United States by World Oil Staff; Canada by Robert Curran, Calgary, Alberta;

Mexico by Dr. Daniel Romo Rico, Mexico City

UNITED STATES

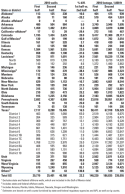

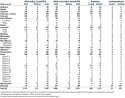

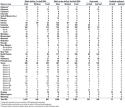

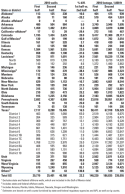

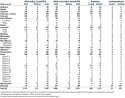

While the offshore drilling sector remains in chaos in the political aftermath of the Macondo well blowout, it appears that US drilling on the whole is recovering nicely from the lows of 2009, due to the rebound of oil prices and continued success in the burgeoning shale plays. Our midyear forecast revision estimates that 20,779 wells were drilled in the US during the first half of the year, with a 22% increase in activity expected during the second half, for a 2010 total of 46,180 wells. This forecast is 3,431 wells (8%) more than we initially predicted in February, and would represent a remarkable 24% jump in activity compared to 2009.

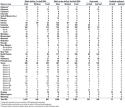

Our second-half forecast reflects the upward direction of rig counts and our midyear operator survey. The 12 major drilling companies that responded plan to drill 24% more wells in the second half than they did in the first half, for a total of 6,080 wells. Independents are even more optimistic, predicting a 44% increase in activity during the second half, for 2,555 total wells.

Area highlights. Compared to our February estimate of US wells drilled in 2009, the drilling recovery will be most pronounced in Pennsylvania, Texas’ Permian Basin, and onshore California. The latter two regions reflect the price-driven return of oil-directed drilling to near-parity after more than a decade of domination by gas. The high level of drilling in Pennsylvania, on the other hand, reflects the rapid expansion of the Marcellus Shale gas play, despite the stagnation of gas prices relative to oil. This continued growth has been driven primarily by operators’ need to drill to hold onto their leases, combined with the fact that many big operators had already signed term contracts for rigs.

Midyear revision, 2010 US

drilling forecast |

|

In truth, our 2009 estimate of 4,315 wells drilled in Pennsylvania was probably far too conservative, based on the fact that both the Baker Hughes and Smith rig counts in the state saw big increases that year compared to 2008 (83% and 64%, respectively). Those rig counts continue to balloon so far this year, hence our midyear forecast of 6,999 wells drilled in 2010.

Other gas shale plays likewise continue to expand, particularly those like the Eagle Ford and the Haynesville with prolific oil and condensate windows, further contributing to a predicted drilling rebound in Texas to 15,405 wells—almost equal to the number of wells drilled in the peak year of 2008.

Meanwhile, another unconventional gas resource, coalbed methane, has seen a remarkable collapse in activity over the last three years, and the fall of gas prices last year relative to oil may mark the end of CBM activity as a significant part of the US drilling sector, at least for the foreseeable future. Reporting of CBM wells drilled has become increasingly unreliable over the past several years, but based on our survey of state agencies and estimates for some states by Ziff Energy Group, we believe that less than 2,200 CBM wells were drilled in the US last year, a decrease of about 60% from just under 5,200 wells in 2008. For 2010, CBM drilling will not exceed 1,650 wells.

| What 12 US major drillers¹ plan for 2010—midyear update |

|

Interestingly, of the five states for which we predict the biggest drilling reductions in 2010, three of them, Wyoming, New Mexico and Virginia, had seen significant CBM booms in recent years. As recently as 2007, Wyoming drilled more than 2,000 CBM wells, over one-third of the US total that year. This year, the state expects to drill less than a quarter of that number (471 wells), and for the first time in years will be surpassed as the leading CBM drilling state—by Virginia with 492 CBM wells forecast.

While the deepwater drilling moratorium and regulatory uncertainty regarding even shallow-water drilling mean that the Gulf of Mexico will be far less active this year than in the past, slow but steady shallow-water permitting has been proceeding—despite complaints of a “de facto moratorium” across the entire offshore sector. Between June 8 and 30, the US Interior Department approved 11 permits for work in the GOM, four of them for the drilling of new wells in less than 500 ft of water. And on July 16, Apache received a permit to begin drilling a GOM gas well in about 50 ft of water.

