Western Europe: United Kingdom

August 2000 Vol. 221 No. 8 International Outlook WESTERN EUROPE North Sea operators are still holding back While onshore E&P firms have been quick to exploit high

WESTERN EUROPENorth Sea operators are still holding backWhile onshore E&P firms have been quick to exploit high oil prices, a reluctance by offshore drillers to boost activity is suppressing the whole regionRobyn Fowler and Susannah James, Arthur Andersen-Petroleum Services Group, London United KingdomLicensing. On March 31, 1999, the government announced a package of measures to boost E&P activity. These modifications included an annual program of licensing, with each round covering half the available unlicensed acreage, transparency of published criteria for license awards, extensions for certain work obligations, establishment of pre-qualification register for licensees, longer production consents and fast track approval of development plans. During the second quarter, the UK/Faroe Maritime Boundary agreement was signed. This establishes the continental shelf boundary in the ’White Zone’ – an area between the UK and Faroe Islands long under dispute. This means that both countries may now hold licensing rounds for acreage in the area. Indeed, it is expected that the 19th round, to be held in 2000, will offer acreage in this frontier area. It is also understood that some of the new regulations outlined above will come into force in time for this new round. In the latter part of the year, DTI announced the Fourteenth Round relinquishments. There were 85 in total, 65 full and 20 partial.

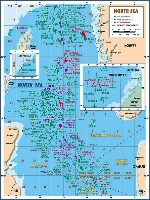

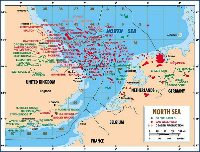

Exploration. As drilling levels fell during 1999, so did the number of discoveries, with just six new accumulations found on the UK continental shelf (UKCS). An exploration success ratio of 30% was achieved in 1999, equaling that of 1998. Four of these discovery wells are located in the Central North Sea, with the remaining two in the northern and southern parts of the North Sea. In the East Shetland basin of the Northern North Sea, Shell drilled an exploration sidetrack from a development well in Merlin field. Well 211/23a-15Z was deviated in an undisclosed direction and encountered oil. Early in the year, Phillips completed Well 30/7a-12, which was spudded in 1998. The well encountered a small accumulation, named Jemima, to the north of the company’s Joanne and Judy fields. Well 30/7a-12 produced 4,000 bopd and 42 MMscfgd through a 40/64-in. choke. In April, Elf completed operations on Well 29/4d-4 after it tested 23 MMcfgd and 2,100 bcpd through a 40/64-in. choke. The well was suspended for production at a later date and the discovery was named Glenelg. Shell made two additional discoveries in the Central North Sea during 1999. The first was the Clapham oil accumulation on the western margin of the West Central Graben. There, Well 21/24-6 tested 5,894 bopd. Later in the year, the company encountered and tested gas in the Fram prospect (not to be confused with the field of the same name in the Norwegian sector) with Well 29/3a-6. In May, Conoco announced a gas discovery in the E-Plus structure, later named Vixen field, in the Sole Pit basin. Well 49/17-3 encountered hydrocarbon-bearing reservoir sections with a net thickness of 350 to 370 ft. Onshore, of the five exploration wells drilled in 1999, two were successful, giving a 40% success rate. Of the remaining three wells, two were abandoned as dry holes, and the third was completed tight. Drilling. UK drilling activity continued to decrease during 1999. The number of wells spudded fell by 49% between 1998 and 1999 to a total of 33. As in 1997 and 1998, Shell and Amerada Hess were the two most active operators. Shell took first place with nine wells and Amerada Hess came second with five spuds. In a change from recent years, the area with the highest level of new activity was the Moray Firth, accounting for 40% of the spuds. Conversely, the percentage of wells spudded in the Central North Sea fell to 27%. About 18% of the wells were drilled in the Southern North Sea, with only 9% in the Northern North Sea and 6% in the West of Shetlands. Onshore exploration and appraisal drilling fell to the lowest level since 1995, with only seven spuds during 1999, five of which are exploration wells. Development and production. In 1999, a total of six fields (Bell, Cook, Keith, Millom, Orion and Vixen), containing 60 million bbl of oil and 555 Bcf of gas, received development approval. This is a significant decrease from the 19 fields approved for development in 1998. The average size of these six fields – two of which lie in the Central North Sea with a further two in the Southern North Sea – was 26 million boe. The remaining two fields are situated in the Northern North Sea and the East Irish Sea. All of these fields are to be, or have been, developed as tiebacks to existing infrastructure. Three of the fields (Bell, Millom and Orion) were developed rapidly and started production during 1999. A total of 19 offshore fields started production in 1999. One of these fields lies in the Northern North Sea, six in the Central North Sea, seven in the Southern North Sea, three in the Moray Firth and two in the East Irish Sea. Ten of the new fields have been developed via subsea tiebacks to existing infrastructure. Five minimum facilities platforms were installed, and the remaining four fields were developed using either FPVs or FPSOs. These new fields brought 428 million bbl of liquids and 1,994 Bcf of gas into production. The average field size was 41 million boe. The largest accumulation brought on stream was Pierce, with reserves of 111 million bbl of oil and 182 Bcf of gas. Pierce has been developed using a leased FPSO with six production and three injection wells. Oil is exported via tanker loading, while gas is being injected for the first five years, after which, a new pipeline will transport gas sales. Onshore, the Saltfleetby field in Lincolnshire, with reserves of 38 Bcf of gas and 2 million bbl of condensate, was granted development approval in May 1999. By December 1999, gas and condensate production had started via four horizontal wells, including two recompleted appraisal wells. During the first half of the year, production of coalbed methane from the disused Steetley mine in Nottinghamshire was started. In 1999, total UK crude production reached a record level of 930 million bbl,

an increase of 1.5% on the 1998 level. This represents an average daily rate of 2.5 million bopd. Gas

production also rose (by 10.7%), reaching 3.54 Tcf for the year, or 9.7 Bcfd. Condensate output increased by

49% to a total 57 million bbl.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||