Middle East: Upstream sector retains the status quo

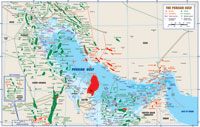

Middle EastUpstream sector retains the status quoHigher oil prices reduced budget deficits and improved the economic outlook, but foreign investment and economic reforms have been delayed againDr. A. F. Alhajji, Contributing Editor

Saudi Arabia. The Saudi Gas Initiative, consisting of three core ventures valued at $25 billion, has been delayed. Nevertheless, negotiations with ExxonMobil and Conoco were underway when this report was written, and positive results were expected soon. Major issues that stood unresolved between the eight, pre-selected, international oil companies (IOCs) and the Saudi government included the quantity of available gas, production costs, taxes and likely rate of return. The IOCs are seeking to increase the amount of acreage open to them and negotiate a higher price for the gas produced. They believe that gas in the core venture areas is more expensive to extract and transport than non-associated gas in Saudi Aramco’s reserves. This is due to complex geological structures that are geographically far from downstream destinations

Aramco last March announced three new oil/gas discoveries in the Eastern Province – Jafin 1, Warid 1 and Takhman 2. At the end of 2001, Aramco discovered a new gas deposit in al-Ghazal field of the Eastern Province. The estimated number of wells expected for 2002 stands at 300, up moderately from the 265 wells drilled in 2001. The number of offshore wells is predicted to increase by five. Aramco plans to triple gas production during the next six years after adding 30 Tcf to its non-associated gas reserves over the last five years. At the end of 2001, Halliburton was awarded a $140-million contract to provide services for Qatif onshore / offshore oil field. Last March, Aramco awarded five lump sum turnkey contracts totaling $1.2 billion. The contracts are part of the Qatif development project that will add an estimated 800,000 bpd of oil capacity. It is due to be completed in 2005. An Aramco statement last February indicated that Haradh Gas Plant was six weeks ahead of schedule. It should begin delivering sales gas to Saudi Aramco’s system by June 2003. OPEC’s decision to decrease oil production reduced Saudi output by 3.6% in 2002. Saudi Arabia produced an average 7.75 million bopd in 2001, exclusive of output from the Neutral Zone shared with Kuwait. Gas production stood at 6.7 Bcfd last month, when gas reserves were estimated at 227 Tcf. Kuwait. For the third year in a row, Kuwaiti oil production suffered from well blowouts, refinery explosions, leaks and fires. An explosion at a gas booster station at an oil collection center in Raudhatain field at the end of last January shut in 600,000 bpd of Kuwait’s northern oil production. In addition, Burgan oil field production was cut by 60,000 bpd last February, due to an oil leak at an oil gathering center. A corroded piping system shut down Gathering Center (GC) 23 last March and decreased production by about 100,000 bopd. In June, technical difficulties in GC 27 and GC 28 forced Kuwait to increase production from Burgan field to meet its OPEC quota. Press reports indicate that former Oil Minister Adel al-Subaih, who resigned after the Raudhatain explosion, had complained that political interference and pressures were causing problems within the oil sector. These problems supposedly contributed to negligence and mismanagement that resulted in the string of accidents in the oil sector. Last January, Kuwait Oil Co. (KOC) announced the discovery of light crude oil reserves (37° API) in Minagish oil field, in western Kuwait. The initial well tested 7,950 bopd. Drilling activity during 2002 should decrease substantially to just 60 wells versus 100 last year. The rig count average for Kuwait was just 5.0 for first-half 2002, as opposed to 9.8 during the same period last year. In February, KOC invited international oil companies to pre-qualify for an $800-million engineering, procurement and construction contract to build new storage and export facilities at Ahmadi. Kuwaiti oil production declined 7.4% in 2002, following a decrease in its OPEC quota and the string of accidents. Crude oil production averaged 1.87 million bpd in the second quarter of this year. This figure includes Kuwait’s share of the Neutral Zone, currently about 300,000 bopd. For 2001, the average was 1.67 million bopd. Neutral Zone. In Kuwait’s portion of Khafji field, Japan’s Arabian Oil Co. (AOC) holds a concession that expires in January 2003. The AOC concession in the Saudi half of Khafji expired in February 2000 and was not renewed. A memorandum of understanding for a service contract was signed between AOC and Kuwaiti officials in December. An agreement was reached in March to sign five separate contracts, to transfer AOC assets to Kuwait Gulf Oil Company (KGOC) and provide technical support