Middle East: A steady pace continues

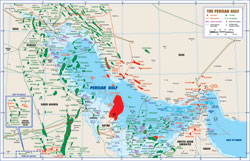

International Outlook: Middle EastA steady pace continuesHigher oil prices have reduced budget deficits, but the invasion of Iraq weakened economic growth. Foreign investment has been delayed, and economic reforms are moving at a very slow rateAll countries by Dr. A. F. Alhajji, Contributing Editor, Middle East Saudi Arabia. Higher oil prices and minor reforms improved economic performance. The economy grew at an estimated 3.8% in first-quarter 2003, from less than 1% in 2002. The Saudi Gas Initiatives – three core ventures valued at $25 billion – have been a diplomatic nightmare. After arguments about proposed rates of return for the oil companies, the government canceled Core Ventures 1 and 2, led by ExxonMobil. On the other hand, Shell’s persistence paid off on July 16, when the firm signed a deal for the $5-billion Core Venture 3, to develop Shaybah field’s gas reserves.

On the exploration front, Aramco last April struck the Yerbin oil find in the Eastern Province, 162 mi southeast of Riyadh. It yielded 5,100 bpd of very light crude (37°API) and 7.4 MMcfgd at a 9,330-ft depth. Meanwhile, the world’s largest aeromagnetic survey was completed last January, covering all of the Eastern Province. The estimated number of wells drilled in 2003 should increase 8%. Last March, Aramco announced that the 800,000-bopd, 350-MMcfgd Qatif-Abu Sa’fan development project in the Eastern Province should finish in October 2004. This will offset normal declines in mature fields but will not increase capacity. With Iraqi, Venezuelan and Nigerian oil completely or partially off the market, Saudi Arabia increased its production by more than 1 million bpd early this year. The Kingdom increased production to 8.966 million bopd in first-quarter 2003 from an average 7.634 million bopd in 2002. The Kingdom plans to increase its capacity 15%, to 11.5 million bopd. Aramco also produces 6.7 Bcfg, making Saudi Arabia fifth globally in gas output. Hawiyah Gas Plant reached full capacity and was officially inaugurated in 2002. Construction of the second, exclusively non-associated gas facility, the 1.6-Bcfd, 170,000-bcpd Haradh Gas Plant, finished this summer, five months ahead of schedule.

