Small companies in the Russian petroleum business

Small companies in the Russian petroleum businessCurrent political issues and potential advantages of joint venture participation of smaller, independent oil companies with larger, established Russian organizationsKhamit Z. Khaveev, OAO Tatneft Almetyevsk, Russia; and Rustem R. Shagiev, Academy of National Economy under the Government of the Russian Federation, Moscow

Introduction David W. Martin, president, Texneft Inc., a wholly owned subsidiary of Ocean Energy Inc., prepared this introductory section and says the following article will interest U.S. executives considering oil ventures in the Russian Federation today since it touches on most issues inherent in joint venture participation. The significance of this article is found in the realistic appraisal of requirements and expectations of a Russian major as it adjusts to the realities of post-Soviet Russia, using foreign partners in small scale projects to approach economic solutions. Although not intended as a treatise on the current state of the Russian industry, it acknowledges fundamental changes in this direction. For example, the "extensive" or centrally planned development will be supplanted by a more "intensive" or field-specific approach employing the latest techniques. Also, the issue revolving around the efficient exploitation of mature production by majors is identified, and the transfer of such assets and many support functions to independents is predicted. The very important taxation and legislative points raised are self-evident but, to date, the Federal Government has shown no real inclination to improve the investment climate for either domestic or foreign companies. Not Only Giants Reforms of the energy and fuel complex – a colossus of the former Soviet-planned economy – together with the urgent need for transition from extensive methods of mineral resource development to intensive ones, have caused dramatic changes in the oil business. Over the last 10 years, concurrently with foundation of 15 vertically integrated companies, a number of small independent petroleum companies were established; these now produce almost 10% of Russia’s total oil production. It has become apparent that development of small business units plays an important role in restructuring / developing the competitive capacity of vertically integrated oil / gas companies. It is the small companies that: create the business environment, guarantee competitive relations in the marketplace, and de-monopolize production capacity. This has even more significance when it is appreciated that, for very different reasons, the Russian majors – as a whole – are moving toward even greater consolidation. As a result, formation / development of the independent oil sector in Russia was, and is, far from a smooth process. This renewed concentration of hydrocarbon resources has also occurred in Europe and North America, although the underlying business dynamics driving such consolidations may be quite different. Table 1 shows selected comparable statistics of the largest petroleum countries in the world – Russia and the U.S.

