Composite-lined tubulars can lower operating expenses

SPECIAL REPORT: OCTGComposite-lined tubulars can lower operating expensesAlthough there are less expensive ways to protect OCTGs and components, fiberglass epoxy linings offer excellent resistance to corrosive gases and mechanical wear. As a result, equipment replacement and well workovers are reducedKenneth Ross, Rice Engineering Corp., Odessa, Texas

Increased capabilities of fiberglass-lined tubulars in deep, corrosive gas wells, for example, have given operators greater flexibility by providing less-expensive options to costly alloy steel production tubing. These were previously perceived to be the only choice. New products have emerged that will tolerate temperatures in excess of 300°F, as well as high concentrations of H2S and CO2, among other corrosive gases and liquids. In addition, operators of disposal facilities are cutting costs by disposing of waste gas through FG-lined tubing into depleted sands and carbonate reservoirs in lieu of constructing elaborate treatment plants to remove corrosive waste products. This article will examine the long-term economic benefits of fiberglass epoxy-lined tubular goods vis-à-vis various alternatives – typically less expensive methods such as internal plastic coating (IPC) and tubulars lined with polyvinyl chloride (PVC) and polyethylene products. Additionally, comparative examples are presented in which corrosive gases are being produced through alloy steel in high-temperature applications at production facilities. Finally, case histories are included for high-temperature gas production and large-volume, low-pH waste product disposal. Corrosion Costs Corrosion damage to capital assets inflicts a high, negative impact throughout nearly every industry. NACE estimates that annual corrosion costs effectively remove $300 billion per year from U.S producers alone. About $150 billion of these costs can be prevented by various forms of corrosion engineering.1 It is estimated that tubular corrosion alone costs the oil industry hundreds of millions of dollars per year. Kermani and Harrop define the cost of corrosion in terms of capital and operating expenditures and HSE (health, safety and environment) costs.2 Four cost categories are identified as follows:

These figures impact negatively on total ROI. Although any cost can be construed as negative, the economic effect of downhole corrosion is especially dire, because it is largely preventable. In addition to the direct costs that corrosion has on the industry, indirect costs associated with HSE and compliance (with regulations made necessary through shortsightedness and poor planning) weigh heavily upon the industry. Prevention of damage (and costs) associated with downhole corrosion can be achieved through:

The corrosion barrier is the simplest, and arguably the most effective, of these alternatives. Composite technology has evolved rapidly to provide economically viable solutions to corrosion in the form of a barrier between the corrosive elements and the steel in service. Composites And Lined Tubulars Composites are defined as fiber-reinforced, thermosetting or thermoplastic matrix materials. The introduction of composites into the oil field has yielded the opportunity in many instances for operators to select lightweight, corrosion-resistant alternatives to high-cost alloy steel. Applications include onshore (pipelines, tanks and storage vessels), offshore (injection lines, structures and flowlines) and downhole (composite tubing and lined tubulars). Lined tubulars consist mainly of steel tubing with standard oilfield connections lined with composites like glass-reinforced epoxy (GRE) or thermoplastic matrix materials such as high density polyethylene (HDPE) and polyvinyl chloride (PVC).3 This article examines the use of GRE composites as a barrier to downhole tubular corrosion – a practice that has gained wide acceptance during the past 20 years. Technology has advanced to the extent that production costs of GRE have been lowered to feasibility. Additionally, the construction of GRE material itself has evolved to the point where it is now being manufactured to tolerate increasingly severe environments. GRE has outperformed thermoplastic products, including HDPE and PVC, in high temperatures or in gaseous environments, thus providing a strong economic driver for the manufacture and installation of GRE in lined-steel tubular goods. For example, the permeability to small gas molecules, combined with their low hoop strength, has rendered thermoplastics largely ineffective in CO2 injection service and gas-lifted production. Temperatures above 150°F are typically outside the capabilities of polyethylene and vinyl chloride materials as well. Additionally, GRE liners enjoy an advantage as a superior corrosion barrier over less-costly ID coating. Lining of tubular goods has proven to be a preferred solution to ID coating of urethane and epoxy-resin compounds by virtue of the steel surface itself. The roughness of the finished carbon steel product ID is such that a completely "holiday-free" coating can never be completely achieved. Subsequent handling damage to the coated steel product frequently is the cause of corrosion failures where the corrosion surface is the exposed steel beneath impacted coating. GRE lining of steel tubular goods replaces the ID completely, and the lined-steel tube is inherently holiday-free. In addition, the durability of GRE composite yields a higher abrasion resistance to multiple wireline tool runs and coiled tubing intervention. The lined tubing is capable of providing trouble-free service in high-temperature, gas-saturated corrosive environments where thermoplastic linings and pipe coatings oftentimes fail. GRE Description GRE composite liners are manufactured using a filament-winding process in which continuous strands of fiberglass material are wetted with a proprietary resin compound prior to being wound about a spinning mandrel. The winding is repeated in a helical fashion over a series of repetitions until sufficient thickness has been achieved. The resulting tube is subsequently gelled and cured at high temperature over several hours. The tube is then finished to specification in a series of machining procedures prior to installation. Quality measures integral to this process include rigorous control of temperature and curing times during the manufacture of the GRE tubes. Strict monitoring of the epoxy composition is critical, in addition to careful measurement of the product dimensions throughout the manufacturing process. Because the product is expected to perform in a variety of harsh environments, periodic testing of the finished product is fundamental to quality control. Representative samples of completed GRE tubes are measured on a periodic basis for other criteria, including:

When the GRE-lined tubing is installed by the end user, accommodations must be made to ensure protection of the coupling area from exposure to the corrosive fluid or gas. Historically, the most effective method has been to install an elastomeric compression ring into the coupled area, which, upon makeup of the connection, is compressed to fill in the J-dimension of the coupling.4 This completes the integrity of the protective surface inside the tubing string and eliminates contact of the carbon steel with the fluid or gas in transport. The design for this component has proven effective in this application for over 45 years and continues to perform well in every circumstance. Need For Corrosion Protection Many oilfield processes are detrimentally affected by corrosion. Within the scope of this presentation, four distinct applications involving the use of oilfield tubular products are examined:

Corrosive environments in enhanced recovery projects. Not surprisingly, most downhole tubular corrosion is associated with the exposure of downhole steel to low-pH environments, encouraged by the combination of groundwater with a variety of acid-forming elements. Typically, carbon steel injection tubing utilized in secondary or tertiary recovery is a candidate for treatment to either prevent the corrosive solutions from forming or to construct a barrier against the resulting corrosive fluids. Groundwater from fresh water sources, as well as high-saline sources, can lead to the formation of acids and solvents by combining with H2S and CO2 from either downhole sources, injected fluids or a combination of both. Large-scale users of GRE-lined tubular goods generally are involved in waterflood and CO2-flood enhanced recovery. Injection wells and, in some cases, production wells in these fields are excellent examples of highly corrosive environments. Most commonly, untreated produced water is used as the source for injection to maintain reservoir pressure. This fluid is quite often high in salt content and has large quantities of dissolved solids. The reaction of carbon steel to high-saline environments is well documented, and it is not hard to imagine the effect of exposure to these fluids alone. However, there are additional elements present in produced fluids that can contribute to the deterioration of steel tubing. As the waterflood matures, corrosive gases typically are introduced into the injection fluid, increasing the likelihood for downhole damage. Injection of CO2 has created perhaps the most severe of all corrosive environments. The procedure used in maturing CO2 floods is to alternate produced water with CO2 injection (WAG), combining all the necessary ingredients to form carbonic acid. The formation of this acid in constant exposure to downhole tubing will quickly render the injection project unmanageable, since carbonic acid is highly reactive with carbon steel. Well service costs and HSE issues will manifest themselves over a very short period of time and operating costs will quickly rise. Another benefit of GRE composites presents itself in CO2 injection at the molecular level. The size of the CO2 molecule is very small and has the ability to penetrate most thermoplastic materials previously used exclusively as tubular lining products. Polyvinyl chloride and polyethylene are two commonly utilized materials that are easily penetrated by CO2. Once the gas has penetrated the plastic, the danger of lining collapse becomes imminent upon rapid depressurization of the tubing string. Ultimately, the exposure of the gas with the steel will result in a corrosive situation, and the costs associated with lining the tubing will not contribute to the life of the project. GRE is an amorphous, fiber-reinforced solid – properties that give the material its unique high hoop strength and superior resistance to gas penetration. The nature of the GRE composite is such that its molecular structure inhibits the passage of gas through the liner, thereby reducing both dangers of corrosion due to surface exposure and the possibility of subsequent liner collapse upon rapid depressurization of the tubing string. Additionally, the orientation of the glass fibers increases hoop stiffness, which gives the liner increased ability to resist collapse. Disposal of corrosive fluids and gases. Produced fluid being disposed of is typically comprised of salt water and can contain gaseous elements as well. By themselves or in combination with one another, disposal of these compounds quite often requires special corrosion-resistant downhole facilities. GRE composites are the lining materials of choice for a variety of applications. Again, the ability of the fiberglass to resist gas penetration is a fundamental benefit of disposing of highly corrosive salt water and various other fluids through GRE. Acid gas injection is a highly cost-effective method of disposing of waste gases downhole, eliminating the requirement for costly surface treatment facilities. H2S and CO2 are frequently stripped out of the produced hydrocarbon before entering the sales line. Until recently, these gases were vented to the atmosphere after removal of the acid-forming elements. As an incredibly durable barrier to corrosion, GRE linings for tubular goods have given the operator advanced capabilities to withstand deterioration of downhole disposal tubing caused by these corrosive gases. Compounds consisting of 40 – 60% H2S and 40 – 60% CO2 (combined gas products) are being disposed of downhole on an increasingly regular basis through GRE composite-lined steel tubing. In most instances, produced water is injected along with the acid gas at rates on the order of 2,000 to 5,000 bpd. The oil field is not the only environment where corrosion has been stopped by GRE composites as a barrier to corrosion damage caused by acid-forming gas components. Industrial waste gas (gaseous sulfuric acid, e.g.) is processed in wet flue gas desulfurization (FGD) using GRE composites as conduits between reaction vessels. Wet FGD is the preferred method for removing sulfur dioxide from coal combustion by-products. GRE stack liners are also used increasingly in these processes as a preferred method to costly alloy steels.5 GRE lining of production strings to mitigate corrosive gas damage. Case histories exist in which GRE-lined tubulars provided cost-effective prevention of corrosion in high-volume, gas-lifted oil production. A majority of IPC-coated tubing failures are leaks in the tubing pins and couplings. The corrosion barrier ring associated with the GRE lining system minimizes the contact of corrosive fluid with the steel tubing and subsequent years of trouble-free production are made possible.6 Additionally, GRE-lined steel tubing in production wells can be demonstrated to retard the tubular deposition of paraffin and asphaltenes. GRE lining of surface tubular goods. On an increasing basis, surface lines handling corrosive produced fluids and injection fluids are lined with glass-reinforced epoxy. The flexibility and low weight of the composite are attributes that lend themselves very well to this application. An additional benefit of GRE-lined steel tubing over FG (fiberglass) tubing lies in the fact that special bedding does not have to be prepared. GRE-lined tubing can be buried like any other steel product. The bending modulus of the GRE composite permits the liner to withstand bends up to the steel pipe elastic limits. The end user realizes the benefits of the corrosion-free surface provided by the GRE-liner, as well as the strength and durability of the steel. Composite-lined flowlines in excess of one million feet are in service today, most commonly as injection and transportation surface lines. Installations of GRE-lined flowlines have employed threaded tubular connections and welded connections. The aforementioned high costs of corrosion with respect to HSE periodically become apparent when material failure in a surface line bearing corrosive fluids or gases is identified as the cause of an environmental catastrophe. The cost of compliance with environmental regulations has been extremely high over the past decade. The potential for damage is well documented when the need for protection against corrosion on the surface has been ignored. Costs Of Well Service Due To Corrosion In today’s environment of diminishing reserves and marginal projects, greater emphasis is placed upon reducing production costs. There is now a stronger case to be made for an increase in capital expenditure at the commencement of a project in exchange for lower operating costs over the project life. The high cost of well service is the easiest to recognize and is likely the most obvious. Additionally, costs that reduce the operating efficiency of an asset include the costs of lost production due to downhole and surface maintenance, HSE costs and cost of product replacement. An incremental increase in cost of tubular goods constructed using GRE to eliminate the cost of corrosion is a prudent economic measure where project life is expected to surpass the useful life of a lined or coated product of lower quality. The following model illustrates actual research performed by a North Sea operator to qualify GRE-lined tubulars for water injection service to increase design life from present limits of 5 – 7 years to beyond twenty years. Workover economics: Offshore vs. land operations. Using the North Sea operator’s example of offshore workover economics, platform workovers have target costs of $3.13 million for IPC tubulars with low-chrome CRA accessories. The cost of the workover includes rig time, the tubing string, completion fluids and accessories. This cost is expected to increase by $330,000 to employ GRE-lined tubulars (allowing also for much higher-cost CRA accessories – higher chrome / nickel content accessories are judged necessary due to increased life expectations). Using IPC, the time between workovers is judged to be seven years maximum; therefore, the annual cost of each well equals $3.13 million divided by seven years product life, or $447,000 per year. Using GRE-lined completions, the cost of working over a well is $3.46 million. The completion only has to have an additional life of nine months beyond IPC life to pay out the incremental premium of the GRE lining (marginal cost = $3.46 million – $3.13 million = $0.33 million; $0.33 million ¸ $0.447 million per year = 0.74 years or nine months, see Table 1).

