Despite legislative successes, increased federal regulation threatens US oil and gas

Industry lobbyists blocked provisions that would have hampered commercial hedging, and cap-and-trade may be DOA. But recent decisions by the EPA and the Interior Department could still make 2010 a rough year for E&P.

Industry lobbyists blocked provisions that would have hampered commercial hedging, and cap-and-trade may be DOA. But recent decisions by the EPA and the Interior Department could still make 2010 a rough year for E&P.Roger H. Bezdek, Contributing Editor, Washington

Over the past year, the Obama administration has moved on a number of fronts to increase regulation and oversight of the US oil and gas industry, including financial reform, climate legislation, agency-implemented CO2 regulation, and oil and gas leasing. Although not all of these initiatives will be successful, increased litigation and greater uncertainty are sure to result from those that do succeed. Consequently, US oil and gas production and distribution will be getting increasingly difficult and expensive. DERIVATIVES: DODGING A BULLET In December, the US House of Representatives passed a bill to overhaul government regulation of the financial industry that included provisions to authorize the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) to regulate over-the-counter (OTC) derivatives for the first time. The comprehensive Wall Street Reform and Consumer Protection Act (HR 4173) passed after months of negotiations in the wake of the worst financial crisis since the Great Depression. It includes language that would, among other things, create a new Consumer Financial Protection Agency, revise mortgage lending practices, and provide for the orderly dismantling of a financial entity in bankruptcy. The bill’s derivatives language encompasses virtually all deals conducted in OTC markets, requiring all standardized transactions to be cleared and conducted on an exchange. In addition, it would direct the CFTC to set aggregate position limits across multiple markets and in physically delivered futures and options markets; subject financial players to strict capital requirements and an audit trail; and require foreign boards of trade that permit trading from US terminals to comply with regulatory standards like those required of US entities. For the oil and gas industry, the bill is most notable for what it excludes. In response to the concerns of physical hedgers, such as energy producers and distributors, lawmakers agreed to exempt OTC deals from the above requirements if one of the parties is not a major financial institution. Non-standardized deals would be reported to a central trade repository. The House rejected a controversial amendment by Financial Services Committee Chair Barney Frank (D-Mass.) that would have given the CFTC and the SEC authority to set margins for transactions involving end users. This is the provision that energy producers and distributors opposed, contending that it would increase the cost of legitimate hedging transactions by forcing them to clear. In the Senate, the Agriculture Committee and the Banking, Housing and Urban Affairs Committee are drafting their own OTC legislation, which will eventually have to be reconciled with the House bill. So, while the oil and gas industry has dodged a regulatory bullet in the House, it is not yet out of the woods. CAP AND TRADE: RIP? The House of Representatives in June passed the American Clean Energy and Security Act (ACESA) designed to drastically reduce US greenhouse gas (GHG) emissions over the next four decades, with devastating potential impacts on oil and gas production. Despite the Democrats’ large majority in the House, the legislation—also called the Waxman-Markey bill—passed by only a razor-thin margin, Fig. 1. Nevertheless, it represents the first time either house of Congress has approved a bill designed to reduce GHG emissions, and is thus an ominous landmark.