In addition, on July 22 contract driller Ensco announced that two of its rigs had received the first permits for work on existing deepwater wells since the initial drilling moratorium took effect in May. The permits required recertification of the rigs’ blowout preventers under new safety regulations. They potentially open the way for additional permits for completions, plugging and abandonment, re-entries, workovers, injection well drilling and other activity not covered by the moratorium. This may help limit the exodus of deepwater rigs from the US Gulf so some remain to resume exploratory drilling once the moratorium ends in November.

Between the slow growth of permitting in federal waters and survey responses from operators and regulatory agencies, we expect 69 wells to be drilled in the second half of the year. Combined with first-half total of 130 wells, reflecting rapid activity leading up to the Macondo blowout, we predict a total of 199 wells to be drilled in the GOM this year, about half as many as in 2009.

About these statistics. World Oil’s tables are produced aided by data from a variety of sources, including the American Petroleum Institute, Ziff Energy Group and state regulatory agencies. Most importantly, 172 operating companies with drilling programs responded to this year’s survey. Please note credits and explanations in the table footnotes. We thank all contributors for their time and effort in providing data and analysis for this report.

World Oil editors try to be as objective as possible in the estimating process to present what they believe is the most current data available. It is understood that sound forecasting can only be as reliable as the base data. In this respect, it should be noted that well counting is a dynamic process and most historical data will be continually updated over a period of several years before “the books are closed” on any given year.

CANADA

The times remain turbulent in 2010 as Canadian producers continue to slowly pull themselves out of the two-year slump they’ve experienced since the midpoint of 2008. The troubled waters have been further stirred by politics and the prolonged slide in gas prices. And the strength of the Canadian dollar against the US dollar has taken a bite out of export revenues. But there have also been some positive signs through the first six months of the year. The relative stabilization of global oil prices has allowed oil producers to develop projects in their inventories and move ahead with larger-scale developments, including tight oil plays and oil sands. In fact, the gas-price slump has reduced costs at oil sands operations, many of which use gas as a primary feedstock.

| What 160 US independents¹ plan for 2010—midyear update |

|

The flip side is that gas producers have shut in production and scaled back or shelved exploration and development. In the long term, unconventional gas plays, predominantly shale, have taken on greater prominence in Canada, suggesting that lower gas prices may remain for a long time. Adding further pressure, per-gigajoule costs for conventional gas production have remained high in Canada, making unconventional prospects even more appealing.

Ironically, one contributing factor to the higher costs of finding and developing conventional oil and gas is yet another looming shortage of skilled labor in Western Canada. Even though activity is nowhere near the boom levels of early 2008, many skilled laborers that lost their jobs two years ago shifted to other industries. A recent report issued by the Petroleum Human Resources Council of Canada predicts that a severe labor shortage could occur as early as 2012 and that up to 100,000 oilpatch workers will be needed over the next 10 years.

Taxation and regulation. On the positive side, the situation in Alberta has improved dramatically since last year, as the ruling Conservatives recently rolled out revisions to the province’s royalty structure. Designed to stimulate activity, they have been welcomed by an industry that had bristled at previous royalty hikes. The new structure more closely aligns with the royalty regime in British Columbia, particularly for emerging resources. Producers say the changes have already translated into increased drilling in Alberta and have also resulted in some significant purchases at Alberta land sales.

In addition, British Columbia, Alberta and Saskatchewan have been examining ways to increase harmonization of their regulatory regimes and enhance producers’ ability to operate more seamlessly between the three.

On the federal front, as prospects for a US cap-and-trade law become dim, it seems less and less likely that Canada will impose one of its own. Prime Minister Stephen Harper’s ruling Conservatives have steadfastly maintained that they would only consider such a system if the Americans were implementing something similar.

Meanwhile, the chairman of the US House Energy and Commerce Committee recently submitted a letter to the US State Department, urging it block construction of TransCanada’s Keystone XL pipeline, which would ship crude produced from Alberta’s oil sands into the US. Of course, politicians and special interest groups targeting Canada’s oil sands are not new, and producers of the sticky substance appear unconcerned by what is largely perceived as political posturing, particularly given that Canada remains the No. 1 supplier of crude to the US, and oil sands alone are expected to be the leading non-domestic source of US petroleum as early as this year. Canadian oil sands operators have also been busy developing new customers, and there has been considerable interest and investment from growing Asian markets like China, Japan and Korea.

