Can’t we all just get along? If the answer is “sort of,” then it’s probably costing your company money. Managing emotions in intercultural business environments can boost production.

Ruud Weijermars, Delft University of Technology and Energy Delta Institute, Groningen; Volko de Jong, Energy Delta Institute, Groningen; and Kay van der Kooi, University of Groningen, the Netherlands

Professionals in the international oil and gas business are naturally endowed with a range of human emotions and now have their roots in an increasing diversity of cultures. Therefore, the interaction between social groups and proper management of human emotions must be continually optimized in an industry dominated by formidable technical challenges that relies on a multicultural workforce to solve those challenges. The impact of cultural diversity on business efficiency is certainly not new to this business, but has steeply intensified due to globalization.

The increase in energy demand and unequal access to reserves has led to a situation where International Oil Companies (IOCs) struggle for access to hydrocarbon reserves, controlled by National Oil Companies (NOCs). As a result, energy negotiations and relation management now involve stakes higher than ever before. Consequently, any flaw in effective communication between stakeholders may have an adverse impact on the outcome of the business cooperation-causing loss of future business value.

We suggest that only those energy organizations that know how to skillfully handle Emotional Intelligence-and are prepared to invest in it-will be successful. The impact of human emotions on business development is quantified here in terms of Probability Of Success (POS). The POS is the product of mutual attitude toward cooperation for which a chance factor is introduced in this paper. The chance factors build onto the model of Cornelis’ “Feeling’s Logic” and codify risks related to culture, personal skills and self-actualization (goals). The model is based on our vision of gas trade relationships between Europe and Russia and illustrated with a hypothetical case of new business development between an IOC and an NOC.

Our approach results in the following conclusions: The oil and gas industry traditionally places much focus on the management of technical, financial and political uncertainties and associated risks. Incorporating a coherent view on the management of cultural and emotional risks adds a dimension that can help to avoid negative outcomes in negotiations and relation management. Organizational Learning at NOCs, IOCs and service companies will benefit from intensified programs that muster respect for the goals, expertise, culture and feelings of business partners in a competitive, multicultural business environment.

GLOBAL RESERVES AND GLOBAL CULTURES

International Oil Companies (IOCs) traditionally work together with National Oil Companies (NOCs) to secure mutually beneficial partnerships, although in some cases, the distinction between IOCs and NOCs can be transitional, as NOCs are diversifying to become IOCs. Securing access to reserves is a strategy driver in the energy business. NOCs are attractive strategic partners in the oil industry because they hold more than 90% of the world’s oil reserves, Fig. 1. In these partnerships, the IOCs have access to equity and can bring in their carefully developed, cutting-edge technology. And most NOCs have limited access to equity markets-because they are not listed as shareholding companies. Strategic cooperation between NOCs and IOCs is needed to meet the required production targets and to bridge an impending oil and gas supply gap. The large, multi-discipline Service Companies (SCs) increasingly facilitate production optimization by providing NOCs with horizontally integrated management solutions and vertically integrated technology solutions, trying to cut out the need to involve IOCs.

|

|

Fig. 1. The majority of the reserves of the supermajors lie outside their country of origin; they have access to less than 5% of the global oil reserves. Reserves of France’s Total (less than 1%) are included here in the European NOC reserves.

|

|

The strategic relationships among NOCs, IOCs and SCs are governed by the following questions:

- Is there enough mutual trust

- Is there sufficient knowledge sharing

- Where can they improve their joint efficiencies

- Should any of these stakeholders change their policies?

Obviously, the solutions to these strategic issues need to be settled by people coming from an increasing range of professional backgrounds, a diversity of company cultures, ethnic cultures and national cultures. Attention for technological innovation, the speeding up of reserve growth and production growth remains important, but the human factor should not be overlooked. Modern business management must address cultural diversity and requires trans-cultural competence, using communication, empathy and creativity.1 As human actions are, in part, based on emotions rather than rational consideration, it is legitimate to highlight the role of emotions and cultural barriers and quantify the potential impact on international oil and gas business.

COMMUNICATION GAPS

The global oil and gas business is driven by speed: speed in gaining access to new prospects, speed in discovering new reserves and speed in deciding whether it is profitable to pump up hydrocarbon volumes subject to multiple subsurface and operational risks. All these activities are executed by professionals, who must communicate and share their expertise to make rapid and balanced decisions on the risk and opportunities in E&P operations. The hiring of a multicultural workforce from a range of countries, distinct company cultures and different age groups poses a challenge in itself through the increased risk of communication barriers or gaps. Global companies must now integrate their knowledge across different disciplines, in teams with experiential differences and cultural diversity. We map out the common traps and pitfalls in communication-at interpersonal and inter-organizational scales-and make recommendations for avoiding unproductive and costly mistakes.

