North Sea

Regional Update

High prices boost North Sea region

High commodity prices, creative licensing and use of new technologies have all combined to improve activity levels and project spending in this key region.

Paul Webber and Llion Pritchard, IHS Energy; and Kurt S. Abraham, Managing/ International Editor

UNITED KINGDOM

Activity and spending are up in the UK North Sea and onshore, as operators take advantage of high commodity prices and improved licensing terms. So far, the 10% production tax surcharge imposed last year is only proving to be a nuisance. However, if prices fall or some other incident occurs to lower profitability, then the surcharge could contribute toward a pull-back in plans by operators.

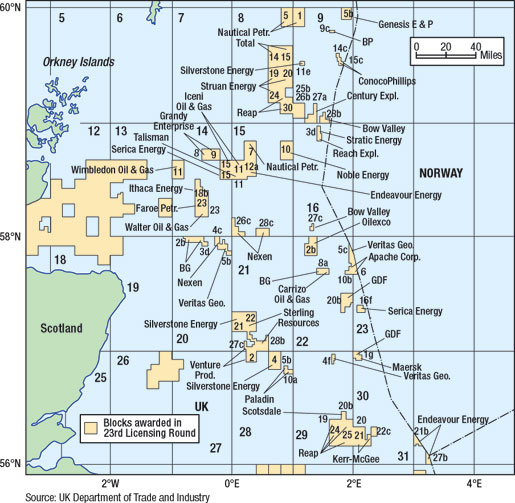

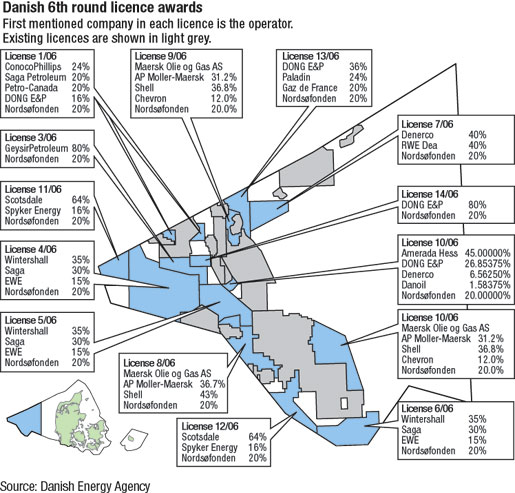

23rd Licensing Round. The Secretary of State for Trade and Industry opened the 23rd Seaward Licensing Round on March 10, 2005. Under this round, 1,329 blocks in the UK offshore sector were on offer, Fig. 1. For the first time since 1998, the entire North Sea was open for oil and gas exploration. More than 50 previously fallow blocks were offered in the round, demonstrating that the government’s Fallow Initiative, aimed at stimulating activity in the North Sea, appears to be working.

|

Fig. 1. Central and northern North Sea blocks offered in the 23rd UK offshore licensing round.

|

|

As in the 22nd Round, interested persons were invited to apply for Seaward Production Licenses (Traditional), Promote Licenses and Frontier Licenses. Applications for Frontier and Traditional licenses were invited over blocks and partial blocks not currently subject to an existing license, and coming within SEA 1 and 4. Applications for Promote and Traditional Licenses were invited over areas in SEA 2, SEA 3, SEA 4 and the recently completed SEA 5.

On June 14, 2005, Energy Minister Malcolm Wicks announced that applications for the 23rd Round had hit a 30-year high with a record 279 block applications, the largest number since 1972. The deadline for applications was June 9, 2005. The Department of Trade and Industry (DTI) received 134 applications from 114 companies, of which 28 were new applicants to the UKCS.

On Sept. 6, 2005, at the Offshore Europe 2005 Conference in Aberdeen, Minister Wicks announced that a record number of licenses were to be offered in the 23rd Round. In all, 152 production licenses were on offer to 99 companies, the highest number since 1964. Covering 264 blocks, the round offered 70 Traditional Licenses, six Frontier Licenses and 76 Promote Licenses. This represents nearly 38% more than the number offered in 2004. Of the 99 companies, 24 were new entrants in the North Sea. In his announcement, Minister Wicks stated that the government’s licensing innovation was producing results that maximize production of the North Sea’s remaining resources. It is anticipated that between 22 and 28 Bboe remain to be exploited, he added. Seventeen wells were firmly committed to by successfully awarded companies, an amount unsurpassed this last decade.

