OUTLOOK

Middle Eastern countries ride a tide of prosperity

Higher oil prices have contributed to greater economic growth, and inflation is also on the rise. Productive capacity is growing, but slowly.

Dr. A. F. Alhajji, Contributing Editor, Middle East

SAUDI ARABIA

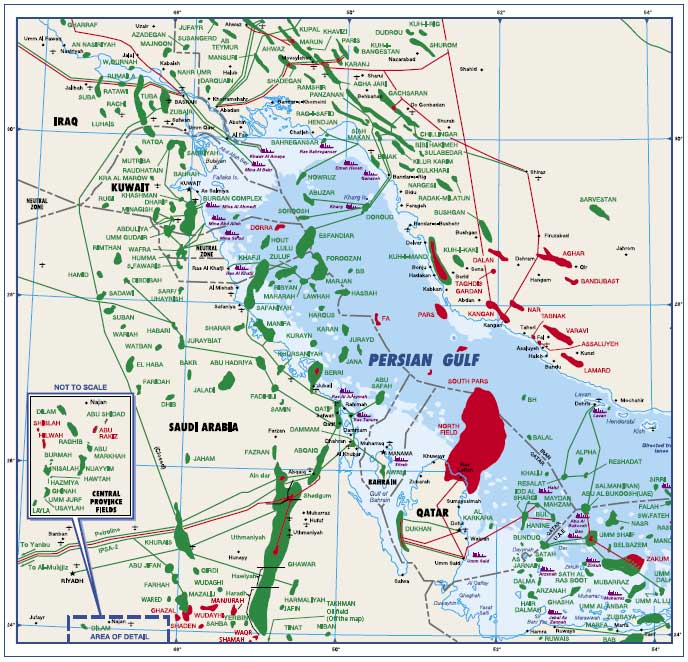

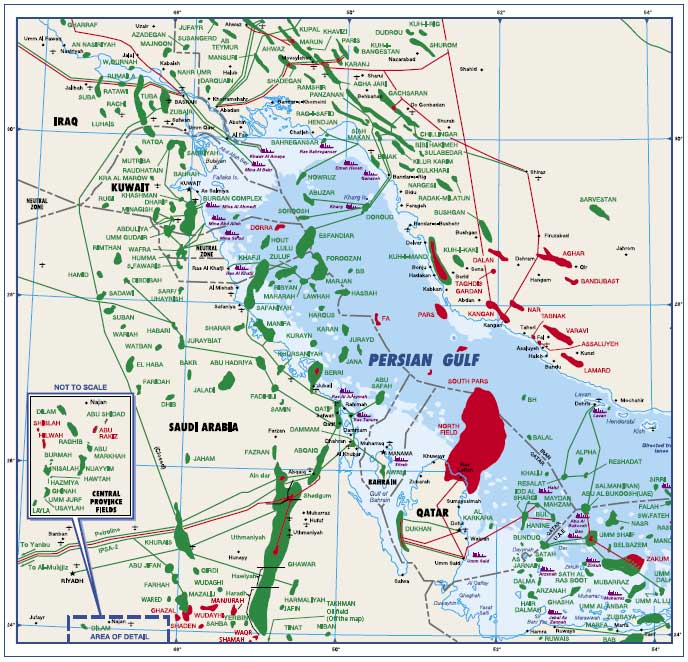

Saudi Aramco has 52 projects active to expand productive capacity to 12.5 million bopd. All expansion plans until 2009 will materialize, but it is unclear what will happen after then. Expansion of gas output continues.

Exploration. Aramco discovered four new gas fields in 2006. LukSar, a JV formed in 2004 between LUKoil and Saudi Aramco to explore for gas in Block A, hit a find last February on the Tukhman structure south of Al-Ghawar.

Drilling/development. Saudi Aramco completed 368 new wells in 2006, including 39 offshore. More than 80% of all wells drilled in 2006 were horizontal wells. (For detailed information on recent developments in Manifa, Khursaniayh, Khurais and other areas, see the feature article on Saudi Arabia.)

