|

May 2000 Vol. 221 No. 5

Feature Article

|

SPECIAL REPORT: Southeast Asia Part 4

Malaysia’s upstream shows new vigor

As Southeast Asia recovers from financial doldrums and low oil prices,

Malaysian E&P activity is ready to increase on the strength of an aggressive government crude policy and an

expanding natural gas sector

Kurt S. Abraham, Managing / International Editor

ike many

of its neighbors, Malaysia is beginning to show signs of renewed E&P strength after being battered by low

oil prices from late 1997 to early 1999. Drilling rates are up, efforts are underway to bolster crude

production, and natural gas is playing a growing role in the upstream scheme. ike many

of its neighbors, Malaysia is beginning to show signs of renewed E&P strength after being battered by low

oil prices from late 1997 to early 1999. Drilling rates are up, efforts are underway to bolster crude

production, and natural gas is playing a growing role in the upstream scheme.

After a decade of strong economic growth that averaged 8.7% annually, Malaysia

was hammered by the Asian crisis. However, a recovery began in second-half 1999, and it continues during

first-half 2000. The economy showed minor growth in 1999 after shrinking 7.3% during 1998.

The economy has not always been consistent over the country’s 43 years as

a sovereign nation, but the government has been a model of stability. Various incarnations of the dominant

14-party coalition known as Barisan Nasional have controlled Malaysia’s government since the nation

gained independence in 1957. In the last general election in 1995, Barisan Nasional won an overwhelming

majority – 162 out of 192 parliamentary seats.

State oil company Petronas (through its operating arm, Petronas-Carigali),

Exxon and Shell dominate an E&P sector that has persevered despite see-sawing oil prices. On average, six

rigs are now drilling 70 to 80 wells annually. Crude production during 1999 averaged about 630,000 bpd, to

which another 90,000 bpd of condensate output were added. There are three areas of principal activity:

offshore Peninsular Malaysia, and offshore Sarawak and Sabah states on the northwest side of Kalimantan

Island. Separately, additional work is done in the Malaysia-Thailand Joint Development Area (MTJDA), offshore

in the Gulf of Thailand.

Despite the dominance of Petronas Exxon and Shell, several other operators are

involved in Malaysia. Three new operators – Amerada Hess, Santa Fe Snyder and YPF – entered this

market in 1998 by signing new PSCs. This had been the goal of Petronas when, in the mid-1990s, the company

devised a flexible PSC, to attract more investors to small fields. The firm also loosened terms for all PSCs

in 1997. In January 1999, Murphy Oil signed for three PSCs as operator.

|

|

Area covered by PSC tracts is divided fairly evenly between

Peninsular Malaysia, Sarawak and Sabah. The most recent award is Block SK312, offshore Sarawak, to

Shell in March 2000. |

|

| |

Malaysian

PSCs operated |

|

| |

PSC area/blocks |

Operator |

|

| |

PM301, PM302, PM306, PM307 |

Petronas-Carigali |

|

| |

PM3 |

Lundin Oil |

|

| |

PM304 |

Amerada Hess |

|

| |

PM308 |

Santa Fe Snyder |

|

| |

PM303 |

Shell E&P Malaysia |

|

| |

PM320, PM322 |

Shell E&P Malaysia |

|

| |

Deepwater Blocks A, B, & C |

Exxon (EPMI) |

|

| |

SK306 |

Amerada Hess |

|

| |

SK 301 |

YPF Malaysia |

|

| |

SK308, Deepwater Block E, SK312 |

Sarawak Shell |

|

| |

SK307 |

Petronas-Carigali |

|

| |

SK309, SK311 |

Murphy Oil |

|

| |

SB302, Deepwater Block H |

Exxon (EPMI) |

|

| |

SB301, Deepwater Blocks G & J |

Sabah Shell |

|

| |

SK312 |

Sarawak Shell |

|

|

|

|

Petronas-Carigali and the foreign operators face a challenge in their goal to

keep Malaysian oil output up, to a range of at least 600,000 to 630,000 bpd. This will require them to find

substantial new reserves, yet recent experience shows that the majority of new reserves are coming from

incremental growth in existing fields, while oil discoveries are trending smaller and smaller.