Promote Licenses, Second Phase. On Nov. 10, 2005, Minister Wicks announced the results from the first Promote Licenses, awarded as part of the 21st Seaward Licensing Round in 2003. Of the 54 Promote Licenses awarded in 2003, 24 were given approval to continue into the next phase of the license.

Work commitments for these licenses included 15 firm wells (five of which had already been drilled), seven new seismic surveys with associated contingent wells to be spudded before the end of September 2007, and one proposed development well. DTI reported that the drilling commitment levels equate to 27% of 21st Round Promote Licenses, compared to 22% for the 21st Round Traditional Licenses. As a result of the Promote initiative, about £90 million ($157 million) were secured for further exploration on the UKCS.

Minister Wicks stated that these results proved both the innovative drive of the firms involved, and the success of the Promote License concept, without which most of this acreage would not have been touched by the Traditional License route. The minister also said that the companies have succeeded in promoting or developing the acreage to attract investment.

24th Licensing Round. On March 16, 2006, DTI invited applications for licenses in the 24th Seaward Licensing Round. Applications for Traditional and Frontier Seaward Licenses were accepted on June 15, 2006, and Promote Licenses were accepted on June 16, 2006.

Eighty previously licensed North Sea blocks that were inactive are receiving a shake-up in the 24th Round, announced by Minister Wicks. The blocks were recently given up under the government’s Fallow process, which seeks to put blocks and discoveries in the hands of those who can exploit them.

Exploration and appraisal drilling. An increase in exploratory drilling activity was seen in 2005, with 87 wells drilled offshore the UK (wells spudded in 2005), Fig. 2. Of these, 39 were classified as wildcats, of which 12 were reported to be discoveries. Drilling for 2006, for which DTI so far has first quarter numbers, totals eight wildcats and five appraisals. The combined total of 13 would only translate to 52 exploration wells versus last year’s 87, but a pickup in activity is expected for the balance of the year.

|

Fig. 2. UK annual E&A activity, 1980 – 2005.

|

|

DTI reported that seven wells were classified as significant discoveries – Gaz de France’s (GDF’s) 43/25a-2W, Apache’s 22/6a-14Z, Talisman’s 13/23b-5Z, BG’s 22/15-3, and ConocoPhillips 44/23b-11 and 21/5a-6 and 6Z. These finds have been defined as discoveries, where flowrates of equal to, or greater than, 15 MMcfgd and/or 1,000 bopd were achieved or would have been achieved, if the well had been tested. This does not indicate the commercial viability of a discovery, and it is unlikely to be considered a definitive list, because operators may keep this information confidential for up to five years after completing a well, if they so desire.

GDF kicked off mechanical sidetrack 43/25a-2W in May 2005, after 43/25a-2Y was plugged and abandoned. Sidetrack 43/25a-2W was suspended as a gas discovery in June 2005. In mid-June, Tullow Oil issued a business unit update, which stated that the Opal exploration well, 43/25a-2W, encountered gas-bearing reservoir sands in the targeted Carboniferous section.

Apache kicked off sidetrack 22/6a-14Z in July 2005. The well was plugged and abandoned tight in mid-August. On Aug. 1, 2005, the well had been reported to be operating tight in sidetrack. Originally, Apache had spudded exploration well 22/6a-14 in May 2005, utilizing GlobalSantaFe’s Galaxy I jackup in a water depth of 89 m (293 ft). The well reached TD in late June 2005 and was abandoned in early July, prior to sidetrack 22/6a-14Z being kicked off.

ConocoPhillips spudded exploration well 44/23b-11 at the end of July 2005, using the Ensco 92 jackup in a water depth of 32 m (105 ft). In late September, the well was P&A’d as an untested Carboniferous gas discovery with a TD of 13,419 ft.

Talisman kicked off sidetrack 13/23b-5Z in September. The well was plugged and abandoned tight in mid-October, after reaching TD. Well 13/25b-5Y was kicked off in mid-October. Three weeks later, Talisman announced that well 13/23b-5 was a new discovery, with oil-bearing sandstones of Lower Cretaceous age. Appraisal 13/23b-5Z was sidetracked to the southwest, where thicker oil-bearing sands were encountered, and tested 35° API oil at 6,700 bopd. The 13/23b-5Z appraisal sidetrack was drilled to the west and proved the extent of this thicker sand sequence over the structure. Talisman said that further studies are required, but initial estimates indicate the discovery could contain in-place reserves of between 20 million and 50 million bbl of oil.

