Building a world class organization in a volatile oil price environment

Building a world-class organization in a volatile oil price environmentPart 1 – Key to success will be companies’ ability to reduce costs of their services while increasing the value delivered to clientsJohn de Wardt, de Wardt and Co. Inc., Steamboat Springs, Colo.

True performance must be achieved in the oil industry. Consolidation, yielding improved economic and operational performance, is likely to occur in reaction to volatile and low oil prices. New entrants to the industry could rapidly emerge if the current players do not wake up. Competitive Industries Competitive industries have had to work and thrive in low-margin environments, and companies have grown in this environment. But the upstream oil and gas industry has yet to face this reality, which may well dawn as oil prices show a potential to stay low and energy markets become highly competitive through legislative deregulation and globalization. Competition between new sources of production (from, for example, newly opened countries, low-cost producers with vast reserves and traditional producers with high-cost reserve bases) will lead to a new level of performance.

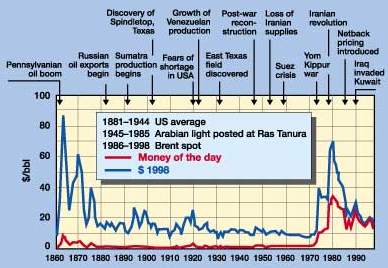

New entrants to the business have no fear about conquering significant market sectors, as seen by Enron’s aggressive strategy – now an energy company, now a water company (just because there is a $30-billion market waiting to be optimized), now a communications bandwidth trader. Who knows what it will try next? The Mask Is Off Many middle-management-level people who are now leading the oil industry grew up in the inflationary environment of the late 1970s and early 1980s; which is where, in reality, their understanding of operations performance was formed. As has happened in many other industries, inflation masked poor performance. The natural learning of these managers in this environment was that performance didn’t really matter since budget overruns were forgiven by higher oil prices. The decline of oil prices in the late 1980s instilled some discipline. In reality, this was still a superficially high-priced environment, as shown by the accompanying real oil price plot. This plot clearly shows that real price pressure is only just beginning to happen in the current environment of $11 to $20. This is the first time in almost 25 years that the oil industry has had to endure real price competition. Furthermore, as oil has become a commodity, its price has taken on significant volatility. Senior managers at oil companies are beginning to plan on $11 to $20 oil with significant volatility. BP Amoco’s John Browne, one of the most aggressive managers, is forcing his company toward profitability at $11 per barrel. Future Is Uncertain Many people are wisely refusing to predict oil prices. As John Jennings, former managing director of Royal Dutch Shell, is quoted as saying: "The only thing oil price forecasts had in common was that they were wrong." A wise comment indeed, particularly since it came from the leading practitioner of scenario planning. Scenario planning is a form of planning that enables companies to consider different futures in an uncertain environment and to prepare for this recognized uncertainty. Shell had, in fact, used this method to predict the oil price rise in 1973 and the subsequent decline in the mid-1980s. Current oil price scenarios are varied, ranging from a low and volatile price to a significant rise resulting from limited oil reserves. The ranges are indeed extreme and include:

While the extremes seem unlikely, volatility in the lower range is a real possibility upon which investment decisions are being based today. It is these decisions that will drive the industry in the next few years.

