Deepwater Activity

Brazil furthers its leadership in deepwater E&P

Addressing new operating challenges, state firm Petrobrás continues to set new deepwater records and enjoy fresh exploratory successes

Giovanni Toniatti, Rio de Janeiro

For many years, Brazil has been a leader in deepwater E&P technology, thanks to ongoing exploitation of the country’s offshore basins in the Southeastern Atlantic margin. Back in 1997, Brazil attained a world record, deepwater operating depth of 1,709 m (5,607 ft). Since then, this leadership role has remained unsurpassed. At present, Brazilian wells – exploratory and in new field developments – are being spudded at water depths greater than 3,000 m (9,800 ft).

A LOOK AT HISTORY

When one looks at these striking achievements and searches for the driver behind them, the answer simply comes down to one name: Petrobrás (Petróleo Brasileiro S.A.). Petrobrás this year is celebrating its 50th birthday as Brazil’s national oil company, having been founded in 1953.

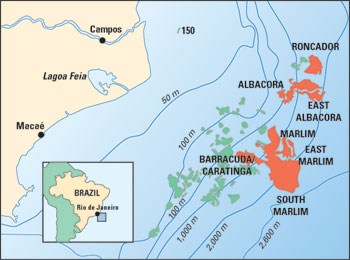

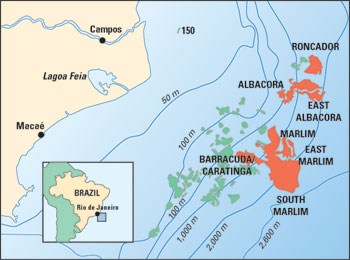

To date, substantial oil reserves have been found in deep and ultra-deep waters. Examples of such fields are Marlim, Albacora, Roncador, Barracuda, Caratinga, Espadarte and Marimbá, all of which are in the Campos basin, Fig. 1. Estimated recoverable reserves for the three giant oil fields in ultra-deep water – Marlim, Albacora and Roncador – exceed 8 billion bbl.

|

Fig. 1. Most of Brazil’s deepwater and ultra-deepwater fields are still in the Campos basin, shown here.

|

|

It is now very timely to analyze the whole deepwater cycle of exploration, development, production and relevant events, both for Petrobrás and for the most recent chapter in Brazilian E&P history. In presenting Brazil’s deepwater story, two tales must be told. One is Brazilian society’s inevitable path toward opening up the economy. The other tale is that of a monopoly-holder utilizing all of its strength and competence to retain maximum possible wealth in oil and gas resources, before the monopoly is broken.

While putting these two tales into a coherent perspective, one realizes that the most important factor has come to be (paradoxically) the new Brazilian Constitution, approved in 1988. This document was the fruit of uncharacteristically democratic debates (remember, Brazil had freed itself from 20 years of authoritarian, military rule). Unfortunately, the new legislation was more nationalistic than previous regulations in some very important aspects. These areas included upstream hydrocarbons, mining rights, and power and energy.

The almost immediate result, enhanced by a weak global economy, was a general withdrawal of foreign investments from Brazil. Gradually, the federal administration and a significant part of the legislature came to realize that some changes were crucial to regaining foreign investors.

In the oil and gas sector, specifically, the implied opening-up to international operators was sparked by amendment No. 5 of 1995. This plank would effectively break Petrobrás’ monopoly on upstream operations. After this amendment was approved, law 9478/97 of August 1997 set up the proper legislation for enforcing that plank. This document, the “oil law,” went into force after January 1998 and laid the foundation for Agencia Nacional do Petróleo (National Petroleum Agency), better known as ANP.

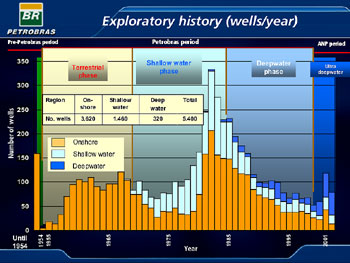

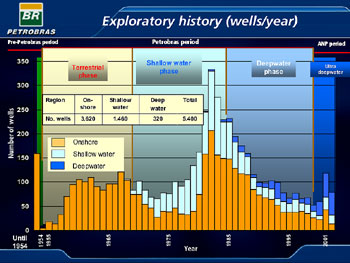

Getting back to Petrobrás, and during the same period (mid-1980s to 1998), the firm actively pioneered a long list of offshore operations, beginning in shallow water. A steep increase in reserves occurred after 1984, when Albacora and Marlim fields began producing in the Campos basin, Fig. 2.

|

Fig. 2. Since the mid-1980s, deepwater wells have comprised an ever-growing share of Brazil’s hydrocarbon finds and now constitute a majority of the national total.

|

|

EVOLUTION OF STRATEGY

Petrobrás’ management, sensing the inevitable loss of its monopoly, began applying a two-prong strategy:

- To be a strong, technical and commercial player in the forthcoming attraction of partners

- To acquire as much acreage as possible before the actual opening of the E&P sector.