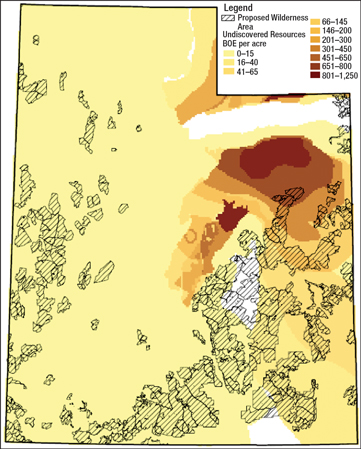

President Barack Obama had sought Senate action on the House bill in time for December’s Copenhagen global warming talks. The Senate Committee on Environment and Public Works approved a cap-and-trade bill in November that would require a 20% reduction in GHG emissions by 2020, as compared to 17% below 2005 levels required by ACESA. However, the bill did not even come up for a Senate vote in 2009, and its prospects for passage in 2010 look increasing problematic. Bruised by the health care debate and worried about the 2010 elections, moderate Senate Democrats are urging the White House to give up on any effort to pass a cap-and-trade bill in 2010. At least half a dozen Democrats, including Senators Mary Landrieu (D-La.), Evan Bayh (D-Ind.), Ben Nelson (D-Neb.), Kent Conrad (D-N.D.), Dick Durbin (D-Ill.) and Mark Pryor (D-Ark.), have told their leadership and the White House to forget about cap-and-trade this year. Thus, while there may be some sort of “energy and jobs bill” passed in 2010, cap-and-trade is not likely to be part of it. CO2 ENDANGERMENT FINDING: CATCH 22 On Dec. 7—not coincidentally the start date for the Copenhagen climate conference—the US Environmental Protection Agency issued its long-anticipated CO2 “endangerment finding.” The finding identified six greenhouse gases as posing a potential threat: carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons and sulfur hexafluoride. In a statement, EPA Administrator Lisa Jackson said the finding “confirms that greenhouse gas pollution is a serious problem now and for future generations.” EPA contends that climate change may lead to higher concentrations of ground-level ozone and that additional impacts could include increased drought, more heavy downpours and flooding, more frequent and intense heat waves and wildfires, greater sea level rise, more intense storms, and harm to water resources, agriculture, wildlife and ecosystems. The agency also stated that climate change has serious national security implications. The finding has entered the public comment period, which is the next step in the deliberative process EPA must undertake before it can take any steps to reduce GHGs under the Clean Air Act (CAA). The finding did not include any proposed regulations, and EPA must conduct an appropriate process and consider stakeholder input before it can take any steps to reduce GHGs under the CAA. The finding was long-anticipated because of an April 2007 Supreme Court ruling (Massachusetts v. EPA) that found that Congress had authorized EPA to regulate GHGs for climate change purposes when it enacted the 1970 CAA. That decision all but ensured that EPA would issue an endangerment finding for GHGs, which, in turn, would compel EPA under the CAA to establish first-ever GHG emission standards for new motor vehicles. However, there is a Catch 22 involved: Once EPA adopts the GHG motor vehicle standards, CO2 automatically becomes a pollutant “subject to regulation” under the CAA Prevention of Significant Deterioration (PSD) pre-construction permitting program and the Title V operating permits program. Under the CAA, firms must obtain a PSD permit in order to construct or modify a “major emitting facility,” and a permit to operate such a facility. A facility is major under PSD if it is in one of 28 categories and has a potential to emit 100 tons per year (tpy) of a regulated pollutant, or if it doesn’t fall into one of these categories and it emits 250 tpy. Millions of currently unregulated buildings and facilities—office buildings, apartment buildings, commercial and retail stores, shopping malls, heated agricultural facilities, small manufacturing firms, commercial kitchens, etc.—emit enough CO2 to meet these thresholds. EPA estimates that if PSD were to be applied as written to CO2 sources, the number of PSD permit applications per year would increase from 300 to more than 41,000, and the number of Title V permit applications would increase from 15,000 to 6.1 million. This is clearly neither technically nor politically feasible, so EPA has proposed a tailoring rule to limit the number of permits required by suspending the PSD and Title V requirements for any source emitting less than 25,000 tpy of CO2-equivalent GHGs. However, it is unclear whether EPA’s tailoring rule will survive judicial challenge because it conflicts with statutory language. Furthermore, the tailoring rule, if upheld by courts, could result in the imposition of national ambient air quality standards (NAAQS) for CO2 that could seriously harm the US economy. The endangerment finding asserts that current atmospheric CO2 concentrations endanger public health and welfare, and a NAAQS for CO2 would thus have to be set below current levels. Environmental organizations have already petitioned EPA to establish NAAQS for CO2 set at 350 parts per million (ppm). The present atmospheric CO2 level is about 390 ppm. Even if the entire world met the emissions reduction target of the Waxman-Markey bill—83% below 2005 levels by 2050—this would only “stabilize” CO2 concentrations at about 450 ppm. Not even a worldwide depression lasting decades would be sufficient to reduce CO2 concentrations to 350 ppm. Nevertheless, under established legal interpretation, EPA is prohibited from considering compliance costs when establishing NAAQS. Industry groups are also planning legal challenges, and their prospects may be favorable. EPA derives its authority to regulate pollutants from the CAA, but to use that law to regulate GHGs, the agency must prove those gases are harmful to human health. That is, it must prove that a slightly warmer climate will cause Americans injury or death. Given that many climate scientists contend that a warmer earth could provide net benefits to the US, this may be difficult. The leaked emails from the Climatic Research Unit in England (“Climategate”) are also providing rich fodder for those who want to challenge the science underlying the theory of man-made global warming. Finally, in the ultimate irony, industry groups may join environmental litigants in trying to force EPA to regulate millions of entities under the CAA. The industry groups feel that such regulation would provoke sufficient political backlash to prevent EPA from implementing any CO2 regulation. LEASING: SHOWDOWN WITH INTERIOR In my February 2009 column, I wrote that the Obama administration was likely to implement a shift away from President George W. Bush’s energy and environmental policies in a variety of areas. It did not take long. In early February, newly installed Interior Secretary Ken Salazar canceled oil and gas leases on 77 parcels of federal land that he felt would blight Utah’s scenic southeastern corner, Fig. 2. Salazar’s action reversed a decision made shortly before Bush left office to allow drilling on about 130,000 acres in Utah.

