|

Hess has 500,000 net acres of Bakken leases in the North Dakota region. “We plan to build up to a 10-rig program over the next 18 months and invest about $1 billion per year over the next five years,” said Chairman and CEO John Hess during a January 2010 update. “As a result, we expect net production to increase from 10,000 boepd currently to 80,000 boepd in 2015.” The company expects its rig count to increase from three in 2009 to 10 in 2011.

EOG Resources controls 100,000 net acres in its “Bakken Core” area around Parshall Field and has an additional 400,000 net acres in an extended area it calls “Bakken Lite.” The company has a 12-rig program in 2010 and expects to drill 35 wells in the core area and 72 wells in the Lite area.

XTO Energy entered the Bakken play in 2008 by acquiring 352,000 acres from Headington Oil at a cost of $1.85 billion and adding another 100,000 acres through its own efforts. The company was producing 17,225 boepd during the third quarter of 2009. It had three drilling rigs operating during 2009, but plans to increase the rig count to six during 2010. Roughly 27% of the leasehold is concentrated in Elm Coulee Field, where XTO continues to drill infill 640-acre locations. However, the bulk of the acreage and drilling is focused in the North Dakota Bakken, targeting both the Middle Bakken and the TFS zones. As XTO has delineated the TFS across the central and southern Nesson anticline, it has posted some of the strongest peak rates in the play, including the Jorgenson 43x-4 well, which flowed at 2,825 boepd, and 10 others exceeding 1,000 boepd.

Marathon Oil is producing 11,000 boepd from its Bakken fields at an operating cost of less than $5/bbl. The company entered the Bakken with 187,000 acres in 2006 and has disposed of 37,000 acres and added 200,000 from 2007 to 2010 to currently hold 350,000 net acres. The company expects to increase production to 22,000 boepd by 2013.

PetroBakken operates on the Saskatchewan side of the Bakken play. The company has over 210,000 net undeveloped acres in the Bakken with more than 1,100 potential drilling sites. PetroBakken’s acreage is close to oil and gas processing facilities, gathering systems and the Enbridge pipeline. The company currently has 65 bilateral and 130 single horizontal wells on production. Initial production rates from the horizontal wells range from 150 to 275 boepd.

Brigham Exploration has 156,800 net acres in its Bakken core development areas and is operating 745 wells in the Parshall/Austin/Sanish and Rough Rider plays. In April 2010, Brigham announced record production from its Sorenson 29-32-1H well. Subsequent to drilling out frac plugs, the Sorenson well produced at an early 24-hour peak flowback rate of 5,133 boepd. Located in Brigham’s Ross project area in Mountrail County, the well is a long lateral completed with 27 frac stages.

MDU Resources Group is currently producing 2,500 bpd from the Three Forks/Sanish Formation. The company has budgeted $45 million for its 2010 drilling budget and plans to drill 13 wells at a cost of $5–6 million each. MDU currently has 56,000 net acres in the Bakken play.

Northern Oil & Gas has 90,000 net acres to explore the Bakken/TFS Formations. The company has participated in more than 180 gross wells and is currently producing 2,000 boepd.

Whiting Petroleum has 88,000 net acres in Sanish and Parshall Fields. The company completed 38 wells in Sanish Field in 2009 and plans to complete 86 wells in 2010 with a capital budget of $274 million. In addition, Whiting is participating in two net wells budgeted at $11 million in its nonoperated Parshall Field.

MERGERS AND ACQUISITIONS

ExxonMobil announced in December 2009 a $41 billion all-stock deal to acquire XTO Energy, a leading player in the Bakken. XTO itself had bought into the Bakken play by acquiring 352,000 acres of shale leases in Montana and North Dakota from privately held Headington Oil in November 2008. XTO has been drilling extensively on the acquired properties by operating four drilling rigs and has strengthened its leasehold position to over 450,000 acres. ExxonMobil is expected to continue XTO’s Bakken drilling program and possibly apply the newly acquired shale exploration and production skills to other prospects such as Poland.

In October 2009, Petrobank Energy and Resources and Tristar Oil & Gas completed a strategic combination to create PetroBakken, the leading Bakken operator on the Canadian side of the play. The newly formed company is actively pursuing Bakken opportunities through 12 rigs, seven of which are now exclusively drilling bilateral horizontal wells.

In May 2009, GeoResources acquired a 15% interest in 59 producing wells and 60,000 net acres through a $10.4 million joint venture with Slawson Exploration Co. Other participants in the land acquisition included Northen Oil & Gas and Lario Oil & Gas.