Production. Saudi oil output decreased 2.2% to 8.9 million bpd in 2006. Yet, Aramco increased its maximum sustained crude production capacity in recent months to 10.7 million bpd, not including output from the Saudi half of the Neutral Zone. Aramco increased gas production 4.5% in 2006, to 8.224 Bcfd. NGL production has virtually stayed the same.

Aramco discovered 3.6 billion bbl of oil in 2006, 4% more than it produced, pushing total oil reserves to 259.9 billion bbl in 2006. Last year, Aramco added 10.4 Tcf of gas, bringing Saudi gas reserves to 252 Tcf.

KUWAIT

Higher oil revenues, roughly $25.8 billion in the 2007-08 budget, have improved the economy in recent years. However, Kuwait is still very dependent on oil exports. Oil facilities still suffer from explosions, leaks and fires that plagued the Kuwaiti industry in recent years. A lack of accountability is a chief reason for such incidents.

Exploration. In February 2006, Kuwait Oil Co. (KOC) made a non-associated 35-Tcf gas/condensate find in the Afqiyah well in northwestern Raudhatain field, in northern Kuwait. The field should start providing gas for power generation in 2008. Last April, KOC announced another gas discovery in Umm Niga near the earlier find. Production from both discoveries may come online as early as the end of 2007, at 175 MMcfgd, rising to 600 MMcfgd by the end of 2011.

In March 2006, officials announced discovery of 10-13 billion bbl of light crude reserves in Bahra and Rawdatain fields. Production from these finds should begin by the end of 2007, at an initial 50,000 bopd, increasing to 500,000 bopd within a few years. In April 2006, KOC hit another light oil and gas find at Arifjain in southeastern Kuwait.

Drilling/development. World Oil predicts that the number of wells drilled will increase 2.7%, to 77 in 2007. The government plans to expand production capacity over the next few years through drilling more development wells, expanding production from northern oil fields (Project Kuwait), developing gas reserves and expanding surface facilities. Oil production capacity will expand gradually from 2.4 million bpd to 3.213 million bpd by 2010. The plan would also expand gas production to 1.806 Bcfd by 2010.

Political bickering has delayed Project Kuwait again, after almost a decade of debates and negotiations among powerbrokers. The project was supposed to increase output to 900,000 bopd by 2005, including development of the northern oil fields. The $7-billion project will expand output from five oil fields, from 621,000 to 1.41 million bpd, while boosting reserves there from 11 billion bbl to 17 billion bbl. The National Assembly stalled the project in the last two years, concerned that IOC participation might violate the constitution. Recent reports indicate that the law governing the project is still under consideration and may be completed shortly.

|

Click Image for Larger View

At Qatar’s Al Shaheen field in Block 5, operated by Maersk Oil, production is gradually increasing from 240,000 bopd in first-quarter 2006 to a plateau level of 525,000 bopd in late 2009. Photo courtesy of Maersk Oil.

|

|

Production. Oil output increased 0.7% in 2006, to reach 2.225 million bpd (excluding Neutral Zone production). Output declined, in line with the OPEC quota, from 2.46 million bopd in January 2007, to 2.40 million bopd last March.

Kuwait plans to raise productive capacity to 3 million bopd by 2010. In fulfilling the plan, KOC envisages a new gathering center at Al-Sabriya in the north, with a capacity of 465,000 bopd and 240 MMcfgd. It also plans 155,000-bpd water injection facilities in the north.

Official figures put Kuwait’s oil reserves around 100 billion bbl. However, official numbers were questioned last year, when a report indicated that Kuwait’s reserves could be less than half of that figure. Officials labeled the report as “incomplete and misleading.” Recently, the government announced that it will never reveal the exact size of its oil resources. The opposition in the National Assembly has proposed a law that ties production to reserves, whereby output would be around 1% of official reserve numbers. At 100 billion bbl, 1% translates into 2.65 million bopd. This, by itself, will stall Project Kuwait. The law would force the energy minister to provide detailed information on an annual basis.

