SHALE ENERGY: Developing International Plays-Shale search goes global

Energy-hungry countries throughout the world are beginning embryonic efforts to replicate the success of US shale plays.

Energy-hungry countries throughout the world are beginning

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

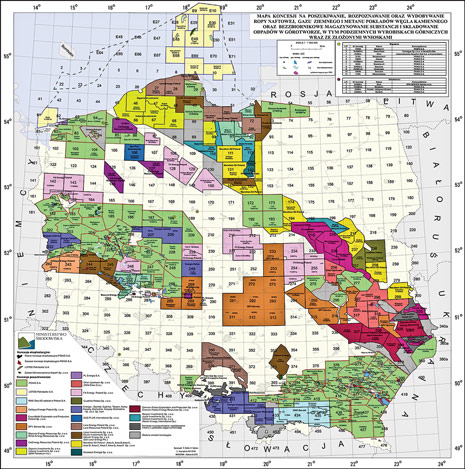

Poland. The Polish state geological institute is currently conducting an assessment of shale gas resources in association with the US Geological Survey. The first estimate will be available for the northern region in spring 2011 and then for the entire country by the end of next year. The lack of a reliable resource estimate has not stopped the country from awarding more than 70 concessions to over 40 operators in the Lublin, Mazowsze, Pomeranian and Lower Silesian regions, Fig. 2. About one-fourth of the concessions have been licensed to Polskie Górnictwo Naftowe i Gazownictwo (PGNiG), the domestic natural gas utility.

|

|

|

The gas-charged shale formation in Poland varies from 100 to 500 ft in thickness and is located at depths ranging from 8,000 to 13,000 ft. Work commitments made to the Ministry of the Environment are expected to result in about 12,000 line mi of 2D seismic, 2,300 sq mi of 3D seismic and 50 to 80 exploration wells per year. Poland had experienced a similar bubble in the 1990s when coalbed methane drilling was in vogue. If the shale activity is productive, Poland, which imports 72% of its natural gas from Russia, could become a net exporter.

The first-ever shale hydraulic fracturing operation in Poland was conducted in July by Halliburton for PGNiG in the Markowola-1 exploratory well near Kozienice in Lublin province. Production results from the fracturing operation were not revealed.

Another operator active in the drilling and completion phase is Lane Energy, a subsidiary of UK-based exploration enterprise 3Leg Resources. Lane has acquired six licenses covering about 1 million acres in the Baltic Basin and three licenses covering about 620,000 acres in the Krakow Basin. In August 2009, Lane signed a joint evaluation agreement with ConocoPhillips to develop the Baltic Basin project. After conducting seismic surveys in the region, Lane drilled its first well (Łebień LE1) to test the Baltic Basin in late September with Schlumberger as the services partner for drilling, well logging and fluids, Fig. 3. “The formation evaluation from the well is encouraging,” Kamlesh Parmar, Lane’s country manager, told World Oil. “We’re now using the well log and core analysis data to design the completion and fracturing program.” The company is also progressing with drilling operations on the adjacent Łebień LE2 well.

|

|

|

One of the larger independents that has managed to get an early entry into Poland is Marathon, which has acquired 10 concessions in the country with 2.1 million net acres. The company is planning a five-year exploration program consisting of seismic surveys commencing in the first quarter of 2011 and drilling later in the year.

Realm Energy, a Canadian independent, has identified 17 potential shale plays in Europe and is currently acquiring acreage in four countries. In Poland, Realm has about 465,000 net acres in three concessions: Wegrow with 50% of 180,136 acres, Ilawa with 50% of 161,109 acres and Gniew with 100% of 294,296 acres. The company is working with Halliburton to perform geological data comparisons with US shale plays and select prospective sites for drilling and further evaluation (see column on page D-79).

San Leon Energy, a UK-based independent, has interests in six concessions covering 600,000 acres in the Baltic Basin through a joint venture farm-out agreement with Talisman Energy. The company is using $2.18 million of Talisman funds to plan for a 2D seismic program followed by the drilling of three to six wells.

In December 2009, the Ministry of the Environment awarded five-year exploration licenses to Chevron for three concessions in the towns of Zwierzyniec, Krasnik and Frampol. The licenses permit Chevron to carry out seismic surveys and conduct exploratory drilling to 11,500 ft.

