Regional Report: Russia mulls withdrawal from OPEC accord, boosting production

Although it is not a member of OPEC, Russia has aligned itself with OPEC’s efforts to cut production and reduce a worldwide glut. The 24-country alliance has aimed to cut 1.8 MMbopd and bring balance to the global energy market. As the largest country, with the world’s biggest natural gas reserves, the Russian Federation has significant bearing on whether or not the alliance’s efforts ultimately prove successful.

The participating countries were seen beating estimates earlier this year, as oil producers exceeded their production cut commitments. Consequently, UAE Energy Minister Suhail Al Mazrouei said he was “optimistic that this year we will achieve market balance.”

Talk of an extension of the production cuts has been swirling, of late. In March, Russian Energy Minister Alexander Novak told Bloomberg that the nation will likely decide to prolong its cuts in output into 2019 or it will consider “gradual withdrawal” at the next OPEC meeting in June. He said, “We will act, depending on the current situation.”

By the end of May, however, Russia and its allies reportedly were resolved to believe that their mission had already been accomplished. Bloomberg reported that data were assessed at a meeting of OPEC’s Joint Technical Committee in Jeddah, Saudi Arabia, where it was determined that the oil-inventory excess had dropped to less than the five-year average for stockpiles.

It was later reported that Rosneft, Russia’s largest oil producer, told its investors that capacity testing would be carried out in preparation for a production boost, adding about 70,000 bpd to its output during the first week of June. Despite the increase, the company reportedly remains in line with production constraints allocated under the OPEC deal.

Meanwhile, Russia’s E&P activity is flourishing. According to GlobalData Upstream Analytics, Russia led the way in exploration, with eight of the world’s 30 discoveries reported in third-quarter 2017. All eight of the discoveries—two of which were in the West Siberian basin, while the remaining six were in the Volga-Ural basin—reportedly produced conventional oil. GlobalData also reported that Russia’s upstream projects (it has 1,673 oil and gas fields now) could require an average $34.1 billion per year in capital expenditure between 2018 and 2020.

ARCTIC

Novatek (operator, 50.1%) reported in December that its Yamal LNG project had begun producing from the first of three LNG trains. Each train, with a nameplate capacity of 5.5 MMtpa, was constructed specially to withstand the harsh Arctic conditions of the Yamalo-Nenets Autonomous region. Consequently, Mark Gyetyay, CFO and deputy chairman of Novatek’s management board, called it “one of the most difficult projects in the world,” with more than 650 companies involved in its execution. In addition to the three LNG trains, the project includes an integrated gas treatment and liquefaction facility, as well as storage tanks, port and airport infrastructures. According to Total, which holds a 20% interest in the project, the second two trains will be commissioned in 2018 and 2019, respectively.

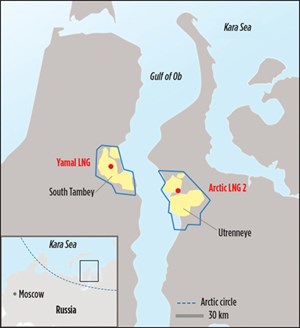

The $27-billion Yamal development processes natural gas from the giant onshore South Tambey gas and condensate field, on the Yamal Peninsula. It reportedly will produce about 4.6 Bboe in reserves. At full capacity, the facility will supply 16.5 million tons of LNG per year to Asia and Europe.

Just days following the start of production, the Yamal project exported its first cargo of LNG. The shipment was loaded onto the Christophe de Margerie tanker at Yamal’s Port of Sabetta. The tanker was named after Total’s former chairman and CEO, who was killed in an airplane crash in Moscow in 2014. The tanker reportedly was bound for China, as appreciation for its support (CNPC holds a 20% stake in the project, as well). Gyetyay said, “It is our view that the first LNG tanker should be off-loaded by CNPC, in recognition for their overall contribution to the project and the importance that the Asian-Pacific market represents as a key consuming region.”