The principal barriers that obstruct effective interpersonal communication between professionals in complex engineering organizations are:2

• Experiential Technical Gaps: When junior and senior professionals interact, the receiver and sender may lack some common language, slang, jargon, vocabulary or symbols. For example, junior reservoir engineers lack the experience of a field asset manager. Integration of their knowledge base requires continual effort to bridge the interaction gap, Fig. 2, Gaps 1. Establishing Communities of Practice, mentoring and career planning play a major role here.

|

|

Fig. 2. Communication gaps may inhibit the effective sharing of technical knowledge. As professionals specialize, they need to stay in touch with younger colleagues by mentoring to help bridge Experiential Technical Gaps (1). They need to broaden their knowledge base, connecting with professionals in other disciplines to bridge Interdisciplinal Technical Gaps (2).

|

|

• Interdisciplinal Technical Gaps: Oil operations require experienced professionals to interact coming from a range of different specializations. For example, the static-reservoir model built by G&G professionals is handed over to reservoir engineers for dynamic modeling and then forwarded for economic appraisal. Because the receivers and senders frequently lack common understanding of vocabulary and symbols, this requires mutual effort to bridge the interaction gap by broadening their inter-disciplinal technical knowledge, Fig. 2, Gaps 2.

• Organizational Gaps: In large organizations, the chain of command may have too many layers that a message passes through between sender and receiver. A large number of receivers will require clear, concise and consistent message-sending methods. Strategic goals must be understood at all organizational levels. Increasing the learning speed-as well as the quality of communication-is a major contributor to the success of an organization. For example, integration of subsurface, economic evaluation and facilities development teams can reduce the average lead time from discovery to production to four years or less.3 In essence, this reduces the Interdisciplinary Gaps of Fig. 2.

• Cultural Gaps: Different cultural customs and beliefs may profoundly interfere with mutual understanding, Fig. 3. Spending time abroad in different cultures and in different companies is very beneficial-if not essential-for bridging Cultural Gaps.

|

|

Fig. 3. Communication gaps may inhibit the effective sharing of knowledge. As professionals come from different company cultures, different countries, or both, they need to bridge the Cultural Gaps (3).

|

|

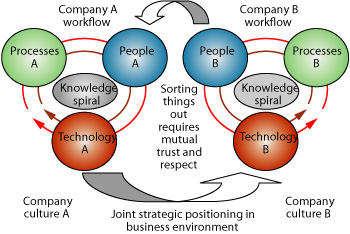

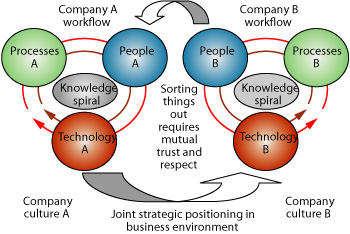

The ultimate secret behind effective cooperation between professionals is to avoid lack of trust. Professionals working within newly merged IOCs (e.g., ExxonMobil, ConocoPhillips, ChevronTexaco, BP, Total), or newly merged NOCs (e.g., StatoilHydro), or within diversified NOCs and IOCs, all know too well that peoples’ egos, prejudices, traditions, cultures, conflicting feelings, goals and their strong differences of opinion may undermine mutual understanding. Company mergers must integrate people, technology, processes and workflow across the former company cultures, Fig. 4. If people are on opposite sides of an issue, they may not be comfortable sharing their knowledge to full effect. Many of these feelings, prejudices and traditions have their roots in cultural identity. We focus on the management of Emotional Intelligence and the related emotional risk that may impair the efficiency of the up- and downstream business cycles.

|

|

Fig. 4. Integration of people, technology, processes and workflows of Company A and Company B requires dedicated attention. The respective Organizational Learning programs of Company A and B need to specifically address cultural gaps in communication in a continuous effort to safeguard and increase their overall Emotional Intelligence.