Kuwait. Higher oil prices improved economic growth and resulted in a budget surplus. For a fourth straight year, Kuwait’s oil industry suffered problems. Last March, two wells blew out in Wafra field, while in November 2002, a fire at Burgan field closed down Gathering Center 4. Recently, Kuwait Oil Co. (KOC) said that it would meet with eight pre-selected IOCs to discuss terms for possible operating and service agreements for “Project Kuwait.” The $7-billion development work will expand five northern oil fields’ combined output to 1.41 million bopd from 621,000 bopd. Last March, the oil ministry released its strategic development plan that calls for a $42-billion investment over the next 20 years. The plan will increase spending on E&P activities, to increase production capability to between 4.5 million and 5.6 million bopd. The number of oil wells drilled in 2003 should decline in the short term. KOC was set to award drilling contracts for Medina field. Another new project is construction of 160,000-bpd Gas Gathering Center 24 in the north. Kuwait increased output by 250,000 bopd in March to compensate for the loss of Iraqi crude during the US invasion. Production from the northern fields declined in February and March, when the Defense Ministry created a military exclusion zone. Neutral Zone. Japanese firm Arabian Oil Company’s (AOC) concession in Kuwait’s portion of Khafji offshore field expired in January 2003. The company had already lost its concession in the Saudi portion in February 2000. An agreement was reached in March 2002, to sign five separate contracts to transfer AOC assets to Kuwait Gulf Oil Company (KGOC) and provide technical support to KGOC for five years. In addition, AOC will sign a 20-year crude oil purchasing contract with Kuwait Petroleum Corp. (KPC) and provide $750 million to finance development. AOC signed the final agreement with Kuwait in January 2003 and surrendered its drilling rights to KGOC. KGOC planned to issue an international tender last June for seismic studies and technical operations necessary for developing Dorra offshore gas field. KGOC also said that it planned to increase output from the offshore portion of the Neutral Zone to 350,000 bopd by 2007. Current offshore production is 280,000 bopd. Iran. The Islamic Republic continued to award new blocks and contracts, even as Oil Minister Bijan Zanganeh declared last February that Iran needs still more new investment to reach a 5-million-bopd capacity target. Looking at exploration, Iran’s Pars Oil & Gas Co. (POGC) spudded an appraisal that targeted South Pars gas field’s oil layer. This second appraisal follows an earlier one in 2001. At the end of last October, POGC discovered a new oil field in southern Iran. Three wells were drilled, with a combined capacity of 35,000 bopd. The number of Iranian wells drilled should decline 11% this year. Meanwhile, an agreement between NIOC and a Japanese consortium to develop giant Azadegan oil field was delayed. Iran said last March that the Japanese proposal did not meet expectations, and further talks were needed. The South Pars gas development is on track, and more phases should be awarded in the coming months. Output from the first 10 phases will reach 10 Bcfgd and 400,000 bcpd. Last August, local company Sadra won a $394-million contract to develop Phases 6 through 8. Last September, KCA Iran was awarded a $25-million contract to support exploration on the Anaran Block in western Iran. Following OPEC’s quota cuts, Iran’s oil production declined 6.6% during 2002. War fears halted operations and production at Soroosh field near the Iraqi border last March. Last February, Balal offshore oil field began producing 20,000 bopd from two wells. Three wells are now being drilled and should go onstream this year. After several delays, Phase 1 went onstream in July 2003. NIOC also began producing up to 707 MMcfgd from Tabnak gas field. Iraq. The US and Britain invaded on March 20, and Baghdad collapsed on April 19. Only a few wells were set afire by Saddam Hussein’s retreating soldiers, and they were extinguished easily. US and British troops secured the southern oil fields within a few days. Kurdish fighters and US troops secured the northern fields. US plans to bring Iraqi oil onstream and increase Iraq’s exports have failed to progress swiftly. Even before the US invaded Iraq, the country’s oil industry suffered from years of poor reservoir management, corrosion problems, deteriorated water injection facilities, lack of spare parts, and damage to oil storage and pumping facilities. After the invasion, many facilities were damaged, and looting exacerbated the problem. The fate of Iraqi field contracts that were signed between 1991 and 2003 is still undetermined. Before the invasion, 20 Russian exploration experts arrived in Iraq to conduct geological surveys at Kirkuk and Bay Hasan fields. The surveys were part of a $10-million contract to boost oil reserves. Iraq last December canceled Lukoil’s $3.5-billion development contract for West Qurna field and awarded it to another Russian company. In January, Iraq awarded a contract to Stroytransgaz for development of Block 4 in the western desert. The US has awarded contracts to American firms to restore Iraq’s productive capacity. During the invasion last March, the US Department of Defense awarded Halliburton subsidiary KBR a contract to contain oil well fires, and restore oil facilities and infrastructure. In all, the US plans to spend $500 million. Iraqi oil production averaged 2.02 million bopd in 2002. Last January, press reports indicated that the quality of Iraqi crude was deteriorating, an indication that Iraq was producing flat-out, to sell as much oil as it could. UAE-Abu Dhabi. Government officials plan to expand production capacity to 3.5 million bopd by 2005 and 4 million bopd by 2010. Most of the increase will come from existing fields via gas re-injection and other enhancements. Abu Dhabi is expanding oil capacity through four major projects: Northeast Abu Dhabi, Bab field, Bu Hasa/Huwaila field and Umm Shaif oil field. It is also expanding natural gas capacity through the Dolphin and Margham field projects offshore, plus Phase 3 of the Onshore Gas Development and Phase 2 of the Asab Gas Development. Dolphin Energy Limited (DEL) published a short list of qualified bids for three packages that make up the Dolphin Project’s offshore element. The packages include construction and installation of platforms in Qatar’s North field. In accordance with OPEC quotas, Abu Dhabi reduced its production to 1.650 million bopd in 2002 from 1.775 million bopd in 2001. UAE-Dubai. The government continued its income diversification schemes as oil reserves diminished. Oil production has declined steadily since peaking in 1991 at 420,000 bopd. The number of wells drilled is expected to stay the same, around 10. Dubai evaluated bids last February from four US oil companies for a $16-million drilling contract covering two onshore gas/condensate fields. The contract calls for drilling an appraisal at Khubai field onshore, and the workover and drilling of two wells at Margham field. Last August, four companies submitted bids for front-end work on a pipeline package covering the proposed Khubai gas development. The 14-mi pipeline will transport gas from Khubai to processing facilities at Margham. Dubai’s production declined for the twelfth consecutive year, averaging 215,000 bopd in 2002 vs. 220,000 bopd in 2001. Qatar. An emphasis on LNG projects continued in 2003, and Qatar plans to become a world leader in LNG exports. Qatar Petroleum (QP) and its foreign partners plan to invest $24 billion over the next five years to increase crude, gas and LNG capacities. Last November, Talisman Energy signed a PSA to explore Block 10 between Al-Khalij and Al-Shaheen oil fields. The company will invest $8 million during the first five-years. Qatar also plans to offer Blocks 4, 3 and 14 for bids. Qatar drilled 96 wells in 2002, but this figure will decline in 2003. In October 2002, Maersk Oil Qatar, operator of al-Shaheen field, awarded a $250-million construction contract. Last year, a contract was awarded for the central processing facilities project at the offshore Idd al-Shargi South Dome field. It will add about 500,000 bpd of capacity. The field is operated by Oxy under an agreement with QP. At the end of last March, QP and ExxonMobil announced the launching of Al Khaleej Gas Phase One (AKG-1). Al Khaleej will produce gas from North field, recover associated condensate and NGLs for sale, and market 1.75 Bcfd of pipeline gas. As a result of OPEC’s quota cuts, Qatar’s oil production declined slightly. QP said that oil reserves jumped 42% at the end of 2002, to 19.6 billion bbl. Gas reserves leaped 80%. Oman. Petroleum Development Oman (PDO) plans to revamp the nation’s oil industry. PDO will increase annual investment for enhanced recovery and development to $1.5 billion by 2007. To increase its oil reserves, Oman last year signed a number of exploration PSAs. In June, Oman offered three new blocks in the north – 18a, 18b and 41. Last January, Australia’s Novus discovered an offshore gas field in Block 8 of the Strait of Hormuz. The Tibat 1 was drilled deeper than planned, due to a larger gas reservoir than expected. Oman continues to lead the region in drilling, with more than 400 wells expected in 2003. PDO plans to invest in EOR at Mukhaizna and Hraweel fields. IOCs were invited in April to bid for a contract to draw up front-end engineering and design (FEED) studies for Phase 2 expansion in these fields. Omani production fell 60,000 bopd in 2002, due to natural declines in maturing fields. PDO will have to maintain its aggressive drilling schedule to keep output from falling further. Syria. The country has been active, awarding several exploration contracts to IOCs to halt an oil production decline. Crude output has declined at a 6% rate in the last few years, Syria plans to explore all 27 onshore blocks and survey offshore waters. It also will offer new blocks in the coming months. At the end of last June, a 42.4-Bcf gas discovery in central Syria was announced. Syrian Petroleum Co. also discovered a new gas field in Block 22, and Croatia’s INA Naftaplin found three gas fields on the Hayan Block. A 12-block tender was announced in December 2002, and various regions were opened for bidding this September. Four IOCs participated in bidding for offshore exploration contracts in June. The estimated number of wells drilled should increase 15% during 2003. Last March, Syria signed a PSA with China National Petroleum Corporation (CNPC) for development of Kebibe field. In the second phase, CNPC must spend $104.5 million to triple field capacity. In May, Devon Energy and Gulfsands were awarded a PSA deal. The two companies must invest at least $17 million on geological and geophysical studies. Canada’s Dublin International gained a PSA to further develop Oude oil field in northeastern Syria. The 18-well field has a 1,500-bopd capacity that is expected to increase to 15,000 bopd. Syrian production stands at 502,000 bopd and about 8 Bcfgd. Oil reserves are about 2.3 billion bbl. Syria recently boosted its gas reserves to 18 Tcf. Yemen. Terrorism, tribal disputes and political instability are slowing down the foreign investment. While economic growth is still relatively high, it is threatened by a lack of water resources. Ironically, several oil fields suffer from severe water cut problems. In June, India’s Reliance Industries Ltd. struck oil at an offshore exploration block. At the end of 2002, TransGlobe Energy discovered new oil reserves on Block S-1. Ngyah 2 was suspended as a future oil producer after testing. Calvalley Petroleum was due to spud two wildcats on Block 9 this summer, 50 mi west of the Masila oil fields. The firm struck oil on Block 9 in July 2002, when Auqban 1 flowed 750 bopd. The Ministry of Oil and Mineral Resources also signed an EPSA with a consortium led by Australia’s Oil Search. Drilling is expected to increase 4.5%. The ministry said that it expects 20 exploratory wells in the next 12 months. Industry sources expect Yemen’s production to decline to 423,000 bopd in the next few months, compared to last year’s average of 460,000 bopd.