ConocoPhillips kicked off exploration well 21/5a-6Z last November. The well was plugged and abandoned in early December, prior to kicking off sidetrack 21/5a-6Y. ConocoPhillips spudded exploration well 21/5a-6 last October, using the J. W. McLean semisubmersible in a water depth of 463 ft. Well 21/5a-6 (Enochdhu) was plugged back to the bottom of the 13-3/8-in. casing prior to kicking off 21/5a-6Z (Finlaggan).

Last December, Maersk spudded exploration well 22/15-3, using the Noble Ton V. Langeveld semisubmersible in a water depth of 285 ft. The well was suspended as a future producer in mid-January after testing. Maersk drilled exploration well 22/15-3 on behalf of license operator BG. The well was targeting the Banks prospect.

In May 2006, GDF Britain made a gas discovery “with significant potential upside” in the 44/12-2 well on the Cygnus prospect. The field is about 106 mi off the Lincolnshire coast in roughly 65 ft of water. The 44/12-2 discovery well was suspended following a successful testing program. The well encountered a number of gas-bearing zones in the Rotliegendes and Carboniferous. It was anticipated that most of the key pre-development studies needed to facilitate a commerciality decision will be completed by the end of this year.

Onshore E&A drilling totaled eight wells. Of this amount, six were wildcats, and two were appraisals.

Development and production. There were 228 development wells spudded in the UK offshore during 2005. This is an increase on the 168 development wells reported to have been spudded in 2004. So far in 2006, DTI figures show 67 development wells spudded offshore in the first quarter, which would translate to 268 for the full year.

Development drilling took place on 71 fields during 2005, nearly double the number of fields in which development drilling activity took place in 2004. Apache’s Forties field saw the most activity, with 30 wells drilled. A significant amount of development activity also took place on Chevron’s Alba field, with 15 wells spudded. CNR International drilled 14 development wells on Ninian field during 2005.

Onshore UK development drilling increased during 2005, with 17 wells drilled, compared to nine wells drilled in 2004 and 17 wells drilled in 2003. BP drilled 12 of the onshore wells at its Wytch Farm field. The remainder were drilled at Singleton and Welton (Star), and West Firsby (Europa) fields. So far in 2006, first-quarter onshore development drilling has totaled three wells, but that pace is expected to increase some during the rest of the year.

One new gas find was reported onshore early this year. Egdon drilled the Kirk-leatham 4 (L40/1 5-14) on the PEDL0 68 license in North York County.

Production and Development Consent was given for 13 new offshore developments and nine incremental developments during 2005. Four onshore development consents were granted. New offshore oil field developments during 2005 included Wood (Paladin, May), Blane (Paladin, June), Enoch (Paladin, June), Brenda (Oilexco, November), Chestnut (Venture, November) and Maria (BG, December). Incremental oil projects included Sycamore (Venture, May), Statfjord “late field life” (Statoil, June), Captain’s Addendum Area C (Chevron, August), Kyle (CNR, August), Nevis Far North (Exxonmobil, September) and Medwin (Talisman, October).

Four new, additional, oil field developments have been approved in 2006. In January, Venture received approval of Goosander field in Block 021/12. A month later, Maersk obtained the go-ahead for developing Donan field in Block 015/20a. Two more fields followed in May. These include Oilexco’s Nicol (Block 15/25a) and Nexen’s Ettrick (Block 20/02).

The new offshore gas field developments in 2005 included Munro (ConocoPhillips, March), Cutter (Shell, June), Garrow (ATP, July), Kilmar (ATP, July), Cavendish (RWE DEA, August) and Hunter (Caledonia, August). The incremental gas projects approved included: Trent and Tyne (Perenco, May) and Johnston (Caledonia, October). ConocoPhillips received approval to develop two fields in April 2006. These include Mimas (Block 048/09a) and Tethys (Block 049/11b). During May, DTI approved Newfield Exploration’s development of Grove gas field (Block 049/110).

