Information Technology

Knowing the economic value of information

Business intelligence, including timely insight from the field, as well as regulatory bodies, is emerging as the critical knowledge of how to run the business – field operational intelligence.

Scott M. Shemwell and D. Paul Murphy, Strategic Decision Sciences, Houston

Historically, the largest operators have made the investment to find, develop and produce greenfield properties. As oil and gas fields age, they are often passed to smaller firms with lower overhead that continue to exploit them until the last drops of petroleum have been wrung, and the economics dictate subsequent plug and abandonment. This basic business structure has been in place since Titusville, and so it always will be – or will it?

Nimble players will prosper and new actors will emerge, while others will join the vanished members of the Oil & Gas 500 of 20 years ago. Similar to most other industries that are embracing Six Sigma (see Definition box) practices, the digital oil field is becoming less oil and more digital. Timely and accurate information is more important to shareholder value than simple physical assets, because only this type of information can optimize geological and hardware performance.

|

|

|

| |

Definition: Six Sigma

Six Sigma is a rigorous and a systematic methodology that uses information (management by facts) and statistical analysis to measure and improve a company's operational performance, practices and systems by identifying and preventing ‘defects' in performance and service-related processes in order to anticipate and exceed expectations of all stakeholders to accomplish effectiveness.

|

|

|

|

|

|

The information contained in this article is extracted from the results of a recent study, Road map to the optimal enterprise: A guide to the impact of information driven field operations on the petroleum corporation by the authors. This research assessed the operational aspects of the information driven oil field. The study comprised extensive literature research as well as interviews with key executives charged with delivering the value of integrated operations.

NEW HORIZONS

Well over 90% of the world's daily oil and gas production is managed by legacy IT systems such as SCADA and process control systems. In many cases, these systems have been in place for decades and, like other investments and facilities that produce petroleum, upgrades should be scrutinized on the economic benefits provided.

In the past, many IT investments were poorly understood, ill defined and frequently suffered the end result of any project with these two deficiencies. Today, however, IT is as mature as any other oilfield technology, e.g., horizontal drilling, multilateral production, etc. As such, it is simply a tool that, in the hands of a master craftsman, may produce a work of art, but, in the hands of a hack, may actually damage what he sought to repair or enhance.

If the oil field is becoming more information-driven and knowledge-based rather than the mechanistic practices manifested throughout its history, then the decision-making process will be different.

Another major driver is demographics. The industry continues to expand operations throughout the world and is hiring a broad range of individuals from all cultures. Knowledge that is largely in the hands of Western-trained personnel must be transferred to a new, more diverse generation.

Technology has always played a major role; indeed, the very definition of reserves is a function of the available technology to extract the mineral. IT offers a set of sophisticated tools which, selected and used properly, can make a direct economic contribution to operators and their service/ supply chain partners.

EXPECTED VALUE OF MARGINAL INFORMATION

Marginal utility is the additional satisfaction/ benefit that a consumer enjoys from consuming an additional unit of a commodity or service. While appearing academic at first blush, this concept is the lynchpin of any OPEX decision, regardless of technology.

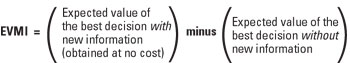

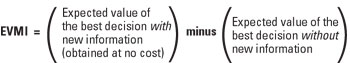

Expanding marginal utility into the information age, one can extend it to assess the benefit the firm enjoys from an additional unit of information. The Expected Value of Marginal Information (EVMI) represents the probabilistic (expected) maximum cost of new information to the decision process, Fig. 1. As long as the real cost of new information does not exceed EVMI, the information is adding economic value to the firm. In other words, it is the threshold value proposition, or NPV is greater than zero, for new information. The Asset Maturity Model, defined later in this article, is a five-step approach for ascertaining the value captured from investments in information technology.

|

Fig. 1. EVMI- – expected value of marginal information defined.

|

|

The value matrix. Optimal enterprise performance is defined as obtaining maximum value from the portfolio of assets using appropriate investment in IT. Suitable expenditures in technology can increase the yield of a particular asset. However, putting a large-scale enterprise-wide IT solution in place for all assets may not be either necessary or cost-effective.

Moreover, there is a cost associated with each step in the model. Management must assess whether the cost of taking a step or two will result in a return that meets organizational goals. Adhering to this model will help companies assess whether the time and cost required is the best use of capital. It is important to realize that it is not necessary that assets of lower maturity move up to the next level. Investments in IT can simply add value to the current level without necessarily changing levels. For example, updating a SCADA system may simply make a Level 2 asset more efficient at lower cost.

The value matrix is multidimensional. Information and knowledge management are multifaceted, and any value proposition based on these components must recognize that a number of variables are interacting. This is essentially a set of linear equations, whose solution is a matrix by definition.

It is clear that developing and providing an integrated operations solution is a non-trivial activity. It requires three basic collaborative components: capital deployment, asset maturity assessment and supporting business processes.

OPEX should seek its most productive level. Whether investments are in IT or tubing, asset managers must determine what provides the highest return. More importantly, firms must decide which assets to keep, invest in, harvest or dispose of.

