Positive sentiment for floating production in frontier areas indicates busy time for contractors

Floating production units, particularly Floating Production Storage and Offloading units (FPSOs) and Production Semisubmersibles, have been instrumental in developing offshore hydrocarbons in deep water and in remote locations with little existing infrastructure.

FPSOs are considered the most flexible of all floating production systems and are certainly the most prevalent, with 174 in operation, 25 available and 25 on order, as of January 2020. These units receive the complete wellstream; separate the oil, water and gas; store the oil; and offload the stabilized crude oil to export tankers. By comparison, Production Semisubmersibles do not have storage and usually are connected to a pipeline or a Floating Storage and Offloading unit (FSO).

NEW FRONTIERS

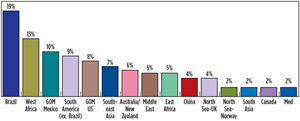

Floating production systems are key to unlocking remote discoveries in all parts of the globe. Brazil, West Africa and the U.S. Gulf of Mexico have, historically, generated the most activity; however, outside of this known “golden triangle,” there are exciting prospects in other locations,

Fig. 1. New areas of activity include Guyana, the Mexican side of the Gulf of Mexico, and East and South Africa. In West Africa, exploration and production has expanded to new countries like Ghana and Senegal.

Guyana. ExxonMobil has announced 16 discoveries in the Stabroek Block offshore Guyana since May 2015. It is expected that at least five FPSOs well be required to develop the 8 Bbbl of recoverable oil resources. The first FPSO, Liza Destiny, began production in December 2019. SBM Offshore converted the unit, which can produce 120,000 bopd.

The next FPSOs are based on SBM’s standardized Fast4Ward hull, with topsides capable of processing 220,000 bopd and 400 MMscfgd, and injecting 250,000 bwpd. The Liza Unity FPSO is planned to commence operation in mid-2022. Delivery of the third FPSO for Payara field to the north of Liza is expected in 2023. Subsequent units could begin production approximately 12 months apart.

ExxonMobil has contracted five drillships in Guyana, and other operators are also exploring in the area.

Mexico. Following the end of Pemex’s monopoly and historic opening of Mexico’s upstream sector, new operators were awarded leases, beginning in 2015. First drilling on these areas started in 2017. Development of commercial discoveries is now underway. Although the current Mexican administration reversed course, it has honored existing leases.

Eni– Amoca. In 2018, Eni sanctioned development of Amoca field in Area 1. Initial production is from a small fixed platform, followed by full-field production in 2021 via a leased FPSO, able to process 90,000 bopd. The FPSO Miamte MV34 is under conversion and will be leased to Eni for at least 15 years. Due to potential hurricanes and shallow water, the FPSO will be moored by the world’s first disconnectable tower yoke system.

BHP–Trion. BHP acquired a 60% stake and operatorship in Mexico’s deepwater Trion development for $62.4 million in December 2016. Pemex made the initial discovery in 2012. Development plans call for a Production Semisubmersible able to process over 100,000 bopd, connected to a large FSO moored in over 2,000 m of water. Target break-even is below $50/bbl. Final investment decision (FID), the point where major procurement contacts can be placed, has been pushed back from 2020 to 2022, with first oil expected in 2025.

Talos – Zama. This field in Block 7 sits in 166 m of water, with recoverable reserves between 670 MMbbl and 1.1 Bbbl of oil. Talos will develop this field via two fixed platforms producing 150,000 bopd via a large FSO. The estimated break-even is less than $20/bbl. A unitization process is underway, as studies show that the reservoir is shared with Pemex. This may impact the schedule, which calls for FID by 2020 and first oil in 2023.

West Africa accounts for the vast majority of developments offshore Africa. However, there has been a shift in development location over the past decade to new areas in West Africa, as well as other parts of the continent. Traditional hot spots, Nigeria and Angola, have not seen a large new offshore development sanctioned since 2014. Development in these countries is now driven by high local content demands, which have driven up project costs. Uncertainty in Nigeria, stemming from the government’s continual negotiation and changing regulations over taxation and project royalties, has stagnated the investment climate. In the same period, projects have been approved in less-developed areas offshore Ghana and Senegal, along with a significant discovery in South Africa.

Offshore production began in Ghana during 2010 via an FPSO in Tullow’s Jubilee field. Additional FPSOs followed in 2016 on Tullow’s TEN field, and in 2017 on Eni’s Sankofa field. In February 2020, Aker Energy issued an LOI for a leased FPSO on its deepwater Pecan field. The tender process had begun under Hess, which sold its stake in the field to Aker Energy during 2018. Yinson will convert the 2003-built VLCC tanker Hawk into an FPSO able to produce 110,000 bopd and 100 MMscfgd while spread-moored in 2,400 m of water. The FPSO will be leased for 10 years firm, with options for another five years. Senegal will begin offshore production from E&P projects in 2022–2023.

