Far East: Myanmar

August 2000 Vol. 221 No. 8 International Outlook FAR EAST Myanmar Under the Ministry of Energy, the state oil company for upstream is the Myanma

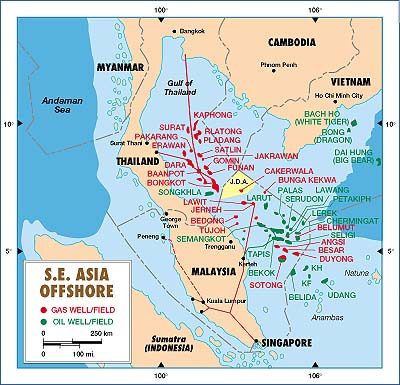

FAR EASTMyanmarUnder the Ministry of Energy, the state oil company for upstream is the Myanma Oil and Gas Enterprise (MOGE), which reportedly drills about 50 wells a year onshore. The country imports most of its estimated 40,000 bopd crude demand. But offshore gas from its two new fields, Yadana and Yetagun, will supply both growing electrical power need and exports to Thailand, when the demand and the infrastructure are developed. Foreign investments have been curtailed by the 1997 sanction on new U.S. company investments. And alleged human rights violations related to pipeline construction have complicated Unocal’s presence as a 28% partner in the Yadana projects. Slow development of the Thailand gas market and internal problems between MOGE and the military government add to the general feeling that Myanmar is not yet a promising place to invest in. Exploration. There were no new licensing awards in 1999 due to the lack of prospects for commercializing gas. Pacrim Energy and Exspan relinquished onshore Blocks RSF-9 and EP-1, respectively. In January 2000, Prime Resources Mgm’t. Cyprus was awarded a PSC in EP4. No foreign-operated wells were completed in 1999. MOGE discovered the onshore Nyaungton field west of Yangon, which was put on production. In March, TotalFina drilled the M8-A1 in BM8 in the Gulf of Martaban as a dry hole. And Genting Oil & Gas used the Marine 5 jackup to drill Ye-1 in 18-m water on BM4 in the Gulf, with gas shows.

Development. Offshore activity in Myanmar is centered in the Gulf of Martaban around TotalFina-operated Yadana field, 100 mi SW of Yangon, and Premier-operated Yetagun field, 170 mi SW of Yadana. These developments require the marketing of gas in Thailand, primarily to the Ratchaburi power plant operated by the Petroleum Authority of Thailand (PTT). Yadana gas is marketed through a 260-mi-long, 36-in. pipeline to the coast and across a land strip to Thailand, where it enters a 42-in. PTT line to Ratchaburi. The final section of PTT’s line was completed in 1st quarter this year. Yetagun gas is exported via a 24-in., 130-mi pipeline to landfall near Zadi, where it parallels the Yadana line and ties into PTT’s trunkline. Yadana will also supply domestic Myanmar via a 140-mi, 20-in. line to the coast, 30 mi SW of Yangon – that project is still on hold. A June 2000 report in Oil & Gas Journal says PTT has resolved a take-or-pay dispute and, after two years’ delay, Ratchaburi may begin taking Yadana gas at about 150 MMcfd – only part of a 525-MMcfd commitment. OGJ says final Yetagun delivery volumes will be delayed and PTT would accept 200 MMcfd as of July 2000, rising to 260 MMcfd by August. Additional deliveries are said to be under negotiation. Meanwhile, although the Gulf of Martaban is a promising exploration area, gas marketing problems are curtailing exploration interest. Onshore, Mann field is the dominant producer among several smaller, older oil

/ gas fields that contribute a total 9,500 bopd. Exploration and development drilling in all areas, outside of

Mann, has been "spotty, at best." |

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)