|

| |

|

By Petroleum Technology Transfer Council |

Internet data rooms save dollars, increase marketing efficiency

New software enables buyers of upstream assets to simultaneously view data and prospect details, saving clients and the marketer considerable time. The online data room also nets the seller and marketer savings in paper, copying and distribution costs

Greg Pipkin, North America Upstream Energy, Lehman Brothers; and Mickey Henry, Petris Technology, Houston

Once a decision is made to divest an oil and gas asset, time is of the essence to take advantage of opportunistic market conditions or realize cash flow quickly. The marketing objective is to get relevant data to qualified prospects quickly and efficiently.

Lehman Brothers employed Petris Technology, Inc.'s Internet Data Room (IDR) software to present data online for a 500-well Gulf of Mexico/Louisiana divestiture. This approach saved Lehman, the marketer, and the seller more than 100 hr of time. Savings in normal paper, copying and distribution costs incurred with a physical data room offset the IDR costs.

Competition was enhanced, because each prospective purchaser had an opportunity to begin evaluating the package without leaving his office. Each prospective purchaser who reviewed the package saved thousands of dollars and many hours by being able to review it more efficiently. IDR access history provided real-time feedback to the marketer and its client about the interest levels of prospective purchasers.

CONVENTIONAL DATA ROOMS

Conventional, "physical" data rooms are cost- and resource -inefficient for all involved. Because prospective buyers have no quick way to examine asset packages in physical data rooms, this can limit the number of parties who seriously review an offering package.

The seller also must prepare a physical data room, control access and maintain order during visits. Seriously interested buyers often experience delays in scheduling data room visits, plus there is the cost and resource commitment for physical visits, which can take days. Robert Harrell of HP Associates, a frequent user of IDRs, estimates that an out-of-town trip to a physical data room could cost $750 to $1,500 per person, and multiple-person teams are common.

If one considers that as many as 50 prospects might review a package, then the cumulative savings to the investment community become significant. Additionally, potential buyers will often find that some data needed for their internal analyses are not in convenient digital format. They then must rely on inefficient hand notes, incur the costs of making data digital, or forgo some analyses they would have liked to perform to make their offer more informed.

SALE OF A 500-PLUS-WELL ASSET PACKAGE

Lehman Brothers investment banking group was hired to assist in the sale of an E&P company. The asset package contained more than 500 wells in the Gulf of Mexico and onshore Louisiana. The seller and the marketer used IDR to organize and display relevant asset data. Within just a few days, the vendor set up the IDR site and branded it with the client's logo and color scheme. The client and marketer worked with the application's easy-to-use tools to load data from their offices directly into the IDR.

From past experiences with transactions of similar size, the marketer estimates that, working together with the client, the two firms saved more than 100 hr retrieving, organizing and distributing data to prospective purchasers. In addition, each out-of-town prospect that had its team review online data from its offices saved travel and overhead costs.

Data for this divestiture were organized into folders and subfolders, very much like the Microsoft tree hierarchy on one's personal computer. The main folders were labeled as follows: General, North Louisiana, South Louisiana, GOM, Other Offshore, Reserves, Wellbore Schematics, Additional Reserves and Value, and North Louisiana Drilling Wells Cross-sections. As new data were added, they were loaded into another folder labeled Updates. Subfolders defined other categories and contained the specific datasets.

Initially, the data were loaded in a bulk upload process. Data were easily loaded by using a simple browse-and-upload feature embedded in the application. Individuals that were assigned project creation privileges could effect changes, while others only had viewing rights.

Using this administrative feature, folders and documents were just as easily moved, renamed or deleted. More than 600 separate documents were loaded. Virtually any document format could be uploaded, including Microsoft Word, PowerPoint and Excel documents, and jpg, tiff, gif and bmp images.

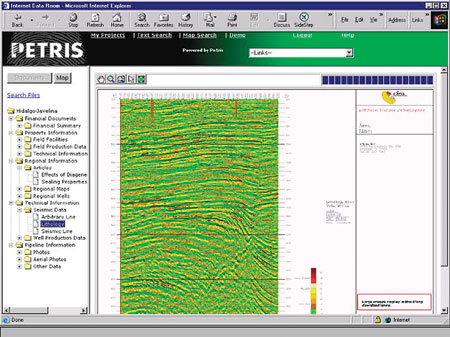

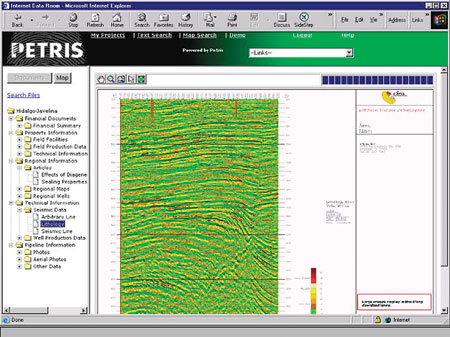

Large-format images, like maps and cross-sections, were sent to the vendor, whose team used a special compression technique to make these images web-friendly. These images were loaded into IDR folders, as well. Embedded viewing tools allow the viewer to zoom and pan the image after it opens in the viewing screen, Fig. 1.

|

Fig. 1.Large-format images, like maps and cross-sections, are specially compressed for web-friendly viewing. Embedded viewing tools allow prospective buyers to zoom and pan images after they open in the viewing screen.

|

|

Beyond initial loading, IDR enables dataset updates to be made within minutes with the "click of a mouse." Thus, potential buyers always have the most current data in front of them. No information technology personnel are required to install or use this application, since the software is provided as an ASP (Application Service Provider) service.

Lehman Brothers, through its relationships and knowledge of the market, identifies prospective investors that are qualified to make specific acquisitions and invites these prospects to review the data package once the offering commences. IDR creates a more level playing field, because each invitee has a username and password that enables simultaneous review of the offering's datasets.

Administrative tools also allowed the marketer to monitor user activity. This provided helpful, real-time market feedback about the serious buyers.

BENEFITS THROUGHOUT THE VALUE CHAIN

The marketer found IDR to be an effective tool for providing prospective buyers access to data. Large sets of data can be organized, updated and presented to prospects online, resulting in significant efficiency for all parties. Since the software can be licensed for only the marketing period, and its usage helps reduce copying and delivery costs, it has little impact on marketing expenses. Internet access to data also expedites the communication of data during the marketing process.

From the seller's perspective, the IDR approach was much less intrusive, both initially and during the viewing stage. The firm's staff was short-handed, yet the software enabled fewer people to easily upload and organize the data online. This also allowed the seller's staff to focus more of its energy on the ongoing business decisions needing to be made.

For a buyer, it can be a disadvantage to attend a data room after other invitees. The IDR approach enables all parties to simultaneously start their reviews and determine their levels of interest within a matter of hours. Minimal time and resources are required, so they are also able to examine other asset data packages during the same time interval.

THE AUTHORS

|

|

Greg Pipkin is managing director of Lehman Brothers' North America Upstream Energy unit. He has more than 20 years of experience in energy investment banking. He earned a BS degree in chemical engineering, as well as an MBA, from The University of Texas. He can be contacted at gpipkin@lehman.com.

|

|

Mickey Henry is vice president of Market Development at Petris Technology, Inc. He also serves as product manager for the Petris Internet Data Room, which he has helped develop. Previously, Mr. Henry spent more than 20 years in commercial and investment banking, and in real estate finance. He holds BA and MA degrees from Southern Methodist University, and an MBA from the University of Texas. He can be contacted at henry@petris.com.

|

| |

|

|