|

|

COMMON CHALLENGE OF NOCs AND IOCs

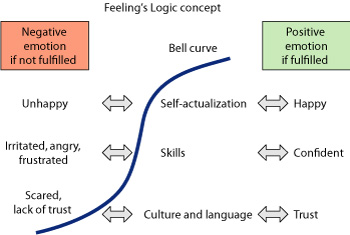

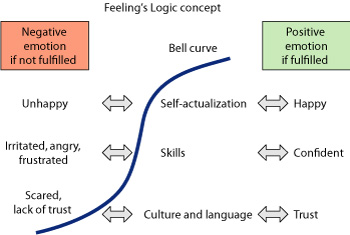

A rational framework for the role of emotions in communication across socio-cultural systems has been postulated by Cornelis.4 The Cornelis model of “Feeling’s Logic” conceptualizes the embedding of emotions in so called “cultural layers of stability,” Fig. 5; three such layers are distinguished: “Culture,” “Skills” and “Self-actualization.” Each layer needs conditional fulfillment for any action on the subsequent level to be undertaken and may be applied at both an individual and a macro or societal level.

|

|

Fig. 5.Cornelis generic concept of Feelings Logic (modified from Cornelis4).

|

|

The lowest level is the “Culture” level, which refers to cultural “embeddedness” of social groups or companies, the extent to which they have adopted its language, norms and customs. Individuals in a society share a common language, adhere to cultural traditions, and display similar customs and beliefs. “Skills” refers to the specific set of skills the people in a certain social group require for successful functioning. Skills enable recognition of-and adherence to-a social regulatory system; i.e., the economic, legal and political systems. “Self-actualization” refers to people’s ability to formulate and realize their goals and ambitions within a society. These three layers “stack” on top of one another. In other words, fulfilling the skill layer is contingent on fulfilling the cultural layer; it is highly implausible for a member of any society or organization to realize his or her goals and ambitions (self-actualization) without first learning the language and understanding the culture.

The great merit of “Feeling’s Logic” lies in Cornelis’ recognition of the importance of emotional responses to the layers. Social entities that understand and ‘grasp’ each other’s cultural layer feel trusted, while they may still recognize culturally distinct habits of one another. Social entities that do not learn to understand each other’s culture (or fail to recognize it) may feel scared when confronted with distinct cultural habits. Once societies become scared through cultural misunderstanding they can adopt only three strategies: fight, flight or stay put. Within an international institutional context, misunderstanding at the cultural level may therefore ultimately lead to war. One society may battle with the other because they cannot reach their goals of self-fulfillment, and do not possess a cultural bond of mutual understanding with their rivaling society.

The emotional responses related to the skill layer are “Confidence” for those who have the appropriate skills-and “Frustration” for those entities that do not. The most fundamental emotional response is related to the self-actualization or self-fulfillment level. A social entity or organization is happy and successful if self-fulfillment can be realized, and sad and unsuccessful if this is not the case.

We apply the “Feeling’s Logic” model to the international oil and gas business and quantify the risks implied in the emotional interaction of energy partners. In business relationships, emotions can grow to become more positive (and increase the probability of success, see later) if cultures are aligned on each level of the Cornelis model, or negative (and increase the probability of failure, see later) if one entity dominates others-meaning levels are mis-aligned. Risks emanate from potential mismatches between the respective layers of emotional compatibility or from the lack of mutual conditional fulfillment of these layers. Exactly how our emotions drive our instincts and decisions can be unraveled by applying modern psychology insights, as has been captured in the Laws of Emotion by Frijda.5

EXAMPLE OF SOCIO-CULTURAL TENSIONS

Delivering gas from the world’s major reserves to the future demand centers will require a major expansion of inter-regional, cross-border gas transport infrastructures.6 Europe is no exception, as European natural gas production, the bulk of which is located in and around the North Sea Basin, has entered into decline.7 The imminent gas demand-supply gap in Northwest Europe will need to be filled by increasing supplies from Norway, Russia and LNG sources such as Qatar.8 Of all prospective suppliers ready to fill Northwest Europe’s gas appetite, Russia is the largest supplier, and its share in Northwest European supplies is expected to grow steeply in the coming decades.7

Managing the risk of the emotions involved (based on Feeling’s Logic) and realizing the value of cultural education are crucial stepping stones, if North-West Europe and the Northwest European gas industry are to realize a secure energy supply. As Northwest Europe is ready to engage in even larger scale natural gas trade with Russia, one may ask: “What is the match between the socio-cultural systems of Northwest Europe and Russia?”