In April 2010, Kodiak Oil & Gas announced the acquisition of 4,531 net acres in McKenzie County near existing Bakken and Three Forks producing wells and increased its working interest by 25% in properties in the southeastern portion of Elm Coulee Field.

PRODUCTION IMPROVEMENT TECHNOLOGIES

Economic production from the tight Bakken Formation would not have been possible without multistage hydraulic fracturing. Figure 6 demonstrates how production and estimated ultimate recovery can be improved by adding more stages.

.jpg) |

|

Fig. 6. Brigham Exploration production profiles for Bakken wells shows typical decline, but production and EUR improvement through additional stage fractures. Courtesy of Brigham Exploration Co.

|

|

Microseismic fracture monitoring. MicroSeismic Inc. has buried seismic arrays across more than 150 mi2 in Mountrail County for Whiting Petroleum. The array uses more than 1,200 geophone channels to monitor, map and analyze hydraulic fracturing operations in Whiting’s Bakken and Three Forks wells in Sanish Field.

Rotary steerable drilling. Many operators are utilizing rotary steerable drilling systems, such as the Schlumberger PowerDrive system or the Baker Hughes AutoTrak system, to provide precise well placement control while delivering a smooth wellbore that enables single trip, trouble-free completion installations. Additionally, 3D rock properties evaluation is performed, using acoustic scanning platforms such as the Schlumberger Sonic Scanner system to help optimize the design of fracture treatments.

Enhanced recovery. While most wells producing the Bakken Formation are in primary recovery, some operators looking ahead at enhanced recovery options. In late 2008, Continental Resources initiated a secondary recovery pilot project, using carbon dioxide injection, to evaluate the potential to increase oil recovery from the Montana Bakken reservoir. Using a huff-and-puff method, Continental injected CO2 in January 2009, then allowed the CO2 to soak into the reservoir. Production from the well will be measured and the performance will be analyzed to assess the incremental recovery and production economics.

TAX AND PRODUCTION INCENTIVES

The Bakken play draws considerable support from the state governments in Montana and North Dakota. An oil-drilling tax break enacted by North Dakota in 2007 shifted attention in the Bakken from Montana to the North Dakota side. The number of wells drilled in the North Dakota Bakken jumped from 300 in 2006 to 457 in 2007. The legislation cut the state’s tax rate for newly drilled Bakken wells from 11.5% percent to 7%. The incentive took effect July 1, 2007, and expired a year later, when the tax was restored to 11.5% of the oil’s value.

The lower tax rate applied to the first 75,000 bbl of oil from a newly drilled Bakken well. The gross production tax rate on oil is 5% of the gross value, and the oil extraction tax rate is 6.5% of the gross value.

WATER USAGE

Typical water use for hydraulic fracturing in Bakken wells is 1.5–4.0 million gal per well. While drilling takes place throughout the year, the wells are fractured between May and December. Lake Sakakawea and the Missouri River are primary sources of water. Costs for acquisition of frac water for injection and costs for the disposal of formation and frac flowback water can range from $2/bbl to $11.75/bbl.

The US Department of Energy, the North Dakota Petroleum Council and the North Dakota Industrial Commission are participating in a research project to assess the technical and economic potential to recycle frac flowback water in the Bakken play. The project is considering new technologies such as mechanical vapor recompression to reclaim the water.

One of the projects approved by the North Dakota State Water Commission includes funding for a regional water service for the McKenzie County Water Resource District. The first part of the project will bring up to 4 million gallons per day of water from Williston County to McKenzie County to supply water depots that will be used for bulk water sales to the oil industry. The commission approved up to $3.5 million in funding for the $7 million project.

A second project approved by the commission will tap into the existing Southwest pipeline near Dodge in Dunn County to access up to 1.4 million gallons of Lake Sakakawea water. The pipeline carries water to Dickinson for treatment, and the water not needed by the rural water system will be sold to oil companies to enhance exploration and extraction activities in Dunn and Mercer Counties.

ENVIRONMENTAL IMPACT

A looming threat to oilfield operations comes from environmental groups in the Western US that are concerned about greenhouse gases. In late March, the US Bureau of Land Management suspended an April 13 sale of 91,000 acres of oil and gas leases in Montana and the Dakotas pending an agency investigation to study “how oil field activities contribute to climate change.”

