Regional Report: Permian Basin

Following one of the industry’s worst crashes five years ago, the U.S. shale boom has been integral to keeping global supply afloat. Yet, after a rapid takeoff, Permian shale production, in particular, has hit a speed bump of sorts.

The deceleration can be attributed largely to cuts in spending by some of North America’s major producers. According to Schlumberger, North American producers’ spending has declined 10% or more this year. During his first conference call with analysts as Schlumberger’s CEO, Olivier Le Peuch said that the third quarter’s results “reflected a macro environment of slowing production growth rate in North America land, as operators maintained capital discipline, reducing drilling and fracture activity.”

Meanwhile, shale pioneer Mark Papa (retired from EOG Resources in 2013), who has been chairman and CEO of Centennial Resource Development, Inc., since October 2016, has also been a director of Schlumberger since October 2018. And in August 2019, he became Schlumberger’s chairman of the board. Just last month, Papa, along with fellow shale pioneer Scott Sheffield, who is President and CEO at Pioneer Natural Resources, told the Bloomberg news service that they believe the days of ever-increasing production from U.S. shale fields is ending.

During Centennial’s third-quarter results call, Papa commented, “This is likely not just a 2020 event. I believe U.S. shale production, on a year-to-year growth basis, will be considerably less powerful in 2021 and later years than most people currently expect.” He then went on to downgrade his 2020 U.S. shale growth forecast to 400,000 bopd from a previous 700,000-bpd estimate that he made in early September.

Among some of the leading Permian explorers, Occidental Petroleum Corp., Apache Corp., Cimarex Energy Co. and Pioneer Natural Resources Co. have all reported plans to tighten their budgets, Fig. 1. “I don’t think OPEC has to worry that much more about U.S. shale growth, long-term,” said Pioneer’s Sheffield during a conference call with analysts. He said that he’s “definitely becoming more optimistic that we’re probably at the bottom end of the cycle regarding oil prices.”

Commodity prices have been relatively static of late, finally settling near $58/bbl in late November amid U.S.-China trade tensions that have weighed heavily on the global economy, as well as fuel demand. Negotiations have been strenuous between the two countries, as neither can agree on which tariffs should be withdrawn. The ongoing impasse has taken a toll on the Permian, North America’s top producing region.

SUPPLY AND DEMAND

Last year, growth in the Permian was already showing signs of a relapse, as producers struggled with the inability to transport oil and gas quickly enough to keep up with the region’s growing production rate. This created a logjam that forced many of them to shut in wells and lose revenue. Major pipeline constraints were causing lower wellhead prices, as well, which also contributed to the slower-than-usual growth in production.

Since then, newly commissioned oil pipelines in the Permian basin have yet to impact U.S. crude exports in a meaningful way. According to Bloomberg, this is due largely to the ongoing U.S.-China trade dispute, which is having a particularly profound effect on Asian demand.

Two new pipelines started operations in the Permian basin in August—both running from West Texas to the Gulf Coast—with a combined capacity of over 1.0 MMbpd. However, the U.S. Census Bureau said that exports averaged 2.73 MMbpd that month, which is just 40,000 bpd more than the month prior. “A lot of capacity will eventually be online from those pipes, but it would take some time before all of that becomes available,” Wood Mackenzie Consultant John Coleman told Bloomberg. “We shouldn’t expect to see all of that show up in a month.”

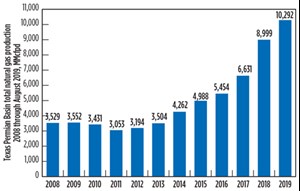

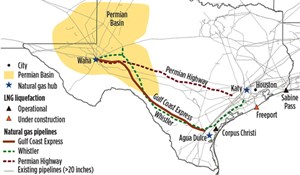

Because the Permian has seen a substantial increase in associated natural gas output in recent years (Fig. 2), there are several new gas pipelines planned for the region, as well. Projects including the Permian Highway, Whistler, Permian 2 Katy, Pecos Trail, Permian Global Access, Bluebonnet Market Express and Permian Pass pipelines are expected to increase regional capacity by more than 12 Bcfd, Fig. 3. However, the Permian Highway and Whistler pipelines are the only projects to reach FID, so far. They reportedly are scheduled to start operating in 2020 and 2021, respectively. And, as Permian gas production mounts, so do levels of flaring and venting, a problem that producers continue to address and work to reduce.

PRODUCTION

Although U.S. natural gas production, consumption and exports set new records in 2018, things are beginning to slow. According to the U.S. EIA, dry natural gas production increased 12% in 2018, reaching a record-high average of 83.8 Bcfd. Likewise, consumption rose 11%, and exports increased 14% year-over-year. The latest outlook from IHS Markit, however, sees total U.S. production growth leveling out in 2021, with just “modest growth” resuming in 2022.

“Going from nearly 2 MMbpd annual growth in 2018, an all-time global record, to essentially no growth by 2021 makes it pretty clear that this is a new era of moderation for shale producers,” said Raoul LeBlanc, V.P. for North American unconventionals at IHS Markit. “This is a dramatic shift after several years, where annual growth of more than 1.0 MMbpd was the norm.”