The Russian and Northwest European cultures vary to a great degree; one is hierarchical and has a long history of centralized government and the other is a liberal decentralized “networking” society. Seen from the perspective of the “Feeling’s Logic” model, the Northwest European social regulatory systems for natural gas emphasize unbundling and liberalization along the gas value chain to maximize price and efficiency, Fig. 6. Even though large-scale infrastructural projects are undertaken, with investments and politics explained, there is a seemingly large difference in the socio-cultural systems of Europe and Russia.

|

|

Fig. 6. European and Russian socio-cultural systems, their potential mismatch, and the associated risks.

|

|

We observe differences in base aspects such as language and cultural disposition toward authority, differences in the regulation of gas distribution systems, differences even in the political ambitions about gas. These differences pose risks to agreements, which must be reached if NW Europe is to secure supply. Russian regulatory systems emphasize concentrating all activities along the gas value chain in a single organization, and creating synergy between state affairs and fuel-resource affairs, Fig. 6. In brief, NW Europe’s ambitions seem to be securing supply and facilitating open markets, whereas Russian ambitions seem to be the growth of export volumes, maximizing revenue and using energy as a political tool.9

Today, multi-billion-dollar investments are risked in infrastructural projects of unprecedented scale to balance energy supply and demand of Russia and Northwest Europe. Existing gas infrastructure is expanded, new gas contracts are negotiated, and existing ones are extended and oftentimes renegotiated. Examples are Shtokman and Sakhalin Field developments, the Nordstream pipeline and the Interconnector project. European engineers and CEOs remain optimistic about future prospects for oil and gas deals with Russian partners-the odd report set aside.10

To acquire security of energy supply, the Feeling’s Logic model indicates that actions have to be taken to narrow the language and cultural gaps between the partners. For example, Gazprom and Gasunie invested in the establishment of the Energy Delta Institute as a business school for skills and knowledge exchange in the oil and gas business, Fig. 7. Large cultural exchange programs underpin the joint technical and business cooperation (e.g., the Replin and Diagalev exhibitions in Groningen). The common aim is to establish an emotionally balanced relationship between the two partners and to narrow the communication gap. This results in better alignment of cultural values, skill sets and common goals, which is important to overcome the residual Cold-War impediments of the past.

|

|

Fig. 7. Emotional map for Feeling’s Logic between Gasunie/EDI and Gazprom.

|

|

QUANTIFYING EMOTIONAL RISKS

Monitoring the progress in a new business venture after expenditure on relational development and the building of intercultural understanding is important. A company wants to know: What are the chances of success in this new business development? Quantifying the probability of success in a business negotiation that accounts for the impact of emotions on new business development is possible using basic expectation theory under uncertainty.11

Let the maximum net reward or value of cooperation for Party A equal a discrete value XA max. The minimum acceptable net reward for Party A is a lower threshold value XA min. Figure 8 shows the probability density function of the outcome of the cooperation between Party A and Party B. The expression for the Expected Monetary Value for Party A (EMVA) of the cooperation, at any one time, is:

|

|

Fig. 8. Probability Density Function P(y) with the range of Net Profit Options for Party A in a cooperation agreement. The center is the mean score µ on the x-axis, and the standard deviation is (s), which becomes the variance (s).2

|

|

The Probability Of Success (POS) expresses the likelihood of a tangible outcome based on probabilities of success by an arbitrary number of N parties involved:

Equations 1 and 2 are generic for assessing the progress in efficiency of reserve generation as a result of expenditure on subsurface exploration in the search for economic oil and gas accumulations.12 The transformation made here to monitor the yield of business development and negotiation success is novel and yields significant new insight in the chances of success of any cooperation. The associated expectation curve is shown in Fig. 9. The probability of failure is 1 - POS, and decreases as POS grows when business cooperation develops positively. If only two parties are involved, with a high determination to establish a win-win cooperation agreement, both parties may start off with a neutral attitude or 50% interest to cooperate: POS = PA × PB = 0.5 × 0.5 = 0.25. The corresponding probability of failure is 75%. It is clear that over time, for negotiations to be successful, it is crucial to invest in the relationship to increase the POS. Table 1 gives the range of chance factors assigned to individual attitudes toward a prospective cooperation.

|

|

Fig. 9. Expectation curve for Party A’s Net Profit Options in a cooperation agreement.

|

|

| TABLE 1. Chance Factors assigned to an individual aptitude toward cooperation |

|

|

|

Relating the probability of each layer to the Cornelis model (Fig. 5) implicates that this probability is the product of three uncertainty estimates:

- Pgoals - probability of agreement on common goals

- Pskills - probability of matching professional skills

- Pculture - probability of alignment of cultures.

