Floating production units set to grow

PRODUCTION TECHNOLOGYFloating production units set to growNew study shows worldwide support for floating production systems of all typesJohn Westwood and Martyn Wingrove, Douglas-Westwood Ltd., Canterbury, UK The World Floating Production Report, a new study just published by international energy-business analysts Douglas-Westwood and industry-data specialists Infield Systems, details the past and future of floating production systems (FPSs) in the 1995 – 2004 period. The study includes (among other things) FPSs by type, region and ownership, as well as examining the future of FPSOs in the Gulf of Mexico. A brief portion of the report is presented here.

Current FPS Stock In third-quarter 2000, there were 112 FPSs of various types in operation and seven others available. The regional breakdown is shown in Table 1. Of all FPS units employed worldwide, 64 are FPSOs, 34 are floating production semisubs (FPSSs), 11 are tension-leg platforms (TLPs, of which 3 are mini-TLPs) and 3 are Spars – all of which are in the Gulf of Mexico (GOM). Europe is the most important region for FPS employment with 33 units (29% of world total) operating; the majority of these are in the UK and Norway. This is significant in that it highlights the application of FPS units for field development in harsh environments.

Latin America closely follows, where there are 27 units (24% of world total) employed offshore Brazil, which shows the importance of FPSs for developing deepwater reserves. The FPSS is the most important type involved in Brazil, which is partially due to the low costs of utilizing such units in benign environmental conditions. Asia is an important region for FPS activity, with 19 floaters, of which 17 are FPSOs and 2 are FPSS units. The units can be found in both harsh and benign environments. Northern Chinese waters can rate as a harsh environment; however, FPSs employed in the Far East are in a normally benign environment, but where typhoons and cyclones can occur. There are 13 FPS units operating in Africa, of which 11 are in West Africa and 2 are in the Mediterranean. There are 12 operating units in North America, of which 8 are TLPs and 3 are Spars. The population of operating FPSOs is roughly half of the total floater population. There are 64 operating FPSOs and 5 available for leasing. About 31% of the operating FPSOs are employed in Europe, with most (14) in the UK sector. The next important region is Asia, with 26% of the employed FPSOs. Of the 17 in Asia, there are 8 in China (47%), 3 in Indonesia, while Malaysia, Thailand and Vietnam each have two. Africa is a growth region for FPSOs. Currently, there are 12 operating in the region, of which 10 are in West Africa and two are in the Mediterranean. The other two regions where FPSOs are operating are Australasia, with 8, and Latin America (Brazil), with 7. Operator Ownership Predominates Of the 112 operating FPS systems, 78 are operator owned and 34 are contractor owned and leased. The majority of contractor-owned systems are FPSOs, while four are leased FPSS units, Table 2. All Spars and TLPs are operator owned.

Of the 112 operating FPS units, 63 have been conversions, while 49 are newbuild units, Table 3. Therefore, 56% of the operating units have been converted from either tankers or semi-submersibles. All TLPs and Spars employed are newbuilds.

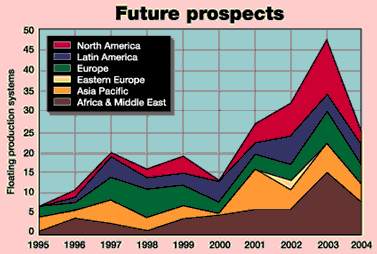

A large proportion of the hulls of operating FPSOs and FPSSs were constructed in the 1970s. This is about 28 FPSO and 14 FPSS hulls. In the late 1990s, there was a large increase in the number of units constructed, which was due to newbuilds installed in the North Sea. FPS Utilization In the past five years, 75 units have come into operation; but in the next five years, 144 are under consideration. This is not a forecast, as some may not come into being; but with oil prices at such high levels, more prospects will soon emerge. However, the numbers are a strong indication of the level of interest in the use of floaters worldwide, see figure. With the exception of Eastern Europe, the trend toward floaters is global as, in many situations, they become the production method of choice. Of those under consideration, the greatest numbers of prospects are in West Africa. The Gulf Shuttle Problem The absence of FPSOs from the U.S. GOM is partly due to a well-developed production and pipeline-export infrastructure, as well as the prevalence of gas developments in the region, which are better exploited through dry completions on fixed platforms with larger topsides. The other main issue is environmental concern. Nevertheless, as production advances into deeper waters that could be remote from any export infrastructure, pressures for using FPSOs become stronger. It is anticipated that the Record of Decision will be in favor of FPSO utilization in various areas of the U.S. GOM. Results of the Environmental Impact Statement (EIS) have suggested that MMS is viewing the environmental-impact risks from FPSO deployment to be comparable to risks incorporated in other deepwater FPSs and pipelines. The EIS draft document also suggests that excluding FPSOs would not decrease the environmental-impact risks, since other production systems would be utilized in their place. However, the EIS draft document did conclude that there was a higher risk with shuttle-tanker use and offshore loading, and that most of the oil-spill risks are from the use of shuttle tankers – not the FPSO itself. The problem of associated-gas disposal was considered by the draft document. The MMS only allows flaring in emergencies or for very short-term tests. Therefore, in the EIS draft document, pipeline export for associated gas was assumed; this high-cost activity may continue to be a potential hurdle for future field developments. Other problems could result from shuttle-tanker operation in the GOM, as they will need to comply with the Jones Act. This implies that tankers must be U.S. constructed, carry the U.S. flag and employ local crews in U.S. waters. Shipbuilders have stated that 3-year lead times will likely be required for initiation of an FPSO development involving shuttle tankers because of the Jones Act. This implies that there would not be an available fleet of shuttle tankers before 2003 – ’04 at the earliest. A potential method of reducing the Capex and Opex of transporting produced

fluids would be to involve Articulated Tug Barges (ATBs), which have a proven track record in U.S. inland

waters. Variations on this concept have been proposed for offshore use.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)