The decision matrix is not one-, two- or even three-dimensional. Rather, it is the interaction of increasing numbers of variables, each with their own equation or line item in a set of simultaneous equations. This is not your father's decision-making process.

High impact. All business models are undergoing a high level of critical scrutiny. The upside is very high; however, the track record is poor. Can information technology really add value to field operations? If so, how can success be determined, both at the enterprise level as well as with the business unit?

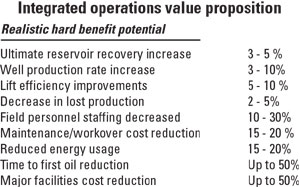

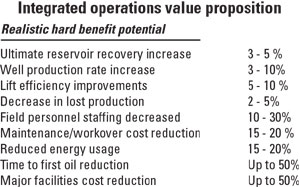

Integrated operations has the potential to remake the upstream oil and gas business, Fig. 2. Unlike other possibilities of the past, this time it is for real. Technologies and business processes associated with information management tools have reached a point where massive systemic industry change is not just possible or likely, but is inevitable.

|

Fig. 2. Integrated operations' potential to remake the upstream oil and gas business.

|

|

Certainly brownfield and possibly even greenfield production is driving toward Six Sigma. Regardless of the price point of crude oil or natural gas, firms are tasked to continually drive costs down and provide commodity products at high margins. Moreover, Sarbanes-Oxley and the capital markets demand that performance is real and documented.

The pressures on the executive suite are enormous, growing and unrelenting. Better and timelier information is the only way executives and board members can meet their fiduciary responsibilities.

ASSET MATURITY MODEL

Investments in IT have been hard to quantify and, thus, justify. Business cases, often filled with soft benefits, such as increased productivity, are difficult to compare with other opportunities in the portfolio. Moreover, the IT track record is mixed, and it has not been clear that firms with robust information-based strategies have performed better than those that have not embraced these tools.

The typical portfolio of assets is a set of properties that span various exposures and risks, differing performance and dissimilar stages of maturity. The asset life-cycle curve is well known, and companies assess investment opportunities and performance using portfolio management techniques.

Management makes OPEX decisions continually. When tubing collapses or wells sand up, decisions are made to either P&A or work over the well. Economics dictate the type and amount of investment to be made. Why should investments in the IT that powers revenue-producing assets be made any differently?

Any investment, including IT, must be fit-for-purpose. Most oil and gas production is governed by legacy systems, and maintenance, enhancement and upgrade paths must be assessed against rigorous criteria that are aligned with both the strategic goals of the firm and its approach to portfolio management.

The Asset Maturity Model (AMM) does not focus on the asset life-cycle model, but, rather, the robust nature of a revenue-producing asset. For example, what is a specific resource producing? And if x amount of investment is made, what additional performance can be expected? AMM ties IT investments to the firm's portfolio of assets. In this sense, it is a more realistic approach than traditional net present value (NPV) models. Every asset has an individual characteristic. The investment criterion for each asset differs and IT expenditures are no different. Moreover, many IT solutions are focused at the enterprise level and, therefore, are not specific to individual assets.

One size does not fit all, and each asset requires a specific management process. For example, an aging, low-revenue producing asset most likely cannot be enhanced by significant IT investment. Other revenue producers may have a higher impact on the bottom line. Each must be assessed independently, and then rolled up into the total portfolio.

STEPS OF THE AMM

AMM is a five-step model (Fig. 3) similar to the approach that others have used to describe the maturity of business and technical processes. It provides the principles and practices underlying the investment of IT in each asset class and is intended to provide organizations with a logical methodology for making IT decisions.

|

Fig. 3. The five-step AMM model.

|

|

Basic. Assets in this class are managed with minimum IT infrastructure. Processes are ad hoc and robust systems are not required to deliver maximum value.

Structured. These types of assets capitalize on IT solutions composed of COTS (Commercial Off-The-Shelf) solutions with a minimum of customization – strictly limited to minor configuration with no code change.

Standardized. IT solutions are configured to support well-defined and documented management and engineering processes. Information systems may be customized to the specific needs of an asset.

Integrated. Assets in this category are networked together and back to an operation center(s). Operators manage performance, capitalizing on sophisticated systems that integrate field assets to Enterprise Resource Planning (ERP) systems. A diverse set of software applications from a number of vendors may be deployed.

Optimized. Asset management is enabled by continuous improvement (Six Sigma) intelligent solutions (comprised of smart devices with human oversight systems) that fully integrate field performance with the back office. Feedback and feed-forward loops capitalize on all aspects of this approach, driving asset performance to its Pareto optimal equilibrium.

It is important to realize that each organization's asset portfolio may include all levels of asset maturity; however, a more optimal enterprise-level approach may be for a company to focus on fewer asset classes – in much the same manner that firms emphasize specific core competencies.

EXAMPLES

AMM Step One, or Basic, would typically be older fields, often onshore, where the need for IT systems is minimal, e.g., stripper wells in West Texas. Assets classified as Step Four might include relatively new deepwater facilities. Few, if any, assets are currently classified as Optimal, or Step Five, as this is the ultimate goal of the enterprise.