The best exploration prospects for finding incremental crude reserves are

near, or adjacent to, existing fields, where additional small pockets of oil are situated. Deepwater areas are

also considered high on the list of prospectivity. Petronas acknowledges that with improved seismic

techniques, it can now look at deeper horizons, as well as identify high-pressure horizons in shallower

waters.

A number of development projects at small oil fields are underway offshore.

Another 10 or more oil and gas fields are considered probable for development, with onstream dates ranging

from 2001 to 2005.

Reasons for why natural gas is playing a larger role include expanding

industrial usage, gas discoveries outnumbering oil finds and new oil pockets becoming smaller. Gas output was

about 4.7 Bcfd during the last three years. Petronas would like to begin drilling for gas in deepwater areas,

too, but that program has been delayed until the leftover effects of low oil prices have passed.

Petronas

Petronas’ strategy, as mentioned earlier, is to keep oil output from

slipping below 600,000 bpd, so new projects are geared to that goal. Meanwhile, condensate output is now at

about 90,000 bpd, and its share of overall oil production is likely to grow, given the expansion of gas

activity throughout Malaysia.

"We must find ways to keep up our reserves," said Tuan Haji Akbar

Tajuddin, senior general manager of Petronas’ Management Unit. "We must do this either through

greater exploration or through growth of our existing finds. Realistically, we know that an increasing share

of our incremental reserve growth is coming from revisions to existing fields."

Akbar said that current policy is to maintain a very aggressive development

program, something that the government has consistently supported for the last 30-plus years. For its part,

Petronas-Carigali operates 12 fields offshore Sarawak, of which nine are in joint ventures with Shell. An

additional seven fields are operated in joint ventures with Exxon offshore Peninsular Malaysia. Outside of

joint ventures, Petronas-Carigali operates four fields on its own, offshore Sabah.

|

| |

Petronas continues to implement an aggressive field

development program offshore Malaysia. |

|

In efforts to improve a 36% average oil recovery rate, the company hopes to

utilize new technologies to boost the figure. "We have the opportunity to do much more," said Akbar.

"If we can improve by just 5%, to 40% or 41% (which is something that is doable), we can see a measurable

gain. It also is cheaper, pointed out Akbar, than drilling to find new discoveries. The use of new

technologies, such as 4-D seismic and interpretation, also is expected to have considerable impact on the

ability to find additional oil pockets within existing reservoirs.

Convinced that technology will permit them to do what was not feasible 10

years ago, Petronas officials say they will go back to many older wells and see what kind of measures can be

applied to squeeze out additional reserves. "We also need to look at the life cycles of these fields,"

said Akbar. "We must put a lot of energy into this and focus on it. An important factor in this effort is

that service firms, rather than oil companies, are coming up with the new methods necessary for extending

field life. Meanwhile, we should continue to bring in fresh people to evaluate field conditions – people

with ‘new’ pairs of eyes to look at the fields and their accumulated data."

The growing role of service companies in maintaining the health of Malaysia’s

upstream assets is a trend that has not gotten enough attention, said Akbar. "If you look at the

evolution of the local oil companies, you can see how we have gone from them trying to do everything in-house

to a point where they farm out a large share of the tasks to service firms. At Petronas, we now recognize that

all parties have to work as a ‘composite.’ This includes the national oil company, the major foreign

oil company, the service companies, everyone. When we all work as a team, we all win. This is good for our

industry at large."

An increasingly important contributor to fostering the teamwork concept is a

project spearheaded by Petronas and known as "CORAL" (Cost Reduction Alliance). It is the Southeast

Asian counterpart to the UK’s CRINE initiative and something that Petronas is heavily involved in. The

programs share a common goal: to reduce average finding, development and production costs.

"Petronas has taken the lead on CORAL," said Akbar. "Our

company is using 1995 as a cost base and has calculated that it can reduce average development and production

costs by 30% by later this year. Additionally, we are trying to reduce development cycle times by 30%."

Akbar stressed that all companies active in the country can discuss common standardization, optimization, etc.