Adoption of this strategy strongly influenced Petrobrás’ internal culture. For instance, R&D began to receive great support, at a level never seen before. One example is Petrobrás’ Research and Development Center (CENPES), which was endowed with yearly funding in an amount equivalent to 1% of the company’s gross revenues. In addition, new alliances and partnerships with universities and research institutes were intensified. COPPE, the Institute of the Federal University of Rio de Janeiro (UFRJ), also plays a major role as one of the partners in ultra-deepwater technologies conceived and developed by Petrobrás.

In addition, the firm sent more professionals to be educated and trained abroad than ever before. Substantial training also succeeded with expatriate engineers and geologists working for Braspetro (Petrobrás’ foreign branch) in numerous joint ventures with majors and NOCs worldwide. Essential to Petrobrás’ joint ventures were projects carried out in the Gulf of Mexico, beginning in the early 1990s with Texaco, (with great success) and then with BHP in an ultra-deepwater environment. In 2001, the Offshore Technology Conference gave Petrobrás its annual award for excellence in deepwater technology.

The strategy of negotiating partnerships from a strong position also has succeeded. In 2002, more than 50% of the company’s exploration work on its concessions was already conducted through partnerships. Of these, 62% were operated by Petrobrás’ partners.

EXPLORATION EFFORTS

During 2003, the activity cycle that started as an immediate reaction to the 1995 amendment has peaked, triggered by the preparation of approval requests to ANP for E&P projects. In the so-called “blue blocks” (exploration concessions granted to Petrobrás by the “oil law”), 6.2 billion boe of gas and light oil have been discovered and evaluated outside of the Campos basin, in the Santos, Espirito Santo and Sergipe-Alagoas basins.

The challenge is to solidify knowledge of the plays in these new frontiers, where ultra-deepwater ventures have not yet been unveiled. This new cycle should be profitable for all the companies that have centered their exploration efforts on the blocks they acquired in one or more of the five bidding rounds already held by ANP.

The remnants of Petrobràs’ “blue blocks,” which had to be relinquished to ANP recently by expiration of the concession terms, will be the great stars in the 2004 bidding round for obvious reasons.

Recent discoveries. Since Brazil’s E&P market opened in mid-1998, many important Campos basin discoveries have found heavy oil in the range of 11° to 19°API. They also have been in water depths between 4,300 and 7,200 ft. These finds, together with recent discoveries in the Sergipe-Algoas, Santos and Espirito Santo basins, have added nearly 4 billion bbl (3.985 billion bbl) of new oil reserves and 14.8 Tcf of gas reserves to Brazil’s resources

Among discoveries made in the last two years, in the northern Campos basin, two of the more notable are Jubarte and Cachalote fields. Together, they hold 950 million bbl of oil. An early output scheme began at Jubarte in October 2002, at just over 18,000 bpd of 17°API oil, through an extended test system in 4,350 ft of water. Meanwhile, at Cachalote, the reservoir holds similar oil at a site about 6 mi northeast of Jubarte. Development plans were under study as this article was written.

In January 2003, Petrobrás announced a Campos basin oil discovery in the 9-MLL-3 well, about 60 mi from the coast, near Marlim Leste (Marlim East) oil field. The well was drilled to a 9,843-ft TD in 3,215 ft of water. It found two reserves of 20°API oil, measuring 121 and 39 ft. This discovery is estimated to be 150 million boe.

Two months later, Petrobrás struck the 1-SES-147 and 4-SES-149 finds, on Block SEAL-100 in the Sergipe-Alagoas basin, offshore Sergipe state. Flowrate for the 1-SES-147 well was 3,000 bopd. Reserves for the two wells were recently estimated to be 150 million bbl of oil.