This is especially true in the Permian, where drilling productivity has flatlined over the past few months. The shale slowdown is expected to aid OPEC’s long-time efforts to exhaust a global supply glut. Not all producers are stepping on the brakes, however. Supermajors Exxon Mobil and Chevron have reported plans to ramp up drilling in the Permian. Each company plans to produce approximately 1 MMbpd from the basin by the early 2020s, Fig. 4.

In late October, Exxon Mobil Corp. said that its Permian production rose 70% in the third quarter, compared to last year. Likewise, Chevron reported a 35% gain. At the Lone Star Energy Forum in Austin, the president of Chevron’s North American business, Steve Green, said that the company sees “a long, healthy pace of activity in the Permian and Texas for decades to come.”

The gains seen by major producers in the region may help to offset the significant declines from smaller independent producers that have smaller balance sheets. Independents have been struggling, of late, to generate the free cash flow necessary to increase output. Consequently, many of them are feeling the pressure from investors to cut back on spending.

M&A: SURVIVAL OF THE FITTEST

While some majors are still expanding in the region, Occidental (Oxy) represents what the majority of operators in the Permian are experiencing—an imperative need to slash spending. For Oxy, the budget restrictions stem, in part, from its $37-billion takeover of Anadarko earlier this year.

Despite cutting costs and drilling volume in the Permian, Oxy reportedly expects to still see a 2% increase in overall output during 2020. After outbidding Chevron, the operator is now eager to make certain that the acquisition was worthwhile. CEO Vicki Hollub said that the company intends to “fully execute on [its] value-capture initiatives.” To do this, the company has reported plans to drop expenditures in the Permian basin by approximately half, spending about $2.2 billion in the region next year.

Chesapeake Energy, which was once a shale industry leader, also plans to reduce spending by nearly a third next year, as it seeks to generate free cash flow and get out from under the massive amount of debt it has incurred. With more than $9 billion in debt, the $2.6-billion company has its work cut out for it. This is especially true after its $1.9-billion takeover of shale explorer WildHorse Resource Development Corp. earlier this year. Despite the 30% reduction in capital expenditures next year, the company said that it expects flat oil production year-over-year, utilizing 10 to 13 rigs.

Likewise, after its $9.5-billion merger with RSP Permian Inc. last year, Concho Resources is attempting to save cash as it sells off its New Mexico Shelf assets to an affiliate of Spur Energy Partners LLC for $925 million. The company reportedly lost billions in market value this summer after crowding 23 wells too closely together, which led to disappointing production results. The company’s third-quarter results showed improvement, however, as it posted a net profit of $558 million compared to a nearly $200-million loss during the same quarter last year.

Diamondback Energy also joined the ranks of struggling Permian basin shale producers, after its third-quarter results showed that its crude output fell more than 2% short of analyst estimates. “When you stub your toe like we did in the third quarter, you’ve got to be able to adjust your future forecast to make sure that you can hit those numbers,” said CEO Travis Stice.

The company acquired Ajax Resources and Energen Corp. in two multi-billion-dollar deals last year, establishing it as one of the Permian’s top emerging producers. Stice explained that during the third quarter, the company sold a Permian asset, which explains why it missed its mark. He said that the company is now bearing in mind any potential interference from wells fraced by neighboring producers and that “these are operational problems, not reservoir problems.”

Apache Corp., another major player in the Permian basin, also reported a quarterly loss. The company cited reduction in Alpine High reserves, due to weakening NGL and gas prices. Consequently, Apache said that it will reduce Alpine High drilling and defer some fourth-quarter completions into next year. During the third quarter, the company’s overall Permian production averaged 254,000 boed, operating an average 10 rigs.

OFS FIRMS HIT HARD

Because producers are working so diligently to slash spending, service providers are also being forced to make changes and implement new strategies. Halliburton, the world’s biggest supplier of fracing equipment, reportedly cut 8% of its workforce during the second quarter. The service company’s North American revenue, which is largely obtained through operations in the Permian basin, fell 11% in the third quarter, compared to the second quarter. “We recognize the changing behavior of our North American customers, and are executing a new playbook to keep generating returns and free cash flow,” said CEO Jeff Miller. “What was the right playbook several years ago, when there was a different cadence and pace of customers’ spend, today needs to change.”

Schlumberger saw an 11% decline in North American revenue, year-over-year. According to Le Peuch, the company’s North American business saw strong offshore sales, but saw “minimal growth on land, due to slowing activity and further pricing weakness.” The company reported that its “OneStim activity decelerated, as frac programs were either deferred or cancelled, due to customer budget and cash flow constraints.”

NEW MEXICO DRAWS ATTENTION

While the West Texas section of the Permian basin has more commonly garnered the attention of U.S. operators, the New Mexico portion is beginning to steal the spotlight. During a second-quarter sale covering parts of New Mexico, the U.S. Bureau of Land Management (BLM) drew proceeds of approximately $2.9 million for 50 parcels totaling 39,300 acres. The highest bid came from Cimarex Energy Co. for acreage in New Mexico’s Eddy County. The company purchased 40 acres at just over $30,000/acre.

However, results of the quarterly lease sales were down significantly from the first-quarter sale, in which New Mexico received $15.4 million for 45 parcels totaling 13,888 acres. In that sale, the highest bid of $40,400 came from Exxon’s XTO Holdings for 80 acres in Eddy County.

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)

- Machine learning-assisted induced seismicity characterization of the Ellenburger formation, Midland basin (August 2023)

- Executive viewpoint (July 2023)