NORWAY

On June 16, 2005, the Norwegian Ministry of Petroleum and Energy announced the 19th Licensing Round on its continental shelf. In an attempt to push for new activity and value creation in northern Norway (Fig. 3), 64 blocks, in both the Norwegian and Barents Seas, were included in the round. The 19th Round closed on Nov. 15, 2005, with awards expected to be made in first-quarter 2006.

|

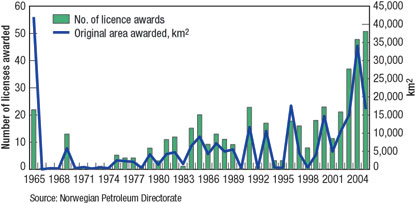

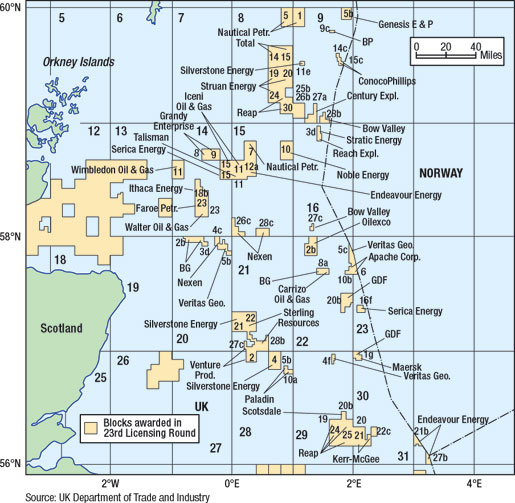

Fig. 3. Norwegian licenses and acreage awarded, 1995 – 2005.

|

|

This was the first such announcement for the frontier areas of the Barents Sea since 1996, with 30 blocks on offer this time. In all, 24 companies applied as individuals or as part of a group, a considerable figure compared to the last two licensing rounds. This confirms the belief that the NCS is becoming more competitive, especially in an international perspective.

The 2005 Awards in Predefined Areas (APA) were announced on Jan. 31, 2005, and comprised 192 blocks or parts of blocks in the North, Norwegian, and Barents Seas. The awards were made on Jan. 6, 2006, with 26 companies being offered 45 production licenses (31 in the North Sea and the remainder in the Norwegian Sea). The next APA was announced in February 2006.

Exploration and appraisal drilling, There were 16 exploratory wells spudded on the Norwegian Continental Shelf (NCS) during 2005, of which there were three appraisals, nine new field wildcats and four new pool wildcats, Fig. 4. Three wells, one new field wildcat and two appraisals that spudded in 2004 were completed in 2005. Although exploration activity was down slightly from recent years (17 wells spudded in 2004 and 22 in 2003), results from the wells drilled in 2005 were considered to be good, with new discoveries in new areas and new plays in mature areas. During 2005, 10 wells found hydrocarbons, yielding a 63% success rate, compared to 59% in 2004.

|

Fig. 4. Norwegian annual E&A activity, 1967 – 2005.

|

|

Statoil’s sidetrack, 34/10-48A (Topas), which was spudded in December 2004, was completed in January 2005 after intersecting oil. The aim of the well was to maximize production from the previously drilled 34/10-48S (Topas) discovery.

Norsk Hydro spudded the 35/11-13 (Astero) new field wildcat in March 2005. The well encountered oil and gas in Upper Jurassic sandstones and reached a final TD of 10,715 ft. A production test flowed 3,150 bopd, suggesting good commercial prospects for the discovery. The well was P&A’d in May 2005.

Shell spudded new field wildcat 6406/9-1 (Onyx SW) in June 2004. The well was suspended later that month as a result of the Norwegian offshore workers strike. Shell resumed drilling in November 2004. Throughout early 2005, a comprehensive logging, testing and sampling program was performed, which was hindered by technical problems. Gas was encountered in Jurassic sandstones, where two production tests, in two zones, each flowed a maximum 49.4 MMcfgd. The well reached a final TD of 16,650 ft and was P&A’d in May 2005. The size of the discovery has been reported to approach 2 Tcf of producible gas.

Statoil spudded the 6302/6-1 (Tulipan) new field wildcat in June 2005. The well encountered small quantities of gas in early Tertiary sandstones at a depth of 8,530 ft. It reached a final TD of 13,901 ft and was P&A’d last October.

Statoil spudded the 34/7-D4 H (Vigdis) new pool wildcat in June 2005. The well was drilled from an existing subsea template on Vigdis field and targeted the M5 structure. Oil was encountered in Brent Group sands. To optimize production, a sidetrack, 34/7-D4 AH, was kicked off in July 2005. Operations were completed in mid-August.

Norsk Hydro spudded the 30/9-J13 H new pool wildcat, in the Oseberg South area, in June 2005. It was listed as an observation well by the NPD. The well encountered oil and gas, and was drilled to a TD of 8,465 ft in the J-Central prospect. The well was suspended in mid-July 2005, but plans were underway to convert it into a production well and link it to the Oseberg South platform through an existing template on the J-Structure.