In May 2003, Petrobrás struck oil in the 1-ESS-121 wildcat on Campos basin Block BC-60, just 6 mi south of Jubarte. Drilled in 4,364 ft of water, the well found several intervals that totaled 344 ft of oil pay. Several weeks later, the company announced that three more oil finds had been drilled in water depths between 4,833 and 5,036 ft. Since then, the company has announced a preliminary reserves estimate of 1.85 billion bbl for the four wells.

In mid-July, Petrobrás hit a significant oil find outside the Campos basin. On Block BES-100 of the Espirito Santo basin, 37 mi from the coastline. the company drilled the 1-ESS-123 wildcat to a productive depth of 12,415 ft in 4,508 ft of water. The find is also notable for being light oil (40°API, relatively rare for Brazil). Initial reserves are 450 million bbl.

In October 2003, Petrobrás said that two tests showed light oil in the BC-60 Block off the coast of Espirito Santo state in the Campos basin,. The company said it found 40° and 41°API oil (again, relatively rare) while testing the 1-ESS-130 well. No estimate of potential reserves for this find had been announced as of press time.

In addition to oil, a landmark natural gas find was made last April. On Block BS-400 in the Santos basin, 85 mi offshore São Paulo state, Petrobrás drilled the 1-SPS-35 wildcat. It was spudded in 1,591 ft of water and reached a 16,260-ft TD, with a 328-ft reservoir. Initial reserve estimates had been 70 Bcm (2.47 Tcf) of gas and 435 million bbl of condensate. However, Petrobrás has revised the gas figure to an impressive 419 Bcm (14.8 Tcf).

DEVELOPMENT

Always keen to expand business in Brazil, Petrobrás still holds a substantial portfolio of fields with large proven reserves to be developed. They all lie in deep and ultra-deep waters, and hold relatively heavy crude oil. In addition, several recent discoveries and trends in the exploratory blocks indicate potentially substantial volumes of heavy and light oil are available to be exploited in the mid-to-long-term future, in ever increasing water depths.

Several deep and ultra-deepwater projects are under development or in the conceptual design phase, all of them in the Campos basin. The main ones are the permanent production system phases of Barracuda/ Caratinga, Marlim Leste and Albacora Leste (Albacora East) fields. Each of these fields has already gone through a small, pilot production phase.

In addition, the next phases of permanent production systems at Marlim Sul (Marlim South), Roncador, Albacora, Marlim and Espadarte fields are also progressing or in planning. Altogether, these various projects will develop grades of oil ranging from 14° to 30°API, in water depths from 3,500 to 8,500 ft. By 2010, these projects will account for around 1.0 million bopd.

Barracuda/Caratinga. Development of these Campos basin fields is a tandem project with two phases, pilot and permanent. Barracuda field was discovered in April 1989, in water depths ranging from 1,969 to 3,609 ft. It is about 60 mi from the coast. Initial Barracuda production via the pilot system began in September 1997 from one well and concluded in October 2002. The system’s FPU, P-34, sat atop a water depth of 2,740 ft.

The permanent system (20 producing wells, 14 water injectors) should begin producing by January 2005 through a 150,000-bopd FPSO, P-43, Fig. 3. Production should peak as high as 146,000 bopd by 2006.

|

Fig. 3. The P-43 FPSO, with topsides configuration shown in this rendering, is set to handle up to 150,000 bopd from Barracuda deepwater field by January 2005.

|

|

Caratinga field was discovered in February 1994, in water depths ranging from 2,789 to 4,429 ft. It is 62 mi from the coast. The field was hooked to the pilot system from November 1997 to October 2002 via one well. Caratinga’s portion of the permanent system will include 12 producing wells and eight water injectors. Output should peak at 127,000 bopd in 2006. A second FPSO, the 150,000-bopd P-48, will handle and store Caratinga’s output.

Marlim Leste. This field was discovered in January 1987 in a 4,104-ft water depth, 75 mi from the coast. Development began with a pilot production operation from April 2000 to June 2002, via connection of one well to the P-26 semisubmersible production vessel in Marlim field.

For the field to go into full production, the company plans to station an FPU that will be connected to nine producing wells and five water injectors. This system should go onstream in 2006. Lifted oil will be transported onshore. Gas will be carried to the P-26 vessel. Peak oil production will be 105,000 bpd in 2007.

Albacora Leste. Discovered in March 1986, Albacora Leste field is roughly 75 mi from the coast. Just one development phase is planned. A floating production unit (the P-50 FPSO) will be installed, and output is set to begin in July 2004. Subsea facilities will consist of 22 producing wells and 10 injectors. Produced oil will be transferred from the FPSO via shuttle tankers to the mainland. Production should peak by 2007 at 180,000 bopd.