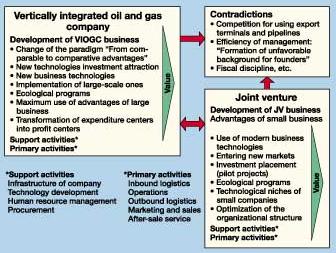

The primary divergence between the data by country lies in the number of small, independent oil / gas companies and the number of refining entities. However, both in Russia and the U.S., there are similar problems related to the maturing of the oil / gas provinces that reduce the preconditions necessary for successful work with assets of large, integrated oil companies. Strategic targets of the Russian VIOGCs are generally projects on a quantitatively larger scale than in the case of the independents. Further, as practice shows, an important condition of effective operation of large-scale VIOGCs is continual interaction with small companies, with the transfer of alien functions and aging assets to the latter. The recent reform of the Russian oil / gas complex introduced a number of significant and positive changes, such as: establishment of a legislative base, transition to world prices, a fee-paying system for subsoil assets, privatization, differentiation of the powers of regions and the center of the Federation, etc. But the most important target of reviving the investment process in the oil industry has still not been achieved. There is also a significant lag in the introduction of innovative process and technological support to the operations of Russian oil companies – when compared with world standards. The latter is extremely important, since the transition from extensive methods of developing subsurface assets to economically intensive ones is directly linked to the innovation process, and introduction of state-of-the-art technical designs to the industry. Development Stages In revising the foundation and development of small oil businesses taking place in Russia – using the examples of enterprises with foreign investments – several major stages can be identified, as discussed below. The first stage coincided with liberalization of the national economy in the early 1990s, when companies with foreign investment, i.e., joint ventures (JVs), received privileged treatment in taxation and sale of production to foreign markets. Under such conditions, JV activity became a convenient vehicle for major VIOGCs (as founders of the JVs) to sell their oil on the foreign market. At that time, 50 JVs were established in the Tyumen region alone. The same process took place in Tatarstan, Republic of Komi and other regions of Russia. It is worth mentioning that JVs were, at that time, a channel of transfer of modern industrial / management technologies, as well as the equipment required to rehabilitate idle wells and develop more-complex oil fields. Over a short period, hundreds of millions of dollars were spent to deliver the required equipment and technologies to Russia. However, as early as the beginning of 1994 (the second stage), there were signs of deterioration in the operation of joint ventures. A number of taxes increased sharply. Instead of the two initial taxes, there were more than 10 that had to be paid. During the following years, conditions continued to worsen due to introduction of an oil-excise tax and an increased export tariff. JV activity decreased somewhat in development intensity in response to this economic disincentive, but that did not interfere with the systematic increase in oil production of the enterprises, which was coming online as a result of the earlier foreign investments. The number of JVs operating declined from the early beginning of the 1990s, but the remainder – in regard to their makeups and economic indices – is a stable and independent segment of the Russian petroleum complex, comparable in total to the oil production volume of a single VIOGC of medium size. The multiple changes in the financial and economic conditions surrounding JV activities resulted in the third stage, when the JVs found themselves in a situation where the original financial assumptions that drove the projects were both obsolete and unattractive. Further, due to liberalization of exports, the JVs lost their former appeal to the VIOGCs (their founders) and, in turn, came to be viewed more and more by the latter as competitors. Partners Or Competitors The overriding factor complicating relations between VIOGCs and JVs is simple. The JVs often operated at higher efficiencies in operating and economic terms, thus creating an "unfavorable background" for their Russian founders. Significantly, the JVs are punctual with payments to federal and local taxing authorities, as well as local suppliers. In fact, in some regions, the JV allocations constitute the primary basis of a local budget; e.g., in Nenets district, more than half of the entire district budget’s receipts comprised JV allocations. A similar situation exists in the Republic of Komi in Western Siberia. Very often the JV adapts to the market more easily than large oil companies that founded them. Fig. 1 shows this "traditional" model of interaction of the VIOGC-JV which is now typical of most companies.

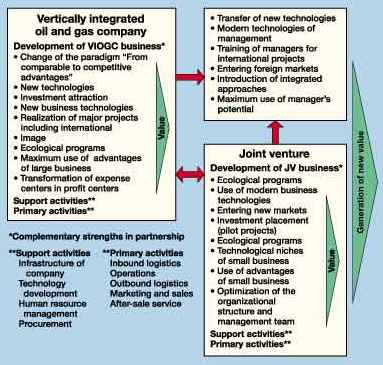

Under this situation, the most promising is a new model of interaction of the vertically integrated oil and gas company and its JV, Fig. 2. This model assumes the transformation of their relations from competition to partnership. As a result of establishment of such partnerships based on mutual supplement, there is the real possibility of generating new values based on the economy of scale of a large company on the one hand and the dynamic character of a small company on the other. Transfer of new technologies, management decision taking, and manager and specialist training are also key elements.