If any of them comes up with a good cost- or time-saving idea, then the state firm will listen and most likely

adopt it.

|

| |

More efficient drilling operations are just one goal of

Petronas’ participation in Southeast Asia’s CORAL program, which aims to cut E&P costs

by 30%. |

|

"You know, it’s a funny thing," said Akbar. "Whenever

there is something new introduced in the industry, we have some people who do not want to change. They say, ‘Why

change what we always do?’ But we must adopt new technologies early enough before they become obsolete.

We must learn to change to new methods early enough to get some value creation from them. If you are not

prepared for challenges, you may not be able to survive."

Exxon Mobil

Forty five years of operating in Malaysia will be celebrated this year by

Exxon Mobil’s subsidiary, Esso Production Malaysia Inc. (EPMI). The company opened its office in 1965,

and the first exploration well (Tapis 1) was drilled in 1969.

However, it was not until 1971 that EPMI struck its first oil discovery in

Tembungo, offshore Sabah. This find was followed by a second crude discovery offshore Terengganu in 1973. Oil

production was initiated at Tembungo and Terengganu in 1974 and 1978, respectively. Responsibility for

operations at Tembungo was handed off to Petronas in 1986. An additional five fields were handed to Petronas

in 1995 under a global agreement.

Today, EPMI is the largest oil producer in Malaysia and the largest supplier

of natural gas to Peninsular Malaysia. The firm produces about 50% of the nation’s oil production. "Our

company has seven production sharing contracts (PSCs) offshore Peninsular Malaysia and operates 31 platforms

in 12 fields within these areas," said Dr. Lee Chee Fook, EPMI’s corporate affairs manager. "EPMI

also has six PSCs in deepwater plays offshore Sabah and Sarawak in eastern Malaysia. In total, our company

holds an interest in 13.4 million acres offshore Malaysia. In 1998, Malaysia accounted for 8% of Exxon’s

net oil and gas production, worldwide."

The 1998 completion of the Raya-A platform, which developed North Raya and

Yong fields, marked the first oil production from the PM-8 PSC area. After putting Yong and Raya fields

onstream, EPMI is developing Larut field on its PM 5/8 Block. "PM 5/8 is north of our major fields and is

a site where we have found smaller oil accumulations," said Dr. Lee. "We are now beginning to

develop some of these, while to the south of there, we also have installed a new platform at Tapis field."

In the 1995 PSC area, development drilling continued on the Seligi-F platform.

In other existing fields, the focus continues to be on infill drilling to capture additional reserves and

provide new production capacity. In addition, improvements to base business activities are providing operating

expense reductions.

|

|

Seligi is the oldest of 12 fields producting oil for EPMI

offshore Malaysia. Average producing depth is 4,300 ft. |

|

EPMI’s net gas production in 1998 and 1999 was maintained at over 600

MMcfd. Detailed contractual arrangements were concluded in 1998 on a new, long-term, gas production sharing

contract (GPSC) with Petronas. Gas sales of 12 Tcf from 15 fields under this contract and a separate, existing

agreement should meet about two-thirds of Peninsular Malaysia’s projected gas demand for more than 25

years.

Planning continued into 1999 for Angsi field, which will be an integrated oil

and gas development, and the first GPSC field to be developed. Production is expected to commence in 2002

through a new gas pipeline system in which EPMI holds a 50% interest. New compression became operational in

1998 in Lawit field, increasing gross capacity by 170 MMcfgd.

Deepwater blocks will become increasingly important in EPMI’s portfolio. "The

last five blocks (SB 302, SB-H, SK-A & B, SK-C and SK-D) that we signed up for are deepwater exploration

tracts," said Dr. Lee. "A few of these were once held by Mobil, and we farmed into them. To develop

them economically, we are going to need good people and good technology, and we are going to have to find ways

to do things more efficiently. Of course, the same could be said for most operations in today’s upstream

environment."

Shell

More than 100 years of operations of one kind or another have been chalked up

by Shell in Malaysia. The firm began business by selling kerosene under the name of Marcus Samuel and Company.

In 1891, the company set up oil storage depots at various straits settlement ports, including Butterworth.

Also at this time, Shell purchased Singapore’s Pulau Bukum and set up a depot to distribute petroleum

products in the region.

On Dec. 22, 1910, the firm struck Malaysia’s first oil discovery, Miri 1,

on top of Canada Hill in Miri. This was followed by construction of Malaysia’s first refinery, also in

Miri, in 1914. This refinery still produces a wide range of petroleum products for the Sabah and Sarawak

markets.

