OUTLOOK 2003: United States

US Drilling

Uncertainty will keep drilling increase moderate

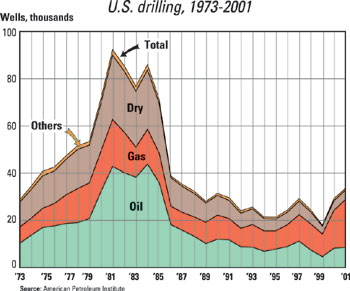

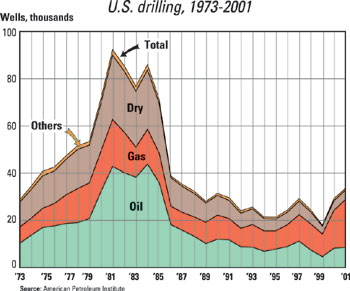

Predicting upstream activity for 2003 is more complicated than in prior years, given the industry’s performance in 2002. Discontinuities among the leading activity indicators were the norm and difficult to explain. Business was still reeling from 2001’s recession and terrorist attacks, and despite oil and gas prices that climbed consistently during first-half 2002, drilling activity went the opposite direction. It wasn’t until the second half, when prices reverted to early 2001 levels, that E&P work began to rise. But it was too little, too late, and the prevailing pessimism limited drilling to its lowest level since 1999.

This year will likely be similar, since discontinuities remain. Oil and gas prices are very strong and could go higher before the chaos in Venezuela and the war situation with Iraq are settled. But operators are nervous and wonder how much of the recent price increase is truly demand-related rather than emotionally driven. Even if the situations in Venezuela and Iraq are resolved without further oil disruptions, the additional pressure on commercial inventories is likely to cause oil stocks to remain low through most of 2003. In addition, the US economy is expected to grow faster in 2003 than in 2002, contributing to a recovery of US (and world) oil demand. Almost half of the 1.3-million-bpd growth in world demand this year is projected to come from the US, with China and other non-OECD countries projected to provide another 0.5 million bpd of demand growth next year.

Highlights of World Oil’s forecast for 2003 include:

- For the US, 30,487 wells are expected, an increase of 5.5%.

- US Gulf of Mexico drilling will rise 3.5% to 831 wells.

- With 8,720 total wells, Texas will see the largest increase.

- The US rig count will average 870 during 2003, up 4.6%.

|

Oil and gas prices. There’s a saying in Houston – if you don’t like the weather, stick around, it will be different tomorrow. There should be a similar one for the oil patch. At this time last year, we were counting on OPEC to support oil prices by cutting its production quotas. Now, most everybody hopes OPEC can boost production enough to stave off the very high prices that would dampen demand and put the world’s economies in jeopardy. The obvious wildcards are Venezuela and Iraq. For this forecast, it was necessary to assume that there will be no (or at least a very short) war with Iraq and that the Venezuelan strike will end soon. However, PDVSA’s fields are mature and it will be difficult to boost their production in the short term. The result will be tight supplies throughout the year and an average oil price of about $33 per bbl.

Natural gas is an even bigger problem. Gas is the objective for around 80% of total US drilling, so when gas prices weaken, the effect is felt throughout the industry. This was the case during most of 2002, only to be exacerbated by the gas trading scandals triggered by Enron. Most all of the gas merchants with production divisions drastically cut drilling in an effort to avoid financial meltdown.

There are no reliable statistics on gas production from the Gulf of Mexico for second-half 2001, nor all of 2002. The Gulf accounts for 25% of US gas production, and many of its new fields have exhibited first-year decline rates of 50% per year. Total marketed gas production in the US has been falling at 2.5% per year since 2001, and a return to normal winter weather this year will increase demand. These factors, and an improving US economy, are expected to push average US gas prices to $5.00 per Mcf at the Henry Hub this year.

Operator surveys. World Oil’s year-end survey of 15 US major drillers (integrated companies and independents with large drilling programs) and 111 independents indicates improved expectations for 2003. While majors plan 4,568 wells, up just 2% from last year, independents responding will drill 1,373 wells, a 50% increase. Both types of operators will place more emphasis on exploration in 2003. Slightly more than 4% of the majors’ overall drilling will target exploration, compared to 3% last year. Exploration by independents will rise to about 30% of total drilling, compared to 25% a year ago.

Salomon Smith Barney’s annual year-end survey of 226 US and international operators indicates that worldwide E&P budgets will rise a tepid 3.8% this year. This is in line with a 3.4% growth the firm originally forecasted for 2003, but is well below the 25% growth in 2001, the highest year-to-year increase since 1981. Respondents’ spending plans are based on their average price assumptions of $23.43 per bbl for oil and $3.53 per Mcf for gas.

