New pipeline infrastructure to accommodate rise in Permian oil production: EIA

WASHINGTON, D.C. -- As crude oil production in the Permian basin of western Texas and eastern New Mexico has increased, pipeline infrastructure has also increased to deliver this crude oil to demand centers on the U.S. Gulf Coast.

One indicator of a potential shortfall in available takeaway capacity in the Permian is a negative spread between the price of West Texas Intermediate (WTI) crude oil at Midland, Texas, and the price of WTI at Cushing, Oklahoma.

Going forward, the Midland versus Cushing discount, which recently widened to more than $1/bbl, is unlikely to be either as large or as persistent as it was following the rapid increase in Permian production from 2010 to 2014. At points in both late 2012 and mid-2014, WTI-Midland was priced at least $15/bbl lower than WTI-Cushing. Pipeline capacity expansions and other market changes are now underway to deliver more Permian crude oil to demand centers.

Compared with other oil producing regions, the Permian has a large number of productive geological formations stacked in the same area. The Permian’s in-region refining capacity, close proximity to large refining centers on the Gulf Coast, and existing pipeline infrastructure also make the Permian attractive to oil producers.

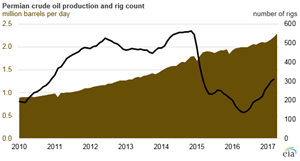

Crude oil production in the Permian grew from 886,430 bpd in January 2010 to nearly 1.5 MMbpd in January 2014, and this production level was more than could be accommodated by in-region refining capacity and pipeline capacity. This situation resulted in large price discounts at the crude oil gathering and transportation hub in Midland, Texas, compared with Cushing, Okla., indicating that pipeline capacity was becoming constrained and crude oil was likely moving out of the region by more expensive methods, such as rail or truck.

In 2014, WTI-Midland averaged a $6.94/bbl discount to WTI-Cushing, compared with a $1.68/bbl average discount during 2013. However, as new and expanded pipeline capacity was added, WTI-Midland’s discount to WTI-Cushing narrowed, falling to an average of $0.18/bbl in 2015 and $0.07/bbl in 2016. With the rise in oil prices from their low point in early 2016, EIA’s April Short-Term Energy Outlook (STEO) expects crude oil production growth in the Permian to accelerate. EIA’s April Drilling Productivity Report (DPR) indicates a total of 310 oil-directed rigs active in the Permian, 158 more than at the same time last year. The DPR also estimates crude oil production in the Permian at 2.3 MMbpd as of April 2017, or almost 300,000 bpd higher than the same month in 2016.

Pipeline infrastructure in the Permian is now better equipped to handle new production than it was in 2014. Several pipelines that came online to accommodate rising Permian production in recent years, such as Magellan’s BridgeTex pipeline, Sunoco Logistics’ Permian Express pipeline, and Plains All American’s Cactus pipeline, are undergoing expansions that are set to come online later this year, adding approximately 340,000 bpd of capacity.

In addition to expansions of existing pipelines, Enterprise Product Partners is building a new Midland-to-Houston pipeline with a capacity of 450,000 bpd, expected to come online later this year. Other pipeline expansions are planned for gathering systems and intra-Permian pipeline infrastructure to bring increasing volumes of oil to the larger pipeline origin points like Midland. After 2017, several more new pipelines and expansions are planned, or are in the planning stages, that could carry any additional increases in Permian production.

Other pipeline project developments recently completed in the Gulf Coast will allow Permian crude oil to be sent to refining centers in Corpus Christi and Houston in Texas, St. James in Louisiana, and points in between.

With these pipeline additions and expansions and the lifting of export restrictions on domestically produced crude oil in December 2015, Permian oil will also have greater access to international markets through the Gulf Coast’s crude oil export infrastructure.