Regional Report: East Africa

After reaching record-low production levels in 2016, East Africa is still battling to revive its energy sector. While some E&P progress has been reported this year, the region is still facing a number of obstacles related to debt, war and lack

of infrastructure.

KENYA

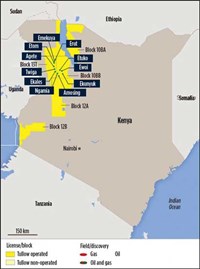

After a very successful year of exploration in 2016, Kenya continues to blossom as one of Africa’s chief oil provinces. In May 2017, Africa Oil Corp. reported another oil discovery in the northern part of the country. The Emekuya-1 well is in Block 13T, where Tullow Oil (operator) reported several 2016 discoveries in the South Lokichar basin, Fig. 1.

The well encountered about 246 ft of net oil pay in two zones. The PR Marriott Rig-46 drilled Emekuya-1 to a total MD of nearly 4,449 ft, penetrating reservoir-quality Miocene sandstones. The sandstones reportedly compared to those observed in the Etom-2 well, just 1.5 mi south. The company said that samples indicated that Emekuya-1 was on the same static pressure gradient as the Etom-2 well. The findings ultimately determined that much of the Greater Etom structure is oil-filled.

The discovery followed the Erut-1 find in January 2017, which proved the migration of oil to the South Lokichar basin’s northern limit. It encountered a gross oil interval of 180 ft with 82 ft of net oil pay, at a depth of nearly 2,297 ft. Africa Oil reported that multiple appraisal wells were drilled during 2017, as well. The Ngamia-10, Amosing-6, Amosing-7 and Etom-3 wells reportedly encountered intervals of 213 ft, 115 ft and 82 ft, respectively.

The JV partners—Africa Oil Corp. 25%, Tullow Oil (operator, 50%) and Maersk Olie og Gas A/S (25%)—are now preparing to enter the field development stage for Blocks 10BB and 13T, with FEED activity expected to begin this year. FID, however, is not expected until 2019. Plans call for developing Amosing and Ngamia fields as the initial phase of the South Lokichar project. The first phase of the development plan includes a 60,000-to-80,000-bopd central processing facility and an export pipeline to Lamu Island, situated on Kenya’s eastern coastline. Additionally, it will include 210 wells at Ngamia and 70 wells at Amosing. The JV says first oil could be achieved as early as 2021.

UGANDA/TANZANIA

The Lake Albert region continues to be prime real estate for operators in Uganda, Fig. 2. The country is home to an estimated 6.5 Bbbl of oil—1.7 Bbbl of which are said to be concentrated in the Lake Albert basin.

Total and Tullow Oil are JV partners in the Lake Albert Development Project, a major effort that is expected to reach a plateau of 230,000 bopd, once it is fully operational. According to Tullow, FEED and ESIA activity is already underway for the project, and the JV expects to reach FID this year.

Atlas Oranto entered the Lake Albert region in October with the award of the Ngassa Block (Fig. 3), just north of Kingfisher field. The former operator, Tullow Oil, had already established the presence of a shallow gas play, as well as a deeper oil play. According to Atlas Oranto, the rift system likely will need an in-lake drilling solution, such as a barge, to allow the drilling of vertical wells. The company says that, based on a number of mapped closures at different stratigraphic levels, the block could yield in-place oil volumes of about 311 MMbbl.

To bring these resources to market, the Ugandan government has approved the construction of an export route through Tanzania to the Port of Tanga, south of the Kenya-Tanzania border. The $3.5-billion pipeline will stretch almost 900 mi from Uganda’s western region to the Indian Ocean seaport. Construction of the project—which, according to Total, will be regarded as “the longest electrically heated crude oil pipeline in the world”—began in August 2017 and is expected to conclude by 2020.

Following the start-up of Tanzania’s newest gas-fired electrical power generation facility, Kinyerezi-2, Wentworth Resources has reported that its producing reserves continue to grow. Last October, the company reported that gross production volumes from its Mnazi Bay gas field averaged 60 MMscfd. Overall proved (1P) reserves within the Mnazi Bay concession reportedly stand at 16.2 MMboe, gross.

MOZAMBIQUE

Mozambique remains one of the highlights of African E&P, despite being one of the world’s poorest countries. A number of large natural gas discoveries have been reported in the country’s northern offshore Rovuma basin of late, which could soon transform Mozambique into a global LNG exporter. According to the EIA, however, international companies have failed to make timely FIDs, hindering the country’s ability to begin exporting.

In June 2017, the $7-billion Coral South LNG project was given the green light. The project will see the development of sizeable gas resources in the Rovuma basin’s Area 4. Coral field, situated off Mozambique’s Cabo Delgado province, is said to contain approximately 450 Bcm of gas-in-place. Its FLNG plant will have a capacity of approximately 3.4 million tons per year, supported by six subsea wells. Production of up to 5 Tcf of gas is anticipated, and start-up is planned for mid-2022. According to Eni, the FLNG unit will be the first for Africa, and only the third globally. Eni CEO Claudio Descalzi said, “The Coral South Project will deliver a reliable source of energy, while contributing to Mozambique’s economic development.”

During that same month, GE Oil & Gas signed on to support the development of gas resources offshore Mozambique. The company reportedly procured orders for the Coral South FLNG, for the supply of seven Christmas trees; three two-slot manifolds with integrated distribution units; MB rigid jumpers; seven subsea wellheads with spare components; a complete topside control system to be installed on the facility; and associated services equipment and support, including IWOCS and landing strings, tools, spares and technical assistance for installation, commissioning and start-up.

