Gulf of Mexico Report

Deepwater activity trends in the Gulf of Mexico

After a robust upturn for several years, is there a downward trend developing?

W. N. Plamondon Jr., PM Consulting

How is the deepwater Gulf of Mexico faring? Well, the answer to that question depends on your time frame. If one looks over the last 15 years, the answer is, “very active.” However, if one looks at just the past year or two, the trend is flat to downward, which is especially puzzling considering the upswing in oil and gas prices. Part of the answer may lie in the fact that there has been a spate of recent discoveries, and budgets need to be divided between wildcatting and appraising on the one hand, and development drilling and infrastructure development on the other. This article provides information to help answer this question.

POSITIVE AND NEGATIVE FACTORS

The key question is, “How much CAPEX will be allocated to pure deepwater exploration, compared to completions and development, and shelf activities?”

Some negative factors. Many companies are risk adverse in the extreme. The memory of the 1998 – ’99 price collapse has not faded. Various operators do not have confidence in current commodity prices, and some are still using $25 per barrel for future budgeting purposes. In addition, rather than drill new wells, some companies have been buying back their stock, or paying down debt. And although high prices have slowed the pace of finding reserves on Wall Street rather than through the drillbit, mergers and acquisitions continue.

Drilling costs are very high, and it is difficult to achieve deepwater authorization for expenditure (AFE) estimates. On average, $44 million has been estimated for deep wells, while the actual average cost achieved was $73 million.1

For fifth-generation units, day rates have increased to $180,000 – 250,000 and above. With increasing demand, day rates could be pushed higher. Spread costs approach $400,000 – 450,000 per day. Completion costs in ultra-deep water are also expensive. Completions take 57% of the deepwater development CAPEX (Fig. 1).2

|

Fig. 1. GOM deepwater development CAPEX. Courtesy, BHP Billiton.

|

|

Costs are also increasing for services, engineering and new production facilities. Since many wells in the Central and Western Gulf are subsalt, the drilling costs are substantial, and it is difficult to predict success. To add insult to injury, Hurricane Ivan caused considerable damage to platforms, spars and pipelines. Time and money had to be spent on repairs. We are just now returning to full production. A number of pipelines are still not back in service.

It takes a considerable amount of time for G&G prospect evaluations, to form partnerships and to work out farm-in agreements. It also takes a long time to work out the joint cost-sharing for the construction of hubs being used for production facilities.

Various studies indicate that large reserves remain to be found in deep water. Yet, we still are not replacing reserves.

Some positive signs. However, not everything is negative. This year’s budgets and well plans are encouraging. Lehman Brothers’ Survey for 2005 indicates that global E&P spending will increase by 6% and US spending by 8%. The Credit Suisse First Boston (CSFB) report projects an 8% increase for North America and 12% overall.

Commodity prices are remaining at very high levels. Should they continue, E&P expenditures could be increased. Commodity prices have been up for more than two years. The spot and futures price for WTI oil is staying near $50/bbl in today’s chaotic market. Natural gas futures are in the $6.00/Mcf range. As a result, oil company profits are up substantially. For 2005, the firm Groppe, Long and Littell forecasts an average price of $49.00 for WTI wellhead and $6.00 for natural gas at Henry Hub.

The Central Gulf Lease Sale 190 and Western Gulf Lease Sale 192, held in 2004, increased the inventory of deepwater blocks. Central Sale 194 and Eastern Sale 197 held on March 16, 2005, may add additional deepwater leases to the inventory. In addition, if not drilled – which seems likely to be the case – 1,708 leases will expire from 2005 to 2007, in water depths of 1,000 to 10,000 ft.