for KGOC for five years. In addition, AOC will sign a 20-year crude oil purchasing contract with Kuwait Petroleum Corp. (KPC). The number of wells drilled should not change discernibly from last year. OPEC’s quota cuts have forced Saudi Arabia and Kuwait to decrease production from the Neutral Zone. Output declined from 625,000 bopd in January 2002 to 585,000 bopd in March 2002. Iran. The U.S. Congress voted on June 25, 2001, to extend the Iran-Libya Sanctions Act of 1996 (ILSA) for five years. The bill intended to prohibit foreign oil companies from investing more than $20 million in Iran. Ironically, the tremendous progress shown by the oil sector proved that the bill has no impact on Iran’s oil development and foreign investment. In addition, buy-back contracts were modified in a manner that made ILSA obsolete, even if the U.S. tries to implement it. Recent reports indicate that National Iranian Oil Company (NIOC) is entering the final stage of its plan to start a new licensing round for up to 20 offshore blocks. This comes after NIOC finished a 100,000-sq km, 2-D seismic survey. Meanwhile, Iran discovered the 400-million-bbl Tossan oil field in June 2001, about 20 mi southeast of the port city of Lingeh. According to NIOC, 125 onshore wells were drilled in 2001. In addition, 17 offshore wells were drilled, of which 12 were gas wells. NIOC expects 77 onshore wells and 43 offshore wells to be drilled in 2002. Perhaps 10 of these will be exploration wells. Redevelopment of Soroush oil field enabled Shell to produce oil last November for the first time since the field was damaged by the Iran-Iraq war of the 1980s. TotalFinaElf and partners said last March that they had brought Phases 2 and 3 of South Pars offshore gas field onstream. These are the initial phases of a massive development. Eni was awarded Phases 4 and 5 in July 2001 and is expected to invest $1 billion. In addition, NIOC has begun appraising giant Azadegan onshore oil field. The Oil Ministry signed a $585-million buy-back contract with PetroIran to develop Foroozan and Esfandiar offshore oil fields. The three-year project will increase output by 69,000 bopd. Adhering to its OPEC quota, Iranian production declined from an average 3.66 million bopd in 2001 to 3.4 million bopd in second-quarter 2002. Iran was able to add more production from Dorood field, starting last May. Recent reports indicate that Iranian offshore output will exceed 800,000 bopd by March 2003. Reserves at the end of 2001 were 99.08 billion bbl of oil and 939.4 Tcf of gas. Iraq. Political problems and disputes with the UN hampered Iraq’s ability to increase productive capacity and maintain steady output. Iraq imposed a 30-day oil embargo on April 8 to protest Israeli offensive actions against the Palestinians. While all UN-monitored exports were stopped, press reports indicate that Iraq smuggled about 500,000 bopd through its neighbors. The self-imposed embargo ended in May, and Baghdad resumed exports. In May, Iraq announced the discovery of two large gas wells in al-Mansourya, near the border with Iran, plus other finds in the western desert. Turkish Petroleum International Corp. won UN approval last December to drill for oil in Khurmala field near Kirkuk. In addition, the UN approved Tatneft and Zarubezhneft’s contracts to drill in Bai Hassan, Kirkuk, and Saddam fields. The Tatneft contract specifies drilling 78 new wells. Press reports indicate that Russia and Iraq are working on a package deal worth $40 billion for 67 projects. These projects include development of such fields as West Qurna, Runaulah and Luhais, plus work on other blocks in the western desert. A $52-million service contract was signed last October with Slavneft for Suba-Luhais field – drilling may begin this year. Middle East Economic Survey predicted last January that Iraqi production may increase to 3.1 million bopd in 2002, due to receipt of new equipment and spare parts under the oil-for-food program. Iraqi officials announced recently that they plan to increase output from the largest fields by 200,000 bopd during 2002, without the help of foreign companies. Iraq also began producing 50,000 bopd from the Majnoun fields in May 2002. UAE-Abu Dhabi. Occidental Petroleum replaced Enron in the Dolphin gas project and paid $310 million to acquire a 24.5% stake in the project. Dolphin will supply natural gas from Qatar to the UAE, Oman and Pakistan. Abu Dhabi Company for Onshore Oil Operations (ADCO) invited commercial bids for a $250-million engineering, production and construction (EPC) contract to upgrade surface production facilities at Bu Hasa field. The deadline was set for June 11, 2002, for bids on installation of four separation units. Also in June, ADCO invited bids for an EPC for capacity expansion at Bab field – an increase to 350,000 bopd from 250,000 bopd. The number of wells drilled should increase to 91 this year, versus 84 wells in 