Norsk Hydro spudded the 6605/8-1 (Stetind A-6) new field wildcat in mid-June 2005. The well encountered gas in a relatively unexplored area of the Norwegian Sea, and a production test flowed about 4,235 MMcfgd. It reached a final TD of 14,806 ft and was P&A’d in October 2005.

Norsk Hydro spudded new pool wildcat 31/2-N11 H in July 2005. Oil was encountered in the deeper Brent formation of Troll field. The well was listed as an observation well by NPD. It reached a TD of 6,742 ft and was completed last August.

Norsk Hydro spudded the 35/2-1 (Peon) new field wildcat in July 2005. A large gas deposit was encountered in Pliocene sands. The well was drilled to a TD of 697 m (2,287 ft), and to date is the shallowest prospect drilled on the NCS. It was suspended late last August.

Eni spudded the 7122/7-3 (Goliat) appraisal well last October An oil and gas column measuring 180 m (591 ft) was encountered in prospects of Jurassic/ Triassic age at a depth of about 1,000 m (3,281 ft). Oil was also intersected in the Mid-Triassic at a depth of around 5,905 ft. The well reached a TD of 8,944 ft and was P&A’d in January 2006.

Subsequent to the drilling of exploration well 7122/7-3, the NPD in March 2006 made an upward adjustment of the estimated proven resources in the Goliat discovery in production license 229. The new estimate indicates about 250 million boe, made up of roughly 75% oil and 25% gas. The resources in the Kobbe formation account for the largest portion of this estimate.

Statoil, operator of production license 025, confirmed a discovery of oil and gas on the Gudrun structure. The discovery is 25 mi north of Sleipner field. Appraisal well 15/3-8 was drilled in 358 ft of water to a total depth of 14,993 ft below the sea surface. The well was concluded in rocks from the Late Jurassic Age. Oil and gas were proven in Late Jurassic sandstone. Two successful production tests were carried out, yielding maximum production rates of 1,000 and 1,200 m3 of oil per day.

This appraisal largely confirms the size of the discovery in the Gudrun structure. The NPD estimates that it holds at least 150 million bbl of recoverable oil equivalents. The licensees will now proceed with planning activities aimed at developing the Gudrun discovery.

In April 2006, Talisman Energy, operator of production license 038, proved additional petroleum resources in the 15/12-12 Rev discovery (previously called 15/12-12 Varg South). The discovery is 4 mi south of Varg field. Talisman also finished appraisal well 7/8-5 S in PL 301. The appraisal was drilled 1.2 mi southeast of the 7/8-3 Krabbe discovery well. The well was drilled in 266 ft of water to a TD of 13,675 ft below the rotary table. Development of Krabbe is currently being evaluated, along with the Mime Field, which is planned to be appraised later in 2006.

In June 2006, Statoil, operator of PL193, confirmed the discovery of hydrocarbons in a segment of the Valemon discovery near Kvitebjørn field. The well 34/11-5 S was drilled from the Kvitebjørn platform in 623 ft of water to a TVD of 14,337 ft below the sea surface. The well was completed in rocks from the Middle Jurassic Age. Total length of the well is 24,213 ft.

Hydrocarbons were proven in Middle Jurassic sandstones. The well has provided important information on the extent and properties of the 34/10-23 Valemon discovery. The licensees will continue to evaluate potential development of the Valemon discovery.

Statoil also completed drilling, in June 2006, an appraisal well on Morvin (6506/11-8) in PL 134B, which is located on Haltenbanken. The well’s objective was to prove the presence of hydrocarbons in the southern part of Morvin. The discovery is The well was drilled to a depth of 16,053 ft and completed in Early Jurassic rocks. Preliminary analyses confirm that the oil discovery extends into Middle Jurassic rocks.

Development and production. Twenty six development wells were ongoing at the start of 2005, with a further 143 spudded during the year. This compares to 21 underway at the start of 2004, with a further 130 or so spudded during that year.

During 2005, development operations commenced on Urd field, were restarted on Embla, Ula and Vale fields, and continued on Asgard, Brage, Ekofisk (area), Grane, Gullfaks, Gullfaks South, Gyda, Heidrun, Kristin, Kvitebjorn, Njord, Norne, Oseberg East, Oseberg South, Ringhorne/ Balder, Sleipner area, Snorre, Snøhvit, Statfjord, Troll, Tune, Valhall, Varg, Veslefrikk, Vigdis and Visund fields.

