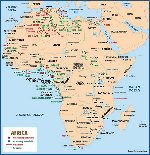

Africa: Algeria

August 2000 Vol. 221 No. 8 International Outlook AFRICA Algeria Algeria depends on energy for 95% of its outside revenues. Recent years have see

AFRICAAlgeriaAlgeria depends on energy for 95% of its outside revenues. Recent years have seen a slowdown in exploration contracts; oil prices, bureaucracy, mediocre fiscal terms and war are among the chief causes. Eight years of violence have killed at least 100,000 people, but peace prospects have improved under President Abdelaziz Bouteflika. Algeria’s energy sector is being liberalized to compete with other nations trying to attract foreign investment. About 20 foreign oil companies currently operate here. New Energy and Mines Minister Chakib Khelil appointed Abdelhak Bouhafs as chairman of state oil company Sonatrach in January 2000. Together, they have been implementing the changes necessary to attract investment. Exploration. First Calgary Petroleums Ltd. signed a PSC for exploration of Block 406a in the Berkshire basin. The block, which covers 375 mi2, is 10 mi southeast of Anadarko’s giant Hassi Berkine oil field. The five-year agreement requires acquisition of new seismic data and drilling two wells within the first three years.

The Berkine basin comprises ample source rock and stacked, high-porosity sandstones overlain with shales and evaporites; consequently, an estimated 4 billion bbl of crude have been discovered there by Agip, Talisman / Burlington, Cepsa, Anadarko and BHP in recent years. Burlington Resources and Talisman Energy hit big in Menzel Lejmat Block 405 in the Berkine basin, with their MLNW 2 and MLSE 3 appraisal wells. In MLNW 2, three zones tested a combined 12,813-bopd flowrate, while MLSE 3 tested 21,857 bopd and 26.2 MMcfgd. These wells follow the success of last year’s MLNW 1 discovery, which tested 8,459 bopd and 12.6 MMcfgd. BR has now completed 16 wells in Block 405, and more wells are planned for 2000.

ARCO Ghadames appears to have a discovery with Well Semhari East 1 in the onshore Hassi Bir Rekaiz project. Log data and RFTs (reservoir formation tests) indicate likely pay over two reservoirs. Sahara Mehadjer 1 will be drilled 6 mi to the north later this summer. Confirmation of structural continuity could result in the region’s largest new oil field. Sonatrach discovered 43° oil on Block 438 in the southeastern Oued Mya basin; its Benkahla East 1 well tested 3,650 bopd and 3.8 MMcfgd. Drilling/development. A new type of risk service contract – where partners invest in a proven resource – was signed in July 2000 between a BHP-led consortium and Sonatrach. The eight-year agreement is for development of four gas / condensate reservoirs in southern Algeria’s Ohanet region. The $1-billion project should begin production in late 2003; liquids output is estimated at 60,000 bpd. The Ohanet fields are located in Illizi province, about 800 mi southeast of Algiers. They contain proven and probable reserves of 3.4 Tcf gas, 107 million bbl of condensate and 116 million bbl of LPG, BHP said. State-owned Sonatrach bought out ARCO’s 40% share of the giant Rod Al-Baghl oil field in southeastern Algeria. Sonatrach paid $135 million and will pay another $50 million annually until 2004. Sonatrach and Amerada Hess signed a 25-year PSA for development of Qasi, Aqrab and Zouti fields, worth $550 million. Hess will drill 36 wells and lay a 44-mi gas pipeline. Agip, BHP and Sonatrach will spend $500 million to develop Rourde Oulad Djemma field and four neighboring fields in Berkine basin, Blocks 401a/402a, Sahara Desert. Production from the 300 million-bbl fields should begin in 2003 and plateau at the 80,000-bopd level for several years; associated gas will be re-injected. Joint-operating committees, comprising the three partners, will conduct development and operations. BP Amoco and Sonatrach are developing a $2.3 billion gas field complex in central Algeria for supply of about 300 Bcfg annually to Europe. First deliveries from the seven-field In Salah complex are due in 2003. Another BP Amoco gas project, In Amenas, will cost about $875 million and result in another 219 Bcfg produced annually by 2004. Production. Sonatrach intends to increase crude production

capacity to 1.4 million bpd by 2004, from its 1999 average of 772,000 bpd. OPEC production cuts of

80,000 bopd, shared by Sonatrach and foreign operators, resulted in average crude-plus-condensate production

of 1.2 million bpd in 1999. NGLs added another 155,000 bpd.

|

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)