The effects of BP’s disastrous Gulf of Mexico deepwater blowout have been felt in Canada as well, with members of Parliament recently voting unanimously in support of a motion to review federal laws that govern the development of unconventional oil and gas, as well as deepwater drilling off Canada’s East Coast. In May, extra precautions were mandated by federal and provincial regulators for an offshore well being drilled northeast of Newfoundland in 8,500 ft of water.

Corporate deals. The blowout also manifested itself in merger and acquisition activity, as BP announced it would sell US$7 billion in assets to Apache, including its Western Canadian upstream natural gas business for $3.25 billion. The sale was made to cover costs accruing from the blowout.

There were also some big deals in the oil sands in first-half 2010, with Sinopec shelling out US$4.65 billion for ConocoPhillips’ stake in Syncrude Canada Ltd. Total E&P Canada Ltd. has announced that it is acquiring UTS Energy Corp., which holds a 20% interest in the Fort Hills oil sands mine, for C$1.5 billion. And China Investment Corp. acquired a 45% interest in Penn West Energy’s Peace River oil sands assets for C$817 million.

Other notable deals include Crescent Point Energy’s purchase of Shelter Bay Energy for C$1.1 billion; ARC Energy Trust’s acquisition of Storm Exploration (and its substantial shale gas holdings in British Columbia) for $680 million; Suncor Energy’s recent sale of assets in Alberta to Abu Dhabi National Energy Co. for $285 million, and divestiture of its Dutch subsidiary for $400 million to Dana Petroleum Plc; and Pengrowth Energy Trust’s expansion in northeastern British Columbia by acquiring Monterey Exploration Ltd. for $366 million.

Canadian producers also saw big improvements both in financial results and access to equity in first-half 2010. In fact, a record $6.1 billion of equity was raised, according to Sayer Energy Advisors. And most producers showed dramatic improvements in first-quarter results compared to both the previous year and fourth-quarter 2009.

Reserves and production. Reserves numbers took a big hit in 2009 on the gas side, predominantly due to negative revisions and the difficult economic environment. Numbers compiled by Nickle’s Daily Oil Bulletin indicate that producers replaced just 54% of Canadian gas output during the year. On the oil side, Canada’s massive oil sands reserves continue to take on greater prominence in the country’s energy profile. With just under 170 billion bbl booked in Alberta alone, oil sands production is expected to reach almost 3 million bpd before the end of the decade.

Conventional production in Canada has been declining steadily for many years, but the big upturn in oil sands production has more than compensated, and it now appears that Canada’s shale plays may play the same role on the natural gas side. Estimates of the size of the shale gas resource in Western Canada vary widely, with some suggesting there could be as much as 1,000 Tcf in place. And shale gas is showing potential in areas of Canada that haven’t previously experienced significant oil and gas development, such as Quebec, where Talisman is pursuing the Utica development close to the St. Lawrence River. The biggest challenge there will be the lack of infrastructure.

Despite the rhetoric from certain politicians and activists, oil sands remain the keystone of the Canadian energy landscape and, on the oil side, of North America as a whole. According to a recent report by the International Energy Agency, increasing oil sands production should more than offset declining US and Mexican oil output, and increase North American production by over 100,000 bpd by 2015.

There are currently three operating oil sands mines in Alberta and nine in situ sites (all of which employ steam-assisted gravity drainage, or SAGD, technology). Two more mines are under construction—Shell Canada’s Jackpine and Imperial Oil/ExxonMobil’s Kearl Lake mines—and seven in situ projects are being developed: Cenovus’ Christina Lake Phase 1C; Connacher Oil and Gas’ Algar Pod 2; ConocoPhillips’ Surmont; Devon’s Jackfish 2; Laricina Energy’s Saleski; Statoil’s Leismer demonstration, and Suncor’s Firebag Stage 3.

Add to this 10 or more proposed mining projects and more than 20 proposed SAGD extraction facilities, and it’s easy to see why most Canadian oil production forecasts are so bullish. Overall, Canadian crude output is expected to increase again in 2010 and could average well over 3 million bpd for the year.

As good as the outlook is for oil, the gas front is decidedly bearish. Canadian gas production is expected to decrease again in 2010, and although there is some hope that unconventional sources like shale gas will offset that decline, the trend will not be reversed until the economics for gas improved dramatically in North America.

