Examining the role of outsourced service providers and external workers

Outsourced service providers and external workers are fueling oil and gas operations to achieve companies’ strategic objectives and get work done. To find out how companies gain better value from non-payroll workers and contracted service providers, SAP Fieldglass collaborated with Oxford Economics to survey senior oil and gas executives. The research results provide an unprecedented deep dive into the ways that the external workforce is sourced, managed and deployed—and how value is added to companies, accordingly.

Our groundbreaking research study, External Workforce Insights 2018: The Forces Reshaping How Work Gets Done, found that nearly half (47%) of oil and gas workforce spend is on external workers—slightly above the 44% cross-industry average.

WHERE ARE THESE WORKERS, WHAT ARE THEY DOING?

Outsourced service providers and external workers are operating at the core of the enterprise. They are spread widely across functions, including field services, facilities management, customer service, administration, product development, cybersecurity, IT and more.

Great importance. In our research, 70% of oil and gas executives told us that the external workforce is critical to their ability to operate at full capacity and meet market demands. Furthermore, just over half (52%) of oil and gas participants told us they could not conduct business as usual without their external workforce. These findings reflect the breadth and importance of work performed by outsourced service providers and external workers.

There has been a huge sea change in this area. A decade ago, companies were reluctant to outsource any core elements of their businesses, so when talent was needed, they hired more employees. Now, forward-thinking companies identify the work that needs to be done—whether it’s a one-off project, field services or a gap in a corporate function, such as HR or IT—then look at the best way to source the talent. The aim is that businesses use flexible labor to respond to opportunities, when and where they arise, as indicated by 56% of the industry executives in our research. In addition, nearly two-thirds (64%) of oil and gas executives look to external workers to increase organizational agility—a vital ingredient for competing successfully in today’s digital economy.

Cost is not the whole story. Another significant change is the relative importance of cost. After the global financial crisis of 2008, many businesses reduced payrolls and increased their use of external workers, looking to cut costs and reduce risk. Today, cost remains an important factor, yet oil and gas executives are more focused on the role of external workers in meeting strategic objectives. For example, 62% believe that external workers are important for developing or improving products and services, and 58% say the external workforce is important for speed to market. Indeed, 68% of oil and gas executives say that their external workforces enable them to improve their companies’ overall financial performances, Fig. 1.

WHY IS THE EXTERNAL WORKFORCE STRATEGIC?

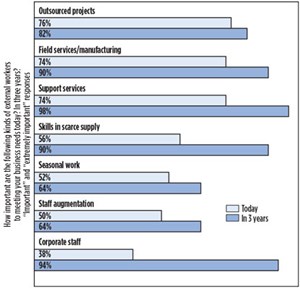

One factor in the strategic role played by external workers is the aging workforce and mass retirement of baby boomers, many of whom had amassed valuable industry expertise. The reliance on an external workforce is also driven by a skills shortage. The number-one labor market trend that executives say is affecting oil and gas today is challenges in accessing specialized skills (e.g., AI and machine learning, data science, industry-specific expertise). The skills shortfall is expected to intensify, as 90% of executives expect that the external workforce will be important for sourcing skills in scarce supply in three years, Fig. 2.

The skills shortage isn’t the only factor at play. Companies have increased their use of outsourced service providers and external workers, because they recognize this approach gives them greater access to skills, when and where they are needed. This flexibility is a key factor, given the intense pressure to maintain profitability in the face of volatile crude oil prices. As such, the external workforce helps companies to meet investors’ high expectations of operating windows and asset performance, and to combat increasing competition, following the recent expansion of several national oil companies.

PEOPLE ARE HAPPY TO DO CONTRACT WORK

You’d be wrong to think that only companies are benefiting from flexible working arrangements. Many people with sought-after skills prefer to work on a contractual basis. Although contractual arrangements are more volatile than permanent jobs, they give workers greater freedom and choice than they would have as an employee. What’s more, for certain skill sets, contract employment can be far more lucrative.

With oil and gas companies paying competitive rates for external workers, engineers and other highly skilled talent are on board with the shift to contract employment, as opposed to being on corporate payrolls. In fact, many engineers from other sectors, such as industrial manufacturing, have re-skilled to take advantage of the lucrative packages and flexible working arrangements available in oil and gas.

EXTERNAL WORKERS RAISE THE QUALITY LEVEL

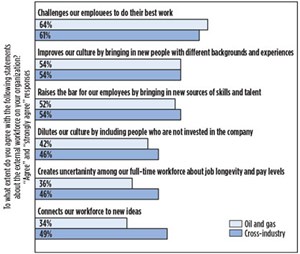

As the external workforce becomes ever more deeply embedded in the oil and gas industry, there is an inevitable impact on corporate culture. Most executives feel that the change in their companies is positive. For instance, nearly two-thirds (64%) of executives say the external workforce challenges their employees to do their best work. More than half (54%) say it improves their culture by bringing in new people with different backgrounds and new experiences. On the flip side, 74% of executives say it’s important that their companies are viewed as good places to work by external workers.

“MIND THE GAP”

While oil and gas companies see significant value in engaging an external workforce, most find it challenging to manage, and, therefore, they will not be able to unlock its full potential. Too often, management has a limited view of who is engaged and where they are working, let alone how well they are performing. This visibility gap hinders leadership’s ability to drive success.

