Editorial comment

The supply and demand wedgie

The atomic wedgie For those unfamiliar with Western schoolboy culture, a “wedgie” is what occurs when someone sneaks up behind you, grabs your underwear, and pulls it up quickly, wedging it between your butt cheeks; hence the name. An “atomic wedgie” is essentially the same thing, only the underwear is pulled up so high that it can be brought down and over the head and eyes of the victim. Admittedly, it’s a theoretical construction, since in reality, underwear will rip before they will stretch that far. But it was still a fun goal to shoot for. I’m sometimes told to “keep it simple” in this column. That won’t be possible this time. So if you’re not familiar with oilfield volumes and units, you might want to stop here. As part of this forecast, we ask state and governmental agencies for their well-drilling and production data. On the production side, there are more sources of data than ever; unfortunately, they rarely agree. Occasionally, we even have a disagreement between a monopoly national oil company and that country’s federal energy department. Oil data is crummy, and when you try to get it early, i.e., a few weeks after the year ends, it’s even more of an estimate-something to keep in mind as you read this. Most of it will continue to be revised over the next two or three years. So, with this mindset, we came to the conclusion that, whatever the risk of an impending peak in world oil production, that risk is now greater. We are forecasting that 2007 conventional crude and condensate production fell 0.5% but that was using optimistic figures-it easily could be double that. Equally troubling is the still somewhat rosy prediction by the official governmental agencies, the US’ EIA and especially, the international IEA. I say “somewhat rosy” because, to be fair, even those agencies are becoming more cautious about their forecasts. Just in case you’re not up to date, all of us who gather data and monitor oil production have noticed that, over the last three years, the category known as crude plus condensate production has been faltering. We know that two of the world’s great production provinces, the North Sea and Mexico, have peaked. The hope was that, through strong governmental effort, high prices and a little luck, the rate of decline would be manageable, allowing the rest of the world time to make up the difference. But with each passing month, it is becoming apparent that neither of these areas are having much luck, and I would not be surprised to see the North Sea fall 3 to 6% annually, while Mexico will be lucky to keep decline to 5% (but 9% would not be surprising). There is a long list of projects due to come online in the next two years. But we were told this last year as well; so far, it has not been enough to offset depletion. Maybe next year. And further out, potentially spectacular discoveries off Brazil offer a new source of production (see Exploration on page 23). The IEA has been filling the growing “wedge” between demand and supply with various other liquids, but mostly NGLs. But all forecasts and scenarios from any agency assume that conventional production increases at least a little-and certainly doesn’t go down near term.

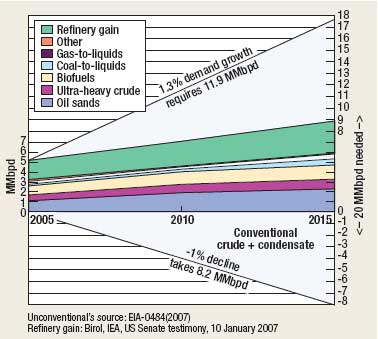

Here’s the problem. Looking at the graph on this page, you see reasonable projections of various non-conventional liquids from 2005 to 2015. At the bottom is a projected falloff of just 1% per year, which translates to 8.22 million bpd less in 10 years. At the top is just 1.3% per year increase in demand, which is a little below the 20-year average of 1.6%. This grows to an 11.9 million bpd increase in 10 years. The difference, 20.12 million bpd, will have to be made up with other liquids. As the graph shows, unconventional liquids and refinery gain could supply an additional 10 million bpd by 2015. That leaves 10 million bbl that NGLs will have to make up. The world now produces 276 Bcfd of gas, and that gas produces about 10 million bpd of NGLs, which is a reasonable ratio. However, to get another 10 million bopd of NGLs, would require another 276 Bcfd of gas, in other words, doubling world gas production in 10 years-a truly phenomenal growth rate. IEA forecasts that NGLs will add 1.9 million bpd in 10 years, so we’re about 8 million bpd short for the 1% decline scenario. So there’s the problem. For things to balance, either conventional production has to at least remain flat, or demand has to remain flat, or some combination of very small (~0.5%) demand increases and conventional supply declines to allow liquids to catch up. As is usually the case, it’s up to Saudi Arabia to settle the world’s nerves. But this time it’s Saudi that is the most off in production-about 1 million bpd over the last two years! Stranger still, this is on the heels of an ongoing surge in drilling activity, with the Kingdom adding upwards of 2,000 wells a year for the last three years, ostensibly just to shut them in under a plan to increase production capacity, but not actual production. That’s a very expensive thing to do, which is something that the Kingdom often mentions. Still, to allow production to fall a million barrels a day is a lot of money to forego. Is Saudi again playing the role of swing producer, to hold OPEC production down and keep prices high? Or are they already producing all that they can, with no spare capacity? No one can say for certain. Perhaps all of this is just due to noise in the data, which, given time, will smooth out. But 2005 through today appears to show an undulating, but nevertheless downward trending conventional crude production. If this continues even at a modest rate, the resulting wedge will grow to unmanageable proportions. At worse, it just means that prices will be high, probably very high, and the word “stagflation” will resurface. We’ll all be driving more fuel-efficient cars, carpooling and finding ways to use less oil. And all of us in the oil business will benefit. It will be a repeat of the early 1980s, but for different reasons. And, just to show us how fickle the world is, the whole thing could suddenly reverse-supply becomes balanced due to a collapse in demand, a price crash follows, just as a spate of expensive projects come online and add supply. In other words, a repeat of 1982. I do know that the wedge cannot grow. Maybe the data is wrong, purely by accident. Or maybe it’s a different kind of atomic wedgie-maybe somebody’s pulling the wool over our eyes.

|

|||||||||||