|

August 2000 Vol. 221 No. 8

International Outlook

|

SOUTH AMERICA

Stuart Wilkinson, Contributing Editor

Brazil

Early this year, President Cardoso’s economic reforms started to

positively affect the country’s exports. They were strengthened by congressional approval of fiscal

reforms needed to maintain IMF funding and the currency devaluation of a year earlier. The government projects

3.8% growth in the 2002–2004 period.

Last year, Petrobrás announced plans to invest $32.9 billion over the

2000–2005 period. The company’s own cash flow and conventional financing will provide 70% of the

sum; 20% is from project financing, and the rest will come from other to-be-decided sources. On the spending

side, 68% will go to E&P.

In May 2000, the State Economic Affairs Commission voted down a law that would

prohibit the sale of shares in Petrobrás. The government owns 82% of the shares, and the sell-off,

planned for July, will still leave the government as majority shareholder.

Exploration. As part of the plan for Brazil to be self-sufficient by

2005, 23 blocks were offered in the second exploration licensing round in June of this year. Of these, 13 were

offshore (7 in deep water) and 10 onshore. Only two areas were not sold. Companies paid $259 million for the

concessions. These contracts are expected to generate investments of $1 billion in exploration and $10 billion

in the production stage.

In the round, Petrobrás and Brazilian Rainier performed strongly.

Petrobrás secured eight of the 10 areas for which it bid, and the company and its associated groups

accounted for nearly three-quarters of the money raised from the sale. Rainier also did well, bidding alone

for four onshore oil fields. Due to the sale’s success, the National Petroleum Agency announced plans to

hold a third bidding round.

In mid-1999, Exxon acquired offshore exploration Blocks BFZ-1 and BP-1. The

million-acre BFZ-1 Block is located in the Amazon mouth, Amapa state, 200 mi offshore in 300 to 7,500-ft

waters. Ten-million-acre BP-1 is in the Pelotas basin 150 mi offshore, Rio Grande du Sul state, in 650 to

9,800-ft water depths. Esso will operate both blocks and have a 60% interest in BFZ-1, plus 50% in BP-1.

Petrobrás holds the remaining interests. Exxon (15%) signed a JV agreement with Petrobrás for

deepwater exploration Block BC-10 in the Campos basin. Other contracts during the year added to Exxon’s

deepwater portfolio.

|

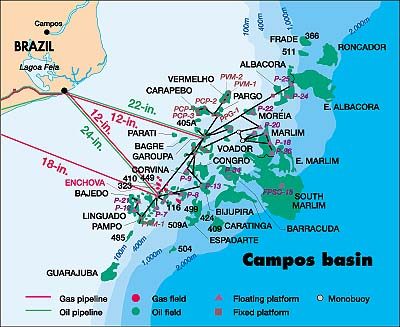

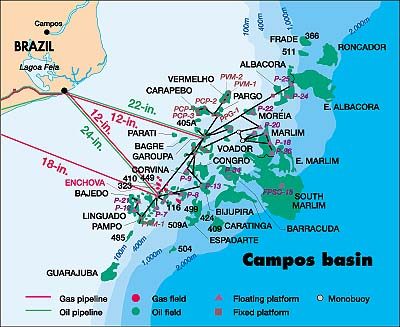

The Unocal, Petroleo Brasileiro, Japex and Marubini consortium signed a

participation agreement for 346,000-acre BC-1009 Block in the Campos basin. The consortium could spend $30

million to $40 million over the next five years for seismic and exploratory drilling. Also in Campos basin,

Petrobrás signed a JV contract with Royal Dutch / Shell, TotalFinaElf and Enterprise Oil to explore the

deepwater BC-2 Block. A major light-oil discovery was made in the northeast part of the Santos basin at a

subsea depth of more than 12,000 ft.

Development/drilling. Like many of its neighbors, Brazil’s wells

drilled slumped 25%, and footage drilled declined 16%. ANP, Brazil’s national petroleum agency, predicts

that drilling will jump 71% higher this year.

Petroleo Brasileiro SA and Halliburton have agreed to cooperate on three oil

and gas projects in Cuenca del Campos for a total investment of $4.45 billion. The aim is to boost area

production to more than 250,000 bopd.

Production. Plans call for domestic oil production to increase to 1.85

million bpd by 2005 from the current 1.3 million bpd. Oil from international subsidiary Bráspetro is

planned to triple to 170,000 bpd. Petrobrás’ partners will provide around 135,000 bopd. Brazil

will be self-sufficient by 2005. Another aim is to increase proven reserves to 13 billion boe from the present

8 billion boe.

|