Editorial Comment

We’re growing in new directionsSince the inception of Gulf Publishing Company in 1916, World Oil magazine and its predecessor publications have reported on industry trends that shaped and then reshaped the upstream marketplace. Today is no exception. And now the subject is technology and Internet-based business-to-business e-commerce and how it will redefine the industry’s procurement / supply chain management process over the next 18 months. The ability to buy and sell oil field equipment and services over the Internet promises to save significant time and money. And now, World Oil itself intends to be a leading part of this evolving story. On January 6, our parent corporation, Gulf Publishing Company, was purchased by two private investment partners. The first objective of this new business venture is to transform our WorldOil.com web site into the leading e-commerce site serving the oil industry. Our two new owners bring the financial resources and e-commerce know-how to lead us in this rapid transformation. The first step will be to "publish" the new, year 2000 Composite Catalog of Oil Field Equipment and Services online. This multi-thousand-page catalog, which we’ve been publishing for about 70 years, includes hundreds of thousands of entries describing all sorts of oil field equipment items, parts and services. More than 200,000 engineers, drilling contractors, rig superintendents, field personnel and other professionals use Composite Catalog when searching for, comparing, specifying and purchasing equipment and services. Current estimates put the size of that equipment and services market at $178 billion each year. And by the end of first-quarter 2000, you will be able to go to our newly-expanded WorldOil.com to find virtually all the information and tools you need, when you need it, online. The next step will be to launch the buy / sell interactive component of WorldOil.com at the end of second-quarter 2000. Buying and selling oil field equipment is, and will remain, a relationship-driven business. We understand that no matter how sophisticated today’s technology becomes, buyers and sellers still need to talk directly with one another to request price quotes, submit bids, negotiate terms and close a sale. Therefore, WorldOil.com’s interactive e-commerce capabilities are being designed to allow you to talk back and forth, faster and more efficiently, online. Our goal is to provide an Internet-based tool that will strengthen – rather than replace – the key relationships that are so important to your business’s global success. What does this new e-commerce focus mean to you, the monthly World Oil subscriber? As a reader, you’ll still receive the same high-quality editorial product that (we hope) you’ve always relied upon for the latest technical information and industry trends. As a buyer (or seller) of oil field equipment and services, we encourage you to play an active part as we develop this new online resource. We welcome your ideas, feedback and comments about your experiences with e-commerce and how you see interactive technology impacting your business. And we invite you to stay connected to WorldOil.com as we migrate the Composite Catalog online in a few months and launch our e-commerce capabilities by mid-year. Our new partners. Battery Ventures is a high-tech, e-commerce venture capital firm based in Boston, which has developed other firms into leading e-commerce companies. We look forward to their guidance as we roll out this new online service. SCF Partners is a leading investment firm based in Houston. With its specialization in oil field equipment and service company investments, SCF brings additional industry knowledge to our experience base.

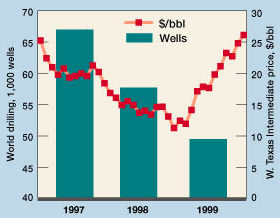

What a chilling ride. While preparing the information presented in this annual forecast / review issue, we were stunned by the magnitude of the collapse that the industry went through last year. Oh, we knew it had been bad, but it wasn’t until the numbers were gathered and shown in relation to prior years that the true nature of the devastation was revealed. As illustrated by the accompanying graph and discussed elsewhere in this issue, 1999 was the worst drilling year in more than 66 years (this relates primarily to U.S. drilling, since there wasn’t much activity elsewhere in the world at the time). But the good news is that operators around the world will be resuming "normal" operations this year, and this will produce some extraordinary gains in well completion figures. However, in the U.S., many of these increases will still fall short of where things stood in 1998. The accompanying graph illustrates a most baffling aspect of 1999, i.e., why were operators so slow to react to oil prices that doubled during the year? The answer appears to be that the earlier price collapse was so devastating to cash flow and bottom-line results that many firms needed nearly a year’s worth of higher revenues just to repair the balance sheet damages.

Indications are that those repairs are about complete, and

with any luck, we should see a period of moderate growth. Won’t it be nice to ride the

roller coaster uphill for a while? Copyright © 2000 World

Oil |