Land-based operations involve considerably lower costs, but the relative economics are based on the same model. To form a more concise basis for comparison, all costs, other than coating and lining expenses, are stripped away. To extrapolate the previous example, internally coating a string of tubing for a West Texas injection well (10,000 ft, for example) now costs about $17,500. The cost of an average workover in the Permian basin can cost between $2,500 and $3,000. The incremental cost of lining API tubing with GRE composite material, as opposed to coating with plastic, is around 20%. For a 10,000-ft string of 2-3/8-in., API 8-round tubing, this is an average cost increase of $3,600. The GRE lining now costs $21,100. Again, using an estimation of a seven-year maximum product life for IPC tubing, annual lining cost of the IPC tubing is $17,500 ¸ 7 = $2,500. If the incremental cost of the GRE tubing is $3,600, the economics of this situation indicate that the GRE will pay out after an additional 1.44 years or after about 17 months of service. (21,100 – 17,500 = 3,600; $3,600 ¸ 2,500 = 1.44 years, see Table 2).

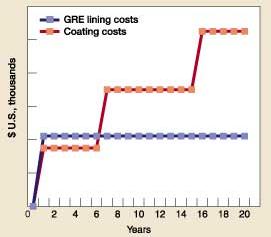

Even in the most severely corrosive environments, GRE-lined tubing remains in service and has been abundantly documented with numerous applications lasting 15 to 25 years. Opportunity cost savings. The preceding examples may be oversimplified to the extent that they do not represent a completely true picture of the cost savings. However, if the data are reconfigured to reflect net present value (NPV) of the original expenditure vs. NPV of future dollars saved, additional economic justification becomes apparent. Briefly, the value of not working over a well due to a corrosion failure increases with the time value of money. More specifically, these values are illustrated in the accompanying charts. Fig. 1 represents undiscounted capital expenditure over an assumed 20-year well life burdened with the previously determined 7-year IPC life cycle.