THE RIG MARKET – THE RETURN OF THE MAJORS

On a short-term basis, it would appear that the deepwater rig count peaked in 2001 at 41 rigs (Table 1), whereas the overall GOM rig count peaked in 1996 at 190 rigs (Fig. 2). s of March 14 there were six rigs working in ultra deep water (>5000 ft) and 31 rigs working in deep water (>1000 ft).

| |

TABLE 1. Deepwater rig

count (annual average). |

|

| |

2000 – 33 |

|

| |

2001 – 41 |

|

| |

2002 – 36 |

|

| |

2003 – 29 |

|

| |

2004 – 33E |

|

| |

2005 – Current average of 35 |

|

|

|

Fig. 2. Red line shows average rig count, while dark blue and light blue bars indicate number of wells drilled.

|

|

Rigs are being committed for 2005 – 2007 on a term basis. Rig day rates for new contracts are up substantially as a result of the increase in demand (Table 2). Commitments are being made by Noble and Diamond Offshore to upgrade existing hulls into new rigs.

| |

TABLE 2. Gulf of Mexico: Deepwater

day rates (per Fearnley Offshore, 1/15/05). |

|

| |

Rated water

depth, ft |

Day rate,

thousands $ |

|

| |

|

|

| |

4,000 to 6,000 |

110–146 |

|

| |

6,000 to 7,500 |

130–170 |

|

| |

7,500 and up |

200–245 |

|

|

Rigs that are available for the High-Specification market are shown in Fig. 3. From 2002 to 2004, there were numerous rigs, with three- and five-year contracts, available for sublets. Some of these rigs could be obtained for less than $150,000 per day. Now, the pendulum has swung the other way for ultra-deepwater activity.

|

Fig. 3. So-called high-specification rigs, such as drillships, late-generation semisubmersibles and heavy duty jackups. Data courtesy of Quest Offshore Resources. Source: Rigzone

|

|

The Ocean Baroness is coming from Southeast Asia to the GOM for Amerada Hess at an estimated day rate of $200,000. GlobalSantaFe took delivery of the Development Driller II in February 2005, which is mobilizing from Singapore to the Gulf of Mexico to start operations in July 2005 for BP. The day rate is in the low $180,000s. Also, the Development Driller I will arrive in the Gulf shortly thereafter for BHP. This day rate will be in the low $210,000s.

Transocean announced contracts for their High-Specification rigs. ChevronTexaco contracted the ultra-deepwater Cajun Express, starting in June 2005, for two years at $207,000 per day, and extended the Discoverer Deep Seas for one year from January 2006 at $240,000 per day. These rates reflect the premiums for dual derrick and off-line capabilities.

ChevronTexaco is increasing their total budget for 2005 by 18%. They intend to spend $2.5 billion in the US. They have contracted the Ensco 7500 for two years starting in August 2005 at a day rate of $185,000. BHP has added a one-year extension to the GSF C.R. Luigs contract to January 2007. The day rate was raised from about $180,000 to the mid $220s. Transocean announced that Shell has extended the Nautilus contract from September 2005 at $220,000 and added the Deep Sea Spirit, at the expiration of the Unocal contract, in September 2005, at $270,000.

Murphy extended the Transocean Marianas contract for 120 days from December 2004 at $150,000. Following this, BP has contracted the rig for $180,000 until December 2006. BP also has issued bid requests for two additional fifth-generation rigs starting in late 2006. With three rigs leaving the GOM in recent months, BP will bring the GSF Explorer back from the Black Sea to fill one requirement.

Noble Corp. has secured a two year commitment from Shell to revamp and upgrade the Clyde Boudreau to 10,000-ft water depth. The rig, an F&G 9500 Enhanced Pacesetter, is now in the Signal Shipyard in Pascagoula, Mississippi. It should be completed during the third quarter of 2006. It will have a drilling depth capacity of 35,000 ft and accommodations for 200 people. The contract value is between $142 million and $153 million.

Noble is also engineering an upgrade of the Dave Beard, also an F&G 9500 Enhanced Pacesetter, in a Chinese shipyard. It could be completed in about 29 months. In addition, they have two Bingo hulls, which were originally started by Ocean Rig that could be upgraded. In addition, Noble is currently proposing to increase the water depth capabilities for the existing EVA 4000 designs from 6,000 to 8,000 ft. This could be accomplished with aluminum-alloy risers.

