Four fields with differing characteristics require a nimble and varied development plan. The challenges are being met with an extension of existing technologies, some of which are still uncommon, and the introduction of some truly new ones.

Perry A. Fischer, Editor

In 2000, Shell began exploration drilling that resulted in the discovery of six fields in Block BC-10 in northern Campos Basin, 60 mi off the coast of Espirito Santo, Brazil. Subsequently, a substantial exploration and appraisal program involving 13 wells was conducted, as well as the needed engineering and pre-FEED studies for commerciality. Of the six discoveries made in the block, four were declared commercial in December 2005. In keeping with governmental wishes, the area was named the “Parque de Conchas” (Park of the Shells), with individual fields named after seashells. They are: Ostra (Oyster), Abalone, Argonauta and Nautilus.

Recoverable reserves estimates are 400 million bbl of oil for the combined fields. Water depths in the area range between 4,900 and 6,900 ft (1,500 and 2,100 m), while the horizontal distance across the fields is about 13 mi. The fields are remarkable shallow sub-seafloor at 2,950 to 3,940 ft (900 to 1,200 m), which means that the planned, long horizontal producing wells will have to have a tight radius bend after exiting the surface conductors. Oil quality varies across three of the fields, from 17° to 24°API gravity and with varying amounts of associated gas as well with 32 to 42°API gravity in Abalone Field, whose reservoir lies deeper at 5,580 ft (1,700 m), Table 1.

| TABLE 1. Field attributes of Shell’s Parque de Conchas in BC-10* |

|

|

A simple development plan would not work for all of the reservoirs involved. Thus, the challenge was to develop a plan that offered as much commonality as possible while accommodating the particulars of each reservoir. Phased development and some “first time” use of technology were needed.

BACKGROUND

In 1997, when Brazil re-opened its oil industry to foreign investment, Petrobras was permitted to retain selected offshore and onshore blocks. One of those blocks was BC-10. The government granted an exploration license in 1998, and Petrobras then solicited farm-in partners. By 2002, Petrobras held a 35% interest, as did Shell, while Esso and Mobil each had a 15% interest. In 2006, Shell exercised a pre-emption option for an additional 30% interest. In addition, Petrobras waived its pre-emption rights and, with Shell’s blessing, sold half of Shell’s additional stake to the Indian state firm ONGC Videsh. Today’s ownership is thus Shell, 50%, operator Petrobras, 35%, and ONGC, 15%.

Shell began producing offshore Brazil in 2003 with its Bijupira and Salema Fields, which are located in BM-C-14 Block not too far south of BC-10, Fig. 1. In addition, Nautilus Field stretches over BC-10 and BC-60 Blocks where it becomes Mangangá Field. Shell and Petrobras, after many months of negotiation, made an agreement that gives each company a 50% share of the unitized reservoir. The delay was caused by the potential share of reservoirs located in a deeper, pre-salt, unexplored area. The agreement now goes to ANP, the governmental regulatory agency, for approval.

|

|

Fig. 1. Location map of BC-10 and nearby fields.

|

|

DRILLING AND DEVELOPMENT

The development is planned in two phases. Phase I is ongoing and should last through most of next year. Ostra Field will be the first field developed, with Abalone and Argonauta “B” West Fields close behind. Phase II will continue through 2013 and will begin with Argonauta “O” North Field. First oil is scheduled for late 2009. The concession lease assumes a 27-year field life.