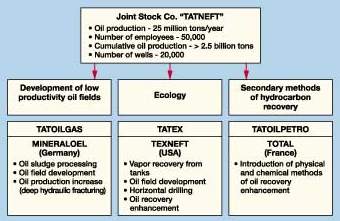

Imperfect Game Rules The most important condition for dynamic development of the oil business is establishment of clear, stable and reasonable rules for all players; i.e., the normative and legislative base must correspond to the time requirements. Over the last several years in Russia, major functions of oil and gas production management were separated from the state through privatization, and a new legislative base for the subsoil assets application was created. Laws about subsoil assets use, about production sharing agreements, about foreign investments, etc. have been passed or promulgated but, in practice, the present normative and legislative base still does not completely correspond to the current stage of oil business development. Frequent rule changes regulating JV activity slowed down production development, causing it to lag behind planned parameters. The history of JV taxation speaks for itself; over the last seven years, taxes evolved from sufficient tax incentives to the situation in which allocations of the JV to budgets of all levels, and to state, off-budget funds, vary from 53% to 57% of total earnings. The aggregate portion of taxes, transport tariffs and other charges to JV earnings is continually increasing every year. As a result, most JVs are now on the edge of profitability. Such a situation does not correspond with the fundamental principles of the investment climate stability affecting prospects of attracting foreign investments. Hence, the influx of foreign investments has decreased considerably over recent years. This tendency is particularly alarming with regard to the concurrent wind-down of state investments, and investments at the expense of borrowed – and the companies’ own – funds. Paradoxical as it may seem, the imperfect "game rules" affect especially those sectors in which the Russian oil industry is most interested – such as hard-to-recover oil reserves, secondary recovery methods, etc. The current taxation system also adversely affects the payback of foreign investors’ capital investments. For instance, many JVs haven’t yet repaid the loans extended by foreign partners and international banking institutions. As a result, there is a contradictory situation requiring, in practice – from the economic point of view – more reasonable and legislative documents, which so far have not emerged at the federal level. Frequently, these anomalies are constructively eliminated at the republic or regional levels. The oil producing regions in urgent need of solving social and economic problems make up for the legislative vacuum by adopting laws governing hydrocarbon recovery. In this connection, therefore, great significance is attached to the experience of: oil business development, formation of the normative and legislative bases, regulation of the activity of small independent companies, JVs, as well as relations with VIOGC (OAO Tatneft) in the oldest oil region of Russia – the Republic of Tatarstan. Experience Of Tatarstan The basis of the oil business in the Republic of Tatarstan (the Russian Texas) is the largest oil company Tatneft – five joint ventures and 19 independent oil companies playing an ever-increasing role in oil-recovery enhancement and introduction of new technologies, including ecological ones. The Republic produces 25 million tons of oil annually, 3 million tons of which are produced by independents and joint ventures. The prospects for the oil industry of the Republic of Tatarstan are connected with the necessity to switch very speedily from the extensive methods of mineral resources development to more intensive ones, although this problem is most critical at the latter stages of oil field development in Tatarstan. Other regions of Russia already have, or will have, the same problem in the near future. Under these conditions, dynamic development of the business – where a significant role is attached not only to VIOGCs, but also to the independents and joint ventures – becomes very important from both strategic and tactical points of view. Based on current forecasts, by 2005, Tatarstan’s oil production will rise to 30 million tons, 8 million tons of which will be produced by JVs and independents. The Republic’s experience in the formation of normative and legislative instruments, etc., helps to create conditions to maintain a high level of oil production, and attract investments and new technologies. Further, the legislative innovations of the Republic will help set a very important precedent for regulating relations in the oil sector, which is an important signpost for the Russian Federation. By decree of the President of the Republic of Tatarstan and adoption of laws such as: "About oil and gas" and "About product sharing agreements," mechanisms for the interrelations between independents and OAO Tatneft were established and are strictly controlled, including: 1) oil produced from licensed fields and obtained through product sharing due to introduction of new methods of oil recovery enhancement, well stimulation and workover is the property of a JV; 2) conditions of own-product sale both at the domestic and foreign markets; and 3) taxation privileges, conditions of relinquishment, etc., and guarantees. Joint Ventures In Tatarstan The JVs of Tatarstan were established in sectors that definitely demanded new foreign technologies, ecological programs, development of depleted and low-productivity oil fields, and application of secondary methods of hydrocarbon recovery, Fig. 1. Successful work in those areas is an important condition of the further development of OAO Tatneft. At the initial stage of JV development, relations between the companies, to a great extent, corresponded to the model of Fig. 2. OAO Tatneft considerably influenced the JVs because of close financial and economic ties and the necessity of solving technical problems common to both parties. For example:

The above contradictions arose mainly because relations between OAO Tatneft and the JV were not strictly formalized, and the balance of the companies’ interests was not found. The companies’ managers made a major effort to eliminate these contradictions. At present, the interrelationship is based on partnership principles and application of strengths and advantages of each other, Fig. 3.