2001. Bunduq Co. reported that it had no drilling activity in 2001, but the firm plans to resume development drilling offshore this year. In May, Bechtel was selected for the front-end engineering / design package on Phase 3 of the onshore gas development and Phase 2 of the Asab gas development. The project includes construction of new facilities at Habshan, Asab, and Ruwais fields, a new gas gathering network and other NGL facilities. In accordance with the OPEC quota, ADNOC cut production 10% last January. In the same month, the UAE announced that it plans to increase output of Upper Zakum field by 250,000 bpd, to 750,000 bpd. Abu Dhabi’s production is estimated at 1.78 million bopd for 2001, down 16% from a year earlier. UAE-Dubai. The government has continued its income diversification schemes while oil output dwindles further. An emphasis on tourism, services, non-oil industries, technology and e-commerce proved to be successful in reducing reliance on oil revenues. Oil represented only 10% of Dubai’s 2001 GDP. Crude production has declined steadily since peaking in 1991 at 420,000 bpd. Output last year averaged 220,000 bopd. Given the declining importance of oil, drilling activity has been virtually unchanged for the last few years at between seven and 10 wells annually, of which two or three are offshore. In late January, Solar Turbines International was awarded an estimated $45-million EPC contract for the Margham field development project. The project will maintain oil output while increasing the gas supply to Jabal Ali. Qatar. An emphasis on LNG projects continues, as Qatar strives to become a leading LNG exporter. Recent contracts indicate that Qatar plans to export LNG to Europe, Asia and (probably) North America. The country expects to offer Blocks 4 and 10 for exploration. This is part of a plan to expand oil production capacity to 1 million bpd from the current 850,000 bpd. The number of wells drilled jumped to 87 in 2001. Qatar Petroleum Co. (QPC) predicts that 89 wells will be drilled in 2002, including 80 offshore development holes. Over the next decade, QPC plans to drill 270 wells in three specific fields: 147 at Dukhan onshore; 37 at Maydan Mazham offshore, and 86 at Bul Hanine offshore. By adding a fourth train to Qatargas, Qatar will boost LNG production to 35 million t by 2010. The country’s first LNG project, Qatargas, plans to increase output to 9.2 million t from the current 7.7 million t by 2003. RasGas will also increase capacity to 8.6 million t in 2005 by adding two more trains. TotalFinalElf and QPC approved the Al Khaleej field development plan recently. The project will increase field capacity to 80,000 bopd, with new facility output beginning in 2004. Qatar’s 2002 production is running lower than 2001’s level by more than 60,000 bopd, but in line with the OPEC quota. QPC said that Qatar produced 828,145 bpd of crude and condensate, and 4.5 Bcfgd during 2001. Proven gas reserves at giant North field were raised by QPC recently to 750 Tcf from 500 Tcf. The country’s overall reserves stand at 13.817 billion bbl of crude and condensate, and 757.7 Tcf of gas. Syria. Beset by a growing population and declining oil production, Syria may become a net oil importer within eight years. Oil production has declined at a 6% rate over the last few years after peaking in 1996 at 612,000 bpd. Syria’s Petroleum & Mineral Resources Ministry vehemently denied reports that oil reserves are being depleted. Yet, no figures were provided to back up this claim. A ministry statement issued in July merely indicates that Syrian oil reserves will last until 2020. In February, the ministry opened up five new blocks to exploration. Preliminary surveys indicate that three blocks may contain gas, while the other two have been explored and may hold significant oil reserves. Last April, Petroleum & Mining Resources Minister Ibrahim Haddad said that a new natural gas field had been discovered, with a productive rate of 10.5 MMcfd. However, no details were provided. Last year’s heightened drilling level (80 wells) should continue, with up to 85 wells forecast. Hungarian Oil and Gas Co. drilled two dusters in 2001 and does not plan any drilling for 2002. The DezGas associated gas project was brought to its full capacity of 455 MMcfd last January, marking the end of associated gas flaring. The $400- million project, operated by Conoco, includes collection, treatment and export of 175 MMcfd of associated gas from 22 fields in the Deir Ez Zor region. The project also included the development and recycling of 280 MMcfgd from Tabiyeh gas / condensate field, operated by TotalFinaElf. The collected gas will be used for power generation and re-injection in oil fields. In April, Syria said that it is producing around 550,000 bopd and consuming between 300,000 and 350,000 bopd. However, estimated production in 2001 was 527,000 bopd, down from 530,000 bopd in 2000.