At the end of 2005, there were 67 fields in production offshore Norway, of which 36 were classed as utilizing improved recovery. During the course of the year, Oseberg South J-Structure (June 2005), Kristin (November 2005) and the Urd development (November 2005) came onstream.

During the year, developments were approved for these fields: Blane, Fram East, Oseberg Delta, Ringhorne East, Statfjord Late Life, Tyrihans, Vilje and Volve. Plans were either submitted or ongoing for Alvheim, Gimle, Gjøa, the Gullfaks area satellites and Hamsun.

Average NCS production during 2005 was 2,494,356 bopd, 12.66 Bcfgd and 292,793 bcpd. Output levels have been low, due to output stoppage and technical problems on several fields.

| |

Subsea and floater markets show continued strength, growth |

|

| |

The relative balance between newbuild and converted vessels is expected to continue, as the number of facilities increases and the overall value decreases. Furthermore, as the demand for floating production systems continues to grow, Infield sees an increasing number of redeployments, partly as a consequence of schedule pressures, but also a reflection of small field developments becoming economic under current oil prices.

|

|

| |

|

|

|

DENMARK

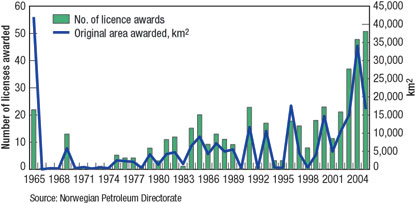

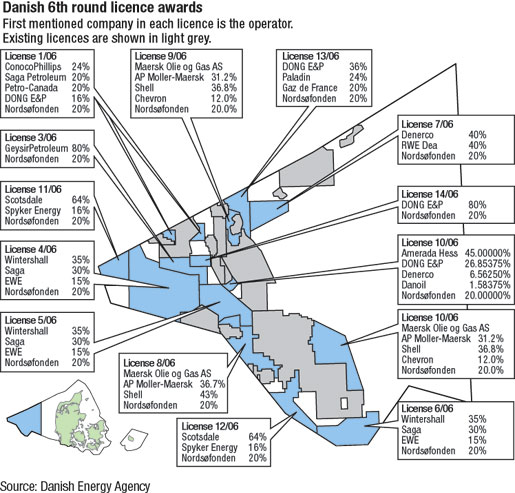

Areas west of the main Central Graben area are awarded through bidding rounds. Details surrounding the 6th Licensing Round, the first since 1998, were published in May 2005. A seminar was hosted in Copenhagen during June 2005, in which interested parties gathered to hear a range of presentations on offshore opportunities that Denmark has to offer.

As in previous rounds, the Danish state participates in licenses with a 20% interest. In past licensing rounds, DONG has been the partner on behalf of the Danish state. Because of DONG’s privatization, a new national unit has been formed, which will contribute to exploration activities and have a part in the proceeds when oil and gas are found.

The amount of exploration wells that companies plan to drill formed the basis on how the Danish Energy Agency (DEA) assessed each tender after the deadline on Nov. 1, 2005. Toward the end of 2005, DEA revealed that 17 applications had been submitted by 20 firms, some of which had not held any licenses in Denmark. During 2005, two licenses were awarded under the Open-Door Procedure, which covers all acreage east of the area managed by DEA.

In March 2006, Minister for Transport and Energy, Flemming Hansen, said that he intended to award 14 new licenses for E&P in the North Sea after having submitted the matter to the Energy Policy Committee of the Danish Parliament. The licensed area in the western Danish North Sea sector will almost double as a result of the new licenses. The 14 new licenses cover an area of 3,490 sq km, corresponding to about one-fourth of the area offered, Fig. 5.

|

Fig. 5. Fourteen new licenses have been awarded.

|

|

The interest shown by Danish and international oil companies in applying for licenses was greater than expected when the 6th Round opened in spring 2005. The licenses were subsequently awarded formally in May 2006. Half of the 14 licenses were handed to companies that were not active in the Danish North Sea before. These include Wintershall, Scotsdale, Denerco and Iceland’s Geysir Petroleum.

Exploration and appraisal drilling. Only one exploratory well was drilled in Denmark during 2005. This was due mainly to a rig shortage in the North Sea. However, two wells that had spudded in 2004 were completed in early 2005.

ConocoPhillips spudded the HPHT Hejre 2 appraisal well in November 2004. In late February 2005, the well was completed after encountering oil in Jurassic sandstones. Sidetrack Sofie 2A, drilled by DONG, was kicked off in December 2004 and completed in January 2005. It was drilled to appraise the reservoir further northwest of Sofie 2.