Diamond Offshore announced initiation of a major upgrade for the Ocean Endeavor, a Victory class semisubmersible, for ultra-deepwater service. The rig has been stacked in Sabine Pass. It will be designed to operate in up to 10,000 ft of water. The cost is estimated at $250 million, with delivery expected from Singapore in about two years. It will be outfitted for 8,000-ft moored operations, have 6,000 tons of variable deck load and twice the usable deck space compared to previous upgrades. These units are less expensive than building a new hull because of the current high cost for steel. Deliveries for new construction could take more than three years.

DEVELOPMENT ACTIVITY

The OCS Report, MMS 2004-021, Deepwater Gulf of Mexico 2004: America’s Expanding Frontier, describes the long time lines from leasing to production. There is a three-year average lag time between leasing and initial drill. An additional two-year average before the well is qualified. From first acquisition to first production, the average is almost seven years.

As an example, the discovery well at BP’s Mad Dog prospect was drilled in December 1998. Development drilling has taken place with good results. The topsides were lifted onto the truss spar hull in February 2004. Production commenced in January of this year. Additional wells are being completed and brought online.

BP’s Thunder Horse, discovered in April 1999, is scheduled for start up later this year. The Atlantis discovery well was drilled in May 1998. Batch setting of 15 wells has taken place. GSF’s Development Drill II, a newly designed semi, is expected to be on location mid-2005. First production is scheduled for the third quarter of 2006. The capital expenditure for partners BP and BHP will be over $2.5 billion.

BHP has the Development Driller I scheduled to arrive in July 2005 to start the Neptune project at Atwater Valley 575. The discovery well was in September 1995.

Some production that recently came onstream includes: Dominion’s Devil’s Tower, which was discovered in December 1999; BP’s Holstein, discovered in February 1999, with production beginning December 2004; Murphy’s Front Runner, discovered in June 2001 is now on production; BP’s Mad Dog, discovered in 1998, began producing this January.

Kerr-McGee’s Red Hawk has been a noteworthy achievement. It was discovered in October 2001. By using a spar on a fast-track approach, the company has been able to get Red Hawk on production in less than three years.

Anadarko discovered Marco Polo in April 2000. Production commenced in July 2004. The TLP was built simultaneously with the development drilling. The time and cost was reduced by using a hub and spoke concept and subsea tiebacks. Following Anadarko’s K-2 and K-2 North discoveries, the delineation wells will be drilled this year. The wells will be tied back to the Marco Polo platform and placed on production in 2005.

According to the MMS, there were 14 new startups in 2004. This included six floating production facilities consisting of two tension-leg platforms and four spars that can serve as hubs for future production.

Possible project sanctions for 2005 include: BHP’s Neptune at Atwater Valley 617; ChevronTexaco’s Blind Faith at Mississippi Canyon 695/696, as well as the company’s Tahiti find at Green Canyon 640 which received ABS approval for a truss spar design, with Kerr-McGee as a new partner; Norske Hydro has taken over the Champlain project at Atwater Valley 63 from ChevronTexaco, renamed it Telemark, and is considering a floating production platform.

PRODUCTION

In terms of production, the various production facilities scheduled for startup in 2005 most likely will not be sufficient to reverse the downward trend in production this year, but 2006 and beyond look more promising, based on some recent deepwater discoveries. A five year MMS forecast, taken from operator surveys and plans, shows that, after a temporary lull in 2004 – ’05, deepwater oil production should increase through 2006 – ’07, before falling off (Fig. 4a). Gas is projected to peak a year earlier (Fig. 4b). Damage from Hurricane Ivan continues, but things are slowly getting back to normal. As a result, the graphs in Fig. 4 are actually a bit high for 2004: 30 million bbl and 130 Bcfg too high, which is the estimated cumulative loss due to the hurricane at year-end 2004.

|

Fig. 4. Total GOM production, from MMS operator surveys. Top, oil; bottom, gas.

|

|

Going out six years, MMS forecasts a rebound to 2.25 million bpd oil for 2011, which would be an all-time high, and 13.25 Bcfd for gas, which is about the same as 1990 gas production and 1.3 Bcfd higher than last year.