Woodside–Sangomar. An FPSO will be used to develop 230 MMbbl of oil in 780 m of water, offshore Senegal. MODEC will convert an existing VLCC tanker into a turret FPSO, able to process 100,000 bopd and 130 MMscfgd, and inject 145,000 bwpd. Twenty-three wells will be connected to the FPSO by 107 km of flowlines, 28 km of flexibles and jumpers, and 45 km of umbilicals, supplied and installed by Subsea7 and OneSubsea. First oil is expected by early 2023.

BP–Greater Tortue Ahmeyim. This deepwater gas project is on the maritime border of Mauritania and Senegal, with 15 Tcf of gas resources. The innovative development will utilize an FPSO to process the gas, which will be sent to a floating liquefied natural gas (FLNG) facility, Fig. 2. In March 2019, TechnipFMC was formally awarded an EPCIC contract for an FPSO, able to process 500 MMcfgd and 20,000 bcpd. The 2.5-Mpta FLNG unit is being converted by Golar at Keppel shipyard. First production is scheduled for 2022.

East Africa. In contrast to activity on the western side of the continent, East Africa represents a new frontier that is in the early stages of exploration and development. Discoveries on the east side are predominantly gas, driving the need for either floating LNG facilities or transportation back to shore for processing. The discovery of mostly gas (instead of oil) has slowed the FID process, as long-term contracts for gas sales are more difficult to put in place and have lengthened the development cycle.

Additional gas discoveries have been made offshore East and South Africa, as detailed below.

Eni–Coral South. This giant gas field was discovered during May 2012 in Area 4, offshore Mozambique. Five years later, in June 2017, Eni awarded a consortium of TechnipFMC, JGC and Samsung an EPCIC contract for an FLNG and associated risers and flowlines. The FLNG unit will be designed to process 3.4 Mtpa, store 238,700 m3 of LNG and 350,000 bbl of condensate, while permanently moored in more than 2,000 m of water. The field development will be funded by $4.7 billion in project financing, to be provided by five Export Credit Agencies and 15 commercial banks. Delivery of this complex production unit is scheduled for June 2022.

Total–Brulpadda. In February 2019, Total announced a “significant” gas condensate discovery on the deepwater Brulpadda prospect, 175 km offshore South Africa. The well encountered 57 m of net gas condensate pay in 1,432 m of water. A subsea development to a fixed platform in shallow water is the most likely option. An FPSO or semisubmersible is possible, but it would be challenging, given the prevalence of severe weather conditions in the area.

Australia. There is a long history of production offshore Australia, with nine units in operation currently. However, many concepts, particular FLNG, have struggled to achieve FID, due to excessive cost. After eight years without a major offshore project, development activity is starting to resume. Many of the FLNG projects have been redeveloped as gas FPSOs or Production Semis, to keep onshore LNG facilities continuously supplied with large volumes of gas.

Santos–Barossa. In early 2020, FID was taken on the Barossa gas development in the Timor Sea. MODEC will construct a new FPSO with a 35,000+ ton topside, able to process 800 MMscfd of gas and associated condensate. The 260-km pipeline connecting the existing Bayu-Undan pipeline to the Darwin LNG plant will be installed by Allseas. First production is planned by the end of 2023, when the onshore LNG plant will have available capacity.

Woodside–Scarborough. To supply the existing Pluto LNG facility, Woodside plans to build a 430- km pipeline from Scarborough field. A newbuilt Production Semisubmersible would be required to handle 20,000 tons of topsides, to process 1 Bcfgd. The unit would be moored in 950 m of water and connected to 12 subsea wells. Front End Engineering Design (FEED) contracts were awarded in February 2019 to McDermott (Production Semi), Subsea7/OneSubsea (subsea umbilicals, riser and flowlines (SURF)), and Saipem/IntecSea (export pipeline). These would become engineering, procurement, construction and installation (EPCI) contracts, subject to FID, which is planned for 2020. Production is targeted to begin in 2024 and continue for more than 30 years.

Woodside–Browse. Three FLNG units were originally proposed to develop this giant gas resource, first discovered in the 1970s. After not achieving FID in 2013, the concept was changed to gas export to the onshore Karratha LNG plant, via a new 1,000-km offshore/onshore pipeline. Two massive FPSOs, each weighing 90,000 tons (hull & topside) would produce 1,100 MMscfgd and 50,000 bcpd. FID has been delayed further and is now expected by the end of 2021. The first FPSO on the Calliance /Brecknock fields would be ready in 2026, followed by an FPSO on Torosa in 2027.

Chevron–Jansz-Io. Additional compression is needed to export gas 200 km to the Gorgon LNG plant on Barrow Island. In March 2019, Aker Solutions was awarded a FEED contract for a subsea compression system, which will be powered from a semisubmersible unit. This field control station is being designed as an unmanned facility, which would be a first for a large floating unit. The hull will weigh 10,000 tons to support a 5,000-ton topside, while moored in 1,350 m of water.