At the same time as he canceled the Utah leases, Salazar also removed eight parcels of commercial oil shale development from an imminent lease sale in Wyoming. The usual suspects reacted in the expected manner. Environmentalists praised the change in direction, but oil and gas industry officials warned that it could hamper the nation’s ability to develop domestic energy supplies in the decades to come. Also in February, Salazar announced a new strategy for energy development on the US Outer Continental Shelf. Salazar called the plan “a new way forward for offshore energy resources” that would “restore order to a broken process, so we can make sound decisions on the OCS based on sound information.” The plan added 180 days to the waiting period for public comment, and it included a 30-day period in which Salazar held a series of four regional meetings around the country. By the time the extended comment period ended in September, Interior had received more than 350,000 comments, many of them from four regional meetings that Salazar hosted in New Jersey, Louisiana, Alaska and California. Following a review and analysis conducted by the Minerals Management Service, the next step in the process, by law, requires environmental analysis and public scoping opportunities associated with the five-year plan for oil and gas development in the OCS. The industry was not impressed. In November, the Independent Petroleum Association of Mountain States (IPAMS) released a position paper severely criticizing Salazar and the leasing program. The IPAMS paper accused Interior of mismanaging the federal onshore natural gas and oil program, citing $100 million worth of unissued leases in Colorado, Utah and Wyoming; reduced lease sales, deferred leases and withdrawn leases; permitting backlogs; failure to issue permits using categorical exclusions, in violation of the Energy Policy Act of 2005; and indefinite holds on project-level environmental analysis, Table 1.

The American Petroleum Institute also criticized Salazar’s decision to make permanently ineligible for lease eight of the 77 federal oil and natural gas parcels in Utah, and to defer development on 52 additional parcels: “Today’s announcement that Secretary Salazar is removing 60 federal leases from development is just another in a series of actions this administration has taken to delay or thwart oil and natural gas exploration in areas where its development has been designated, and where lease sales have been carefully planned.” Salazar wasted little time responding sharply to industry criticism, saying in a call with reporters, “We believe that our oil and gas leasing program is robust, but it is also a program we have brought back into balance. But you wouldn’t know it if you listened to the untruths coming out of oil and gas industry groups.” Salazar said the repeated attacks had “all the flavor and deception of election-year politics” and that oil and gas companies “need to understand that they do not own the public lands; taxpayers do.” Salazar also said too many federal leases get tied up in protest and litigation, which costs taxpayers and companies money, and that Interior is undertaking a comprehensive review of onshore programs to make them more efficient and more rational. Even aside from the increasingly acrimonious debate between Salazar and the industry, it seems clear that the US oil and gas leasing process is becoming more difficult, protracted, expensive and uncertain. It is even questionable whether any significant new OCS exploration will occur under this administration, which will be in office for at least three more years. While hardly unexpected given the Obama campaign and environmentalist appointments in numerous senior policy positions, it is nevertheless dispiriting. In terms of both onshore and offshore leasing, the oil and gas industry is likely in for several years of a long, hard slog. An extended version of this article including more-in-depth analysis can be found in the 2010 World Oil Forecast and Data Book. To purchase, click here or call +1 (713)520-4426.

|

|||||||||||||||||||||||||||

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)

- Canada's upstream soldiers on despite governmental interference (September 2023)