Offshore exploration began in 1954, but it was only in the mid-1960s that

Shell made its first marine oil finds. These included the discovery of major natural gas reserves in central

Luconia Province, offshore Bintulu. Offshore Sabah, sufficient quantities of crude were not found until 1971,

when Erb West 1 came in. When Miri field was closed onshore in 1972, Shell’s upstream operations

subsequently were confined offshore.

Throughout its tenure in Malaysia, Shell has pioneered advances in local

extraction and export methods. One notable achievement is the introduction of the single buoy mooring (SBM)

system in 1960. The SBM system, which eliminates the need for deepwater harbor facilities, was later adapted

and used throughout the world.

While Shell’s E&P business has concentrated on efficient development

and extraction of crude oil, the focus increasingly is on natural gas offshore Sarawak and Sabah. The company

also has made an entry into Peninsular Malaysia blocks. To this effect, four Shell companies – Sarawak

Shell Berhad (SSB), Sabah Shell Petroleum Co. (SSPC), Shell Sabah Selatan Sdn Bhd (SSS) and Shell Exploration

and Production Malaysia B. V. (SEPM BV) – operate as PSC contractors to state oil company Petronas. In

some cases, efforts are on a joint venture basis with Petronas-Carigali (the E&P arm of Petronas).

Prior to 1975, Shell Malaysia, through SSB and SSPC, operated on the basis of

concessions granted by the state governments of Sarawak and Sabah. However, these mining leases ceased to have

effect on April 1, 1975, following promulgation of Petroleum Development Act 1074.

SSB operates Balingian oil field and the Central Luconia gas field. The latter

supplies unassociated gas to Malaysia LNG Sdn Bhd, ASEAN Fertiliser Sdn Bhd, and Sarawak Electricity Supply

Corporation in Bintulu. Crude is also produced under a joint operating agreement with Petronas at Baram Delta,

offshore Lutong, SSPC is involved in activities offshore Sabah. It is a joint partner with Petronas-Carigali

under a PSC. It produces mainly crude for export, while associated gas output is sent to Petronas Gas Supply

(Labuan) Sdn Bhd.

Shell’s recent venture into the relatively more challenging – and

costly – deepwater tracts offshore Sabah and Sarawak is an affirmation of its long-term stance in

Malaysia’s upstream industry. The company continues to pursue application of various state-of-the-art,

cost-efficient technologies in the field. One of these was the application of the region’s first

multilateral drilling. In addition, one of Shell’s offshore production facilities, Kinabalu, became the

first remotely controlled, unmanned platform in the history of Malaysian E&P. Meanwhile, development work

continues at Shell’s F 23 SW satellite and Asam Paya field, straddling the Malay / Brunei border.

Amerada Hess

The entry of Amerada Hess into Malaysia occurred in 1998, when new production

sharing agreements were signed for two blocks. In partnership with Petronas-Carigali, Amerada Hess holds

operatorships in Blocks SK 306 (80%) and PM 304 (70%). Both blocks contain oil and gas discoveries with

established oil reserves. The firm has an initial five-year exploration period for the blocks.

|

|

David

Abrahamson |

|

According to the company’s general manager in Malaysia, David Abrahamson,

an exploration program is in progress, with drilling anticipated in both blocks during 2000. "We are

shooting more seismic and doing additional interpretation," said Abrahamson. "We will acquire some

3-D seismic in Block PM 304 this year, and we plan to begin drilling late in 2000, with one well per block."

What prompted Amerada Hess to get involved in Malaysia was the company’s

identification of Southeast Asia as a growth area. The firm already had offices in Bangkok and Jakarta, as

well as production in Thailand and Indonesia. What also helped the company decide to enter Malaysia was the

depth of information available on both blocks.

"Previous operators logged a considerable amount of drilling data on

these blocks when they drilled the discoveries and, in some cases, followed with appraisals," said

Abrahamson. "The data show significant oil and gas accumulations in these discoveries, and we have the

benefit of being able to examine the production rates achieved when they conducted well tests. While we have

not drilled ourselves yet, we are learning a lot from the sizeable amount of activity and data already

available."