Marlim Sul. Discovered in November 1987, Marlim Sul lies 75 mi off the northern shoreline of Rio de Janeiro state, in water depths ranging from 2,789 to 7,874 ft. A multi-phase pilot production project ran from April 1994 to December 2001.

The first phase of a four-phase, permanent system went onstream in December 2001, operating from the P-40 semisubmersible production vessel in 3,543-ft water. After treatment on P-40, produced oil is transferred to the P-38 FSO and later transferred to shuttle tankers for transportation onshore. The gas produced is compressed on P-40 and transferred to the Namorado platform (PNA-1) at Namorado field.

Due to what Petrobrás calls the first phase’s “excellent productivity,” a second phase project has been designed. It will increase the number of wells to 35, including 21 oil producers, and also install an additional, 100,000-bopd FPSO (P-51) on a temporary basis. P-51 should start operating in March 2006.

Roncador. In the northern Campos basin, 78 mi from the coast, Roncador was discovered in October 1996, in water depths between 4,921 and 6,234 ft. Development has been in four phases. Pilot production started on Jan. 23, 1999. Then, in May 2000, phase one of the permanent production system went onstream. At that time, the system comprised the P-36 semisubmersible production vessel and the P-47 storage vessel, with 28 oil producers and seven injectors.

Unfortunately, the P-36 sustained catastrophic explosions on March 15, 2001, and sank four days later. Subsequently, Roncador’s development concepts were reviewed, and the first phase was relabeled Module 1A and divided into two portions. The first portion, a short-term solution, enabled output to resume. It comprised eight production wells and three injectors, connected to the 90,000-bopd FPSO Brasil, chartered from SBM and converted in record time. Roncador’s output resumed on Dec. 8, 2002, less than 20 months after the P-36 accident. FPSO Brasil will remain until 2008, when its wells will be reconfigured for Module 1A’s second portion.

The second portion will include a new semisubmersible production unit, the 180,000-bopd P-52, to be anchored in 5,905 ft of water. Twenty production wells and 10 injectors will be connected, and oil from P-52 will be exported by underwater pipe to a fixed shallow-water platform. Gas will be exported to shore. P-52 will begin operating in March 2006 and continue until the field’s useful life ends.

Albacora. In the northern Campos basin, 68 mi from the coast, Albacora field lies in water depths between 492 and 3,445 ft. Already, several production phases have been initiated, beginning with Phase I in October 1987, followed by Phase IA in 1989, Phase IIA in 1996 and Phase IIB in 1998.

Albacora’s output peaked in 1998, at 174,000 bopd. Current output routes to the P-25 semisubmersible and P-31 FPSO. Two more development projects have been created for Albacora. One will connect three satellite wells to the P-25, making use of existing production facilities, with output peaking at 20,000 bopd in 2004. The other project will connect two wells to P-31, to make use of idle capacity, with output peaking at 10,000 bopd in 2004.

Marlim. Discovered in January 1985, 68 mi off the Rio de Janeiro coast, Marlim’s development was planned in five phases, or “modules,” with seven production vessels (four semisubmersibles and three FPSOs) and one FSO. Permanent development began with Module 1, when the P-18 semisubmersible production vessel was installed in May 1994. Marlim’s output peak was 586,315 bopd in 2002, when the Module 5 (including the P-37 FPSO) phase was implemented. At the end of 2004, another FSO (P-47) will be installed to increase Marlim’s oil treatment capacity.

Espadarte. This field was discovered in 1994, 68 mi from the coast, in water depths ranging from 2,461 to 4,921 ft. Development is comprised of eight oil producers and five injectors, with output routed through the P-15 semisubmersible. Output began in August 2000 and was expected to reach a 65,000-bopd peak during 2003.

PRODUCTION

During August 2003, Brazil’s crude output averaged 1.59 million bpd, up 2.6% from a month earlier and up 2.3% from August 2002’s average. Of that amount, 1.33 million bopd, or 83.6%, came from offshore fields. The Campos basin contributed 1.27 million bopd, equal to 95% of all offshore output and 80% of the country’s total.

Petrobrás attributed the increases to “greater operational efficiency” at platforms in the Campos basin. The company estimates that 65% of its production by 2005 will come from deepwater and ultra-deepwater facilities.