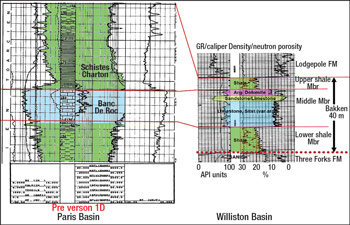

France. Significant leasing activity is taking place in the Paris Basin, which is already producing oil from conventional fields. The lease holders include French independent Toreador Resources, which has formed a 50/50 partnership with Hess to initiate a six-well program to test the Liassic Shale. The partnership believes the Liassic to be an analog of the oil-rich Bakken Shale, Fig. 4. The partners have acquired over 1 million acres in the basin. The first well in the series, which is scheduled to spud in January 2011, will be located on the Chateau Thierry exploration permit. The well will be drilled vertically using KCA Deutag’s drilling rig to an expected total depth of 10,000 ft. The primary geologic target of the well is the Liassic section, the top of which is expected to be encountered at an approximate depth of 7,500 ft. Cores will be drilled to evaluate reservoir and rock properties. Additionally, Realm Energy has applied to lease 2.4 million acres in the Paris Basin.

|

|

|

Others. Falcon Oil and Gas, based in Denver, is exploring tight sands prospects in Hungary’s Mako Trough. The independent operator has long-term production licenses for 247,000 acres in the region and has acquired 443 sq mi of 3D seismic data. Based on this data, the company drilled six wells in depth ranges from 12,000 ft to 20,000 ft. The company had entered into JV agreements with ExxonMobil and MOL, the Hungarian oil company, but both of these companies withdrew from the agreement in February 2010.

TNK-BP is planning to explore for shale gas in Ukraine’s Donetsk region with a budget of up to $2 billion with the hopes of producing 5 Bcf over the next five to seven years.

Realm Energy has secured a 15,888-acre Aschen concession in the Weser-Ems region in the Saxony Basin, located 62 mi west of Hanover. Realm intends to target the Lower Cretaceious Wealden Shale and the Lower Jurassic Posidonia Shale. ExxonMobil also holds shale acreage in Germany with no announced plans for exploration activities.

Shell is running a three-well drilling program in Sweden to test shale formations in the southern county of Skåne. The drilling activity may run into opposition from Swedish political leaders campaigning against fossil fuel drilling, according to Reuters.

Cuadrilla Resources, a privately held exploration company in the UK, holds concessions in England and the Netherlands. Through its Bowland Resources subsidiary, the company is planning to conduct exploratory drilling in southeast England.

INDIA

India’s Directorate General of Hydrocarbons (DGH) is currently working on an assessment of the country’s shale potential and expects to have a shale gas policy in place by the end of 2011. The assessment is being carried out by a multidisciplinary team with representatives from the DGH and public sector companies Oil and Natural Gas Corporation (ONGC) and Oil India Ltd. under an agreement signed with the US Department of the Interior for training of Indian staff. The shale gas policy will include a fiscal regime that will allow different conventional oil and gas, CBM and shale operators to work within a block, according to DGH Director S. K. Srivastava.

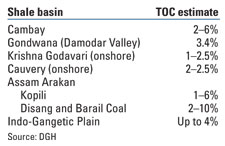

The gas-charged shale deposits in these basins are similar to those in the US, according to P. K. Bhowmick, president of India’s Association of Petroleum Geologists, but he suggests that the cost of producing the gas may be higher because of greater depth. Starting in 2006, ONGC conducted its own assessment of the shale basins. Based on gas content measurements, geochemical parameters, logistics and depth considerations, the operator has identified the Damodar and Cambay Basins as its priority areas. Table 1 lists the potential shale basins and their corresponding total organic content (TOC).

| TABLE 1. India’s shale basins with approximate TOCs | ||||||

|

In the Damodar Valley in the eastern state of Bihar, ONGC is planning to drill four wells to obtain well logs and core samples for an integrated petrophysical evaluation and subsequent resource appraisal and fracture design. The first well was drilled in October 2010 with Schlumberger as the services partner in Ichapur village in the Burdwan district of the eastern state of West Bengal. The well targeted a 2,300-ft-thick shale of Permian age at a depth of 6,500 ft.