IRAN

The performance of Iran’s oil and gas industry is mixed. Some IOCs are less willing to invest in Iran, but this has made the government more aggressive in attracting investment from some countries, especially China.

Last February, National Iranian Oil Co. (NIOC) improved its buyback contracts to encourage international investment. It extended contract terms to 25-30 years, allowing companies to produce for 20 years. It also provided terms that give better returns to foreign investors.

Exploration. NIOC discovered a 1.6-billion-bbl oil field in southern Iran last April. A month earlier, NIOC found gas in the Larestan and Fasa areas of the southern province of Fars. No details were available about these discoveries. NIOC has confirmed the commerciality of OMV’sBand-e-Karkeh 2 discovery made in 2004. OMV estimates recoverable reserves at 150 million bbl of oil and potential production of 40,000 bopd. In December, Norsk Hydro made a second discovery in western Iran. Press reports indicate that Shangule West could be as large as the Azar discovery on the same block.

Last November, NIOC made an oil and gas find in the Khami layer of Ahvaz oil field in Khuzestan province. Financial estimates for the reserves are $7.3 billion. Previous reports indicated that Khami contains a deep gas reserve, with an estimated 7.4 Tcf, of which half can be extracted. During the first development phase, Khami should produce 150 MMcfgd and 37,000 bopd. Sinopec made a non-commercial light oil discovery on the Zavareh-Kashan Block in mid 2006.

Drilling/development. The number of wells drilled this year should remain almost steady. Iran aims to increase its oil production capacity to 7 million bpd by 2015, which is difficult to achieve in the face of production declines in aging fields (estimated at 500,000 bopd), shortages of rigs, increasing costs and economic sanctions. NIOC warned recently that Iran suffers from a shortfall of 20 onshore rigs. Iran owns only one of the 13 offshore rigs operating in its waters. Last April, National Iranian Drilling Co. (NIDC) purchased eight onshore drilling rigs from China, for delivery at the end of 2008. The company is also looking into buying two offshore rigs from China. Various NIOC subsidiaries have already opened tenders to construct several onshore and offshore rigs.

Within the previous Iranian year (March 21, 2006 to March 20, 2007), NIDC spudded 159 wells, 17 wells above the previous year’s number (70 development and appraisal wells, 6 exploration wells, and 83 injection wells).

At the beginning of 2007, NIOC tendered 17 E&D licenses, of which five were offshore, under improved terms. Iran also offered some blocks for tenders in the Caspian Sea.

Last March, NIOC launched the Sarvestan and Sa’adat-Abad oil fields project to produce 15,000 bopd at a cost of over $118 million. Also in March, NIOC started development drilling in the 197-million-bbl Khesht oil field in Fars province. The company expects Khesht to produce 35,000 bopd. NOIC also said that a subsidiary would start an early production program in southern Azadgan field. Iran did not attract international partners to develop this 6-billion-bbl field.

As for South Pars field offshore, NIOC decided at the end of 2006 to cap its gas development at 24 phases. Several reasons have been cited, including rising costs and possible reservoir problems.

Production. Oil output reached a post-revolution record of 4.3 million bpd during the past Iranian year (March 21, 2006 to March 20, 2007), with a sustainable capacity of 4.26 million bpd. Based on several new finds, Iran’s oil reserves might have exceeded 135 billion bbl. At the end of 2005, oil reserves were 131.5 billion bbl. Gas reserves stood at 965,000 Tcf.

YEMEN

Yemen is more dependent on oil than ever. Large subsides and declining production threaten political stability. Yemeni officials are determined to increase oil production.