Royal Dutch Shell became Brazil’s first foreign oil producer during August. The firm began producing 20,000 bopd from one of eight production wells already completed in the Bijupirá-Salema fields area. The adjacent Bijupirá and Salema fields are in water depths ranging from 1,476 to 2,625 ft, 183 mi offshore the city of Rio de Janeiro. Discovered by Petrobrás in 1990, the fields have estimated recoverable reserves of 188 million bbl of oil and 62 Bcf of gas.

The Bijupirá-Salema Project is a joint venture between Shell Brasil (operator, 80%) and Petrobrás (20%). Shell assumed operatorship of the project after acquiring Enterprise Oil in May 2002. Shell also has interests in 14 exploration blocks offshore Brazil. “This is an important milestone for Shell, as well as for Brazil,” said Shell Brasil President Aldo Castelli. “We are the first private company to produce oil in the Campos basin, the most prolific hydrocarbon province in the country, following the opening up of the sector to private investment.”

Shell Brasil began production earlier than anticipated in the plan sanctioned by the National Petroleum Agency in 2001. Output will increase gradually to reach a peak of 80,000 bpd of 28°-to-31°API oil and 35 MMcfgd. The project produces through the Fluminense FPSO, with subsea wells tied back via three manifolds.

Meanwhile, Petrobrás last May put the 7-CRL-4D well onstream at 10,000 bpd of 41°API oil. The well’s output is considerably more than initial forecasts by the company. It is part of the Coral/ Estrela do Mar field development project, 112 mi offshore Paraná state. The project includes two more wells at Coral field and one in Estrela do Mar, all connected to the Atlantic Zephyr semisubmersible production vessel. The additional two Coral wells will boost output to 20,000 bopd.

| |

Table 1. Campos basin – significant data |

|

| |

First discovery |

1974 |

|

| |

Water depth |

165 to 11,155 ft |

|

| |

Floating production

units |

24 (14 semis,

8 FPSOs, 2 FSOs) |

|

| |

Jackups |

13 |

|

| |

Producing fields |

41 |

|

| |

Pipeline network |

2,625 mi |

|

|

MAIN TECHNICAL CHALLENGES

Several fields in production are already in a mature phase, or they soon will be in one. As this occurs, substantial water output is expected, and individual fields’ productivity will decrease. This will make it harder to keep long-term output profitable.

Although several production systems destined for field developments have already passed their sanction phases, many future designs have not yet been considered from all angles. Employing current technologies and practices would not make these designs as economically attractive as previous schemes. Thus, there will be opportunities to implement new technologies that could help improve well productivity while lowering costs.

The main challenges of the future are greater water depths, thinner unconsolidated sandstone reservoir layers (affecting drilling and completion techniques) and the handling of heavier crudes. The latter relates to the anticipated production of heavy oil that has been discovered in recent exploration efforts.

This implies lower overall recovery factors and well productivity. In turn, Brazil might see a lower production rate per well, a greater number of wells, larger and more expensive surface units, and bulkier subsea systems. Nevertheless, to reach the country’s deepwater production targets for the next decade, this issue of heavy oil must be addressed and solved.

Petrobrás also is looking at further reductions in drilling costs to keep deepwater and ultra-deepwater projects viable. In conjunction with equipment/ service companies and other operators, Petrobrás is examining cutting-edge technologies and research projects that aim to minimize drilling expenses.

Additional research is examining how to improve economics through better completion and production technology. For instance, companies are developing methods to tailor new, smart solutions for field operations to Brazil’s deepwater needs. This includes not only applying automation, instrumentation and control techniques to facilities for remote operation, but also utilizing data streams generated by the equipment and software to analyze well performance and optimize recovery.

THE AUTHOR

|

|

Giovanni Toniatti is an oil and gas consultant, based in Rio de Janeiro. Previously, he served a four-year term from 1998 through 2002 as a founding director of Agencia Nacional do Petróleo (ANP), Brazil’s National Petroleum Agency. At ANP, Mr. Toniatti worked with the upstream sector, helping to set up and maintain the system of bidding rounds. Trained as a geologist, he has 41 years of experience, including a term as federal secretary of mines and metallurgy, where he helped draft and submit the new oil law. He has served as a CEO at several successful mining ventures, and has held leadership positions at Petrobrás, Bahia State Geological Survey, Rhone-Poulenc Group, Mineração e Metalurgia S.A., Brazilian Institute for Nonferrous Metals, the United Nations and Geological Survey of Brazil.

|

| |

|

|