DRILLING

It is doubtful that the deepwater drilling trend in the last two years will be reversed this year (Fig. 2). In the overall Gulf, the trend is much more obvious, with rigs having peaked in 1996, and wells in 1997. With a 30% success rate for exploration in the GOM3, this should create a future need for delineation and development wells. While there has been an impressive increase in new rig contracts since July 2004, an average of 32 – 34 deepwater drilling rigs may not be enough to cover the GOM market.

EXPLORATION

On the exploration side, in general, more Plans Of Exploration need to be filed (Fig. 5). Not as many POEs have been filed as a result of the Central 190 and Western 192 Lease Sales in 2004 as one might expect.

|

Fig. 5. Exploration and development plans submitted to the MMS.

|

|

On the positive side, MMS and various operators announced a number of discoveries in 2004. Since 1/1/2001, there have been 47 deepwater discoveries. Of these, 43% are in water depths greater than 6,000 ft (Table 3) and 43% of the borehole depths are greater than 20,000 feet TVD (Table 4).4

| |

TABLE 3. GOM deepwater discoveries. |

|

| |

Drilling depth, ft |

Wells |

|

| |

|

|

| |

25,000 + |

9 |

|

| |

20,000-24,999 |

11 |

|

| |

15,000-19,999 |

15 |

|

| |

<15,000 |

9 |

|

| |

Unknown |

3 |

|

| |

|

|

| |

Total |

47 |

|

|

| |

TABLE 4. GOM deepwater discoveries. |

|

| |

Water depth, ft |

Wells |

|

| |

|

|

| |

4,000–4,999 |

16 |

|

| |

5,000–5,999 |

11 |

|

| |

6,000–6,999 |

6 |

|

| |

7,000 |

14 |

|

| |

|

|

| |

Total |

47 |

|

|

Appraisal and delineation wells are being planned, for explored blocks, but at some point in time, lease expirations will become a factor for undrilled real estate. Whether this results in a burst of exploration activity remains to be seen, but given the realities of day rates, the number of rigs available and the timeframe, it seems unlikely. According to Lexco Data System’s database, the 1,708 upcoming lease expirations break down as shown in Tables 5 and 6. The deepwater tracts from the Central Gulf Sale 190 and the Western Gulf of Mexico Sale 192, should add more deepwater leases, as estimated in Table 7.

| |

TABLE 5. Lease expirations,

1,000–4,999 ft deep water. |

|

| |

2005 |

118 |

|

| |

2006 |

328 |

|

| |

2007 |

445 |

|

| |

|

|

| |

Total |

891 |

|

|

| |

TABLE 6. Lease expirations,

5,000-10,000 ft ultra-deep water. |

|

| |

2005 |

36 |

|

| |

2006 |

281 |

|

| |

2007 |

500 |

|

| |

|

|

| |

Total |

817 |

|

|

| |

TABLE 7. Estimated lease additions from Central

Gulf Sale 190 and Western Gulf Sale 192. |

|

| |

Tracts |

Water depth, m |

|

| |

|

|

| |

37 |

400–799 |

|

| |

101 |

800–1,599 |

|

| |

55I |

1,600+ |

|

|

During 2004, NOIA and the Offshore Operators Committee successfully pressed the EPA for speeding up promulgation of a new blanket discharge permit. The original one had expired in November 2003. The new permit was issued in October 2004. This could lead to activity from the Central and Gulf sales in 2004 and the March 2005 Central sale. However, an increase in POE filings is not yet apparent.

TOP 10 PLAYERS

To reduce the risk exposure in deepwater, many operators are seeking partners to farming, or farming out leases for operation by others. These joint operating agreements take time to be worked out. A number of recent discoveries were accomplished in this manner. The top 10 leaseholders are not necessarily the top 10 operators. Per the Lexco Data Systems database, they are listed in Table 8.