Among 87 blocks in Yemen, 20 are exploratory, 12 are producing, and 13 await approval. Twenty-eight blocks are open for investment, and 14 promotional blocks are available in the Third International Bidding Round. Yemen has 51 fields. About 22 IOCs operate in Yemen. Yemen has finished three bidding rounds and plans to offer 5-10 new exploration blocks and a fourth bidding round in second-half 2007.

Exploration. Safer Exploration and Production Operations Co. (SEPCO) discovered oil and gas in Block 18 in the Marib region last November. The new find, Wadi Saba 1, is southeast of Alif oil field, and encountered three different pay zones of oil and gas condensate. In October, TransGlobe Energy, through the Wadi Bayhan 2 exploration well, confirmed a gas/condensate discovery in the upper Lam formation in Block S-1.

Yemen said last August that it will resume offshore oil exploration in 2007 after a 13-year stoppage. This means that several offshore blocks will be available to IOCs. Last April, the Ministry of Oil and Minerals awarded Occidental Petroleum a PSC for Block 75. Oxy will begin exploration soon. Last December, Yemen awarded eight blocks, including Blocks 17, 19, 28, 29, 57, 82, 83 and 84. Reliance Industries was awarded exploration Blocks 34 and 37 at the end of 2006.

Drilling/development. A 9% drilling decline is expected. DNO plans to drill 13 exploration wells and nine appraisal/development wells in 2007 on Blocks 43, 53 and 44. As of mid-May, DNO had drilled several wells and brought some of them onstream. Last October, DNO brought onstream the Tasour 22, in Block 32, at 8,000 bopd. DNO also started drilling Tasour 23 in early September, while Bayoot 2 on Block 53 achieved a gross flowrate of 700 bopd. At the same time, Oracle reported that Yemen Mayfair Petroleum will drill the Fatima prospect in offshore Block 22 in October.

Yemen plans to produce and export LNG at the end of 2008. It has signed several cooperation agreements for two phases to produce 6.7 million tons of LNG.

Production. Yemen hopes to increase oil production over the next three years from 380,000 bpd to 500,000 bpd. Production declined 7% last year and is expected to continue to fall, if new exploration does not yield significant results. At the end of 2006, OMV began production in Block S2, but at a very small rate. It expects to increase production to 11,000 bopd by 2008, and to 32,000 bopd by 2009.

Oil reserves are estimated to be near 3 billion bbl. Gas reserves, as of the end of 2005, were at about 17 Tcf.

OMAN

Higher oil prices have compensated for declining production. Rising oil revenues created a 2006 budget surplus that exceeded $6 billion. Oman’s oil production has declined in recent years. Massive amounts of investment have been dedicated to curbing the decline.

Exploration. Reliance Industries is due to spud two to three exploration wells in offshore Block 18 by the end of 2007. Drilling will be in water depths between 1,800 and 3,000 ft. In February, Petroleum Development Oman (PDO) discovered three new oil fields. One is in Budour Northeast, in the Birba area of south Oman, and the other two are extensions of Ufuq and Dafiq fields in northern Oman. Early tests showed that Budour Northeast could produce a stable 8,200 bopd.

Last January, Oman said that it will award Blocks 39, 41 and 59 after short-listing three companies. Oman also signed a concession with BP for the Khazzan-Makarem gas structure, which might contain 20-30 Tcf of gas. Also, Circle Oil started acquiring 2D seismic data over offshore Block 52.

Drilling/development. The number of wells drilled is expected to increase slightly this year. Officials believe that production will plateau in 2007 and 2008, but it will start increasing in 2009, when several new EOR projects boost output. Waterflooding will also increase production in such fields as Dhulaima, Lekhwair and others.

Sweden’s Tethys Oil was due to start drilling in second-quarter 2007 to appraise the previously drilled Block 15. The tract contains 50 million bbl of oil in place. Two wildcats were drilled in 1994 and 1997, and deemed subcommercial.

