Executive Viewpoint

While WTI crude prices are ranging from the high-$50s to low-$60s, three defining attributes—unitization, environmentalization, and extreme efficiency—set the de facto rules for the future. An understanding of these three phenomena will be critical to predicting the next generation of winners in global energy markets.

Unitization is the emergence of a common energy language—kilowatts, BTUs or calories—to shop among different brands/sources of energy, such as oil, gas, wind, solar or others. To consumers worldwide, it matters little whether the cars they are driving, or the planes they are flying in, are fueled by shale oil or hydrogen, so long as the economics are right, and the fuel of choice meets prevailing public norms of environmental wellness. The latter is an imperative, and not an option, in the new age.

Environmentalization. Integration of “environmental wellness” into corporate and governmental actions constitutes the essence of “environmentalization,” not meant to be synonymous with global warming. Environmentalization is the sum total of influences on all aspects of the environment. The air quality of Chengdu, China, or fracing-induced tremors in Oklahoma, has to be part of this conversation. What ties everything together for consumers worldwide is the ability to choose the most efficiently delivered kilowatts—environmentally and economically—hence the imperative for “extreme efficiency.”

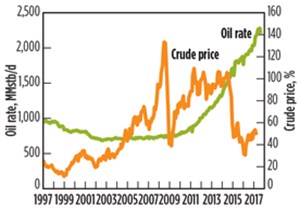

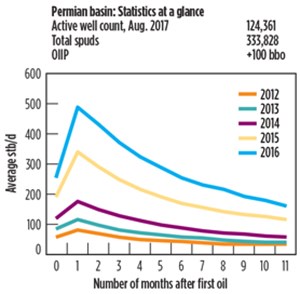

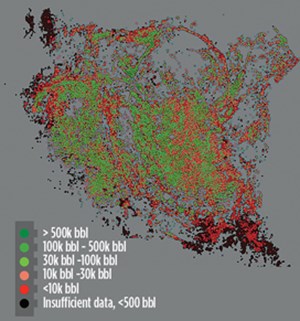

Extreme efficiency is the new paradigm of the energy markets—fossil fuels and renewables alike. A closer look at seemingly unrelated fronts is worth noting. In the Permian basin of Texas—the bedrock of U.S. oil production’s resurgence—crude output levels exceeded 2 MMbpd in mid-2017, despite a 50% drop in crude prices over the last three years, Fig. 1. Note the remarkable learning demonstrated by Permian operators, as manifested by increasing Initial Production (IP) levels from 2012 through 2016, Figs. 2 and 3. During the same period, U.S. solar energy power generation more than tripled, while unit costs dropped 33%. Similar trends in efficiency are evident in wind and unconventional gas.

More importantly, CO2 emissions in the US and EU have come down 20% during the last decade, accompanied by comparable drops in energy intensity (consumption per GDP), while China started a downturn trend in CO2 emissions in 2013. More is on the way.

The powerful comeback of the U.S. oil and gas industry happened—during an arguably fossil-skeptical U.S. administration—as a direct consequence of two “x” factors: innovation and technology. This begs the question to oil and gas executives: What strategies and actions can be incorporated that will multiply the “x” factor, and assure prominence in the global energy markets during the 21st century? Case in point—when a 155-MW wind farm in West Texas began operations in November 2017, it marked a new milestone for Texas—the state’s wind power generating capacity surpassed that of coal-powered plants, highlighting the intense competition between fossil fuels and renewables to provide BTUs-of-choice

to consumers.

The answers lie in being super-competitive in the three defining attributes noted earlier. As simplistic as it may sound, minimizing the net CO2 of fossil fuels must become a top priority for the industry as a whole, as much as increasing the delivery efficiency of kilowatts to consumers through automation, robotics, artificial intelligence and advanced analytics, as demonstrated in Figs. 2 and 3. The best way forward for the oil and gas industry is to join the battle for extreme efficiency with an intention to win. ![]()

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)

- Machine learning-assisted induced seismicity characterization of the Ellenburger formation, Midland basin (August 2023)

- Executive viewpoint (July 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)