Abrahamson believes that the previous operators may have opted not to develop

the blocks for one or more reasons. Their decisions may have reflected the availability of better prospects at

that time, or the contract terms for the blocks may not have been attractive enough. In addition, quite a few

technical advances have been made since these blocks were first drilled.

"For instance, we face a challenge on Block SK 306, where the target is

beneath some thick carbonates, causing older seismic data to not be as good as it could be," said

Abrahamson. "We know that the reservoir holds oil, but there is some gas too. Our goal is to get as

accurate a picture as possible."

On Block PM 304, the challenge is to increase the potential rates of

production, in order to justify commercial development of the field. Accordingly, there is a need to identify

zones that are more productive before drilling targets are selected. "One of the technical challenges

offshore Malaysia is overpressure," said Abrahamson. "In addition, it can be a challenge to achieve

a good, high production rate, but we are targeting what we believe will be more productive zones. The

reservoirs are technically thin by international standards."

During his career, Abrahamson has worked in a variety of countries and

environments. Prior to Malaysia, he served a five-month stint in London, which came after working

three-and-a-half years as exploration manager for Amerada Hess in Gabon. "I can say without qualification

that things work here," said Abrahamson. "The infrastructure is good, and the work ethic of the

local people is excellent. This certainly is a place where you can do business, and we intend to make Malaysia

a core area for us."

Murphy Oil

Vigorous efforts by Murphy Oil’s Frontier E&P group were rewarded in

1999, when the company became Malaysia’s third-largest acreage holder by acquiring three offshore blocks.

The firm hopes that three Murphy-operated properties will serve as a platform for its future growth in

Southeast Asia. Because the firm is optimistic about, and committed to, the Malaysian program, an office was

opened in Kuala Lumpur in 1999 to identify new opportunities in this high-growth region.

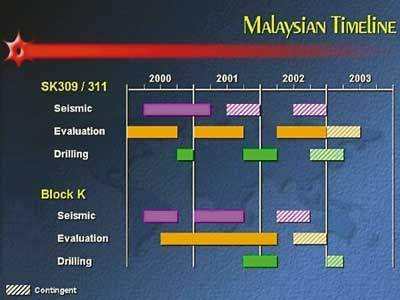

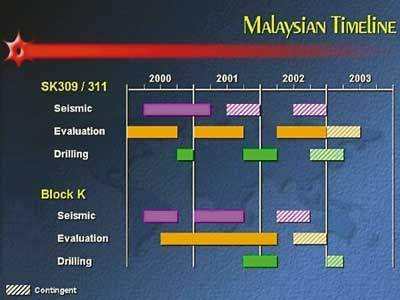

Blocks SK 309 (85%) and SK 311 (85%) are contiguous shallow-water tracts

offshore Sarawak, and they contain several undeveloped discoveries in an area with existing infrastructure.

Work commitments over the next five years include acquisition of seismic data and the drilling of four

exploratory wells. The first wildcat is expected to spud in late 2000 or early 2001.

The third tract, Block K (80%) covers 4.1 million undrilled acres in offshore

Sabah’s deep waters and represents the largest block ever awarded in Malaysia to date. Beneath water

depths of 4,800 to 10,000 ft, significant potential (verified by nearby drilling success) exists in Block K

for large single-field discoveries. Existing commitments require a seismic program and one exploratory well

over seven years. Near term, Murphy Oil is shooting seismic in 2000 to prepare for its first well, planned for

2002.

|

|

Murphy Oil began running seismic programs on its

blocks during this quarter of 2000. The company’s firm drilling plans extend from fourth-quarter

2000 into first-quarter 2002. |

|

Santa Fe Snyder

Santa Fe Snyder initiated operations when it signed a production sharing

contract with Petronas in July 1998. The PSC covers offshore Block PM 308, which lies along the east coast of

the Malaysian peninsula. Santa Fe Snyder operates the block and has an 80% working interest. Petronas Carigali

holds the remaining 20%.

In addition to exploration opportunities on Block PM 308, Santa Fe Snyder has

the right to develop Rhu field, a potentially commercial 1992 discovery within the block. Rhu field requires

additional appraisal work to determine commerciality, and the company will drill at least one additional well.

|