Preparation of a capital budget often involves making assumptions based on historical data and previous experience. To restate the costs of corrosion in terms of lost return on investment (ROI) also can be a wildly subjective process due to the assumptions one must make. But these costs and the impact of corrosion on an operator’s finances cannot be ignored. To reiterate the four costs identified in the introduction and to illustrate the financial aspects of budgetary considerations based on value, the following example is presented. The operator is making the decision to purchase either a premium GRE-lined, WAG injection tubing string or a less-expensive, internally coated string. Following are assumptions used in producing the analysis:

Given the above assumptions, the impact of the costs of corrosion – net present value of savings realized with a premium lining – are determined in the following steps:

Tables 3 and 4 illustrate projected costs and a simulated capital budget in which a strong case for the premium lining product can be demonstrated over the life of the well. The net present value (NPV) of the cost savings over the well’s life has only to exceed the original capital outlay (break-even point) in order to bear out the economic viability.

Costs have been annualized in this example by dividing each individual cost by the eight-year product life. In this case, the NPV of the cost savings (money not spent working over the well) is $56,465 based on an 8% return. The cost of the asset (GRE lining) is $21,100 (note that this is a CAPEX item). The difference equals $35,365, which is well over the break-even point. This makes an obvious case for an increase in capital expenditure up front, as opposed to increased operating and replacement costs and the cost of lost production over the life of the project. Conclusions Historically, use of a barrier between a corrosive fluid and a given material has been the most effective means of protecting a valuable asset from destruction. The evolution of the lining process for tubular goods has culminated in the prolific advance of composite materials as corrosion barriers, especially in the oil field. Costly corrosion damage has been largely mitigated by protecting the tubular goods with GRE liners. This material has proven to be highly resistant to many forms of corrosive environments, durable to the extent of enabling wireline and coiled tubing operations, highly effective in gas service and well-suited to both downhole and surface environments in terms of material strength and performance. GRE is a premium lining product and its initial capital outlay inarguably

exceeds that of IPC and thermoplastic lining products such as PVC and HDPE. However, GRE performance and the

longevity of projects using GRE-lined tubular products are well-documented. The economic advantages of an

incremental increase in cost at the beginning of a project are apparent when examining the costs of using less

expensive products, which will ultimately require high operating expense over a project’s life.

Acknowledgments The author especially thanks Rice Engineering Corp., Odessa, Texas, for granting permission to publish this article and for the opportunity and generous resources made available over the past year. This article was adapted from the paper, "An Economic Case for Composite Lining of Oilfield Tubulars," the author presented at the 47th Annual Southwest Petroleum Short Course, April 12 – 13, 2000, Lubbock, Texas. Literature Cited

The author

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Kenneth

M. Ross holds degrees in petroleum geology from the University of

Wyoming and business administration from the University of Louisiana-Lafayette. He has 20 years of oilfield

experience, primarily working in drilling services with Sperry-Sun (now Dresser-Halliburton) and Schlumberger

Oilfield Services, in the Gulf of Mexico, onshore Louisiana, South Texas, the northern Rocky Mountains and

Canada. Mr. Ross is presently technical sales representative for Rice Engineering Corp. in Odessa, Texas.

Kenneth

M. Ross holds degrees in petroleum geology from the University of

Wyoming and business administration from the University of Louisiana-Lafayette. He has 20 years of oilfield

experience, primarily working in drilling services with Sperry-Sun (now Dresser-Halliburton) and Schlumberger

Oilfield Services, in the Gulf of Mexico, onshore Louisiana, South Texas, the northern Rocky Mountains and

Canada. Mr. Ross is presently technical sales representative for Rice Engineering Corp. in Odessa, Texas.