| |

TABLE 8. Top 10 leaseholders. |

|

| |

Lease Owners |

Total

owned |

Lease operators |

Total

operated |

Rigs* |

|

| |

|

|

| |

1 |

BP Amoco-Vastar |

396 |

ExxonMobil |

322 |

1 |

|

| |

2 |

ExxonMobil |

386 |

ChevronTexaco |

302 |

1 |

|

| |

3 |

ChevronTexaco |

359 |

BP Amoco-Vastar |

272 |

3 |

|

| |

4 |

Shell |

333 |

Shell |

250 |

2 |

|

| |

5 |

Devon |

291 |

Kerr-McGee |

182 |

2 |

|

| |

6 |

Kerr McGee |

270 |

ConocoPhillips |

137 |

0 |

|

| |

7 |

BHP |

195 |

Unocal |

130 |

1 |

|

| |

8 |

ConocoPhillips |

176 |

BHP |

108 |

1 |

|

| |

9 |

Encana GOM |

171 |

Amerada Hess |

67 |

1 |

|

| |

10 |

Unocal |

150 |

Anadarko |

49 |

1 |

|

| |

|

|

| |

|

|

|

|

Total |

13 |

|

| |

*Deepwater rigs under contract as of February 25, 2005, per MMS |

|

|

POTENTIAL ACTIVITY: MAJORS AND INDEPENDENTS

There are now indications that, in addition to Shell, BP and ChevronTexaco will increase their exploration activity in the GOM during 2005. ChevronTexaco may have more term requirements, in addition to their recent contracts. Independents, such as Kerr-McGee, BHP, Dominion, ENI, Murphy, Mariner, Nexen, Noble and Walter Oil & Gas, are contributing to the increase in midrange and deepwater activity. Both Spinnaker, with four wells to drill, and Petrobras, with two wells to drill in 2005, are seeking rig time. Kerr-McGee is now drilling the Chilkoot prospect at Green Canyon 320 and the Constitution prospect at Green Canyon. The company has five more prospects lined up for later in the year.

Amerada Hess is now drilling the Wembley prospect, at Mississippi Canyon 722, and participating in BHP’s Shenzi 4, at Green Canyon 653. The company is increasing its deepwater activities with a number of planned locations, both for wells operated by others and with the Baroness when it arrives later this year. This includes Turtle Lake in Green Canyon Blocks 846 and 891, operated by ChevronTexaco. Its wells include the Ouachita prospect in Green Canyon 376 and Barossa at Garden Banks 158. The company also plans to drill the Jack Hayes prospect off Texas, acquired in Western Gulf Sale 192 in 2004, when it was the most active bidder.

Various projects are awaiting 2005 budget approvals. For example ExxonMobil will sublet the Deep Sea Spirit. ExxonMobil, Marathon, Devon, ConocoPhillips and Unocal do not seem to have plans to increase GOM deepwater activity in 2005 by signing new rig contracts. However, they may sublet rigs from other operators.

Anadarko has two areas of Mutual Interest (AMI’s) under evaluation. Jupiter, which consists of 20 blocks with ExxonMobil in the East Breaks and Alaminos Canyon areas, and Auger, comprising 95 blocks with BP in the Garden Banks and Keathley Canyon areas. Licensing and reprocessing of 3D data is involved, and farm-ins are being sought. Therefore, it is not likely that drilling will take place until mid-2005 for Jupiter, and 2006 for Auger.

According to CSFB’s Energy in 2005, issued on December 20, 2004, Devon plans to drill 5 – 6 Eocene wells with its partners. This would include appraisals at St. Malo, Cascade and Jack, in addition to wells at La Jolla, Isle Royale and Ontario. Most of these locations are in ultra-deep water. Cascade will be drilled by the operator, BHP, using the GSF C.R. Luigs after the current well at Shenzi. Further seismic evaluation is being carried out for La Jolla and Isle Royale. Ontario is being studied by operator ChevronTexaco.