For the US, the Salomon survey indicates total E&P spending of $31.46 billion this year, an increase of only 0.1%. The majors see their spending rising 0.9% this year, but the independents are more pessimistic and project expenditures to drop by 0.6%. The apparent conflict between the World Oil and Salomon surveys is likely due to the fact that the World Oil sample includes more small independents with less expensive, lower risk, infill-type operations.

|

Forecast of 2003 U.S. wells and footage to be drilled |

|

What 111 U.S. independent drillers plan for 2003 |

|

What 15 major drillers plan for 2003 |

|

Operators active in the Gulf of Mexico, and wells drilled, during 2002 |

Area forecasts. The following summaries represent important states or regions that greatly influenced the 2002 forecast.

Activity in the Gulf of Mexico could well rebound better than we are expecting. The 831 wells forecast for this year is up only 3.5% from 2002. But with gas at $5.00 per Mcf, there is a good chance that operators will resume on-the-shelf drilling. If they do, there will not be a problem locating a rig. At year-end, only 32 of the 87 jackups available were working. Higher-risk, expensive deepwater drilling is fairing well with 26 of 38 semis busy and 7 of 8 drillships under contract.

Texas, the country’s largest drilling state, will post an increase of 803 wells (or 10%) – the largest in the US. Adequate infrastructure, nearby markets and tightly controlled operating costs all contribute to operators being able to quickly ramp up development to take advantage of higher oil and gas prices. District 9 will continue as the state’s bright spot and take over first place as the largest drilling district. Some 1,259 wells expected, for a rise of 11%. The Barnett Shale still dominates development.

The three Texas Railroad Commission districts that encompass the oil-prone West Texas region are all indicated to register healthy gains. District 8, which once was the largest in terms of wells drilled, will maintain a strong third place, as activity rises 12.6% to 1,143 wells. A little further north, District 8A should record an 8.3% increase to 785 wells. District 7C will not perform as well percentage-wise, but the 940 wells this year represent a 57-well jump.

District 4 in extreme South Texas will cede its number-one drilling title, even though natural gas is still the preferred target. A 6.4% gain in activity there should produce 1,169 wells this year.

Being reliant on gas development, particularly in the southern half, Louisiana is another spot where activity could turn out better than expected. Our expectation of a 2.6% increase to 1,213 wells may be exceeded if operators become convinced that current gas prices are here to stay. Oil prices, which are less erratic than gas prices, should help the northern half of the state perform a little better than the southern half. As a result North Louisiana drilling should total 737 wells.

California’s mostly shallow-depth, heavy oil fields are highly susceptible to oil price fluctuations, and thus did not fare well last year. Additionally, extremely high gas prices cause even more problems, since the cost of this fuel, which is used to generate steam, can cripple the economics of most steam-injection oil recovery projects. Unfortunately, the low-margin economics of California’s heavy oil projects will continue to be impeded, not by current oil prices, but by gas prices. Consequently, a 6% decline in drilling is expected.

Coalbed methane development programs will again be a major portion of Rocky Mountain drilling this year. And since coalbed methane has been demonstrated to be profitable even with low gas prices, today’s high prices could well push the region to exceed our projections. Wyoming is home to most of it, and will see drilling rise 4% to 4,381 wells in 2003. If coalbed wells are excluded, Wyoming should see around 1,000 conventional wells this year. A lower percentage of Colorado’s wells target coalbeds, but conventional gas drilling will take precedence this year. A 5% increase to 1,256 wells is anticipated this year.

In the Mid-Continent area, Oklahoma will experience a 9% gain in activity to 2,143 wells. Gas development is being impacted by current prices, especially among the majors, and operators of its mature oil fields are quick to take advantage of better oil prices. Kansas is predicted to have a good year, too, as drilling will jump 13% to 1,035 wells. The state is heavily gas-oriented with its giant Hugoton field, and operators have been waiting for higher gas prices.

About these statistics. World Oil’s tables are produced using the aid of data from a variety of sources, including the American Petroleum Institute, ODS-Petrodata Group, the Texas Railroad Commission and most other state regulatory agencies. In addition, 126 operating companies with drilling programs responded to this year’s survey. Please note credits and explanations in table footnotes.

World Oil editors try to be as objective as possible in this estimating process to present what they believe is the most current data available. It is realized that sound forecasting can only be as reliable as the base data. In this respect, it should be noted that well counting is a dynamic process and most historical data will be continually updated over a period of several years before the “books are closed” on any given year.

|