The suspension comes after the BLM agreed to suspend another 38,000 acres of leases. The agreement was part of a settlement between the agency and environmental groups that sued over a 2008 lease sale in US district court. BLM spokesman Greg Albright expects the new environmental review of the suspended parcels to be conducted by late September, according to an Associated Press report.

PIPELINE TAKEAWAY

Due to its remoteness from petroleum refineries and natural gas markets, pipeline takeway capacity is a major issue for Bakken operators. In February 2010, Enbridge Energy Partners announced the completion of the Phase 6 expansion of a North Dakota crude oil system. This expansion brought the nominal capacity of the North Dakota crude oil system to 161,000 bpd. The $147 million project added 40,000 bpd of capacity from the western end of the system to Minot, North Dakota, and 51,000 bpd of capacity from Minot to Clearbrook, Minnesota.

Future pipeline projects by Enbridge and other pipeline operators are designed to keep up with increasing Bakken production, Fig. 7.

.jpg) |

|

Fig. 7. Bakken oil production projections and upcoming pipeline takeaway projects. Courtesy of Continental Resources.

|

|

RESEARCH PROJECTS

The National Energy Technology Laboratory (NETL) is involved in five initiatives to enhance the industry’s understanding of the Bakken in order to improve oil recovery. The initiatives are: 1) an industry consortium to gather information on the performance of hydraulic fracturing stimulations; 2) evaluation of key factors affecting production to determine relationships among Bakken rock properties, well completion methods and well performance; 3) a geomechanical study to measure in situ stresses and properties of the Bakken to better design hydraulic fracture treatments; 4) an initial assessment of the hydrocarbon potential of the Bakken and development of an integrated exploration model; and 5) an effort to determine the controlling mechanisms affecting oil distribution and production and to identify methods for increasing oil flow through monitoring of well conditions and (potentially) injection of carbon dioxide.

The first initiative mentioned above is an ongoing field study gathering a comprehensive suite of geophysical data from surface and subsurface sensors, during and after fracture stimulation of a pair of horizontal wellbores in the Bakken. This experiment, led by XTO Energy, includes a surface geophone array, three 1,000–1,500-ft-deep wells with permanently emplaced subsurface geophones dedicated to continuous monitoring, a series of 18 shallow holes with emplaced geophones, and three horizontal wellbores, one of which includes emplaced geophones for monitoring, Fig. 8. The fracturing carried out in two of the horizontal wells was monitored by this extensive array of sensors in an effort to understand exactly how hydraulic fractures are created in the Bakken. Downward-looking vertical seismic profiling will be used in a passive seismic acquisition mode to continually monitor the formation for years after production is initiated.

.jpg) |

|

Fig. 8. The Bakken consortium study involves the monitoring of fractures using both surface and downhole sensors to measure the performance of hydraulic fracturing operations. Courtesy of NETL.

|

|

GROWTH OR HIBERNATION

The Bakken Shale play is expected to grow at a sustained pace as long as oil prices remain above $60. Just as Bakken activity went into hibernation when the oil prices dipped below $50 during first half of 2009, operators will continue to demonstrate a natural sensitivity to price swings. If the world economy continues to come out of the recession and demand from China and India continues to grow, then drilling and production activity will remain on an upward trend.

|

Record fracturing with 35 stages

Shale wells in Bakken Field in McKenzie County, North Dakota, average a vertical depth of 10,000 ft with laterals extending an additional 10,000 ft. These Bakken wells are generally fractured with the “plug and perforate” method in which a drillable plug is set in the wellbore above each zone after it is fractured in order to enable fracturing of the next successive zone. After all the zones are completed, the plugs are drilled out so that production can begin.

On its Figaro 29-32 well, Brigham Exploration wanted to complete and produce through 35 precisely located frac stages at a record depth, (see figure). Halliburton assembled a team to design and implement a SurgiFrac service treatment. After the SurgiFrac service operation, Brigham announced that the well produced approximately 1,895 boepd during the initial 24-hour flowback period, better than most wells in the region.

This was the deepest SurgiFrac service—a 20,673-ft TD horizontal well. In a continuous 13-stage operation of this well completion, Halliburton’s frac team was able to place a record 409,000 lb of proppant per jet. The proppant amount pumped in this well was 3.1 million lb.

|

|

Halliburton helped Brigham Exploration achieve a 35-stage hydraulic fracturing completion with annular isolation accomplished using 34 swell packers to produce 1,895 boepd.

|

|

|

|

.jpg)

.jpg)

.jpg)

.jpg)