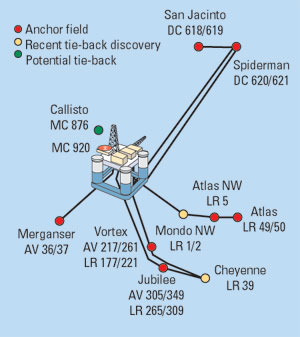

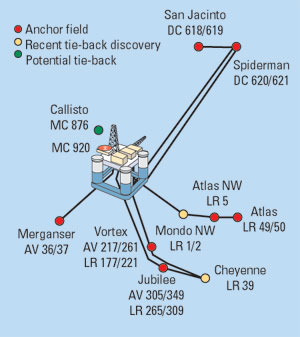

Eastern Gulf. As soon as possible after the long-awaited Eastern Gulf Lease Sale 181 (December 2001), Anadarko drilled four different locations. During 2003, in three out of four wells, it made discoveries at Spiderman, Jubilee Atlas and Atlas Northwest. These are in the Atwater Valley, Desoto Canyon and Lloyd Ridge areas.

Subsequently, the Atwater Valley Producers Group (AVP) was formed. It comprises six companies: Anadarko, with four locations; Kerr-McGee, for the Merganser prospect; BHP, for the Vortex prospect; and Devon, which has an interest in both prospects. AVP also includes Dominion and Spinnaker, which have interests in wells in the area.

An agreement has been announced between AVP and Enterprise to design, construct, install and own Independence Hub, a 105-foot deep-draft semi-submersible platform (Fig. 6). It will have a two-level production deck and be capable of processing 850 MMcfgd. The hub location will be in Mississippi Canyon 920, in about 8,000 ft of water. The estimated cost is $385 million. In addition, a pipeline will be built at a cost of $280 million. First production is expected in 2007.

|

Fig. 6. AVP and Enterprise will design, construct, install Independence Hub in Mississippi Canyon Block 920, in about 8,000 ft of water. Courtesy of Quest Offshore Resources.

|

|

Shell and partner Anadarko made a successful discovery with their deep Cheyenne well in Lloyd Ridge 399, using the Deepwater Nautilus. The well will be tied back to the Independence Hub. The rig has moved to the Vrede prospect at Atwater Valley 267, which was purchased in Sale 180.

Murphy, with Anadarko as a partner, has successfully drilled the South Dachshund prospect at Lloyd Ridge Blocks 1 and 2. This includes a discovery well at LL 2, followed by a successful appraisal with a sidetrack to a bottomhole location in LL 1. The operation will be taken over by Anadarko. They will use a subsea connection to Independence Hub.

Newfield still hopes that their Dalmatian prospect in Desoto Canyon 47/48 will soon receive approval from the MMS.

Petrobras and Marathon have Exploration Plans that have been approved, but no drilling plans have yet been announced.

Central Gulf. There are several announced discoveries in the Lower Tertiary trend in the Walker Ridge area, including BHP’s Cascade and Chinook, and Unocal’s St. Malo. Another well in this play includes ChevronTexaco’s Jack prospect at Walker Ridge 759. On September 7, 2004, Devon and ChevronTexaco announced a discovery with more than 350 ft of net pay. The well was drilled to 29,000 ft, in 7,000-ft water depth. Appraisal drilling will be required.

No announcement has been made about BP’s Das Bump prospect in Walker Ridge 724. This block is close to Unocal’s, et al., discovery, St. Malo at Walker Ridge 678. Another potential well in the area is BP’s Isle Royale. The rig recently moved to the Diamond Back location in Alaminos Canyon 739.

According to the CSFB report, exploration success at St. Malo, Sturges, Cascade and Jack, each of which remains unbooked, provides opportunities for future reserve additions. At some point, a production test may take place on one of these locations. These areas require considerable time to study and evaluate economic development. The problems include distance from shore, at least 175 – 225 mi, and the deep 7,000 to 10,000-ft water depths. It appears that a purpose-built semi or an FPSO may be considered.

There are several new well starts in the Mississippi Canyon area: BP, using the Discoverer Enterprise at MC 822 for Thunder Horse South; Nexen, using the GSF Celtic Sea at MC 755, Anduin prospect; and Chevron at MC 937 Makalu with the Discoverer Seven Seas.