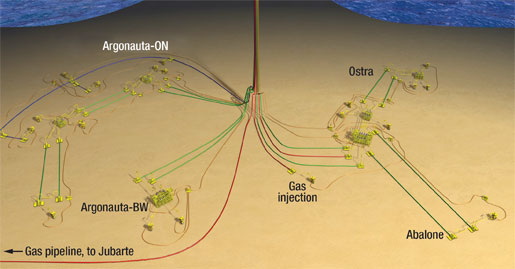

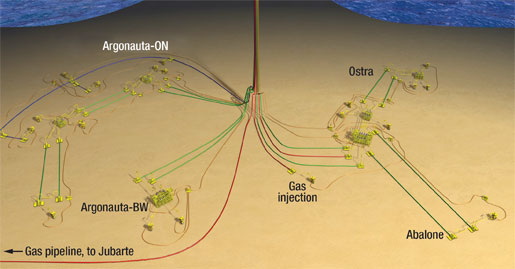

Shell opted for a leased FPSO for BC-10. Keppel FELS Shipyard in Singapore is converting the FSO XV Domy into the FPSO Espirito Santo, with an oil processing capacity of 100,000 bopd, a water-injection capacity of 75,000 bpd and a storage capacity of 2 million bbl, Fig. 2. Production from 14 wells will feed the FPSO, which will be moored in 5,840 ft (1,780 m) of water. After some gas pre-processing, a 25-mi (40-km) subsea gas pipeline will transport the gas to Jubarte platform, Fig. 3.

|

|

Fig. 2. The FPSO Espirito Santo, now double hulled, will handle the oil and gas production.

|

|

|

|

Fig. 3. Layout of the various subsea elements of the BC-10 complex.

|

|

The vessel will be equipped with electric turbines able to generate 60 MW of power for operating the facilities. SBM will own and operate the unit for 15 years with an option thereafter.

The Stena Tay, a fifth-generation semisubmersible, drilled the first 12 wells at BC-10. Another well was drilled with Transocean’s Deepwater Navigator drillship. The development wells now being drilled are planned to have substantial horizontal sections that may reach 3,200 ft and have openhole gravel-pack completions.

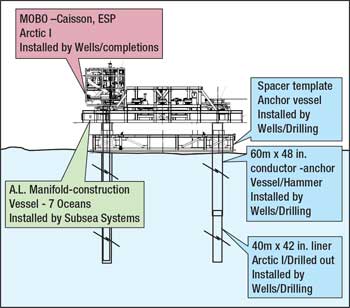

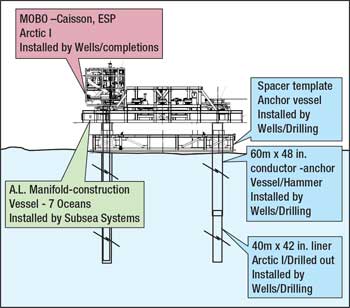

Ten subsea trees of a new design from FMC will be installed. Called Enhanced Vertical Deepwater Tree (EVDT), these 10,000-psi trees will have a 5-in. production bore ID. The EVDT subsea tree system goes hand-in-hand with a surface BOP drilling system. Shell will drill and complete the wells in conjunction with its reduced-bore riser. This allows a cheaper, third-generation semisubmersible rig to be used, in this case, the Arctic 1 from Transocean (originally from Global SanteFe), Fig. 4. A 34-month extendable contract had a day rate of “just” $270,000, which is good in today’s deepwater rig environment.

|

|

Fig. 4. The upgraded Arctic I, a third-generation semi.

|

|

The dry BOP system (Fig. 5) has been used before by Shell for exploration off Brazil, but this is its first use for development drilling. The relatively benign Brazilian waters are essential for the cost-saving dry-stack drilling method; however, it can still be disconnected in an emergency.

|

|

Fig. 5. Schematic of the dry BOP stack system.

|

|

The Arctic I has an onboard computer system that runs Halliburton’s Insite Anywhere web delivery service. Using the Real Time Operations Center system, Shell can track drilling performance and make the data accessible to office personnel around the world.

Although these reservoirs are all turbidites, they have very different thermal histories. Argonauta B West Field has a low GOR, while Abalone and Ostra Fields both have higher gas content, so Shell is incorporating one of the first developments to use subsea oil and gas separation and pumping. All told, there are six subsea ESPs planned (supplied by Baker Hughes’ Centrilift). The six 48-in. caissons offer some flexibility in that a well can be flowed into a different caisson if an ESP needs servicing, without affecting production. Four of these are to be used with a new liquid-gas separator. The remaining two ESPs will have some multiphase capability.