Across the Gulf of Ob, Novatek and Total have formed a strategic partnership to develop more of Russia’s vast resources with the Arctic LNG 2 project, Fig. 1. Although the companies don’t expect to take FID on the project until next year, it is said that the project will be a substantial contributor in supplying Asia’s growing demand. The first of three production units is anticipated to start in 2023. Overall, the project reportedly will boast a capacity of 535,000 boed.

Further east, Genoil agreed to provide the necessary technology and direction to develop five oil and gas fields in the Sakha Republic (Yakutia), which is said to hold recoverable reserves of 1.8 Bbbl. The $35-billion project will employ the company’s hydroconversion upgrader desulphurization technology, which converts heavy or sour crude oil to more valuable low sulphur oil. The process reportedly is much less costly than traditional refining methods.

According to the company, the first block, which is adjacent to Rosneft’s Khatanga Block, will yield output of 240,000 bopd. It will be connected later to the nearby East Siberia-Pacific Ocean (ESPO) and the Western Siberian pipeline systems. The first block is said to contain an estimated proved 550 MMboe, with in-place hydrocarbon resources between 5.5 Bboe and 6 Bboe.

Rosneft reported the first oil discovery in the Laptev Sea last year, in the Eastern Arctic’s Khatanga Block. Considering there is only one offshore platform (Prirazlomnoye, which is operated by Gazprom Neft) in the Russian Arctic so far, the find was regarded as a major breakthrough in exploration of the area. Analysts have reported, however, that further development in the region could still be years away, due to the harsh environment and the threat of Western sanctions.

SOUTHERN RUSSIA

While the majority of Russian E&P is concentrated in the northwestern part of Siberia, several significant developments have taken place in the south, of late. In December, Rosneft and Eni began drilling the Black Sea’s first ultra-deepwater exploration well. Maria-1 is situated in the Zapadno-Chernomorskaya license area. It is expected to tap into resources that could exceed 4 Bbbl.

“The Black Sea has significant oil and gas potential, but yet not a single well has been drilled in the deepwater Russian offshore. Indicated geological traps are located at the areas with the sea depth exceeding 2,000 km. Currently, we assume that the forecasted oil in place for the license area is around 600 million tons (4.36 Bbbl),” Rosenft CEO Igor Sechin said in a release.

Maria-1 was drilled by Saipem’s Scarabeo-9 semisubmersible rig (Fig. 2), equipped with a high-precision dynamic positioning system that reportedly ensures constant location of the platform over the wellhead. It was drilled to a depth of more than 17,273 ft, uncovering a rare carbonate structure with a 984-ft gross interval. Drilling was complete in March, and Rosneft reported that the structure is made up of “a fractured reservoir that is highly likely to contain hydrocarbons.” The company said that it plans to carry out a comprehensive geological processing of its findings, and it will move forward with exploration and appraisal works in the area.

Further east, in the Caspian Sea, Lukoil continues to make progress with Phase 2 of the Vladimir Filanovsky field development. The field, situated 118 mi off Astrakhan, is one of Russia’s largest offshore oil fields, with 1.06 Tcf of recoverable reserves. In February, Lukoil reported that it had completed construction and commissioning of the first well for Phase 2. The single-bore, horizontal production well, with an MD of over 2 mi, reached an initial flow of 17,448 bopd. Subsequently, the field’s overall daily production rose to 122,136 bbl. All Phase 2 construction and assembly operations are expected to be complete by year-end, according to the company.

WESTERN RUSSIA/SIBERIA

Last June, Lukoil announced that it had reached significant milestones at its Pyakyakhinskoye oil and gas condensate field, in the Yamal-Nenets Autonomous District. Accumulated oil production had already exceeded 7.3 MMbbl since the field started commercial production in October 2016. Likewise, accumulated gas production had exceeded 45.9 Bcf. According to the company, the field consists of 57 oil wells and 25 gas wells. It was reported that 26 oil-producing wells would be put into operation last year, including 19 multi-laterals, five horizontals and two directional wells.