DONG’s Sissel 1 well was the only exploratory well drilled in Denmark during 2005. It spudded in mid-March 2005 and, although reservoir quality sandstones were encountered, there were no traces of hydrocarbons. The well was P&A’d later that month.

In May 2006, Amerada Hess completed drilling the appraisal well, Rigs 3 (5604/29-08), on South Arne field. The field is produces oil and gas from Danian and Upper Cretaceous chalk. Production was initiated from the field in 1999. Drilling of Rigs 3 commenced in March 2006 in 203 ft of water. The was later P&A’d after reaching a TD of 10,354 ft. m. Three sidetracks were subsequently drilled to positions west, north and east of the surface location. Rigs 3 and the three sidetracks proved the presence of oil and gas in the chalk layers and confirmed the geological model. Results are being evaluated closely.

Development and production. There were 15 development wells spudded within Denmark during 2005, with one well on-going since December 2004. This total was seven less than the number drilled in 2004. Development drilling operations were carried out at Nini, Siri, Dan, Gorm, Halfdan, Tyra and Valdemar fields.

The majority of development drilling (40% of wells drilled) was undertaken by Maersk on Halfdan field, including HBA-8, HBA-18, HBA-19, HBA-21, HBA-17, HBA-20 and HBA-24. HBA-18 was spudded in late December 2004. Maersk also drilled three wells on Dan field – MFA-13A, MFA-5A and MFA-7A. Further drilling was undertaken on Gorm (two wells), Tyra (three wells) and Valdemar (one well) fields. DONG drilled one development well on Nini field, Nini NA-07.

IHS reported that oil production offshore Denmark decreased in 2005 to an average 358,312 bpd from an average 368,683 bpd in 2004. Condensate production decreased in 2005 to an average 19,113 bpd from an average 20,547 bpd in 2004. Gas output increased in 2005 to an average 1.176 Bcfd from an average of 1.113 Bcfd in 2004.

According to the Danish Energy Authority, oil production was expected to total 138.4 million bbl in 2005, which equates to about 379,000 bpd. This is a 3% decrease compared to 2004. Natural gas output was expected to total 331.8 Bcf in 2005, an upward estimate from that given in the annual report, because of larger-than-expected production. Similar levels are expected up to 2009.

NETHERLANDS

There were 13 exploratory wells drilled in the Netherlands during 2005, of which eight were new field wildcats and five were appraisals. Onshore, a single wildcat was drilled, plus four appraisals. Offshore, seven new field wildcats and a single appraisal well were drilled.

BP spudded one onshore exploration/ appraisal well during the year. Located in the Bergen concession, GRTO-1 was spudded in late October 2005 and completed as a gas discovery in early January 2006.

Gaz de France stepped up its exploration/ appraisal campaign and drilled four wells during the year. The first, G/14-05, was spudded in February 2005 and plugged and abandoned dry over a month later. GDF followed on with G/14-4 in March 2005. That well encountered gas and was suspended in May 2005. Spudded in mid-April 2005, a gas discovery was made with well K/12-17 in June 2005. The final well, B/18-6, was spudded in late December 2005. It was P&A’d dry in late January 2006.

NAM drilled four onshore appraisal wells during the year. Two were drilled in the Rijswijk concession, Gravenzande 3 and 3A, in first-quarter 2005. Results from these wells were unreported. Two outposts were drilled in the Groningen concession during the year. Leens 2 was spudded in March 2005. After encountering gas, it was suspended in late June 2005. The re-entry, Grijpskerk 17ST1, was spudded in June 2005 and plugged and abandoned in mid-July 2005.

Wintershall’s exploration campaign in 2005 had already started in mid-December 2004, when it spudded K/18-7. Operations continued through to March 2005 when a geological sidetrack was made. K/18-7 ST was tested, and, after encountering gas, was suspended in June 2005. An appraisal well, Q/2-6, was spudded in October, and it was ongoing for the remainder of the year. Operations were suspended in January.

Development and production. During 2005, 21 development wells were drilled, six of which were onshore, with the remaining 15 drilled offshore. Onshore, NAM drilled two wells in the Groningen concession and one, each, at Ameland, Gravenzande, Kommerzijl and Oosterhesselen fields.

Offshore, ATP drilled a well at the L/6d field, and Gaz de France drilled two wells at the K/2-1 field and one, each, at the G/14-3, G/16a-1 and K/12-B fields. NAM drilled twice at the K/17-2 field and a single well at L/13-D. Total drilled single wells at the K/4-BE and K/5-E North fields, and Wintershall drilled two wells at F/16-E field, as well as one, each, in L/5b-9 and Q/4-10.

