Improvements in detection technology allow for much better qualification and mitigation of leaks; hydrocarbon gases get rerouted through the sales line.

Perry A. Fischer, Editor, World Oil; Larry Richards, Hy-Bon Engineering

Volatile Organic Compounds, or VOCs, are ubiquitous in the oil industry. Whether from associated gas, some part of the gathering or processing facility, or from storage, the gas is typically wet, low pressure and is often vented or flared in facilities across the globe. Over the past three years, several major technology advances have increased the ability to identify and remedy these gas streams, collectively known as LDAR (Leak Detection And Repair). This has made environmental monitoring and compliance much easier. Equally important, with gas prices ranging between $7 and $10 per Mcf, capturing this gas makes good economic sense.

By far the most striking of these new technologies is the invention of a camera that allows oil and gas companies, for the first time, to actually see these leaking gas streams, something that previously was only captured by equations and imagination.

BACKGROUND

In 1993, David Furry of LSI, a small leak detection company in Early, Texas, began working on a way to allow a viewer to easily see previously invisible hydrocarbon gas streams. By June 2003, he had applied for a patent for a process that filters light so as to exclude those parts of the thermal spectrum, the 3−5-µm range, that correspond to a wide range of hydrocarbon molecules. The compounds detected are shown in Table 1. The camera causes hydrocarbon gases to appear as black or white smoke against a contrasting background. Although Furry is the inventor and holds the patent, he needed a manufacturer to make the camera in a compact, rugged, package weighing less than 5 lb. FLIR was ideally suited to manufacture the camera, as it already is a major producer of thermal imaging cameras for use in various industrial and military applications. So a deal was struck, and the cameras are available through FLIR.

| TABLE 1. Detectable hydrocarbons2 |

|

|

APPLICATIONS

The first time you view a production facility through this camera, it’s a surprising experience. While companies such as Hy-Bon Engineering - a leak detection and vapor recovery specialist out of Midland, Texas - have been capturing low-pressure gas on locations for 55 years. The new camera allowed the company to learn more in the past two years about emission sources and how gas actually functions than in the previous 53 years.

Finding leaks. Traditionally, a “gas sniffer” or soap solution is used to find fugitive leaks. This is a slow process that requires the technician to be in close proximity to the valve, flange or hatch that he is investigating; this includes overhead piping. As David Furry noted, “Using traditional methods, a technician can check about 500 components a day. The camera can check 3,000 components an hour.”1

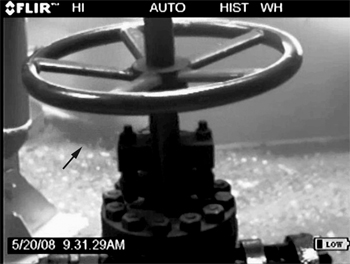

The camera’s sensitivity allows a wide range of emission sources to be seen. Small leaks from valves, pipe threads or pneumatic devices can easily be seen on a component-by-component basis, Fig. 1. Equally important, an entire area can be viewed from a distance to identify large-volume sources of gas leaks, including stock tanks and pipelines viewed from a plane or helicopter. The camera is not cheap, costing in the $50,000-$100,000 range, with aircraft-mounted versions costing up to $600,000.1

|

|

Fig. 1. Leaking valves (arrow pointing at “smoke”), PSVs and stock tank hatches are common sources of leaks. Courtesy of Hy-Bon.

|

|

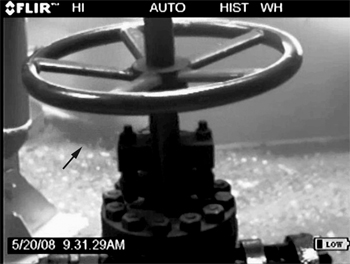

While the camera doesn’t differentiate between various hydrocarbon gases, it does give you some clues if you know what you’re looking at. For example, high-methane gas (methane being the lightest hydrocarbon) floats upward as it exits. In contrast, a heavier gas (higher VOC count) drifts more aimlessly and, if heavy enough, can be seen flowing downward as it exits the emission source, Fig. 2.

|

|

Fig. 2. Using the hand-held camera, even small leaks (weather permitting) can be seen as “smoke” through the viewfinder. Courtesy of Hy-Bon.

|

|

Most oil companies - at least those that can afford it - have now purchased one or more of their own cameras and are gaining experience. Still, many companies have and will continue to use the services of experienced leak detection and vapor recovery companies. Hy-Bon helped a major oil company this past spring at a tank battery in southwestern Texas - with some profitable results. Several leaks were found. In addition, vapor recovery equipment was installed as a result of a tank testing. When combined, this added over 100 Mcf a day to the bottom line. The math comes to about a million dollars over three years using a

$7/Mcf gas price.