Also in the southern region of the Yamalo-Nenets Autonomous District, within the group of Otdalennaya deposits, Gazprom Neft started drilling and testing its first production well at Zapadno-Chatylkinskoye field in July. The company reported an initial production rate of more than 3.635 bpd. “The operational drilling program at the Zapadno-Chatylkinskoye field will continue throughout 2018. We plan to build eight production wells here, ensuring production of up to [3.64 MMbbl/year]. According to our calculations, peak production across the entire Otdalnnaya group of deposits will be reached in 2023-2026, at approximately [14.5 MMbbl] of oil per year.” Vadim Yakovlev, Gazprom Neft’s first deputy CEO, said in a release.

In January, Gazprom Neft announced a major milestone for Russia after it drilled the country’s first multi-lateral well. The 22,165-ft well, which was drilled at Novoportovskoye field, has four horizontal cased-hole sidetracks. Just one month later, the company also reported a high flowrate at Vostochno-Messoyakhskoye field, in the Tazovsky District of the Yamalo-Nenets Autonomous Okrug. After completing construction of its first deep-strata horizontal production well, the company confirmed the high potential of developing the field’s deep strata with an initial flowrate of 1,818 bopd. According to Gazprom Neft, the data obtained from well-logging and multi-stage fracing of the strata would ultimately help govern future drilling of onshore deposits in the region. Another 10 deep wells are anticipated to be commissioned this year.

Meanwhile, Rosneft settled on an extended development plan for Samotlor in the Khanty-Mansi Autonomous Okrug. Samotlor is the largest oil field in Russia and the sixth largest in the world. Much of its reserves are said to be hidden in formations with low permeability and low saturation, while the remaining reserves are found in the edge zones of depleted reservoirs. This may result in low ROI and output decline. To counter this, however, the company has offered an annual mineral extraction tax reduction of RUB 35 billion as an investment incentive aimed at breathing new life into development of the field. Rosneft has agreed to drill over 2,400 wells between 2018 and 2027, adding more than 363.5 MMbbl in output.

FAR EAST

Although most E&P activity is focused in the western regions, Russia’s Far East is home to one of its most important oil and gas developments. Sister projects Sakhalin I, Sakhalin II and Sakhalin III produce off the coast of Sakhalin Island, just north of Japan. The Sakhalin I project (operated by Exxon Neftegas Limited, a subsidiary of ExxonMobil) includes the development of Chayvo, Odoptu and Arkutun Dagi fields, off the island’s northeastern coast, while the Sakhalin II (Gazprom) project includes the development of Piltun-Astokhskoye and Lunskoye fields, in the Sea of Okhotsk. Likewise, the Sakhalin III project includes the Kirinsky, Ayashsky and Vostochno-Odoptinsky blocks, which provide the primary resource base for the Sakhalin-Khabarovsk-Vladivostok gas transmission system, according to Gazprom.

The Sakhalin I project reportedly has set numerous world records for extended reach drilling. According to Rosneft, a member of the Sakhalin-I Consortium, it has drilled nine out of 10 of the world’s longest wells. In November, the company claimed that it had set the world record for the longest well, with a horizontal completion of more than 49,212 ft, including a step-out of 46,355 ft. It was drilled from the Orlan platform at Chayvo field (Fig. 3), which was specifically built to withstand the harsh conditions of the region.

Furthermore, Gazprom Neft subsidiary Gazpromneft Sakhalin began exploratory drilling at the Ayasksky Block last June. Work on the block, situated on the continental shelf of the Okhotsk Sea, included extensive core sampling, geophysical investigations and testing at target intervals. The Hakuryu-5 semisubmersible rig reportedly was scheduled to carry out the drilling and well testing. According to the company, the results obtained will allow a subsequent field investigation program, as well as facilitate the necessary preparations for test drilling during this year’s ice-free season. ![]()