Far East: Malaysia

August 2000 Vol. 221 No. 8 International Outlook FAR EAST Malaysia After being hammered by the Asian crisis of 1997 and 1998 (7.5% decline in gr

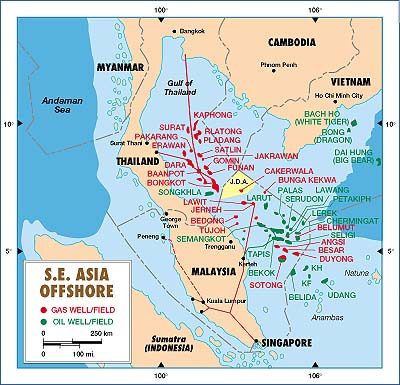

FAR EASTMalaysiaAfter being hammered by the Asian crisis of 1997 and 1998 (7.5% decline in gross domestic product), Malaysia began an economic recovery in second-half 1999. For full-year 1999, GDP grew 5.4%, and that recovery continued into 2000, for which a 5.8% GDP increase is projected. The economy has not always been consistent over Malaysia’s 43 years as a sovereign nation, but the government has been a model of stability. Various incarnations of the dominant 14-party coalition known as Barisan Nasional have controlled the government since independence was gained in 1957.This is one of the country’s strong selling points to foreign operators. Exploration. State oil firm Petronas-Carigali and foreign operators face a challenge in their goal to keep crude output up, to at least 600,000 to 630,000 bopd. They need to find substantial fresh reserves, yet experience shows that most new reserves come from incremental growth in existing fields.

In addition to three production sharing contracts (PSCs) signed by Murphy Oil in January 1999 (see World Oil, August 1999, page 108), Shell E&P Malaysia last October picked up a PSC for Block PM 303, offshore Terengganu. In late March 2000, Sarawak Shell signed a PSC for Block SK 312, offshore Sarawak. Amerada Hess is acquiring 3-D seismic on Block PM 204 this year. The company will begin drilling Blocks PM 204 and SK 306 late in 2000, with one well scheduled for each tract. Meanwhile, Murphy Oil expects to spud its first wildcats for Blocks SK 309 and SK 311 offshore Sarawak, in late 2000 or early 2001. On Block K, covering 4.1 million undrilled acres in deep waters offshore Sabah, Murphy is shooting seismic, preparatory to a first well in 2002. In addition to exploring Block PM 308, Santa Fe Snyder has the right to develop Rhu field, a potentially commercial 1992 discovery within the block. Exploration drilling declined to only 12 wells in 1999, the lowest level since 1976. Seven wells were wildcats, and five were appraisals. Drilling/development. Wells drilled declined 31%, and footage fell 35% (for details, see main table in "World Trends"). This year, an 8% rebound is forecast. On average, six rigs drill 70 to 80 wells annually throughout Malaysia. A number of development projects at small oil fields are underway offshore. Another 10 or more oil and gas fields are "probable" for development, with onstream dates ranging to 2005. From the newly installed Tapis E platform offshore, ExxonMobil last January completed the first of 19 development wells. The firm also began developing Larut field this year, to produce 40,000 bopd and 35 MMcfgd. Planning continued in 1999 for Petronas’s Angsi field, an integrated oil and gas project. Production should commence in 2002. Lundin Oil’s A7 development well at Bunga Kekwa field was completed last December 31 as a dual producer from two oil zones. The well flowed 4,812 bopd and boosted Bunga Kekwa’s output capacity to 17,000 bopd. Development work also continued at Shell’s F 23 SW satellite and Asam Paya field, straddling the Malay / Brunei border. At the D35 oil field, offshore Sarawak, Shell has undertaken a six-well drilling program. Production. Malaysian oil output fell 4.4% last year (see main table in "World Trends"). The figure included 85,000 bcpd. Natural gas production rose 6.1%, to 5.004 Bcfd. For its PM 3 commercial arrangement area (PM 3 CAA), Lundin Oil signed a gas sales pact with Petronas and Petrovietnam. The deal calls for 250 MMcfgd to be sold from PM 3 CAA over a period of up to 20 years. Petronas put Resak field onstream last January. By 2001, output will be 400 MMcfgd and 13,000 bcpd. ExxonMobil is also completing expansion of Lawit field’s "A" platform, with installation of two additional compression modules. This should boost output to 700 MMcfgd, from 450 MMcfgd. Officials are not happy with a 36% average oil recovery rate. They hope to

utilize new technologies to boost that figure by about five points, to 40% or 41%. Malaysian oil reserves are

estimated to have declined 2%, but natural gas reserves were down less than 1%.

|

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)