Wintershall’s F/16-A field came onstream in late November 2005. Two wells were in production in early December, at a rate of 90 MMcfgd.

In January 2006, GDF said that it was bringing four gas fields onstream in the Dutch North Sea, through its subsidiary, GDF Production Nederland BV (ProNed). The fields are north of Terschelling in Blocks G14, G16a and G17a. This production will be added to that of Block K2, northwest of Den Helder, which came onstream in December 2005.

ProNed estimates total reserves of the five fields at 18 Bcm of natural gas, with ProNed’s share amounting to 8 Bcm. About 12.8 Bcm has been purchased and will be brought to market by GDF. Maximum productive capacity for the five fields is estimated at 7.2 MMcmd, which includes 3.6 MMcmd for ProNed. The gas fields in Blocks K2, G16a and G17a were developed by ProNed in partnership with Energie Beheer Nederland BV.

FAROE ISLANDS

On Jan. 17, 2005, the Faroese Minister of Trade and Industry, Bjarni Djurholm, announced that seven licenses had been awarded under the Second Faroese Licensing Round to eight oil companies organized in five groups, or as individual companies. The awarded licenses have varying terms from three to eight years, with shorter sub-phases of one to five years. There are intermediate decision points, where it will be decided whether the licensee continues to the next phase of the license term, or whether the license will be relinquished. Companies awarded interests include Chevron, Statoil, Dong, OMV, Shell, Føroya Kolvetni, Atlantic Petroleum and Geysir.

Firm work programs were negotiated for the first phases of all the licenses. The general work programs cover seismic and other surveys, as well as processing and interpretation, with the purpose of maturing the licensed areas for future exploration drilling. Two of the licenses have commitments for exploration wells in later phases. Also, the Faroese Petroleum Administration reported that in addition, $1.9 million have been granted to projects of relevance for future investigation of the Faroe Shelf, and $2.4 million to competence development of the Faroese business community.

Minister Djurholm said that he was pleased with the number of licenses awarded and the work programs that have been agreed. He also said that it was important that the Faroese proceed with exploration activities to establish whether the country‘s subsoil holds commercial hydrocarbon deposits.

Last October, the Faroese Petroleum Administration announced that Minister Djurholm had signed an agreement with the holders of Licenses 004 and 007 on the drilling of an exploration well during 2007. It was reported that earlier in 2005, the holders of License 004, BP and Shell, initiated negotiations with the Petroleum Administration regarding the possibility of transferring the two remaining commitment wells in License 004 into a sub-basalt exploration well on License 007. BP and Shell have agreed with Anadarko Faroes Company, sole licensee on License 007, on drilling an exploration well within the tract. BP and Shell will farm into License 007, with BP becoming operator. BP and Shell will also relinquish License 004.

Exploration, appraisal and development drilling. No exploration wells were drilled in 2005. No development drilling took place during 2005.

In March 2006, Statoil, as operator of License 006, submitted an application to drill to Jarofeingi (Faroese Earth and Energy Directorate). According to the legislation, an application to drill must be submitted to authorities no later than three months prior to the spud date. The well results from an approval by Minister Djurholm in December 2005 to transfer remaining well commitments from Licenses 001 and 003 to License 006. License 006 is a nine-year deal granted to Statoil in the first licensing round.

The intent to drill this well shows the strategy behind granting nine-year licenses for challenging areas, so as to mature them as worked, as intended. Drilling was expected to begin this month and target the Brugdan prospect in License 006. The prospect lies on the basalt-covered area, making this well the first sub-basalt well on the Faroese Continental Shelf.

IRELAND

On Aug. 16, 2005, Noel Dempsey, the Minister for Communications, Marine and Natural Resources, announced that offers were made to applicants for Frontier Exploration Licenses in the North East Rockall Licensing Round. Two applications for licenses were received by the deadline, from Island Oil & Gas plc and Shell E&P Ireland.

After assessment by the department, these companies were offered the licenses that they applied for on July 20, 2005. The Round was formally opened in July 2004 and had an original deadline of March 31, 2005. However, due to unforeseen delays related to translation and publication in the EU Journal, the closing date was changed to May 31, 2005.

Exploration, appraisal and development drilling. No exploration wells were drilled in 2005. No development drilling took place during 2005. It is possible that a couple of exploratory wells could be spudded this year.

|