Reliance Industries has made sizeable investments in the US shale plays in recent months. The acquisitions include interests in Atlas Energy (recently acquired by Chevron) and Carrizo Resources in the Marcellus play and a joint venture with Pioneer Natural Resources in the Eagle Ford play. These acquisitions may provide Reliance with access to shale technologies and lead the US independents to get involved in shale development in India during the coming decades.

The first Reliance shale venture may take place in the Cambay Basin, where the company has made several discoveries of conventional oil and gas. Gas shows and gas-cut mud are common occurrences while drilling toward a conventional hydrocarbon target in the Cambay Shale, which has a thickness of about 3,000–4,000 ft at a depth of 4,300–5,800 ft in the Lower to Middle Eocene section. Earlier this year, Joshi Technologies, a small operator in the Cambay Basin, conducted two of India’s first shale drilling tests in the Dholka D-A and D-B wells in association with Schlumberger. Before hydraulic fracturing, Well D-A had had no oil production from the shale section. After the fracturing, the well had achieved stabilized production of around 10 Mcfd of gas and 13 bpd of oil. In Well D-B, the shale pay produced a stabilized rate of 20 Mcfd of gas and 13 bpd of oil. (See case study at worldoil.com/Shale-Energy-India-case-study-December-2010.html).

CHINA

China is in the early stages of shale gas appraisal and exploration. The vast country may hold 900 Tcf of shale gas resources, according to the International Energy Agency, which is more than 10 times its proven reserves of conventional natural gas and nearly the same volume as the shale reserves in the US. To obtain an accurate appraisal, China is initiating a three-year study of shale gas potential throughout the country followed by an ambitious exploration and production program.

Technology will be a key factor in how quickly China develops its shale fields. To secure access to Western technologies, China is pursuing both direct collaborations with private operators and cooperation on a governmental level. During US President Barack Obama’s visit to China in November 2009, he signed an agreement with Chinese officials to create a Sino-US initiative for developing shale resources. As a result of this initiative, the two countries will appraise shale gas reserves in northern China and the Jiangsu Province, which have been relatively unexplored.

Most of the current shale testing is in the central Sichuan Basin, Fig. 5. In January 2010, CNPC and Shell began a joint assessment program in Fushun Block. This was followed up by an agreement in March 2010 to develop the Jinqiu Block, also in the Sichuan Basin. CNPC has submitted a 30-year production sharing contract proposal to the government for approval. Both blocks are about 1,500 sq mi. Shell and PetroChina already operate Changbei, a tight gas field in the Ordos Basin near Yulin in Shaanxi Province. Commercial production in Changbei began in March 2007, supplying about 19 Bcf per year. PetroChina and ConocoPhillips are also in talks for joint production from test wells in a 1,500-sq-mi block, also in Sichuan Province.

|

|

|

Meanwhile, China National Offshore Oil Corporation (CNOOC) has invested $2.16 billion to acquire a 33.3% interest in Chesapeake Energy’s 600,000 acres in the Eagle Ford Shale in South Texas. At this time, CNOOC’s role consists of funding 75% of the drilling and completion costs. Chesapeake will continue to perform all leasing, drilling, production and marketing activities. As such, CNOOC may be seeing this as a lucrative investment opportunity with the possibility of collaborating on future projects in China.

In late 2010, China is expected to offer six shale gas exploration blocks to its operating companies. The auction will consist of three blocks in Guizhou Province and one each in Chongqing municipality, Shanxi Province, and along the border between Anhui and Zhejiang Provinces. Located in the southeast region of China adjacent to Sichuan Province, each of the blocks covers an area of about 2,700 sq mi. As an incentive, the government will provide an exploration subsidy of between 0.23 and 030 RMB ($0.03) per cubic meter, according to Zhang Dawei, deputy director of oil and gas strategy research at the Ministry of Land and Resources.

AUSTRALIA

While Australia has tremendous conventional gas resources, some operators are seeking shale gas prospects in the Cooper Basin and Western Australia. Beach Petroleum is progressing on a two-well program to test the gas potential in the Roseneath, Epsilon and Murteree Formations of the Nappamerri Trough. In November, the first well found gas shows at 10,000-ft depth. Wireline logging and core analysis will be carried out. Based on the results, Beach plans to drill a pilot production well in 2011.