Tatex JV Innovations The Russian-American joint venture Tatex was founded in accordance with the agreement of September 23, 1990, between the production association Tatneft and the U.S. oil company Texneft Inc., now a subsidiary of Ocean Energy Inc. The share of each party of the authorized capital is 50%. The main goal of the JV Tatex initially was to solve a major ecological problem – preventing escape of light hydrocarbon fractions through vaporization from tank farms, a pervasive problem in the Russian oil complex. Unrecoverable losses during gathering / treatment, as well as during intrafield transportation, are estimated to be 0.5% to 1.5% of oil production volume. Annual losses in OAO Tatneft alone are estimated to reach several hundred thousand tons. Of this, more than half is from the tank farms. Light hydrocarbon fraction recovery from storage tanks presented a primarily operational problem that was unsuccessfully addressed by a number of Russian organizations for many years. Beginning in the early 1970s, Russian manufacturers produced pilot vapor recovery units on a small scale; but these failed to achieve widespread industry acceptance. The failure of the innovation process, the weakest point of Russian oil companies, is apparent in this case. The decision to attract joint ventures to solve industrial problems connected with innovation processes is believed to be justifiable and effective. The Tatex JV provides an excellent example of analyzing mechanisms / conditions required in implementing an innovation process in the Russian oil companies. Table 2 shows data concerning installation of vapor recovery units (VRUs), not only in Tatarstan, but also in Bashkortostan, Udmurtiya, Belorus, Kazakhstan, West Siberia and other regions.

The table shows that nearly 40 units have been installed over nine years, helping recover more than 740,000 tons (5.2 MM bbl) of hydrocarbons; the payback period of a unit is five months. Meanwhile, over these years, a number of modifications have been incorporated into original designs, and considerable experience was derived regarding specific features of VRU operation under the Russian conditions. Within a short period, a number of Russian enterprises started to produce component parts for the VRUs and the cost has declined significantly. It may be stated that the main problems to be solved by Russian companies when tackling the innovation process are communication difficulties and specific features of the organizational structure of a company. Implementation of the innovation process demands continual improvements in organizational structure / management. In the case of Tatex JV, a relatively small oil company, such reforms were undertaken much faster than in any large company. The advantage of a small oil business was used to maximize the effect of innovation. The main benefits can be clearly defined as follows:

Further, professional improvement of the middle management and selection of the top management personnel is based on their professional training. Introduction of flexible, mobile management schemes are capable of rapid response to any changes in status detected in the company itself or in the external market. And the organizational structure must be utterly functional. Conclusions Development of the Russian oil / gas business has undergone considerable change. The trend of large companies toward consolidation may be viewed as an overall negative for the industry, particularly if accompanied by business practices that penalize the activities of smaller companies. If, however, the playing field is essentially level, both large and small entities can coexist quite satisfactorily. The success of small companies and joint ventures is an essential provision for the dynamic development of oil / gas today. Small oil companies must be considered an important building block of business conditions, which can help guarantee competitive market relations and de-monopolize production, as well as supplement VIOGCs by performing functions alien to the economic operations of large companies. Creation of conditions allowing transfer from extensive oilfield development to intensive depends on implementation of innovation. Analysis of mechanisms / conditions required for innovation in the most important directions of the oil business (ecology, secondary methods of hydrocarbon recovery, low-productivity oil field development) provides the following conclusions. Integration of small companies and joint ventures into the innovation process

and the programs of scientific and technical development of VIOGCs accelerate the introduction of new

technologies to a commercial level. Compared to the VIOGCs, organizational structure / management systems of

small companies and joint ventures are more adaptable in creating the reforms stipulated by specific features

of the innovation process. The authors

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||