In early February, Thailand’s PTTEP began producing gas and condensate from Shams field in Block 44. Initial capacity is 50 MMcfgd and 4,000 bcpd. Also, PDO announced that the Kauther field development was on track for first gas in early 2008. Last November, Indigo Petroleum successfully tested West Bukha 2 from the Mishrif formation of offshore Block 8. The well tested 7,600 bopd and 20.5 MMcfgd.

Production. Omani oil production has declined for six straight years. Output during 2006 fell 4.2%, to 742,500 bopd. PDO’s production stood at 589,000 bopd, and should decline slightly in 2007, by about 30,000 bopd.

UAE- ABU DHABI

Higher oil prices and income diversification have increased UAE economic growth by 45% since 2002. The economy grew 8.9% in 2006, but inflation is now a concern.

Exploration. Last September, Abu Dhabi Marine Operating Company (Adma-Opco), a JV between state firm ADNOC (60%) and BP, Total and Jodco, contracted to build offshore oil production facilities at Umm Shaif field. The facilities, worth $1.6 billion, represent Abu Dhabi’s largest offshore contract ever. They include the building of three fixed platforms, subsea pipelines and bridges. The project will produce 300,000 bopd and 1 Bcfgd, and is set for completion in 2010.

On another front, ADNOC selected ExxonMobil in April 2005 as a strategic partner in a $1.5-billion, further development of Upper Zakum field, and final agreements were signed recently. This is part of upgrading Upper Zakum and raising capacity from 550,000 to 750,000 bopd.

Drilling/development. A slight increase to 112 is expected in the number of new wells drilled this year. Abu Dhabi plans to increase gas output from 5.3 Bcfgd to 7.2 Bcfgd by 2009, an increase of 36%. There are plans to spend $11 billion on gas projects that include integrated gas development, pipelines and debottlenecking of an NGL plant at Asab. This activity will begin with onshore fields before it focuses on offshore gas. Last April, Shell, BP, ConocoPhilips and Occidental were among the bidders for ADNOC’s $10-billion, giant sour gas project. The contract will be awarded in fourth-quarter 2007. The project will be a JV with ADNOC to develop sour gas fields. It will boost output by about 1 Bcfgd.

Production. Abu Dhabi’s output increased 11.6%, to 2.40 million bopd in 2006. Total UAE crude production, which came mostly from Abu Dhabi, has virtually not changed in recent months. It stood at 2.47 million bopd in March 2007.

UAE-DUBAI

Dubai’s economic boom has attracted many top companies, including financial institutions. Last March, Halliburton moved its headquarters from Houston to Dubai. The government realized several years ago that the oil production decline is irreversible. Dubai’s oil output decreased 29% in 2006, hitting 95,000 bopd, versus a peak of 450,000 bopd in 1991.

Last year, Dubai took back operating control of its offshore assets from Dubai Petroleum Co. (DPC), a ConocoPhillips subsidiary. DPC was operator on behalf of the DPC/Dubai Marine Areas (DUMA) consortium, which also involved interests from Total, Repsol, RWE-DEA and Wintershall. The property was transferred to Dubai Petroleum Establishment (DPE), a state firm that was created to take over DPC’s assets. Last April, Petrofac took over full operational responsibility for wells and facility management at the offshore assets, on behalf of DPE. Assets include four fields: Fateh, Southwest Fateh, Falah and Rashid, with 70 platforms and more than 600 wells. Last October, Petrofac awarded a contract to Britain’s SPD, to provide engineering and management services in the above-mentioned areas. SPD plans a drilling/well intervention program. This will increase the number of wells drilled from two in 2006 to four in 2007.

QATAR

Qatar enjoys an economic boom, having unveiled its largest budget ever. The expected surplus for 2007-2008 is $1.6 billion. Concerns about higher costs, and the need to reassess expansion, have slowed LNG and GTL projects.

Exploration. Qatar needs $65 billion of investment in energy projects. Last March, officials said that offshore Block 3 was under bidding. They also said that Blocks 1, 7, 8, and 14 would be offered for bidding soon.