Turkey. Last March, Toreador Resources identified at least six gas exploration prospects with reserve potentials ranging from 200 Bcf to 1 Tcf in the shallow, western Black Sea. This analysis came from a 2D seismic survey (completed in 2002). Amity Oil discovered gas in the Adatepe 1 well, about 90 mi west of Istanbul. Another gas find (Cayirdere 1) made by Turkish Petroleum flowed 3.1 MMcfgd, southeast of Gocerler field. The number of wells drilled should increase 28.6% this year. In addition to drilling, Toreador plans to complete the Barbaros 1 discovery in the Thrace basin gas play. The well could produce 2 MMcfgd. Depending on test results, the company may drill an appraisal and proceed with development. Toreador will also drill three exploration wells on the Gallipoli Peninsula. In Cendere field, Toreador’s development continues. Turkey’s production declined to 46,754 bopd last year from 48,904 bopd in 2001. Oil reserves fell 5.8%. Others. Oil revenues in Bahrain are expected to increase, due to higher oil prices. Press reports indicate that the Oil & Industry Ministry was preparing to open three more offshore blocks for exploration near the Hawar Islands. Last November, ChevronTexaco drilled an exploratory well in 151-sq-mi Block 5 off the country’s east coast. National output remains fairly steady at just above 38,000 bopd. Jordan still has very little output (40 bopd and 24 MMcfgd), although the number of producing oil wells has doubled to four. Trans-Globe Petroleum may resume exploration in 2003. Violence continued to prevent Israel from attracting foreign investment to develop its gas reserves, estimated to be 1.47 Tcf. Isramco

plans to drill a confirmation gas well (Nir-2). The company will also drill Nizanim 1 in 2004. Last March, the Givot Olam partnership logged 45 ft of oil pay at its Meged 4

well, east of Kfar Saba. Israeli output during 2002 was 88 bopd and 840,000 cfgd. |

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)