Yemen. Pipeline explosions, kidnappings and tribal disputes are slowing the flow of foreign investment to Yemen. Officials continued their commitment to economic reform, and the economy is expected to grow 3.6% during 2002. This would be 1% lower than the 2001 rate. Drilling activity is expected to rise 13% in 2002, to 95 onshore wells. Last August, Yemen awarded Block 60 near the Saudi border to a consortium of Spain’s Cepsa, Austria’s OMV, and PanCanadian Petroleum (now EnCana). In its first-quarter 2002 report, TransGlobe Energy said that it abandoned the Aswairy 1 well in Block 32. The company and its partners in Block S-1 plan to drill three new exploration wells and an appraisal in second-half 2002. Hungarian Oil and Gas said that it drilled a dry hole in 2001, but will still drill two onshore wells during 2002. Yemen was likely to abrogate a $5-billion LNG project, if TotalFinaElf and partners did not implement the work by June 2002. A meeting with stakeholders was set for June 16. The project was slated to produce 3.5 million t of LNG annually by 2003. On July 9, 2002, ExxoMobil reportedly exercised its option to opt out of the project. Last April, Yemen announced that it expects crude oil production to average 432,550 bpd in 2002, down slightly from 438,499 bpd in 2001. Turkey. A unit of El Paso Corp. drilled a dry hole offshore. The Mercan-Deniz 1 was drilled in 300 ft of water and reached a 2100-m (6,890-ft) depth. It is the first of three wells that El Paso intends to drill in the area. State oil company TPAO struck "an Arab grade" of oil in the southeastern province of Diyarbakir. Oil was found in the Gokici 1 well at a depth of 2,500 m (8,203 ft). There were 31 wells drilled for 168,253 ft during 2001. Operators included TPAO, Aladdin Middle East and El Paso Production Co. Three dry holes were drilled offshore for 23,738 ft. This year, Turkey’s General Directorate of Petroleum Affairs expects 18 exploratory wells and 12 development holes. Turkish oil production averaged 49,013 bpd. There are 825 producing oil wells (all on artificial lift) and 38 gas producing wells, including five offshore. Reserves are estimated at 281 million bbl of oil and 303.4 Bcf of gas. Others. Demarcation of maritime borders with Qatar brought tangible relief to oil-exhausted Bahrain. The International Court of Justice awarded Hawar Island to Bahrain last March. Immediately after that, Bahrain created four new exploration blocks. The country also gained part of Qatar’s Block 13, which is under an EPSA held by BP, Gulfstream Resources and Preussag. Bahrain awarded some of these blocks at the end of 2001 to IOCs. In November 2001, ChevronTexaco signed an EPSA with Bahrain to explore Block 5 in the eastern offshore. The company said that it will drill its first well at the end of 2002. Last April, Malaysia’s Petronas said that it will drill its first well offshore Bahrain in October 2002. Petronas operates offshore Blocks 4 and 6, per an agreement signed last November. Bahrain Petroleum Co. reported that 22 wells were drilled in 2001. Crude production averaged 33,601 bpd, and gas output was 898.3 MMcfd. The company plans to drill 28 development wells onshore in 2002. According to Jordan’s Natural Resources Authority, only one oil well was drilled in 2001. However, officials expect five onshore wells this year, three of which will be exploratory. Production slipped to 35 bopd and 28 MMcfgd. Currently, Jordan has two active oil wells and 11 gas-producing wells. Last year’s plans to double production at Risha gas field have not materialized. Instead, production declined to 28 MMcfgd from 30 MMcfgd. In January, Jordan and Algeria signed an MOU for exploration and production in the El Azrak basin (eastern Jordan), as well as further development of Risha gas field and oil exploration on the Jordanian-Iraqi border. TransGlobal Petroleum’s drilling of the Issal 1 wildcat in Jordan’s Dead Sea Graben has taken twists and turns worthy of a television soap opera. Spudded in August 2001, the well has been plagued by mechanical problems. After three months of drilling, a stuck pipe forced the well to be suspended at 9,840 ft, enroute to a 16,400-ft TD target. TransGlobal resumed drilling in December and reached a 10,876-ft depth, only to suspend the well again after more technical problems. Violence and the threat of war have prevented Israel from attracting foreign investment for development of its gas reserves. Security concerns led Belgium’s Tractebel to announce last April that it wanted to withdraw from a $400-million project to construct a natural gas distribution network. Last September, Isramco announced that British Gas was abandoning the Tommy, Orly, Shira and Aya concessions. The number of wells drilled declined to five (one gas well, four dry holes) in 2001 from eight in 2000. Israel expects six wells in 2002, including four offshore. Israel produced 72 bopd and just under 1 MMcfgd in 2001. Although 12 oil wells were capable of producing, only six were active, all on artificial lift. Five of 14 gas wells were active. |