Drilling/development. The number of wells drilled will increase from 80 in 2006 to 84 in 2007. On March 14, UAE-based National Petroleum Construction Co. revealed that it had been awarded an engineering, procurement, installation and construction contract covering Packages 17 and 18 for the Block 5 development in Al-Shaheen oil field. A month earlier, Larsen & Toubro was awarded a $250-million contract to build two new offshore platform topsides, a flare platform and an interconnecting bridge at Al-Shaheen.

|

At Qatar’s Al Shaheen field in Block 5, operated by Maersk Oil, production is gradually increasing from 240,000 bopd in first-quarter 2006 to a plateau level of 525,000 bopd in late 2009. Photo courtesy of Maersk Oil.

|

|

In addition, gas production capacity will increase from 6.5 Bcfgd to 20 Bcfgd by 2012. Qatar Petroleum (QP) expects condensate production to increase from 175,000 bpd in 2006 to about 700,000 bpd in 2012.

Production. Qatar’s production increased 6.5%, to 900,000 bopd. QP expects to increase productive capacity to more than 1 million bopd by 2010. QP will increase Al-Shaheen’s capacity from 225,000 bpd to 525,000 bpd by 2010.

SYRIA

A need to curb the continued rapid decline in oil production, and increased domestic demand for gas, have forced Syria to embark on a large-scale exploration and development program. Realizing the need for foreign technology, expertise and capital, Syria last August drafted two new laws to restructure the hydrocarbon sector. The first law established the General Petroleum Organization (GPO), an independent public organization to oversee Syrian oil and gas companies, and draw up exploration, development and investment strategies. The second law established the General Organization for Refining and Distribution of Petroleum Products (GORDPP).

Exploration. Last September, Syrian Petroleum Co. (SPC) struck gas at al-Braij, about 65 mi north of Damascus. SPC estimated output from the new find at 280,000 cmgd. Last March, Syria re-offered seven onshore blocks for tender, including 3, 4, 7, 14, 16, 19 and 21. The closing date for tenders is July 12, 2007. Syria also announced that it is offering four offshore blocks for tender. Last October, Syria awarded Shell PSCs for Blocks 13 and 15. In November, Syria signed another PSC with France’s Maurel et Prom and the UK’s PetroQuest International to explore Block 11.

Drilling/development. The number of wells drilled should increase slightly to 78 in 2007. Last February, Gulfsands Petroleum spudded the Khurbet East (KHE 1) wildcat in Block 26. The well is between two oil fields, Suwaidiyah and Rumailan. The company drilled its first well, Tigris 1, in the same block last September. Data from a well drilled in 1994, in the same area, indicated a substantial hydrocarbon column. The company will drill another well in the same block in July.

Last December, Croatia’s INA began testing gas production from two wells in Palmyra field. The company expects production to start by the end of the year, once the wells are connected to the Arak gas station.

Production. Syrian oil output declined 3% to 400,000 bpd in 2006. Production has not only been declining, but the quality of crude produced has changed. Recent reports indicate that light crude output has decreased, but heavy crude production grew from 150,000 bpd in 1998 to 200,000 bpd in 2006. Syria plans to increase its gas output from 23 MMcmd to 35 MMcmd within the next 5 years.

IRAQ

Political instability, continued attacks on oil facilities, corruption, and technical problems have prevented Iraq from developing its resources and returning production to pre-invasion levels. The only exploration (along with development) is in Kurdish areas of the north, with some development projects in the south. Due to attacks and various technical problems, Iraqi production declined in January 2007 to its lowest level since January 2006, at 1.7 million bopd.

In recent months, Iraq attempted to draft a new oil law. The law was endorsed by the Iraqi cabinet last January but has failed to gain parliamentary approval. Passing the law soon is important, to prevent Kurdistan from implementing its own oil law, which would allow foreign investment without consulting the central government. Topics of controversy in the law include the split of oil fields between federal and provincial jurisdictions, the technical provisions of the oil revenue-sharing law, and profit-sharing contracts with IOCs.

