Western Europe: Norway

August 2000 Vol. 221 No. 8 International Outlook WESTERN EUROPE Robyn Fowler and Susannah James, Arthur Andersen-Petroleum Services Group, London Norway

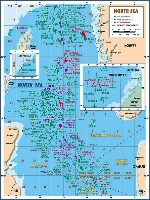

WESTERN EUROPERobyn Fowler and Susannah James, Arthur Andersen-Petroleum Services Group, London NorwayLicensing. Activity was dominated by three occurrences – the "North Sea Awards 1999," the Sixteenth Round and the review of strategy by Norwegian authorities. Twelve licenses were relinquished in 1999, six were fully surrendered and six were partially surrendered; but several were awarded, meaning that in 1999, Norway maintained its highest license level ever. By the deadline of February 25, 1999, the Ministry of Petroleum and Energy had received applications from 18 oil companies regarding the "North Sea Awards 1999." Applications were submitted for 20 of the 33 blocks originally offered. Eighteen of the blocks applied for were awarded, with 14 companies being granted acreage held under 11 production licenses. The most successful operator of the round was ExxonMobil, which was awarded participating interests (including operatorship) in four licenses. Norsk Hydro was granted operatorship of three licenses. Agip, BP Amoco and ExxonMobil were each awarded two licenses. Acreage adjacent to Vale, Gullfaks Gamma and Brage was offered.

The Sixteenth Round of Licensing ran concurrently with the "North Sea Awards 1999," with attention focused on the Norwegian Sea. The acreage on offer was announced in third-quarter 1999 and included 48 blocks / part blocks. The Ministry based its acreage selection primarily on information received from the nominations. However, it was stressed that resource and exploration considerations were of particular importance. Challenging deepwater areas such as Vøring and Møre were on offer, along with shallow water acreage such as the Halten Terrace. The awards were made in the first half of 2000. In June, Norwegian authorities announced a strategy review in order to slow the decline in activity. The Ministry drafted a white paper containing proposals aimed at encouraging new techniques, attracting new business, changing the influence of the State Direct Financial Interest (SDFI) and easing of existing licensing regulations. It was decided that Nkr 100 million will be made available for development of new technologies designed to aid economic retrieval of reserves. Another Nkr two million will be made available to the Petrad and INTSOK foundations to attract a more international company base. In production licenses adjacent to a field, the SDFI will be amended to be the same level as the company applying for the field. Furthermore, the SDFI will not participate in new production licenses in the North Sea, in which the resource potential is seen to be lower than the Norwegian or Barents sea. For licenses in which the SDFI will participate, the interest will be 25% (with the possible exception of licenses with high reserve potential). It has also been proposed that royalty (currently paid on eight fields) is to be gradually phased out from 2000, and there are to be some amendments made to the policy of prolonging duration of production licenses. At the request of the Ministry, Statoil has drawn up a report covering its future ownership structure and the SDFI. By the end of the year, the government was still unsure of the best way forward. It is possible that parts of the SDFI will be transferred or sold to Statoil and other international companies. In the third week of December, it was announced that a production license had been awarded to A/S Norske Shell and partners. The license covers an area of 65 sq mi (170 sq km), including Block 6305/8 and the southeastern part of the Ormen Lange field, extending into previously unlicensed acreage. Exploration. Despite the maintenance of exploration drilling levels from 1998 into 1999, the number of discoveries fell dramatically. Just two new Norwegian accumulations were found in 1999, compared to seven in 1998. This is not due to a lower success ratio (which reached 42%), but instead to the fact that the majority of the exploration wells drilled in 1999 were investigating existing discoveries. During March, Statoil made a gas discovery a few miles north of Skarv field. Well 6507/3-3 penetrated the C-Fangst structure and encountered three gas zones along its vertical section. The company then drilled two geological sidetracks with the hope of finding an oil leg. However, both wells 6507/3-3 A and -3 B failed in this objective. At the end of 1999, Saga (now part of Norsk Hydro) completed successful exploration Well 6406/2-7 on the Erlend prospect. The discovery is located to the west of the large Kristin and Lavrans accumulations on the Haltenbanken Terrace. Gas and condensate were encountered in two sandstone reservoirs in the Middle and Lower Jurassic, of which the former was tested. Drilling. A total of 22 exploration and appraisal wells were spudded in 1999, a decrease of just 15% from 1998’s activity, and indicating that the sharp decline in Norwegian drilling is stabilizing somewhat. Drilling during 1999 was split equally between the North Sea and the Norwegian Sea. As in many other years, Statoil was the most active company during 1999, drilling seven wells. Saga (now a wholly owned subsidiary of Norsk Hydro) was second, with five wells. Development and production. During 1999, the development plans for three fields in the Norwegian part of the North Sea were approved. The combined estimated reserves for Borg, Huldra and Sygna are 182 million bbl of liquids and 760 Bcf of gas. Two of the fields, Borg and Huldra, are being developed as subsea tiebacks, whereas Sygna will utilize a not-normally-manned wellhead platform. Of these three fields, only Borg started production in 1999. Nine fields, with an average size of 525 million boe, came on stream during 1999, bringing 2,750 million bbl of liquids and 11,435 Bcf of gas into production. Five of the fields have been developed as tiebacks. The Borg, Gullfaks South and Rimfaks fields (the former two Gullfaks satellites) have been developed as subsea tiebacks. Platforms have been installed on Oseberg East and Visund, both of which have been tied back to Oseberg A. Production from Troll C began in 1999, bringing on stream the northern area of the Troll West Gas Province (TWG). Both oil and gas are produced from Troll C via subsea clusters tied back to a central Troll C semisubmersible platform. In the Norwegian Sea, Åsgard produces from subsea wells tied back to a semisub for gas and condensate processing and to an FPSO for oil. An FPV was used in the development of the Balder field. In the Jotun field, a production ship, in conjunction with a wellhead platform, has been used to bring the field on stream. Total oil output from Norway in 1999 reached 1,070 million bbl, for a daily

production rate of 2.9 million bopd and a marginal increase of 0.2% over 1998. Gas production rose 9.4%,

reaching 1,680 Bcf or 4.6 Bcfd.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)