The idea is based on Petrobras’ VASPS (Vertical Annular Separation and Pumping System) that was used in Marimba Field, offshore Brazil. Installed in a 36-in. conductor pipe sunk into the seafloor, adjacent to a production riser, raw well fluids are “swirled” about a helix that is welded on the outside of 121⁄2-in. pipe, which causes the gas-liquid separation as the fluids fall and swirl. Gas is then shipped via a separate pipeline while the liquids are pumped with an ESP through the 12½-in. pipe and up a production riser to the surface.

The new separation system is also caisson mounted into the seafloor, Fig. 6. The difference between this and the VASPS is that the raw well fluids are swirled inside a computer-designed “gooseneck,” which imparts a centrifugal velocity to the fluids as they fall downward, Fig. 7. At the end of more than a 200-ft drop, the gas has broken out of the liquid, and gas and water are handled separately as with the VASPS design.

|

|

Fig. 6. Schematic of the subsea seperation/ESP caisson system.

|

|

|

|

Fig. 7. How the subsea gas-liquid separator works.

|

|

In Phase II, Argonauta-ON Field will use a twin-screw design for multiphase pumping to the FPSO.

The development will include the first application of steel-tube hydraulic and multi-circuit high-power umbilicals. These can deliver power to operate 1,500-hp pumps on the sea floor.

Three dynamic and two static umbilicals will total 32 mi. The first combined multi-circuit high/low-voltage umbilical with fluid circuits for chemical injection will be used in the project. In addition, the project will install 10 steel pipelines totaling 68 mi. and 25 rigid jumpers on the seafloor.

It will also be the first application of “lazy wave” steel riser technology. The risers use buoyancy collars to reduce the load at the set-down point. The six risers will connect to a weather-vaning FPSO turret. This allows the use of larger-diameter risers than would otherwise have been possible.

Oceaneering will provide the subsea umbilicals. Hot oil circulation will be needed to help the heavier oil reservoirs flow. Valourec and Mannesman’s subcontractor, Bredero Shaw, will provide anti-corrosion and flow-assurance coating for the deepwater pipeline.

COMMUNITY

While Shell’s lease agreement does not require keeping a quota of local employees, the company does have to put out all offers for bids for work in Portuguese and give due consideration for local firms. Still, as this writer can attest as a result of a recent trip to this area of Brazilian coast, it is a land of extremes in terms of rich and poor. Subsistence work such as fishing can no longer support the local population and certainly cannot provide a platform for growth. With the juxtaposition of the great wealth that projects like BC-10 create, Shell knows the importance of getting and keeping local community support.

The company has been actively engaging and supporting the coastal residents. The company helped start a small fish-meal patty business that supplies local schools. The fish are caught and prepared by local residents, and the small amount of capital needed and the bureaucratic know-how to get the needed licenses were supplied by Shell.

Another small business is an oyster-farming experiment, Fig. 8. The “seeds” are bought from Japan by Shell and local aspiring oystermen grow the oysters to market size and then sell them. As an experiment, it is not clear whether this could be the start of a new industry, given the environmental sensitivity of the area. Regardless, community involvement on a personal level such as these and other projects engenders support and is highly cost-effective as well.

|

|

Fig. 8. An oyster-farming experiment in coastal waters of Brazil, an example of community involvement.

|

|

Shell is also the sole sponsor of an ongoing (since 2002) whale study off Brazil. Last year, Shell renewed its sponsorship for another 5 years. The study is discovering a lot about cetacean behavior though a tagging program, Fig. 9.

|

|

Fig. 9. Tagging whales off Brazil-Shell is the sole sponsor of this ongoing, 10-year study.

|

|

SUMMARY

Keeping a positive relationship with the local population is essential. Equally important is ensuring economic viability of the project. Developing four fields of such widely varying characteristics, as well as a large geographical separation in ultradeep water, requires a combination of unique technologies. This includes lower-cost rigs with surface BOPs for drilling; lighter, buoyant steel umbilicals and risers; subsea gas-liquid separation; water and gas injection; and multiphase subsea pumping are some of the technologies needed to make the project an example in deepwater project economics. Much of this technology will surely become routine as it is applied to other deepwater developments.

|