Exploration. A recent IHS report predicted that Iraq’s western desert might contain another 100 billion bbl of oil. The report includes field-by-field reserve figures, a total of 435 undrilled prospects and non-commercial discoveries, and 81 producing fields and commercial discoveries. Reservoirs have been re-evaluated using new information, and all field reserves and production numbers have been reassessed and validated. IHS expects Iraq to launch 65 exploration blocks for bids in 2007, and 78 fields may be offered for development.

Drilling/development. According to Iraqi governmental sources, the number of wells drilled should increase from 20 in 2006 to 23 in 2007. In early April, the Oil Ministry asked 15 companies to bid for contracts to drill a total of 100 wells in Iraq’s oil fields, Deadline for bids was set for the end of May. This drilling program should increase production by between 50,000 and 60,000 bopd.

Last March, Canada’s Addax Petroleum began drilling a third well in Taq-Taq field, the TT-06 appraisal/development well. Taq-Taq is in the Kurdish Regional Government (KRG) area of northern Iraq. The first two wells flowed 29,790 and 26,550 bpd of light crude. Norway’s DNO said recently, that soon it will start pre-commissioning and final testing of the first phase of the Tawke Early Production facilities in the KRG area. Oil production should begin within two years. In December, Petoil drilled and cased the Bina-Bawi-1 wildcat, which was the first well in its planned, multi-well exploration and development drilling program in KRG.

The US Special Inspector General for Iraq Reconstruction reported last January that the delayed Phases 1 and 2 of the Qarmat ’Ali project would be completed by this July. While Phase 1 is complete, Phase 2 is only 30% finished. The delayed Phase 2 will increase water injection while boosting crude production by 200,000 bpd. By last January, the South Well Workover project in the Basra Governorate was 27% complete. Its objective is to work over 30 wells in Rumaila field, and complete and replace tubing in 30 more wells in West Qurna. The project should complete early this summer.

Production. Oil output increased 3% in 2006 to 1.905 million bpd from 1.850 million bpd. Iraqi crude oil production increased in recent months from 1.70 million bpd in January to 2.05 million bpd in March.

OTHER COUNTRIES

Bahrain. Last March, Bahrain launched four offshore exploration blocks, which cover all of Bahrain’s waters. Bidding will close on Sept. 17. Government sources indicate that 18 companies have expressed an interest in bidding. Winners will be announced on Oct. 31.

Bahrain has only one oil field, known as Bahrain or Awali field. Bahrain plans to drill 700 development wells between now and 2015, to maintain and increase field output. Last March, Bahrain Petroleum Co. (Bapco) awarded a $33-million contract to drill 48 vertical wells and 22 horizontal wells. Production declined from an average 36,569 bopd in 2005 to 35,849 bpd in 2006.

Turkey. The historical feud between Turkey and Greece might flare up again, but this time over oil and gas. The Greek Cypriot administration objects to Turkey’s plans to explore in the Mediterranean Sea off Cyprus. Recently, state-owned Turkish Petroleum Corp. (TPAO) opened an exploration tender for a 4,000-sq-km area in the eastern Mediterranean, where the Greek Cypriots have also planned to explore under a tender launched in February. The final day for the tender is May 23.

In Greek Cyprus, the offshore international licensing round plans to open 11 blocks along the island’s southern coast. In reaction, Turkey issued strong warnings to Egypt and Lebanon, because both signed agreements with the Greek Cypriots to facilitate future exploration in the area. Ankara claims that the deals infringed the rights of Turkish Cypriots.

The number of wells drilled should increase to 100 in 2007. Some of the new activities in Turkey are focused offshore. Last March, Toreador Resources made two additional gas discoveries in the South Akcakoca sub-basin of the Black Sea. Earlier, in February, the company hit the Akcakoca 4 discovery. Turkey’s oil production declined 3% to 42,300 bpd in 2006.

|