The overall probability is the product of these three probabilities:

In a situation where one player is dominant, or the players are culturally fully integrated and aligned, Pculture = 1. The companies do not have to spend much effort to align their respective cultures. But as globalization proceeds, Pculture is a real risk factor ranging between 0 and 1 when involving any particular IOC and NOC. Our codification demonstrates that the oil and gas business should not only focus investment and learning efforts on the goals and skills level, but also on the cultural level.

The attitude toward cooperation in project negotiations and project execution between potential business partners can be strongly affected by different perceptions about project goals, skill gaps and cultural gaps. The POS grows with each step that develops positively. Considering the size of expenditures for new business development in oil and gas trade, we suggest that a substantial part of the business development budget should be allocated to analyze the emotional perceptions of mutual goals, skills and culture.

If multiple parties are involved, the POS approach advocated here still holds. The chance factor for the individual aptitude of each party toward a prospective cooperation must be assessed and monitored using the scale provided in Table 1. These chance factors are the key performance indicators that are entered into the POS equation. Any progress in raising the interest of individual parties (NGOs, academia, companies or governments) involved in a project that requires jointly working toward a cooperation agreement, is built on a stepwise improvement of the individual attitudes toward cooperation, as expressed in chance factors and multiplied in the POS. The net reward or EMV of each party must fulfill their minimum expectation, as outlined in Fig. 9 from the perspective of one party.

CONCLUSIONS AND RECOMMENDATIONS

Our comparison between the socio-cultural systems of Russia and NW Europe serves as an example to foster understanding of the impact of socio-cultural factors on business cooperation. Besides Russia, NW Europe may diversify its energy imports to two more geographic regions: North Africa and the Middle East. A preliminary comparison and examination of the levels of fit between the respective socio-cultural systems may eliminate or at the very least raise awareness of many potential mistakes. These mistakes lie in the wake of overlooking the importance of emotion as a cultural element that is part and parcel to initiating international trade in energy resources. This carries implications for the way companies and governments develop their energy security strategies and policies.

Adding a coherent view on cultural risk management could greatly enhance efficiency in future energy cooperations. We suggest new business development should be allocated a budget to overcome Cultural Gaps in the communication and negotiations. This is needed to ensure that professionals are ready to communicate effectively to share knowledge of their respective company resources.

Here are some recommendations for tackling Cultural Gaps to effectuate a high Emotional Intelligence in oil and gas organizations:

- Assess your goals, skills and culture from an emotional viewpoint and assess the emotional acceptability for your partners.

- Improve not just the cultural understanding of your workforce, but also their Emotional Intelligence, making them capable to sense the emotions of your business partners.

- Start with those groups of people most likely to enter into dialogue with culturally distinct parties. Study and teach your employees the cultural customs and peculiarities of your trade partners.

- Be careful with overemphasizing communication via modern ICT tools; the emotional signals are poorly captured and thus filters out important information from the message.

- Set up and maintain international training centers to engage in cross-cultural cooperation. Train local workers by sending them abroad, thus increasing their appreciation of and ability to adapt to foreign cultures. Organize student exchanges between foreign nations on a far larger scale than what is commonplace.

- Stimulate working abroad, and facilitate complex immigration and migration procedures.

We believe that only organizations that act with high Emotional Intelligence will survive in a increasingly close-knit multicultural world. Building in targeted interventions in your Organizational Learning program is advised if Emotional Intelligence scores are low,2 making provisions for structural improvements.

ACKNOWLEDGEMENTS

This work is based on progressive insight built up during work with several generations of industry professionals attending EDI programs, in particular the Executive Master of Petroleum Business Engineering (MPBE) described in detail elsewhere.13 Constructive comments came from Stefan Luthi (TU Delft) and George Verberg (EDI); visions expressed are the sole responsibility of the authors.

|

Numeric example of POS monitoring in IOC-NOC negotiations

To illustrate the power of our approach, consider an oil prospect subject to a Production Sharing Agreement (PSA) between Rambo Oil International (ROI)-an IOC-and Urki Petroleum Company (UPC), the NOC that owns the oil prospect. The maximum net reward or value of cooperation expected by ROI is €500 million over the productive lifetime of the field. This net reward may be adjusted in the course of negotiations with UPC; the minimum net reward acceptable to ROI is €200 million, considering the required return on investment. Rambo may target for 50%, or 350 million, net reward as a successful outcome of the negotiation process for the PSA. How much money is ROI prepared to invest in the development of the business relationship with UPC?

