What's happening in exploration

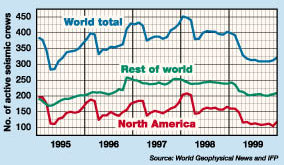

Geophysical report, 1999; new remote sensing technologyThe number of working seismic crews ran flat, at about 410, in 1998 after enjoying steady increases for nearly three years. In 1999, the crew count seems to have stabilized at 310. According to a report from the French Petroleum Institute, the world geophysical service market totaled about $5.2 billion in 1998. In 1999, that figure shrank to roughly $3.2 billion – a 38% decline. Half of the decline was due to decreased volume, the rest because of lower prices. Helping the situation were healthy activity levels in the Gulf of Mexico, the Gulf of Guinea and offshore Brazil. Much of the data currently being shot is non-exclusive, which has undergone an extraordinary upswing in the last six years. Most companies kept crews busy by investing in multi-client surveys. These were especially helpful offshore, since eight state-of-the-art vessels were added to a declining market in 1999. Salomon Smith Barney analysts put these non-exclusive sales at 6% of all sales in 1993. By August 1998, that number was 28%, and in some markets, the figure now exceeds 50%. Non-exclusive surveys accounted for more than 45% of all acreage shot in 1999. Other trends advanced in 1999. Most of the larger firms now offer visualization centers where clients can view data sets in a collaborative fashion – sometimes between continents – before deciding to buy. Also, enhanced processing, such as pre-stack depth migration – even on large, non-exclusive surveys – and some of the first OBC, multi-client shoots took place as contractors competed for clients. The combination of fewer clients (due to mergers) and decreased exploration spending means contractors will have their mettle tested in 2000. Eagle Geophysical’s filing for Chapter 11 bankruptcy last September 29 sent a chill through the industry. It has now become apparent that, unless there’s a quick upturn, some type of industry consolidation is likely this year.

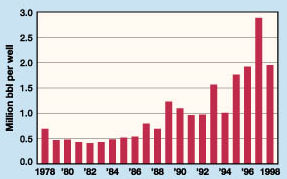

Crude discovery size. For each exploration well completed in 1998 (the last year for which DOE has data), the amount of oil discovered fell 950,000 bbl to 1.9 million bbl, a 33% decrease from the prior year. This brings the level close to that in 1996. The quantity of gas discovered shows a nearly identical trend. Of course, 1998’s low prices affected recovery economics. However, the impact of technology on recovery factors, now commonly ranging 30–40%, as well as on exploration, helps mitigate the price effect. Therefore, the overall trend – exponential increase in quantity (gas or oil) discovered per well completion – will likely remain intact. Sky-high exploration. It has been well known for many years that reservoirs often show surface anomalies. Differences in temperature, water vapor, vegetation, reflectance, vents and seeps are all worthy of closer inspection. Two new companies in the airborne and satellite remote sensing business were recently launched. Texaco has made a new entry into the service sector by launching Alto Technology Resources, Inc., to market its proprietary technology. Called TEEMS, for Texaco Energy and Environmental Multispectral Imaging Technology, the core apparatus is a 200-channel, optical-imaging spectrometer that records reflected and emitted energy. In addition, high-resolution radar allows mapping of geological features. After processing – which is as essential to the breakthrough technology as the hardware – remarkably small seeps and hydrocarbon concentrations in rock, vegetation and soil can be located. The technology itself is inexpensive on a per-sq-mile basis, and the resulting 3-D images can dramatically reduce the amount of seismic needed by narrowing exploration targets. Pipeline monitoring, planning and environmental assessments are just a few of the additional bonuses supplied by the technology. Dr. Alfredo Prelat, a noted authority on the subject, was named president and CEO of the company, a wholly owned Texaco subsidiary. Earth Search Sciences has formed Petro Probe, Inc., another

GIS/hyperspectral-imaging startup. Aside from significant differences in acquisition and

processing techniques from the Texaco venture, Petro Probe will take an equity position in

high-potential properties that it discovers. The company also plans to float an IPO.

Copyright © 2000 World

Oil |

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)