Western Gas–Equus. After Hess did not achieve FID in 2017, the project was sold to Western Gas, which plans to develop the 2 Tcf of gas and 42 MMbbl of condensate via a gas FPSO and near-shore FLNG. Three production wells would be connected to an FPSO that is able to process 250 MMscfd, including gas dehydration and condensate stripping. Dry gas will be piped 160 km to an FLNG unit that can liquefy 2 Mpta. Development plans were completed in September 2019 by McDermott and BakerHughes.

CHALLENGES AND OPPORTUNITIES

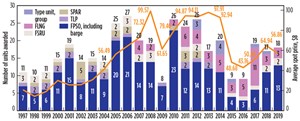

Developing any offshore field is technically and commercially difficult. With historically low oil prices, this becomes even more difficult, Fig. 3. In deep water and remote areas with little infrastructure, floating production systems can enable cost-effective field development. They provide a self-sufficient, complete production solution and can operate in any part of the world. The industry has further reduced the costs of these units through standardization and reduction of interfaces. For example, SBM Offshore’s standardized Fast4Ward hull offers a design that promises to reduce cycle time and costs for construction and deployment.

A move to integrated contracts, where a single company may produce FEED and Execution (instead of multiple companies), or where the same company assumes responsibility for the entire SURF portion, promises to compress timelines and eliminate handover concerns. In remote areas, this contracting method also reduces complexity and the cost of mobilizing different suppliers, while optimizing the total solution instead of costing out individual components.

NATURAL GAS DEVELOPMENTS

Natural gas resources provide additional challenges, because they are more difficult to transport. As a result, many remote gas fields have yet to be developed, such as the Scarborough and Browse projects in Australia that were discovered in the 1970s. If production is transported as gas, pipelines must be used to reach the market. Depending on the location, this could mean thousands of kilometers of pipeline to reach existing infrastructure. In some cases, such as developing Africa, there is limited demand, so new powerplants and other consumers must be created at the same time.

Alternatively, natural gas can be liquified into LNG and transported by ship. However, liquefaction requires a significant capital investment. Securing an offtake agreement for LNG is much more complex than for crude oil. Crude is more marketable and can be sold on the spot market. LNG sales have historically been secured under long-term contracts, although this is changing to shorter-term contracts, as more LNG becomes available.

DRILLING & SUBSEA COSTS

Historically, the costs of a deepwater development were roughly one-third drilling, one-third SURF, and one-third floating facility. Post-2015, offshore project costs declined significantly, due to revamped concept developments, as well as sharp drops in drilling and SURF rates. Five years later, rates are on the rise as activity increases.

Utilization of all types of drilling rigs continued to grow in 2019, according to Bassoe Offshore. Over the past year, rates increased by up to 30% for all types of jackup units, with utilization reaching almost 80%. The floating rig sector also has improved, with Transocean’s CEO stating, “We believe that 2019 marked the beginning of the much-anticipated recovery in the offshore drilling industry.”

Recovery of the floating rig market has been accelerated by fewer available units. Since 2015, 116 floating rigs have left the drilling market. Many older semisubmersibles have been scrapped in the past five years, along with other newer-built units that were uneconomic to reactivate. While positive for the drilling market, higher rates will increase break-even costs for operators and could threaten the economic viability of some projects in a historically low oil price environment.

BARRIERS TO DEVELOPMENT

As the hydrocarbon industry becomes more mature in a country, it is common for the host government to make legislative changes to benefit local business and limit the profitability of the operator. Local content requirements for offshore developments have been implemented in many countries, including Brazil, Nigeria, Indonesia, Mexico and Ghana. Sometimes, these changes can result in sharp cost increases, as well as uncertainty that can jeopardize sanction of future projects. For example, it has been almost seven years since the last large offshore development in Nigeria was approved.

Uncertainty in the oil price also can cause operators to reconsider sanctioning a project, Fig. 4. It is still very early to foresee the impact of the COVID-19 virus; however, it appears likely that some operators will delay FID until there is more clarity on the impact of the virus on the world economy, as well as the industry’s supply chain.

SUMMARY

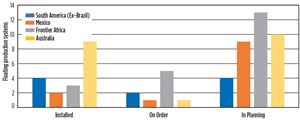

The floating production market experienced a strong 2019, with the highest level of FPSO awards in seven years. Brazil is firmly back, with five orders placed in 2019, and is expected to account for one-third of total spending over the next five years. Confidence has returned, particularly for the leading contractors, which are managing record orderbooks. SBM’s speculative Fast4Ward program has been a success, with contracts secured for its first three FPSO hulls and orders placed for two more at the end of 2019. Oil companies now see attractive opportunities in offshore, particularly deepwater Brazil, Gulf of Mexico, and Australia. There are 30 projects that could be sanctioned within the next year, and now the question is how will they be executed?

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Driving MPD adoption with performance-enhancing technologies (January 2024)

- Digital transformation: A breakthrough year for digitalization in the offshore sector (January 2024)

- Offshore technology: Platform design: Is the next generation of offshore platforms changing offshore energy? (December 2023)

- 2024: A policy crossroads for American offshore energy (December 2023)