Assume that at the onset of the negotiations, €100,000 is invested by ROI in reconnaissance talks with UPC. At that early stage, ROI has a basic interest in the cooperation with UPC (PROI = 0.6) and UPC is only mildly critical toward cooperation with ROI (PUPC = 0.4). The EMV = [(0.24*500)-(0.76*0.1)] ~ €120 million.

Clearly, the EMV must increase rapidly for ROI to succeed in the realization of its mean business target of €350 million net reward. Obviously, the POS can be affected positively by activities that raise the mutual interest in a business cooperation. For example, if ROI succeeds, by investing another €400,000 in the talks and actions towards UPC, to raise PROI to 0.9 and PUPC to 0.7, the EMV increases to [(0.63*500)-(0.37*0.5)] ~ €315 million.

This means that Rambo’s target for mean net reward is potentially reachable. Based on this POS growth, another €500,000 is allocated by ROI for business development with UPC. The investment works out such that PROI = 1 and PUPC = 0.9; the EMV increases to EMVA = [(0.9*500)-(0.1*1)] = €449 million. Clearly, Rambo Oil is close to reaching more than its net revenue objective, with 90% chance of success.

Closure of the agreement critically hinges on the final attitude of UPC toward the cooperation. In a final negotiation, requiring the investment of another €0.5 million by ROI, UPC agrees to the PSA with ROI as a partner (increasing its PUPC to 1), but on the condition that ROI reduces the PSA’s net profit to €350 million. This has become a win-win agreement for both UPC and ROI.

|

LITERATURE CITED

1 Trompenaars, F. and C. Hampden-Turner, Riding the Waves of Culture, Nicholas Brealey Publishing, 1997, 265 pp.

2 Weijermars, R., Building Corporate IQ, Alboran Science Publishing, 2007, 276 pp.

3 Unneland, T. and M. Hauser, “Real-time asset management: From vision to engagement-an operator’s experience,” SPE 96390, 2005.

4 Cornelis, A., “Logica van het gevoel, filosofie van de stabiliteitslagen in de cultuur als nesteling der emoties,” Uitgave Stichting Essence Amsterdam/Brussel/Middelburg, 1988.

5 Frijda, N., Laws of Emotion. Lawrence Erlbaum Associates, London, 2007.

6 Victor, D. G, Jaffe, A. M. and M. H. Hayes, Natural Gas and Geopolitics from 1970 to 2040, Cambridge University Press, 2006.

7 IEA, World Energy Outlook, OECD/IEA, 2006.

8 Clingendael International Energy Programme, Natural Gas Supply for the EU in the Short to Medium Term, The Clingendael Institute, The Hague, 2006.

9

10 “UBS gas report,” 2006.

11 Evans, M. J. and J. S. Rosenthal, Probability and Statistics: The Science of Uncertainty. Freeman, 2003.

12 Johnston, D., International Petroleum Economics, Risk, and Contract Analysis. Penwell Books, 2003, 401 pp.

13 Weijermars, R., “Intelligent decision-making in the petroleum value cycle,” Petroleum Africa Monthly, October, pp. 70−72, 2004; Berkhout, G., Currie, P. K., Bos, C. M. F. and R. Weijermars, “Executive education for oil and gas professionals,” SPE Talent and Technology, 2, 2008.

|

THE AUTHORS

|

|

|

Ruud Weijermars is director of education at the Department of Geotechnology, Delft University of Technology and Energy Delta Institute, Groningen. He holds a PhD in structural geology and geodynamics and is responsible for the organization, contents and quality assurance of the BS and MS programs in applied earth sciences. Ruud also acts as Director for Executive Master programs at the Energy Delta Institute. He teaches direction-setting skills for new leaders in the MPBE program using innovative oil and gas strategy games. Dr. Weijermars can be contacted at r.weijermars@tudelft.nl.

.

|

|

|

|

Volko de Jong has been the director for the past six years at the Energy Delta Institute, the International Business School for Energy and Natural Gas founded by N.V. Nederlandse Gasunie, GasTerra, Gazprom, Shell, RWE and the University of Groningen. In this role, Dr. de Jong has been responsible for delivering specialized training programs for large energy companies like Gazprom, CNPC and RWE. He holds a PhD in econometrics.

|

|

| |

Kay van der Kooi earned an MSc in sociology and has been a study adviser at the Energy Delta Institute, University of Groningen. He is preparing a PhD study in sociology with a focus on European energy transition policies.

|

|

|