United States: U.S. drilling

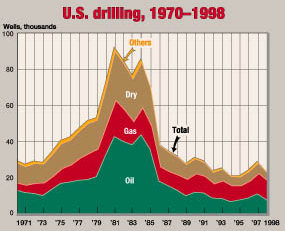

U.S. DRILLINGGetting back to "normal"

The most baffling aspect of 1999 was determining why operators were so slow to react to oil prices that doubled during the year. The consensus explanation is that the earlier price collapse was so devastating to cash flow and bottom-line results that many firms needed nearly a year’s worth of increased profits just to repair the balance sheet damages.

For example, the U.S. Energy Information Administration reported that total net income for the major U.S. energy companies was down 61% from 1997’s all-time record, and that cash flow generated by operations was at its lowest level since the last oil price collapse in 1986. In addition, capital expenditures by the majors have been exceeding their cash flow, which is highly unusual. The group’s capital expenditures normally run 14% below cash flow. These disparities required the majors, as well as several independents, to make wrenching adjustments to their corporate balance sheets. Methods used to close the financing gap included increasing debt loads, selling producing assets, cutting dividends and stock repurchases and drawing down cash balances. However, numerous indicators now suggest that these repairs are about complete and that the industry is in for some moderate growth. The following discussion and accompanying tables and curves enumerate these concepts and other key factors. Highlights of World Oil’s forecast for 2000 include:

Oil and gas prices. The ability of OPEC and its allied producing countries to finally agree to, and comply with, significant production cuts was the catalyst that turned oil prices and the U.S. E&P industry around. And despite some skeptics’ views that higher oil prices would prompt cheating, OPEC held firm. Concurrently, rising world demand and flattening non-OPEC production helped to bring about oil prices not seen since the Gulf War in 1991. In addition, declining stocks throughout the OECD countries should finally disprove the International Energy Agency’s theory of "missing barrels." Together, these fundamentals should yield the firmest prices in several years. As always, the problem is guessing where prices will settle during the year. For help in this undertaking, World Oil consulted the only forecaster that accurately predicted oil prices would increase in 1999. In fact, the Houston-based consulting firm of Groppe, Long and Littell said in October 1998 that prices for West Texas Intermediate (WTI) crude would improve to $20 per barrel during first-half 1999 and could attain $26–$28 by year-end. This was in contrast to the overwhelming consensus that oil was to remain in the low "teens" for at least 3–5 years. For 2000, Groppe, et al., is looking for an average of between $25 and $28 per barrel this year. And, yes, prices will still be volatile because the futures traders will continue to react to incomplete and/or inaccurate supply / demand data. Wellhead prices for natural gas, which suffered from too much storage last year, should rise by about $0.50 to an average $2.50 per Mcf this year. This assumes a normal winter, which got off to a warm start, but is now cooling considerably in the Northeast. Operator surveys. World Oil’s year-end survey of 22 U.S. major drillers (integrated companies and independents with large drilling programs) and 140 independents indicates bullish expectations for 2000. Majors plan 5,665 wells, up 35% from last year. Independents responding will drill 1,407 wells, up a resounding 69%. Both groups will concentrate on gas and field development; 48% of majors’ drilling will be for gas, while gas will account for 64% of independents’ drilling. An overwhelming 94% of majors’ operations will be development drilling, and independents say 76.1% of their work will be in existing fields. Spending plans. Salomon Smith Barney’s annual year-end survey of 177 U.S. and international operators indicates that worldwide E&P budgets will rise 11.4% this year. Spending plans are based on an average oil price assumption of $19.00 per bbl, which is up sharply from the $14.67 price assumed at this time last year. For the U.S., the Salomon survey indicates total E&P spending of $21.6 billion this year, an increase of 11.2%. Independents are more bullish, with expenditures expected to grow by 15.3%, while the majors foresee a modest 6.5% increase. In a similar, but smaller, survey conducted by Arthur Andersen, 64% of the respondents said they would increase domestic capital spending this year. Broken down by operator size, increases are planned by 29% of the majors, 77% of the large independents and 66% of the remaining independents. Other indicators. Increasing loan activity also hints that oil and gas projects are expanding. According to Loan Pricing Corp., third-quarter 1999 lending activity rose by $3 billion to total $19 billion. First-quarter lending had been a scant $8.8 billion. Drilling permits skyrocketed toward the end of 1999, with the number filed for November up almost 55% from November 1998. A huge coalbed methane play in Wyoming is responsible for a large number of permits, but even when these are excluded, the year-to-year increase still approaches 35%. Area forecasts. The following summaries represent important states or regions that greatly influenced the 2000 forecast. Activity in the Gulf of Mexico was off 24% last year, and it surely would have been worse were it not for gas developments that seemed to hold steady. Unfortunately, operator confidence has not been restored to a level yet that will bring a return to expensive deepwater exploration and development. However, look for overall Gulf drilling to improve 24.5% to 880 wells in 2000. Texas was likely the hardest hit by oil prices at the beginning of last year. Oil producers, primarily in the Permian basin, had severe cash flow problems, especially those with more costly tertiary recovery operations. As a consequence, Texas drilling nose-dived nearly 46% between 1998 and 1999. This year should see drilling increase a healthy 28.4%, but the 6,170 wells expected will still be 30% below 1998’s level. The oil price rise since midyear 1999 appears to have restored some confidence in oil field operations. For example, the three Texas Railroad Commission districts that encompass the oil-prone West Texas region are all indicated to enjoy above normal activity improvements. District 8, which once was the largest in terms of wells drilled, won’t quite retake the title, but will still see 710 wells in 2000. A little further north, District 8A should record a whopping 77.2% gain in drilling. District 7C, on the other hand, will have a less stellar 17.3% growth in wells drilled. Gas development will cause Texas District 1 to outpace all other districts. Drilling could nearly double from 144 wells in 1999 to 280 this year. District 4 in extreme South Texas will also experience more drilling targeted toward natural gas. In fact, District 4 could well become Texas’ most active this year. Continuing gas development, particularly in the southern half, will keep Louisiana’s well count on par with 1998 levels. Last year’s decline of 15% was relatively modest compared to other states, and this year’s predicted increase of 17.9% will result in 1,138 wells. Field development will get the most attention, as operators tell World Oil that only 21% of planned drilling will be exploratory. California’s mostly shallow-depth, heavy oil fields are highly susceptible to oil price fluctuations. However, these same attributes allow the state’s operators to react very quickly when improvements come along. Even though California’s drilling fell 19% from 1998 to 1999, the state is one of only a few that will see 2000 drilling not only recover the loss but exceed the 1998 figures. Coalbed methane development programs will send Rocky Mountain drilling soaring this year. In fact, the Rockies were the only region to post a year-to-year increase in wells drilled between 1998 and 1999, and it was because of this coalbed work. Collectively, Rocky Mountain wells should climb from 3,144 in 1999 to 4,889 in 2000. Wyoming is home to most of the coalbed work, and thus will see drilling rise 75.3% to 3,300 wells in 2000. If coalbed wells are excluded, then Wyoming drilling will rise from 982 wells in 1999 to 1,300 wells this year. Approximately half of Colorado’s wells target coalbeds, but developments are more mature, and thus, less volatile. This year, the state should see 661 wells, up 16.6%. In the Mid-Continent area, Oklahoma will experience a 28.5% rise in activity to 1,645 wells. Gas development is still high priority, especially among the majors, and with the return of good oil prices, Oklahoma should almost get back to 1998 work levels. Kansas is predicted to have a good year too, as drilling jumps 69.2% to 831 wells. The state is heavily gas-oriented with its giant Hugoton field, and operators plan to take advantage of higher gas prices being predicted. About These Statistics World Oil’s tables are produced using the aid of data from a variety of sources, including the American Petroleum Institute, Offshore Data Services, the Texas Railroad Commission and most other state regulatory agencies. In addition, 162 operating companies with drilling programs responded to this year’s survey. Please note credits and explanations in table footnotes. World Oil editors try to be as objective as possible

in this estimating process, presenting what they believe is the most current data available.

It is realized that sound forecasting can only be as reliable as the base data. In this

respect, it should be noted that well counting is a dynamic process, and most historical

data will be continually updated over a period of several years before the "books are

closed" on any given year.

Copyright © 2000 World

Oil |