Land sale revenues. The brightest spot for the Canadian industry this year is in land sale revenues collected by governments across the country. Leases and licenses acquired in these sales form the basis for future drilling plans and are viewed as an indicator of future activity. For first-half 2009, total Canadian revenues from land sales were less than C$400 million. That decline was felt most deeply in Alberta, where revenues fell to just $102 million, compared to the $2.2 billion collected in first-half 2006. But halfway through 2010, governments collected $1.7 billion across the country, the third-highest total on record, and an increase of almost 350% over the same period one year ago. The high-water mark was set in 2006, when governments took in $2.7 billion.

Alberta has posted the largest turnaround, taking in $837.9 million, an increase of more than 700% over last year’s first-half total. And the first sale of the second half, in early July, brought in another $450 million, pushing Alberta over the billion-dollar mark.

British Columbia also recovered nicely from last year’s doldrums, collecting $609 million, up almost 150% from $246 million in 2009. The bulk of that was made at the June sale, which brought in over $400 million. Industry observers are crediting interest in prospective shale-gas properties—Duvernay in Alberta and Cordova Embayment in British Columbia—for the big individual sales in both provinces. To the east, Saskatchewan garnered $276 million from its three sales, an increase of over 665% from the $36 million it collected through six months in 2009.

Drilling. Notwithstanding the positive signs from land sales, drilling totals did not recover in the first half of this year. Through six months there were 5,367 wells drilled, down almost 11% from the 5,497 wells drilled in 2009. But there are some positive signs.

The number of well permits issued across Western Canada is up substantially in 2010, which has created some optimism that drilling totals may recover sooner and by more than initially predicted for the year.

In response, the Canadian Association of Oilwell Drilling Contractors has increased its 2010 Western Canadian forecast to 11,587 wells drilled, compared with its previous forecast of 8,523. And the Petroleum Services Association of Canada has also upgraded its forecast substantially, predicting 11,250 wells drilled this year, versus its last forecast total of 9,00

MEXICO

Although upstream operations continue to be the main activities undertaken by the Mexican national oil company Pemex, the challenges are increasing because of declining oil and gas production.

Oil output averaged 2.6 million bpd in 2009, almost 25% less than its peak in 2004. The decrease is primarily due to the continuing depletion of the most important productive reservoir in the country, Cantarell Field, due to natural decline and shut-in of wells. As a result, Mexican crude oil exports have fallen from 1.9 million bpd to 1.3 million bpd in the past five years.

Nevertheless, in 2009, gas production averaged an all-time high of 7.0 Bcfd, though this average occurred during a period of decrease, from record output of 7.3 Bcfd in December 2008 to 6.9 Bcfd in May 2010.

To sustain production, Pemex has implemented several strategies, the most important being to increase the replacement rate of proved and total reserves; improve recovery ratios to reduce field decline curves; develop mature fields and new fields in shallow waters; intensify deepwater exploration; and maintain competitive discovery, development and production costs.

The strategies have been supported by increases in investments. In 2009, E&P capex grew 9.9% to $13.4 billion, compared with an average of $9.0 billion from 2004 to 2007. In particular, exploration investment reached $2.2 billion in 2009, similar to the 2008 level but higher than the average of $1.4 billion from 2004 to 2007.

Drilling activity. Intense drilling activity played an important role in Pemex’s strategy from 2003 to 2009, resulting in a total of 5,774 wells completed during that period. During 2009, drilling was mainly focused on increasing the production of non-associated gas in the Burgos and Macuspana regions and of heavy crude oil in the Ku-Maloob-Zaap (KMZ) project and the Aceite Terciario del Golfo (ATG, previously called Chicontepec) project.

The number of wells drilled has grown consistently since 2006, and in 2009, Pemex increased drilling over 80% compared with the previous year to reach 1,490 wells; of these, 71 were exploratory wells and the remainder development wells.

Forty of the exploratory wells (56%) were completed in the Northern region, 17 in the Southern region and 14 in the Marine region. Likewise, the development wells were mainly (90%) drilled in the North, primarily in the ATG and Burgos projects.

Last year, the success rate for exploratory wells was 36%, less than the 50% average of 2000−2007, because exploratory activity was increasing in new fields. In contrast, the success rate for development wells was 94%, the highest since 2005 and a remarkable result by international industry standards.

In 2009, the average number of active drilling rigs reached 176, 33 more than in 2008. Of the total, 86% were development rigs and the rest exploratory. Pemex owns 126 drilling rigs and was able to drill over 2,337 mi, or an average of 8,184 ft/well.