Significant progress onshore northern Mozambique also has been reported recently, where Anadarko (26.5%) and its partners—Mitsui & Co. (20%), ONGC (16%), ENH (15%), Bharat PetroResources (10%), PTTEP (8.5%) and Oil India Limited (4%)—are developing the nation’s first onshore LNG plant. The plant will consist of two initial LNG trains, with a total capacity of 12 MTPA. Situated on the Afungi peninsula in the Cabo Delgado province, it will support Golfinho/Atum field in the Rovuma basin’s Offshore Area 1. Since 2010, approximately 75 Tcf of recoverable gas resources have been uncovered in Area 1. The central location of this robust resource makes it well-positioned to supply customers in the Atlantic, as well as in Asia-Pacific.

Anadarko reported the finalization of two agreements with the government in late July. The agreements are important steps toward FID, the company said. “It marks the completion of the core components of the legal and contractual framework with the government. We will now look ahead with our plans to begin resettlement, which will enable the construction of the LNG plant,” Mitch Ingram, Anadarko’s executive V.P. of global LNG, said in a news release. “In addition, we continue to make good progress with our efforts to secure long-term LNG sales and purchase agreements (SPAs) with premier buyers, and we will intensify our work to put in place the necessary financing for the project. We expect to take FID once the SPAs and financing are in place.”

By February 2018, Anadarko’s development plan for the $20-billion LNG project had been approved by Mozambique’s council of ministers. On Feb. 20, Anadarko Petroleum Corporation (APC) announced that Mozambique LNG1 Company Pte. Ltd., the jointly owned sales entity of the Mozambique Area 1 co-venturers, has entered into a long-term LNG Sale and Purchase Agreement (SPA) with Électricité de France, S.A., (EDF). The off-take agreement calls for the supply of 1.2 million tonnes per annum (MTPA) for a term of 15 years.

SOUTH SUDAN

Since gaining its independence in 2011, South Sudan has had difficulty exporting oil without its northern counterpart. Back in 2016, the country’s output dropped to 120,000 bopd—a severe decline when compared to the 350,000 bopd that were being produced prior to its secession. When coupled with the industry downturn of 2015–2017, the decline has been devastating for South Sudan’s economy.

For the last several years, the oil-rich nation has been ravaged by corruption and fighting related to a civil war between government and rebel forces. Last year, a number of attacks on oil workers were reported. “Oil remains the only tangible source of revenue for South Sudan’s government. Even at reduced production levels, the government’s war efforts against opposition forces depend on it,” Luke Patey, a researcher at the Danish Institute for International Studies, told Bloomberg.

In March 2017, South Sudan announced a partnership with Equatorial Guinea, establishing a relationship between the two nations that would allow the exchange of knowledge related to the African energy sector. The Memorandum of Cooperation was signed by Equatorial Guinea Minister of Mines and Hydrocarbons H.E. Gabriel Mbaga Obiang Lima and South Sudan’s Minister of Petroleum H.E. Ezekiel Lol Gatkuoth. Gatkuoth said that “South Sudan is proud to share its experience with Equatorial Guinea, and to learn from the great work of [its] fellow African producer.” The collaboration is expected to help South Sudan reach its goal to more than double its output to 290,000 bopd.

Also, to alleviate the economic effects of war on its oil and gas sector, South Sudan’s Ministry of Petroleum announced that it would open Blocks B1 and B2 for direct negotiations for investment in April 2017. The announcement was made soon after negotiations with Total proved unsuccessful.

The area—which is believed to hold an abundance of hydrocarbon deposits, but is under-explored—was once part of a larger block, known as Block B. In 2012, the block was divided into three separate blocks—Blocks B1, B2 and B3. Oranto Petroleum reportedly signed an E&P sharing agreement with the government for Block B3 in March 2017, Fig. 4. Block B3, alone, holds an estimated 3 Bbbl of reserves in place. The 24,415-km2 block is said to be especially promising to the northwest, in the Muglad basin. “We have faith that the differences in South Sudan will be brought to an end, and that our exploration campaign will move smoothly,” Oranto Chairman Prince Arthur Eze told Bloomberg. “Over the medium-to-long-term, as South Sudan develops, security becomes stronger, and export options increase, we expect the price of producing and operating in South Sudan to go down.”

“The resource base in these blocks is enormous, and we need committed operators who are ready to invest and work with our government to comply with the laws of our country,” the minister said. “South Sudan is creating and enabling [an] environment for companies to operate. We want companies to invest, explore, produce, and we are ready to offer incentives to investors.”

Last November, just eight months after signing the E&P agreement, Oranto Petroleum reported the official start-up of its exploration program. The company said that, through an agreement with BGP Inc., its first three-year exploration period will begin with an airborne gravity and magnetic survey of Block B3. With 90% equity in the block (Nile Petroleum holds the remaining 10%), the company reportedly has committed to three exploration periods of three years.

According to Oranto Petroleum, two unexplored sub-basins—Yirol and Tali—have been identified on the block through previously acquired gravity data. Trap types are reportedly anticipated as Cretaceous titled fault blocks, which are on trend with Kenya’s extensional rift system. Yirol and Tali run parallel to the Jonglei sub-basin, an extension of the productive Muglad basin. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- What's new in production (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)