Western Gulf. The Perdido Foldbelt in the Alaminos Canyon area includes Unocal’s Trident and Tobago prospects, Shell’s Great White, and ChevronTexaco’s Tiger prospects. These could be fairly large oil discoveries. ChevronTexaco drilled its Silvertip Prospect in October 2004 at AC 815. They have acknowledged a discovery in 9,226 ft of water. BP is now drilling in 6,850 ft of water on the Diamond Back prospect at Alaminos Canyon 759, using the Ocean Confidence. This location is a considerable distance from previous discoveries.

It will be very expensive to install production facilities, since these locations are in 8,000 – 10,000 ft of water, 150 – 160 mi from shore, and with no infrastructure or pipelines in the area. In all, there are eight companies involved. The estimated cost for pipelines is $1,000,000/mi. Ultimately, it might be connected to the Cameron Highway pipeline system.

This is still considered a frontier area. Shell’s technical group has been studying the possibilities for several years, and sufficient progress could be made to reach a decision in 2005.

Pemex. Unocal’s Trident well is on the US border with Mexico. It is yet to be determined when, and how, Pemex would drill in the contiguous area. While the Mexican Constitution prevents a direct interest by outside companies, there have been discussions with various operators regarding some type of technical agreement.

Luis Ramirez Corzo, the Director of Exploration and Production for Pemex, has been reported to say, “We are currently looking at the possibilities under our legal framework to work with international oil companies in this area.” However, it was announced that the majority will not approve any changes in the Mexican Constitution.

In addition, they have announced a delay in all exploration activity. It is unlikely their Perdido Foldbelt activity will occur during Vicente Fox’s administration, which lasts until 2006. However, they have recently announced that there will be tenders out at the beginning of 2006. These may be Multiple Services Contracts, which they used with private companies last year in some areas. Pemex still needs a way to fund this effort, as these contracts are not acceptable to other companies.

SUMMARY

The GOM provides a politically safe and secure environment with a stable market demand, bolstered by strong commodity prices. Since AFEs have been ranging from $25 to $60 million, better planning and coordination will be necessary between operators and contractors to reduce the average actual cost of $71 million.

Lease explorations might start to add to rig demand in 2005. Although there is an ample supply of deepwater rigs on a worldwide basis, rig utilization within the GOM could be a factor. If large discoveries in new areas occur, it should increase the need for appraisal drilling.

In general, exploration activity is stable, but there are no signs of an increase, at least not in filed Exploration Plans. GOM deepwater leases provide opportunities in new exploration plays, particularly the Paleogene (a.k.a. Eocene/ Wilcox) Play. To continue even the present slow decline in domestic production and ensure that it does not worsen, we will ultimately need to find a way to remove the moratoria on the West Coast, East Coast and offshore Florida.

Can we now count on an increase in continuous, sustained activity? A meaningful increase for 2005 is doubtful, but the present budgeting, rig contracting activities, and operator-based forecasts look optimistic for 2006, perhaps beyond.

LITERATURE CITED

1 Cahuzac, J., of Transocean, Speech on topic: “Treads in Drilling for Exploratory and Development Wells in Deepwater,” OTC Luncheon, Houston, May 2004.

2 Nowe, S., BHP Billiton, IADC presentation on September 29, 2004.

3 Pettingill, H.S.; Weimer, P.; (and Harper, cited), “Worldwide deepwater exploration and production,” The Leading Edge, Vol. 21, No. 4, pp. 371 – 376, April 2002.

4 Dodson, J. K., Transocean presentation, Houston, OTC May 2004.

THE AUTHOR

|

|

W. N. “Bill” Plamondon, Jr. earned a bachelor of engineering from Yale University and an MSc in management engineering from the New Jersey Institute of Technology. His 54 years in the oil field include positions with California-Texas Oil Co., Continental-Emsco, Dixilyn-Field Drilling, Zapata Offshore, Global Marine, Houston Offshore, Marine Drilling Co., Offshore Data Services, Chiles Offshore Inc. and a consultant for BurlingtonResources on the Deepwater Rig Market. He initiated the first monthly offshore rig locater, which was distributed to contractors and international oil companies. He is a member of NOIA, SPE, AADE, IADC and NOMADS.

|

| |

|

|