Reserves and discoveries. In spite of the effort, exploration yielded 388.9 million boe of new proved reserves in 2009, just 24.3% of total oil and gas produced. However, due to field development, 750.9 million boe were reclassified as proved developed reserves.

To better capture reservoir geometry and to increase the reliability of geologic models, Pemex has increased 2D and 3D seismic acquisition since 2005. During 2009, the company acquired 6,960 sq mi of 2D seismic, more than double the level of 2008. The studies were basically applied in the Cinturón Plegado Oreos and Golfo de México B deepwater regions. In addition, Pemex acquired 7,059 sq mi of 3D seismic data, with 56% focused in the deepwater GOM. The rest of the 3D seismic studies were developed in the southeastern basins, as well as in the Burgos and Veracruz projects.

A total of 13 fields were discovered last year, seven of which contain non-associated gas while the remaining six yielded crude oil. Ten fields were discovered onshore: six in the North and four in the South. The other three fields were discovered offshore: two in the Northeastern Marine region and the other in the Southwestern Marine region.

The replacement rate of proved reserves has steadily improved over recent years. During 2009, it reached 77.1%, the highest rate obtained since the adoption of Rule 4-10(a) of Regulation S-X of the Securities and Exchange Commission, defining proved reserves. Pemex has set the goal to achieve a 100% replacement rate by 2012, primarily through development of the KMZ, Crudo Ligero Marino and ATG projects, as well as through delineation activities.

Pemex holds a portfolio of nine exploratory opportunities for oil in deepwater: Cinturón Plegado Perdido, Cinturón Subsalino, Oreos, Quizini, Nancan, Jaca-Patiní, Quimera, Linterna and Sable. To develop some of these areas, Pemex has been considering the scheme of comprehensive contracts to lease exploratory and development activities.

Production. The company is reviewing its strategy in the ATG project, because crude oil output has been much less than expected considering the high level of investment. In addition, the National Hydrocarbon Commission suggested reviewing the operation of the ATG project in order to increase the reservoir’s productivity. As a result, Pemex has signed agreements with Weatherford, Halliburton, Baker Hughes, Schlumberger and Argentina’s Tecpetrol for the installation of field laboratories to help reduce failures and to improve recovery with lower operating costs.

In October 2009, the Chamber of Deputies, the lower house of Mexico’s Congress, approved fiscal regime changes for Chicontepec and deepwater GOM fields to increase their profitability, because the operating costs are higher than in the others Mexican fields.

The depletion at Cantarell is largely attributable to the decrease in the Akal-Nohoch project, which produced up to 2.4 million bpd in 2004, but less than 500,000 bpd in November 2009. KMZ has partially offset this decrease and has become Mexico’s most important crude oil producer, with more than 800,000 bpd and the greatest proved reserves of all Pemex projects. KMZ and Cantarell account for 55% of crude oil production in Mexico.

The Southwestern Marine region contributes 20% of total crude output, and has increased its production by 129,000 bpd from 2004 to 2009. The Southern region contributed an additional 20% of total crude oil production. To increase the recovery factor in some important projects, such as Antonio J. Bermúdez, Delta del Grijalva and Jujo-Tecomiacán, Pemex is drilling additional wells and implementing pressure maintenance programs. This strategy has been partially successful, in that it has avoided output reductions at these fields. The Northern region, mainly dependent on the success of ATG, produces the rest of Mexico’s crude oil.

As for Mexico’s gas output, 64% of it is associated and 36% non-associated. Associated gas production increased in 2009 in the Southern and Marine regions, particularly in the Litoral Tabasco, KMZ and Macuspana business units. Burgos and Veracruz, in the North, contributed 59% and 32% of the total non-associated gas, respectively, despite a 27% reduction in output from three of the most important fields.

Pemex needs to make significant capital expenditures to maintain its current production levels and to increase its proved reserves. In the current market context, high oil prices could be a favorable factor to support the growth program at least in the next three years. The Mexican government maintains healthy finances that are supported by the available funds in the Stabilization for Pemex Investment in Infrastructure Trust and the Oil Revenue Stabilization Fund. And with the implementation of the 2008 energy reform, the company has reached some independence from the government in its decision process, in particular through the influence of the four new professional independent board members.

In the political arena, it is safe to state that no additional changes are expected in the Mexican legal framework at least until after the 2012 presidential elections, because the energy sector will not be a priority in the agendas of the political parties.

|