Our research revealed mixed results about how well-informed executives are about their external workforces. When it comes to non-payroll workers, just 38% of these executives are highly informed about who they are; 38% are highly informed about their access to systems and confidential information; and only 26% are highly informed about whether external workers have the licenses and certifications that are required to perform their roles. Slightly more executives were highly informed when it came to responsibilities (40%) and access to facilities (48%).

Visibility into service providers, although not what it should be, is somewhat better. We found that 58% of oil and gas executives are highly informed about service providers’ responsibilities; 48% are highly informed of their access to facilities; 44% about contract terms; and 40% regarding compliance with licenses and certifications. Fewer report being highly informed when it comes to service providers’ access to systems and confidential company information (34%).

In many cases, the lack of visibility is symptomatic of a broader lack of rigor around engaging and managing the external workforce. Further, many companies do not have a single system that delivers a clear view of external workers across their enterprise. But lack of a structured approach to managing external workers could come back to bite companies.

The stakes are particularly high for compliance with health and safety regulations. If service providers assign personnel without the appropriate skills, licenses and certifications for each task and type of equipment, companies risk heavy financial penalties for non-compliance, even if the workers concerned aren’t employees. If an external worker does not have the correct certifications, and gets injured on the job, the results could be even worse. Companies also must be able to track worker fatigue, to maintain robust safety standards.

Another element of compliance concerns access rights. To reduce risk, companies should ensure that external workers have access only to the facilities and systems they require for their roles—and maintain a robust record of access given.

Another issue is that without a single system, companies cannot verify easily how much they are paying workers and whether rates are in line with master contracts. That makes it very difficult to tell whether appropriate negotiated rates are being used, and all too easy for discrepancies to arise.

There are other finance-related topics to consider. In fact, 34% of executives told us that they had experienced unauthorized spend without approval (6% higher than the cross-industry average), and 56% find this aspect of managing their external workforce challenging. In addition, 30% had experienced overcharges and duplicate payments. Other issues include charges deviating from an agreed rate card or master services agreement (22%), compliance issues (18%), and quality issues regarding resources and/or projects (18%).

The oil and gas industry has unique financial complexities, for which visibility and accurate tracking are essential. For example, it’s critical to know in which country work is getting done, so the correct tax is paid—or no tax, if it’s in international waters. Companies also want to be able to track which activities fall into exploration, drilling, production and tear-down, because these phases are taxed at different rates.

GOING BEYOND VISIBILITY TO INFORMING DECISIONS

Some companies are using advanced analytics and AI/machine learning to gain deeper insight into external workforces, Fig. 3. More than two thirds of executives use data and analytics to help inform workforce strategy (70%), 52% use predictive analytics to inform workforce scenarios, and 42% use predictive analytics to anticipate talent shortfalls. AI/machine learning is used by 56% to inform workforce scenarios, 54% to inform workforce strategy, 38% to get real-time visibility into payroll and rate data to inform workforce decisions; and 32% to anticipate talent shortfalls.

LEARNING FROM BUSINESSES SETTING THE PACE

Our research reveals a path forward for companies that need to catch up. Some respondents demonstrate markedly superior performance in managing and extracting value from the external workforce. These companies—called the Pacesetters in our research—make up about 10% of research participants and stand out from the crowd in three important ways. One, Pacesetters are more likely to say their external workforce enables them to improve their company’s overall financial and business performance, and/or compete in a digital world.

Two, Pacesetters are better-informed about their non-payroll workers and service providers. This includes responsibilities, duration of work, compliance, and access to systems and confidential information. And three, Pacesetters find it much less challenging to effectively perform a wide range of external workforce management tasks, such as finding high-quality resources at the right time, in the right place, at the right rate, and tracking quality of resources and projects.

BECOMING A PACESETTER

The good news is that companies do not have to go on this journey alone. There are specific solutions to help upstream, midstream and downstream companies source, engage, manage and pay their external workforce. With effective management, careful governance, and a robust solution, companies can gain better visibility into outsourced service providers and external workers and manage them more effectively.

A tale of two companies on the journey to improving external workforce management

Having built a large contract workforce using a decentralized, highly fragmented process, a multinational operator was exposed to a myriad of risks, some of which could be costly. There was no single point of accountability for procuring services, a lack of clarity over spend, and poor visibility into many aspects of their contractor workforce.

To address the situation, the company selected a managed services provider (MSP) to manage its external workforce via SAP Fieldglass. This approach enabled the company to take advantage of the MSP’s management expertise and gain access to a robust technology solution, to help manage its external workforce. The solution helps the company gain more visibility and better manage its external workforce, leading to much improved governance and compliance.

A global oil and gas company managed its external workers in a decentralized fashion throughout its numerous business units and groups, lacking common processes and solutions. As a result, the company was unable to meaningfully measure or analyze the effectiveness of its external workforce of thousands of people. To better manage its external workers, the company selected SAP Fieldglass as its technology partner. The company aimed to gain visibility to drive cost-savings, enable better decision-making and maintain compliance. The company adopted a phased approach to the implementation, and now uses SAP Fieldglass to manage thousands of workers—accounting for tens of millions of dollars of spend.

Transitioning to a single solution to manage external workers has dramatically improved visibility into this previously fragmented workforce and has improved compliance with various industry-specific health and safety requirements. Leadership can now identify trends and make strategic decisions, thereby improving the bottom line. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)