Chesapeake recently used the technology to find leaks at a Texas gas processing facility. A vapor recovery unit was already on location, but it was not capturing any gas. The operator was concerned that a dramatic drop in gas volumes may have been related to installation of the new equipment. After paying a serviceman for three days on location, it appeared there was nothing wrong with the unit - it just wasn’t seeing any gas pressure off the tanks.

A survey team equipped with the new camera and a truckload of new gas quantification tools began working to identify all gas emissions at the facility. In a few hours, 12 separate emission sources had been identified and documented. These included a malfunctioning pressure/vaccum relief valve, faulty thief hatches and a small crack in one of the tanks. By actually seeing the vent gas on video from each source, the company was able to quickly fix each component. Gas production from the tanks went from 0 to 56 Mcfd immediately, and has averaged 45 Mcfd for the past three months. Even this small battery, at today’s commodity prices, will pick up $115,000 per year in additional revenue from these repairs.

Chevron and Chesapeake have been leaders in environmental stewardship, and it’s great when that approach also derives strong financial benefits for these companies.

Quantifying leaks. There are a few basics to know if you want to try the do-it-yourself method. First, the 90/10 rule applies: 90% of leaking gas comes from 10% of the leaks. Second, know that the big three sources of leaks are fairly consistent, regardless of location. In descending order, they are vents on oil/condensate tanks, leaking valves and seats at compressor stations, and venting casinghead gas at or near the wellhead.

Through the camera, the velocity of the escaping gas appears greater with increasing flowrates. Experience looking through the camera helps in finding leaks and making these qualitative judgments. Butch Gidney at Hy-Bon uses a qualitative method similar to a color strip that is used in chemistry to check pH. He takes videos of leaks and compares them to a row of pictures of leaks with known volumes, aligned in order of flowrate.

Once the leaks are identified and qualitatively high-graded, the real trick is to accurately quantify a gas stream that is often extremely low pressure, high Btu, wet and often contains H2S or other impurities. There is no one method that works universally when it comes to quantifying these gas streams.

If the leak is large enough, but not too large, then a bag, typically 3 cu ft in volume (but it can be any known practical size), is taped or fixed around the flange, valve or whatever is leaking (assuming that it’s physically possible). A simple timer then tells the story. If, say, after three measurements, the leak is found to fill a 3-cu-ft bag in an average of 1 min., then the leak rate is 180 cu ft an hour (3 x 60), or 4.32 Mcfd (24 x 180).

Many leaks cannot be bagged. Quantifying the volumes from oil and condensate storage tanks requires different sized meters and approaches - depending on whether you are metering 2 Mcfd on a small tank battery in Wyoming or a 2-MMcfd gas stream on a production facility in Mexico.

For some leaking stock tanks, a specially designed turbine meter, configured for testing volumes of leaking hatches and vents, can be used. For small leaks or leaks too awkward to be bagged, a calibrated “vacuum cleaner” - essentially, a sniffer hooked up to a fan in a pipe, which sucks up the leaking gas - is useful. The fan pushes a known volume through the pipe, while the sniffer tells what percentage of the flowstream is gas. Simple math gives a good estimate.

When the gas is “leaking” because it’s designed to, or at least allowed to in the case of some associated gas, then vapor recovery may be needed. The technology available to capture this gas has also improved dramatically over the past five years, but the absolute key is designing the equipment for the proper volume, pressure and gas analysis of the location. The old carpenter’s rule is especially true in the capture of associated gas - measure twice, cut once. The probability of success of any associated gas capture project literally doubles if time is taken to identify all the relevant gas streams, accurately measure the gas, and get a good gas analysis prior to equipment design. The payoff for all this hard work is a rare opportunity to make both the HSE and accounting departments champions.

There is a limitation with the camera. The ability to see leaks is dependent on good weather conditions. Heavy rain can obscure the “smoke” image, while wind can simply blow the leak away. So unless it’s a really big leak, you probably won’t see it in windy conditions. Sunny, windless conditions are ideal. The stronger the wind, the fewer leaks the camera can see. Windy locations, such as the North Sea and other offshore settings, would have to have a camera on standby for months to take advantage of those few hours during the year when the wind isn’t blowing.

Seeing into vessels. Also, as in “ordinary” thermography, the thermal properties of the camera allow imaging the side of a stock tank, separator or other vessel, to reveal the levels of sludge, condensate, oil and water in the tank. Efficiencies can be greatly enhanced when it is known that buildup of sludge or paraffin is interfering with the stratification, layering and separation of fluids.

LOOKING AHEAD

For now, everything is amicable between owners, unions and government regulators. The added safety, both from a hazardous vapor viewpoint, and from not having to climb ladders and get to high places with a sniffer, benefits workers. Improved air quality benefits the citizenry, while increased sales of products go to the bottom line. It’s a win-win-win situation.