UNIQUE OR UNIVERSAL?

Trying to replicate the success of US shale plays elsewhere in the world is somewhat like trying to find life elsewhere in the universe. You would not think life is unique to the Earth. But will we find humans or strange beings with eyes on the backs of their heads? Likewise, you would think that shale plays would not be unique to North America. Whether we find thick, gas-saturated shale formations with lucrative potential in other parts of the world, however, remains to be seen.

![]()

ACKNOWLEDGMENT

The authors wish to thank Douglas Klepacki, Aissa Bachir, Djamel Boukhelf and Udo Araktingi from Prism Seismic and Brian Black and Vicki Stamp from the Rocky Mountain Oilfield Testing Center for their valuable contribution to this work.

LITERATURE CITED

1 Christensen, S. A. et al., “Seismically driven reservoir characterization using an innovative integrated approach: Syd Arne Field:” SPE 103282 presented at the SPE Annual Technical Conference and Exhibition, San Antonio, Texas, Sept. 24–27, 2006.

2 Laribi, M. et al., “Integrated fractured reservoir characterization and simulation: Application to Sidi El Kilani Field, Tunisia.” Journal of Petroleum Technology, August 2004.

3 Ouenes, A. et. al, “Seismically driven characterization, simulation and underbalanced drilling of multiple horizontal boreholes in a tight fractured quartzite reservoir: Application to Sabria Field, Tunisia,” SPE 112853 presented at the SPE North Africa Technical Conference and Exhibition, Marakech, Morroco, March 12–14, 2008.

4 Pinous, O. et al., “Application of an integrated approach for the characterization of a naturally fractured reservoir in the West Siberian basement (example of Maloichskoe Field),” SPE 102562 presented at the SPE Russian Oil and Gas Technical Conference and Exhibition, Moscow, Oct. 3–6, 2006.

5 Bejaoui, R. et al., “Characterization and simulation of a complex fractured carbonate field offshore Tunisia,” SPE 128417 presented at the SPE North Africa Technical Conference and Exhibition, Cairo, Feb. 14–17, 2010.

6 Jenkins, C., Ouenes, A., Zellou, A. and J. Wingard, “Quantifying and predicting naturally fractured reservoir behavior with continuous fracture models,” AAPG Bulletin, 93, No. 11, November 2009.

7 Hammad, M. et al., “Seismically driven characterization of vuggy porosity and fractures in a carbonate field, Sirte basin, Libya,” First Break, 28, October 2010.

8 Lorenz, J. “Summary of published information on Tensleep fractures,” http://eori.uwyo.edu/downloads/Tensleep_FractureStudy1.doc.

9 Cooper, S., Goodwin, L. and J. Lorenz, “Fracture and fault patterns associated with basement-cored anticlines: The example of Teapot Dome, Wyoming,” AAPG Bulletin, 90, No. 12, December 2006.

10 P. Ringrose et al., “Plume development around well KB-502 at the In Salah CO2 storage site,” First Break, 27, January 2009.

THE AUTHORS |

||

|

Ahmed Ouenes is the President of Prism Seismic. His responsibilities include business development, overseeing and executing consulting projects and developing advanced reservoir modeling technologies and software. Previously, Dr. Ouenes was Chief Reservoir Engineer at (RC)2, where he developed the first commercial software for CFM technology. He has held various positions, including vice president for an independent E&P operator and senior researcher and adjunct professor at the Petroleum Recovery Research Center of the New Mexico Institute of Mining and Technology. Dr. Ouenes graduated from Ecole Centrale de Paris and holds a PhD degree in petroleum engineering from New Mexico Tech. | |

|

Tom Anderson has worked in the oil and gas industry since 1977, including 20 years in the Rocky Mountain region. He has experience in exploration, development and production geology and geophysics, as well as significant experience in technical computing development and support. He has worked for Gulf Oil, Conoco, Unocal and Skyline Oil Co., throughout the Rockies, as well as in California, the Gulf Coast and the UK North Sea. Mr. Anderson has BS and MS degrees in geology from Brigham Young University. | |

|

|

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Oil and gas in the Capitals (February 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)