The majority of revenue producing assets falls into Steps Two through Four. Moreover, investments need not be major to extract value. One North Sea operator simply upgraded its communications and control system on a platform and associated subsea systems, to take advantage of new intelligent devices using technology that allowed for communications by means of the existing power cable. This relatively simple and inexpensive enhancement allowed this operator to take full advantage of new smart sensors and reap the benefits of integrated operations.

In other cases, the use of Electrical Submersible Pumps (ESPs) and their ability to provide a stream of information about well performance, communicating sophisticated content to engineers remotely, even on wells without SCADA, is a game-changing capability. Operators using this technology, in some cases, have effectively upgraded assets from Step One to Step Three using this single technology.

These are but two examples of the incremental improvements that are made using intelligent devices, management and assessment software, and new business processes to obtain higher asset performance. There are more opportunities for this type of incremental improvement driving toward Step Five or Optimal Six Sigma factory-like performance.

GOING FORWARD

There is a great deal of discussion regarding the use of digital technologies in the oil field. Some believe that this lies the future. Others believe that the future is now. Game-changing information technology is robust, accurate and available. Moreover, industry business models are in flux.

Recently, a midsize operator partnered with a major Wall Street financier to purchase over a billion dollars of producing assets, with payback supported by a price point per boe. If this business model finds favor, are the super major business models at risk? What about those who are not as creative or do not have access to real-time information?

There is a great deal of discussion on this topic. Pundits put forth scenarios, while major players carve out their view of a solution. However, there are two issues that are often lost in the discussion. First, in the integration of the field to the back office, how has the feedback loop been defined, and what is the value proposition? Second, and perhaps most important, have real, robust, theoretically based economic models been put in place?

More often than not, real economic assessments have not been conducted on the so-called digital oil field. Scenarios of huge success and immediate high value-add are possibly naive and at odds with Six Sigma experience. Why should the upstream oil and gas business be any different than other sectors in this regard?

There are four major components that must be integrated (Fig. 4): 1) data migration into a logical system which all may access; 2) integration of field operations to back office (often communications constrained); 3) the development of a measurable value proposition; and 4) a feedback loop that facilitates the integration of iterative engineering systems with transaction-based financial systems.

|

Fig. 4. Integrated operation workflow.

|

|

CONCLUSION

Tools have been developed that enable operators and their key energy service providers to assess, in a quantitative manner, how shareholder funds will be invested. Many do not understand, much less appreciate, the economic forces at work here. They may choose to claim ignorance as employees of major organizations. Sarbanes-Oxley, the capital markets, and other primal forces will not buy into this excuse. Firms are at peril if they let hourly or professional employees, regardless of tenure, force them into untenable positions.

IT deserves a seat at the table. No longer a stepchild, this mature technology is the equivalent of any other upstream learning. Regulators, markets and stakeholders demand no less. We believe that the fundamental structure of the industry is changing: there are far fewer greenfield opportunities, national oil companies are much more aggressive in their negotiations with petroleum operators and, perhaps more important, Wall Street is making megabucks available to those believed to have superior managerial acumen. Business intelligence, including timely insight from the field, as well as regulatory bodies, is emerging as the critical knowledge of how to run the business – field operational intelligence.

Finally, the AMM model is an efficient and cost-effective way to maximize the interoperability of the IT tools that manage revenue-producing assets. The marginal utility approach has shown to be an effective method illuminating the way forward. All of this must be accomplished within very narrow marginal economic tolerances. Companies who can accomplish this will prosper and grow; those who can't, won't.

THE AUTHORS

|

|

Scott M. Shemwell is the chairman and CEO of Strategic Decision Sciences. The firm provides its clients with Quantitative and Qualitative analysis and insight with tailored, strategic behavioral-economics-based programs throughout the major decision process. For over 25 years, Dr. Shemwell has led the turnaround and transformation process for global S&P 500 organizations as well as start-up and professional services firms. He has led or been a key individual in over $5 billion in mergers, acquisitions and divestitures. He is a leading authority on information management, business processes and industry change, as well as organizational structure analysis with over 140 publications. He may be contacted at: Scott.Shemwell@StrategicDecisionSciences.com

|

|

D. Paul Murphy is executive vice president with over 30 years of consulting, project management, organizational restructuring, process re-engineering, systems analysis and design, programming, management and operations experience. He has implemented key ERP packages such as SAP, Oracle and J. D. Edwards, as well as specialty E&P (Artesia, Excalibur, IRI, Gemisys, OGSYS, Allegro, etc.) and manufacturing industry packages. He has managed national and international consulting practices for Ernst and Young, IBM, KPMG and Cap Gemini Sogeti. He has international project experience working in numerous countries. Mr. Murphy holds a BS degree in economics with an accounting minor from the University of Houston. He also attended MIT for three years. He may be contacted at: Paul.Murphy@StrategicDecisionSciences.com.

|

| |

|

|