But how will this play out in the future, as these cameras come down in price and become ubiquitous? There are now about 200 in the world, but the day will come when there are thousands.

Compliance. Most facilities are allowed a certain amount of emissions by permit. However, neither the operating company nor any state or federal agency knows the full extent of these emissions. In a few instances, such as a large city with nearby refineries (e.g., Houston), air-quality monitors can detect general background pollution, which usually has legal limits. In coming years, the list of hydrocarbons that are monitored is likely to grow. Today and even more so in the near future, these cameras can play a positive role in lowering the general level of fugitive emissions coming from gathering systems, pipelines and refineries, which in turn should improve air quality in general.

Texas regulators (TCEQ) have already purchased six of these cameras. Other states have done so or will soon do so. Consider the following two brief case studies. TCEQ hired LSI to use the camera, mounted on a helicopter, to look for emissions in the Houston and Beaumont areas. The camera documented 175 previously unknown significant leaks.3

Working with one of TCEQ’s own hand-held cameras, Jason Harris was conducting fence-line monitoring near the town of Shoreacres, east of Houston. Harris and a colleague saw significant emissions spewing from separator equipment at a natural gas production facility.

The industrial site had a permit to release 25 tons/yr of VOCs and had been reporting emissions of only 4.7 tons. Subsequent testing showed that, in reality, an estimated 386 tons/yr of VOCs were escaping. TCEQ began enforcement proceedings, and the company installed a vapor recovery unit, which lowered emissions to a permitted level.3

First introduced in 2005, the camera helped TCEQ identify sources of more than 7,000 tons/yr of ozone-forming emissions, including benzene, during its first year; all of those emissions have been eliminated. More important, benzene levels in air have dropped in the Houston area at the three monitoring stations with the highest levels: Lynchburg Ferry, Texas City and Galena Park.3

For interested parties to understand how the agency intends to use data generated by these cameras, TCEQ has developed a protocol, which is available on its website. Look under “GasFindIR Use Protocol.”

As regulators discover that they have a much better tool for detecting emissions, they might require facilities across a broad range of hydrocarbon industries to use the technology. Emission permits could be tightened. That would sort of set up a cat-and-mouse game of having to keep near-constant surveillance to ensure as leak-free a facility as possible. This is analogous to produced water offshore: It cannot ever create a slick - at least not when government regulators come by.

Carbon trading. The emerging carbon trading market presents some potentially unusual situations. Since methane is 21 times more potent than carbon dioxide as a greenhouse gas, any leaks that were repaired and properly documented might qualify for substantial carbon credits, depending on how the rules about these things evolve. However, everyone would quickly become aware that leaks can be a source of substantial revenue. This is not to imply that management would intentionally go around loosening bolts, but humans can do subtle things in subtle, even unconscious, ways when incentivized to do so.

Eventually, the hydrocarbon spectral window of the camera will be tunable, which would allow identification of the particular hydrocarbon(s) being omitted. Carbon trading is not too far off in the US - it’s already a fact in Europe. Questions about what will and what will not earn credits will have to be answered. In the meanwhile, operators are enjoying having a new tool that makes their jobs safer while adding profits.

A FINAL WORD

This technology will continue to be improved, and its cost will come down as adoption proliferates. The international demand for leak detection services is growing too, so much so that companies like Hy-Bon and LSI are getting international work. Furry is planning to open an office in Europe. His company has had leak detection jobs in Nicaragua, El Salvador, South Africa, Malaysia, Singapore, France and Indonesia, to name a few.

In the US, the Natural Gas STAR program, which is focused on eliminating fugitive emissions, among other things, estimates 29.9 Bcf of gas is vented from oil storage tanks in the US. At average US prices of $7/Mcf of gas, that’s more than a half million dollars a day. The average oil-storage facility vents between $15,000 and $50,000 of natural gas to the atmosphere every month. In many markets outside the US, the recent addition of LNG plants and pipeline infrastructure have added dramatically to the market viability of these gas streams.

The Gas STAR program holds regular workshops, one of which was just held in San Antonio, Texas, in November. This is an ongoing process where experience is shared. For more information, go to epa.gov/gasstar. Some technical documents are available in Spanish, Russian and Chinese.

LITERATURE CITED

1 Emison, C., “Early man’s ‘Hawk’ a hit,” Abilene Reporter-News (online version), June 3, 2007.

2 FLIR company literature on its GasFinderIR camera.

3 Texas Commission on Environmental Quality, Natural Outlook newsletter, Spring 2008.

|

THE AUTHOR

|

|

|

Larry Richards is the President and CEO of Hy-Bon Engineering Company in Midland, Texas. A graduate of Texas A&M University, Mr. Richards has 18 years of oilfield experience, assisting oil companies with gas quantification and compression projects across the globe. Hy-Bon currently has successful gas capture projects operating in 28 countries.

|

|