Performance Will Be Key Performance measures have moved from justification of differences between operations due to geology to benchmarking on a grand scale. Other industries have jumped the barrier between best in class (or the so-called technical limit on people’s perception of what is possible) to world class. World class is defined as far exceeding all competitors with an organization that does not fear competition since it is, in the words of Toyota, "relentlessly pursuing perfection and so advancing in performance on a continuous basis." These seem to be valid words of advice, coming from a company that has cash in hand of at least $15 billion in a highly competitive business. These types of companies move forward continuously from the differentiated level of performance they created through step change. World class in the oil industry has been achieved in a very limited number of projects, and most companies will continue to struggle for recognition unless senior managers wake up and perform themselves while demanding these levels from their teams. Examples are set through the many "What ifs" of exploration drilling and rig contracting, that the essence of performance is lost before the game has begun. Matt Simmons, of Simmons & Company International, stated clearly that oil companies are inept at planning exploration ventures. Oil companies will, of course, retort that exploration is an uncertain environment that requires extreme flexibility – then complain when the $300,000-per-day operation is unable to get good logs, fails to recover a core or overshoots the budget by 30%. One day soon, competitors or shareholders will demand the reckoning that will bring to a halt this low-performance game. Best in class, as demonstrated by regional performance studies, usually is a lucky event for oil companies – it is not repeatable. Repeatedly achieving best in class has been accomplished through the application of Lean Drilling1 to projects for different oil companies with different drilling contractors and service providers in Norway during the last two years. World class, as defined in other industries and demonstrated in a very few oil industry projects, is double the performance of these best in class results with exceptional data acquisition in exploration wells and significant production improvements in development wells. Repeatedly achieving best in class performance provides the environment for jumping to the world class level. Reorganizing The Industry Oil industry companies have changed significantly through consolidation during the last 15 years. In the service sector, these consolidations yielded larger companies that are able to offer a broader range of services. Significant redundancies have been made, which could indicate improvement of the cost basis of these businesses. Unfortunately, there has not been any real evidence of improvement in delivering value through these combinations – much of the improvement has been attributed to technology changes. Drilling contractors have undergone significant consolidation, which may not be enough yet to create a highly competitive industry. The rise in offshore rig rates and the demand for deeper water units caused a building boom in 1997. This boom was cut short by the sudden dive in oil prices in 1998. A number of these contractors are facing financial difficulties because of contracts terminated for failing to deliver on time, significant cost overruns incurred during construction and because current market rates fell below the economic level for these high-cost units. Rig contracting is a highly capital-intensive business that requires extremely competent management – from financial management through to project management of both construction and operations. A highly competitive oil industry will not tolerate high costs, delays and cost overruns. Other industries with this type of capital intensity and the need for new designs for more efficient operation have consolidated into two or three primary companies. These companies then develop and sell models needed by the customers and avoid the one-off custom designs based on individual experience and whims. The offshore drilling contracting industry may need to consolidate into one in which a limited range of standard products meets all customers’ needs and are financed, designed and built by only two companies. The same may be true for developing highly efficient land rigs that can be maintained using standard systems. The requirement for strong companies to do this will increase as designs, including seafloor-based rigs and/or coiled tubing drilling units, become real options for very deepwater drilling. These units then can be operated either by the same companies or, more likely in a flexible world, be leased to rig-operating companies that are based in various geographic locations. This is the model currently prevailing in other industries, i.e. airlines. In this industry, two manufacturers control the market for large units; they have the ability to provide the construction financing. In operation, the units are often owned by third-party finance companies and operated by specialized airlines. Re-badging is the name of the game – that plane painted with the familiar airline colors could be owned by either the airline or by a finance company. The products are similar for all users and are developed to meet recognized customer needs. It is doubtful that such a change will occur in the current oil industry. It may be more likely to occur when a highly competitive company, with access to large sources of capital, enters the industry. Outlook True performance must be achieved in the oil industry. Consolidation, yielding improved economic and operational performance of services and rigs, is likely to occur in reaction to volatile and low oil prices. The key to success will be the ability of companies to significantly reduce the cost of delivering their services while increasing the value they deliver to their clients. New entrants to the industry could rapidly emerge if the current players do not wake up. Coming next month: Breaking down the organizational boundaries that contribute to performance problems.

Literature Cited

The author

Copyright © 2000 World

Oil |

||||||||||||||

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)

John

de Wardt is president and founder of de Wardt and Co. Inc, an

international management consulting firm providing services to the worldwide E&P industry. He is a

mechanical engineering graduate of University of Newcastle in England where he focussed on business studies.

Mr. de Wardt has more than 23 years of experience in engineering, contracts, senior management and management

consulting; and previously worked for an international oil company, international drilling contractor and

major service company. He has developed proprietary programs for transforming E&P organizations to lean

enterprises capable of achieving world class performance and developing strategies using scenario planning.

John

de Wardt is president and founder of de Wardt and Co. Inc, an

international management consulting firm providing services to the worldwide E&P industry. He is a

mechanical engineering graduate of University of Newcastle in England where he focussed on business studies.

Mr. de Wardt has more than 23 years of experience in engineering, contracts, senior management and management

consulting; and previously worked for an international oil company, international drilling contractor and

major service company. He has developed proprietary programs for transforming E&P organizations to lean

enterprises capable of achieving world class performance and developing strategies using scenario planning.